Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

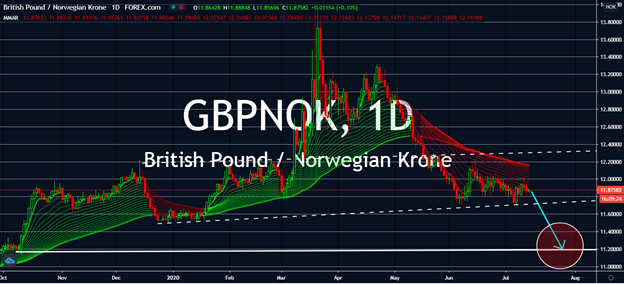

GBPNOK

Excluding its offshore oil industry, Norway’s GDP grew by 2.4% from April to May following two months of sharp declines over coronavirus nationwide lockdowns. Its hotel and restaurant sectors saw a growth of 23% throughout the month while healthcare services saw an 11.2% growth. Although business services and oil production are weighing downward, the economy is looking forward to a better month in June after it fully reopened last week. Meanwhile, investors focusing on UK data are pessimistic: Claimant Count Change for June is expected to lower from 528 thousand in May to 400 thousand this month. The number of unemployed people in May, to be announced today, is also expected to surge from 83 thousand to 234 thousand. Then, UK Construction Output is expected to drop by another double-digit figure for the same month, even following the 44% drop seen the month prior.

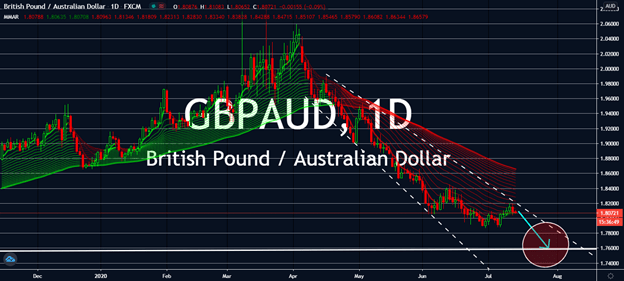

GBPAUD

National Australia Bank’s index of business condition bounced to -7 this month, which was way up from -24 seen in May and -34 in April. The bank expects the figure to see +6 levels, which is much farther away than what was seen during the global financial crisis. Business confidence also went up to +1 in June, up from -20 in May and -46 in April. Meanwhile, the UK is bracing itself for lower figures coming today with rising unemployment rates and construction output, as well as its Claimant Count Change in June. In fact, employment change is expected to report a -83,000 plummet in a monthly comparison against April, which counted 6,000. Claimant Count Change is in center stage with an expected 100 thousand count plummet to 400 thousand in June compared to 528.9 thousand seen last May. The UK is also expected to report its Monthly 3M/3M change today, which markets expect wouldn’t look good this month.

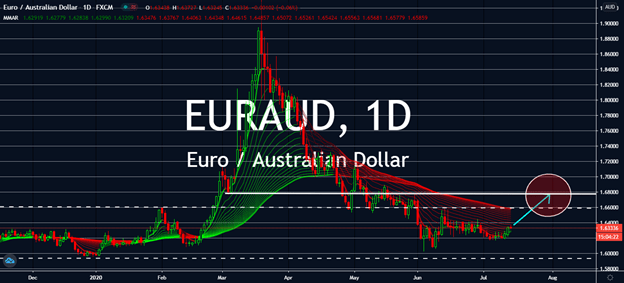

EURAUD

Germany is expected to report a better figure for its economic sentiment index for the month of July, which had already increased last month thanks to the gradual reopening from coronavirus lockdowns during the first quarter of the year. Optimists are also looking forward to industrial production reports for May in both a yearly and a monthly comparison, both of which are expected to rise by 8 percent and more than 180 percent, respectively. To be exact, month-over-month comparison forecasts believe that the industrial production for May will be 15% in comparison to 17% in the month of April. Although business conditions rebounded in June, investors doubt that this could help the Australian economy in comparison to the faith they have for the biggest economy in Europe and its associates, even under pressure for the European Union’s rescue fund agreement to be discussed within this week.

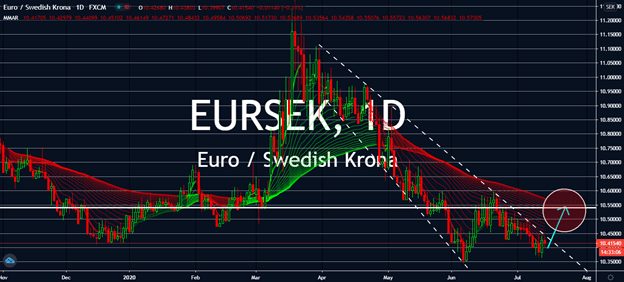

EURSEK

Swedish CPI is expected to rise for the month of June after it increased from 0.4% to 0.0% around the same time last year. For June, the figure is expected to jump half a percentage as it continues to persist its soft lockdown strategy even with increasing coronavirus cases in the country for three months. Moreover, the fact that its year-over-year comparison is expected to see not more than a 0.1% decrease on a monthly basis also led optimism from investors. Meanwhile, German CPI was as expected for June on both a monthly and a yearly basis. IT saw 0.6% against -0.1% and 0.9%, respectively. As Europe prepares for progress with the European Union’s rescue package for coronavirus-affected countries, the significance of better-than-expected German economic data will push the single currency up against the relatively stagnant Swedish krone near-term, or at least until the EU reports negative progress for its proposed rescue package within the week.