Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

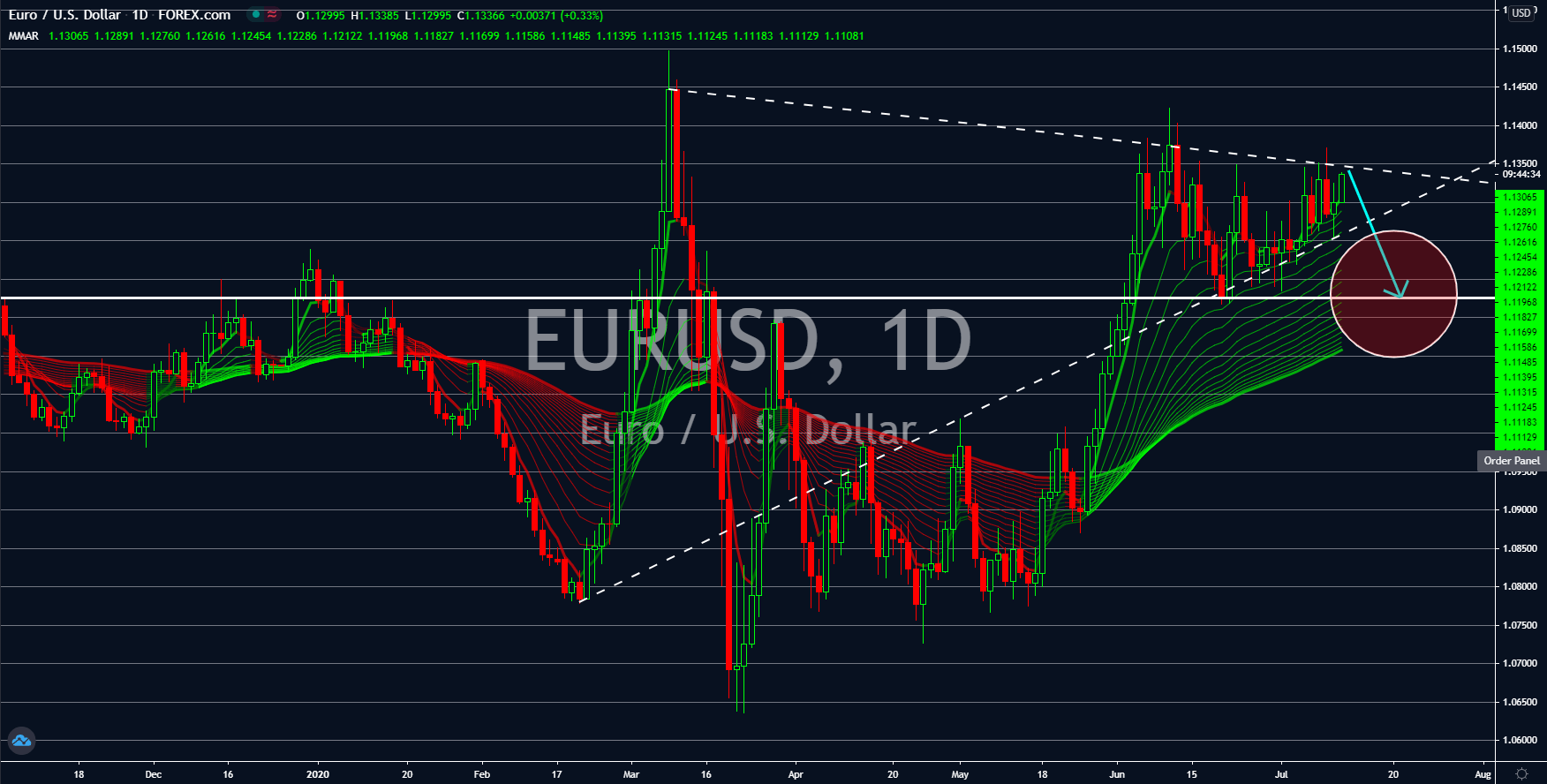

EURUSD

The eurozone will experience a steeper decline this year following the revised outlook for the trading bloc. Two (2) months ago, expectations for the economic performance by the EU this 2020 was at -7.4%. However, the VP of the European Commission for Economy Valdis Dombrovskis said that the economic impact of the lockdown in the EU is more severe than initially thought. Thus, he gave a grimmer outlook of 8.3% for the fiscal year. In addition to this, he warned investors that the recovery in 2021 might also be slower. GDP growth for next year is only seen at 5.8%. Meanwhile, the US is also having problems with the impact of the pandemic. The budget deficit of the world’s largest economy is expected to reach $863.0 billion. If the forecast came close to the actual figure in today’s report, this will be the largest budget deficit in the US. This will force the US institutions to further increase liquidity in the market, a bullish move for the US dollar.

