Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

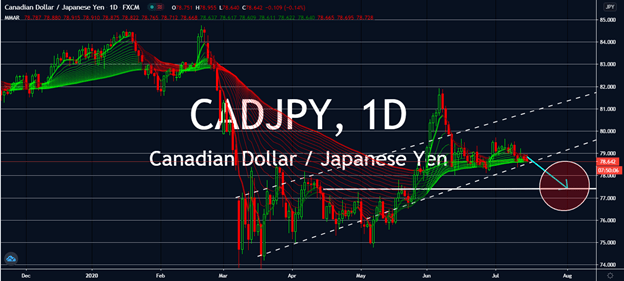

CADJPY

Largely due to Canada’s dependency on oil and gas, the Canadian dollar is expected to fall against the Japanese yen. Both the Bank of Canada and the Bank of Japan are expected to hold a meeting for their monetary policies this week. Both economies are also expected to retain their interest rates by 0.25% and -0.10%, respectively. The BOJ expects Japan to see its GDP decrease by 4.7% by the end of the year, which investors need to take note of before taking long swings. However, uncertainty around oil demand around the world is keeping the CAD on its knees near-term, or when the Organization of Petroleum Exporting Countries (OPEC+) announces good news about their oil production cuts for the second half of this year, or when signs point to more demand for oil and gas brought by reopening economies from lockdowns implemented earlier this year. For now, JPY will retain its role as a safe haven currency in upcoming sessions.

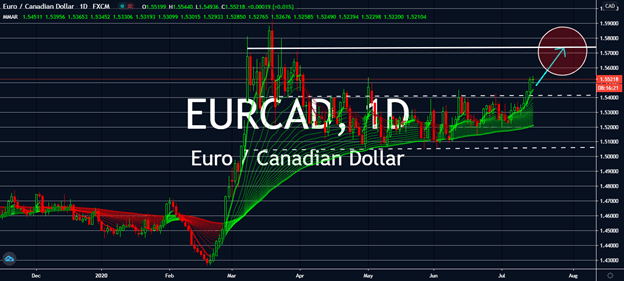

EURCAD

The euro currency has increased by 2.29% against the loonie since June 1. The outlook is looking bleak for the oil-dependent Canadian dollar days before the Organization of Petroleum Exporting Countries (OPEC+) are set to meet this week to discuss their outlooks on oil prices amid the coronavirus pandemic. Brent crude has benefitted in limbo for the last five weeks at hovering prices around $40 to $45, but several OPEC producers are still having a hard time estimating demand for possible production cuts, citing concerns about lack of transportation with the pandemic still lingering in worldwide air. Worries come ahead of the Bank of Canada’s planned monetary policy meeting, which is expected to retain its 0.25% interest rate first seen in March when the pandemic began. Governor Tiff Macklem seemingly ruled out any further drops with a note that the central bank doesn’t plan to raise the rate soon.

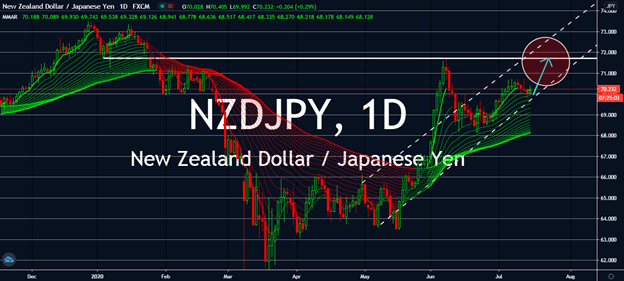

NZDJPY

After news emerged that the Japanese economy would fall by 4.7% by the end of fiscal 2020, the Japanese yen is expected to fall further down against the New Zealand dollar in upcoming sessions. Economists believe that although the kiwi economy shrank in the first half of the year by 15% which started with a 1.6% decline in the first quarter, it could bounce back by 14% in the September quarter already. This is despite seeing businesses struggle following the lockdown in March and April. Meanwhile, the Bank of Japan is preparing to meet this week regarding monetary policy. The central bank seems determined to keep its interest rate at -0.10%, but the possible GDP decrease is worrying markets for safe havens, which could inevitably lead the kiwi to see its early June highs against the Japanese yen in upcoming trading yet again. The pair has been on a bull market since it began easing nationwide lockdowns in May.

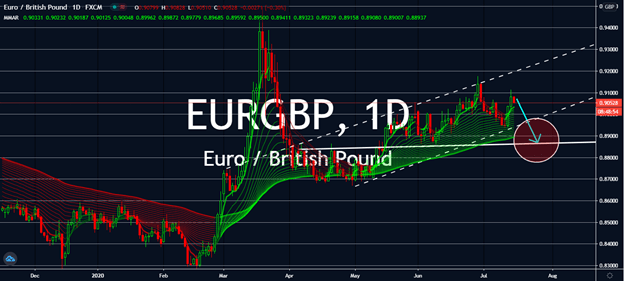

EURGBP

The euro-sterling pair reached its highest point on the daily chart yesterday, which was led by bullish investors who sought to push the pair through its resistance level. But UK economic data predicts otherwise. The City’s Consumer Price Index saw higher than expected results in the month of June, which surprised markets – largely due to the fact that this figure was in a yearly comparison. In June 2019, the United Kingdom saw a 0.5% measure in the change of price for goods and services, but after the forecast expected it to lower into 0.4%, CPI reported an increase to 0.6%. Core CPI also lifted on a monthly basis, also better than expected at 0.1% instead of -0.2% expected prior. On the other hand, Italy saw lackluster results for the same figure, which was the same -0.2%. That said, investors should still look out for the ECB interest rate decision due tomorrow, as the pair is set to react to inflation numbers from Italy.