Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

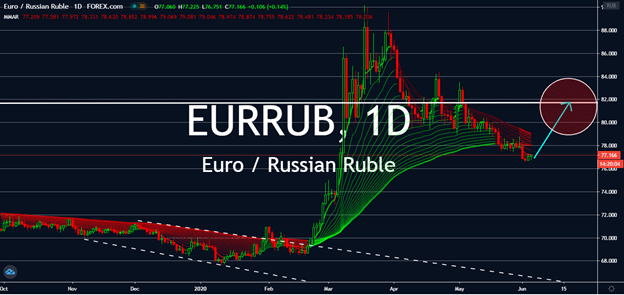

EURRUB

The EURRUB pair went to a three-month low earlier this week, but it looks like the appeal for the euro is about to take over. Although the Russian ruble isn’t fully dependent on oil prices, the commodity still impacts the currency greatly. Oil prices are trading lower these past few days in response to the disruption of OPEC+ ministers’ recent disagreements of the alliance regarding the parameters of the deal to reduce oil production held last month, and it doesn’t bode well with the Russian ruble. The euro, on the other hand, is on a week-long win against other major currencies as the European Central Bank remains vigilant over economic changes brought by the coronavirus, and it’s set to see highs against oil-dependent markets like those in Russia. Risk appetite will side with the euro until the bloc reports negative results in the next month, as will more reports on its trade conflict with the United Kingdom.

EURPLN

The euro had already started gaining up on the Polish zloty on Monday, and it continues to do so. Markets are looking forward to the currency gaining back the value it lost on May 26th in coming sessions as more positive figures dominate the euro market from the ground up. Thanks to the European Central Bank and the European Union, the bloc is about to gain emergency funding for the next couple of months to keep its economy afloat. Risk appetite is expected to side with the euro despite uncertainties surrounding tensions between the US and China, and mass civil unrest stateside. Although, the euro might not win by a landslide. Poland will reach center stage as its delayed presidential election nears, which could determine the future of the Polish economy as we know it, but the euro’s upcoming monetary policy decisions are still expected to benefit its currency at least until Poland reaches good news of its own.

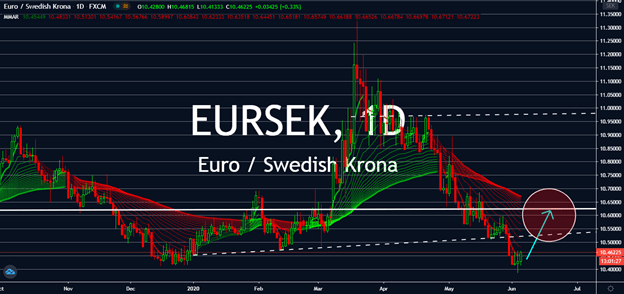

EURSEK

After breaking back down to EURSEK prices seen at the end of 2020, the market is watching both currencies closer. Contrary to its surrounding European countries, Sweden’s economy grew in the first quarter of 2020, raising brows from around the world. Some markets are also wondering if Sweden might even experience the same degree of recession most countries are bracing themselves for. Now that other eurozone countries are reopening their own economies, rising debates are wondering which currency will perform better than the other in coming months. The European Commission and the European Central Bank are both launching monetary programs to help its citizens, which will prove as an advantage for the euro in coming sessions, but dangerous or not, Sweden might see itself fight back soon. Therefore, upcoming news for fiscal help in the eurozone will influence the euro to reach higher but not without strong volatility against the krona.

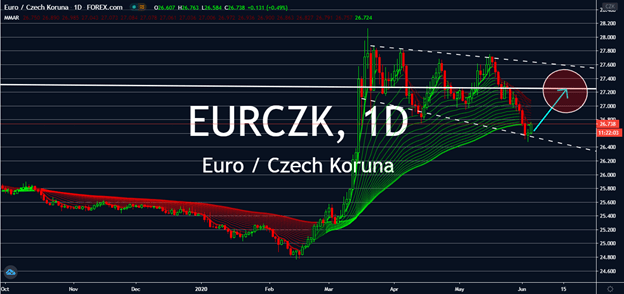

EURCZK

The Czech economy announced better figures than expected on Tuesday. However, this was still the biggest first quarter drop since 2010. Markets expected the economy to slow by 2.2% compared to the same time as last year, but it instead slowed by 2.0%. In a quarterly comparison, it slowed by 3.3% instead of the 3.6% expectation. This emphasized reports that its annual GDP will contract by 6.2 percent by the end of 2020. In the eurozone, the European Commission unveiled plans for a 750 billion euro fund to keep the block mitigate the coronavirus damage, involving 500 billion euros in grants and the rest for loans. The “EU Recovery Fund” is expected to shore up the previous economic slump in the previous quarter. This is expected to represent an important step for the bloc for the desired fiscal policy coordination, especially after months of conflict between countries. However, it would also provide a new source of highly rated euro-denominated debt for global investors, so investors should still remain cautious of trading with the euro.