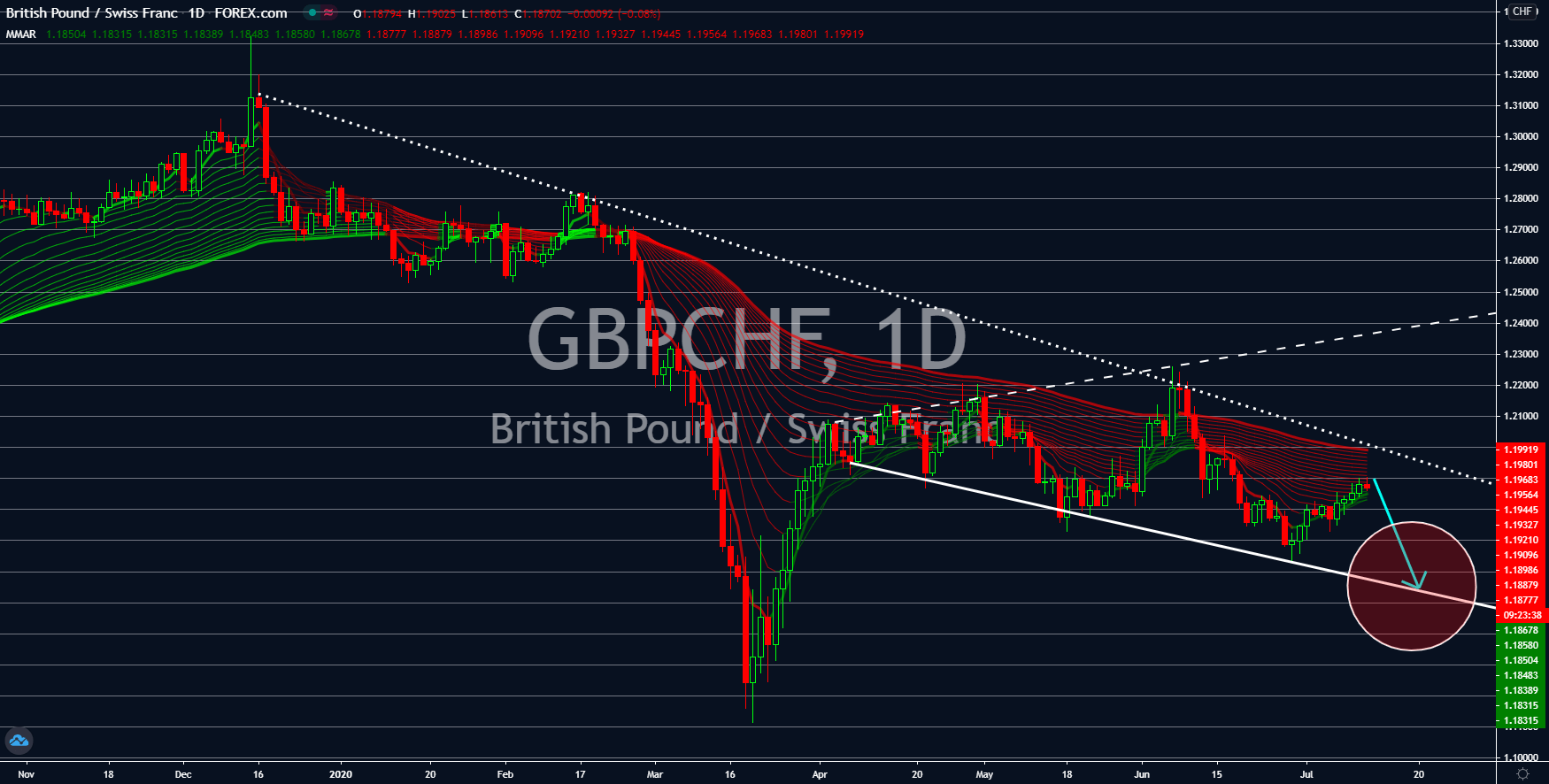

GBPCHF

Both Switzerland and the UK are set to experience their worst economic slump in decades. This was due to the ongoing threat of the COVID-19 in the region. Switzerland is expected to decline by 6.7% this year, the biggest since 1975, while Britain is hugely expected to drop by 17.0% in Q2 2020. If expected figures came close to the actual figures, this will be the United Kingdom’s largest quarterly decline since 1979. The bold forecast for the UK was due to the 20.4% economic activity decline in April. On the other hand, the biggest factor for the current strength of the Swiss franc was the AAA investment grade from Fitch Ratings. The rating agency retains its stable outlook to Switzerland. Meanwhile, problems might pile up for the UK as the pandemic reshapes the negotiation between the country and the European Union. Britain signed its divorce deal with the largest trading bloc in January and is expected to officially cut the string before the year ends.

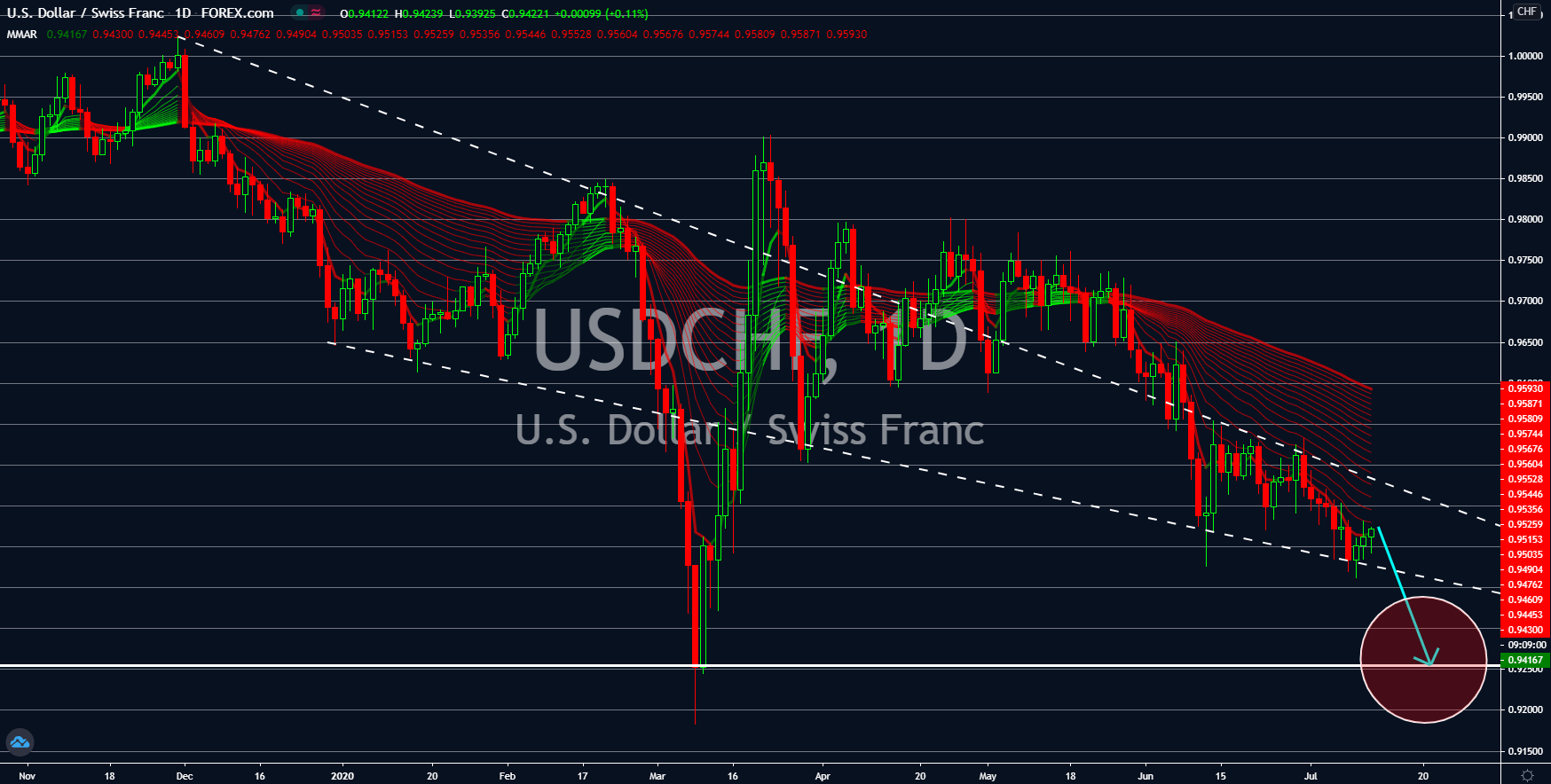

USDCHF

Two (2) safe-haven currencies are competing to become the investors’ darling during this pandemic. Swiss franc gets its strength from the lifting of border restrictions among some EU member states and from the investment grade given by Fitch Ratings. The credit rating agency maintained its AAA or stable outlook for the Swiss economy in the coming months. On the other hand, the US dollar is being pushed upward by the huge demand for the greenback. However, the Swiss currency will be more stable in the long-term. The US budget incurred a budget deficit of $738.0 billion in April and $399.0 billion in May. Also, it is widely projected that the deficit in June will reach $863.0 billion. This, in turn, might push the US institutions to continue injecting money in the economy in short to medium-term. Once the global market stabilizes, this excessive amount of American dollars in the global economy could hit back the greenback.

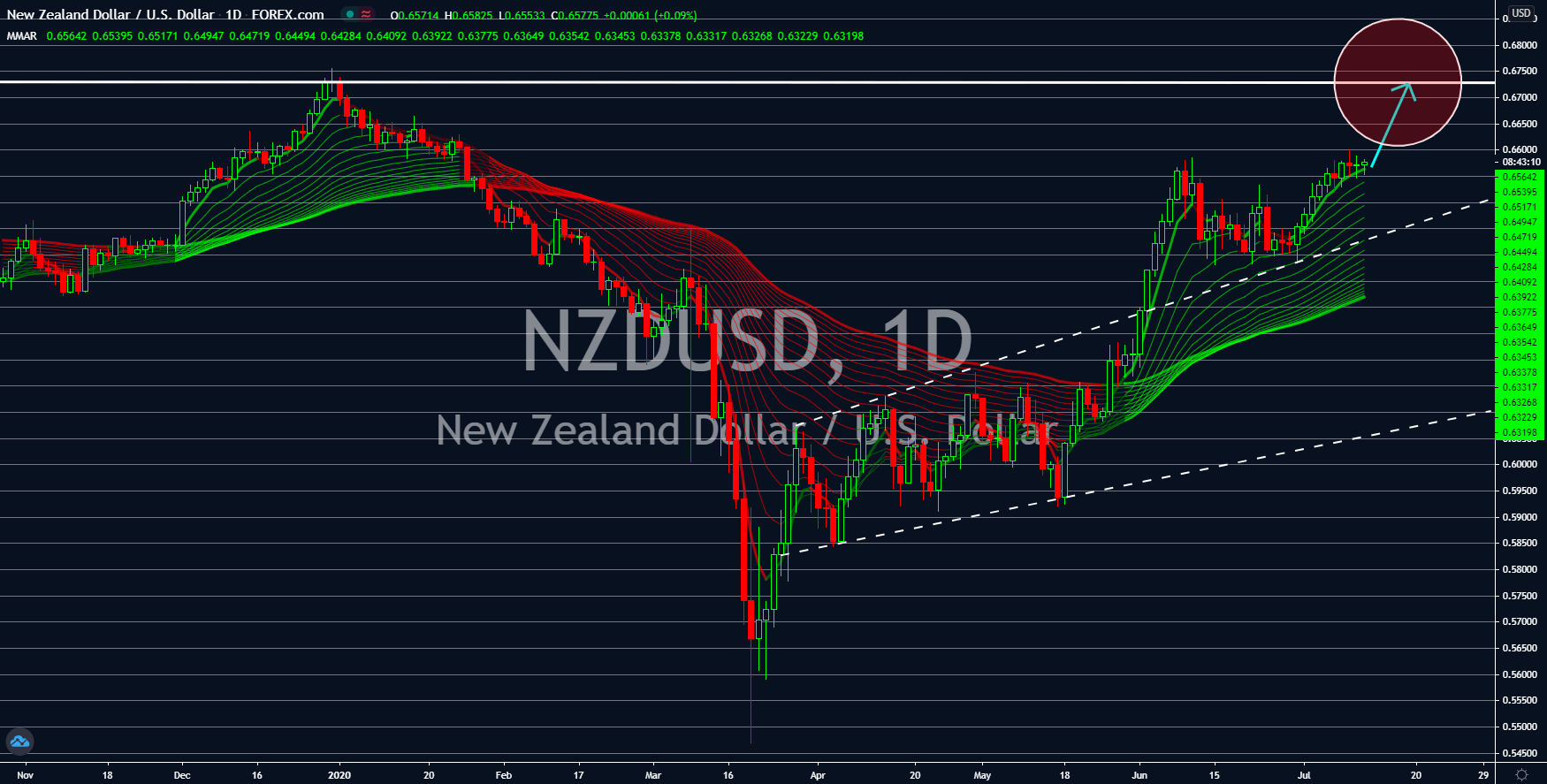

NZDUSD

More and more economists and analysts are getting convinced that New Zealand was able to beat the coronavirus pandemic. It’s been a month since New Zealand Prime Minister Jacinda Ardern ended the lockdown in the country. Businesses are now open which analysts said will greatly impact the economic recovery in the country. HSBC analyst Paul Bloxham said a V-shaped bounce back is seen in New Zealand while its neighboring country, Australia, will get a modest U-shaped recovery. This was supported by Westpac economists who say that the first half of the year will decline by 15% and will be followed by 14% expansion in the third quarter of 2020. By the end of the year, they believed that New Zealand’s annual GDP will turn out to be positive. Moreover, S&P Global said New Zealand will outperform its peers in Asia Pacific region. Also, China, South Korea, Japan, Singapore, Taiwan, and Australia will also thrive through this pandemic.