Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

EURUSD

It’s clear that the US dollar had the upper hand against the bloc’s single currency since mid-January. The pair is widely believed to climb down to its resistance by the first week of February. However, today, the euro is raising its efforts to prevent the pair from plummeting in the market. Notable improvements from Germany and the eurozone’s economies are steadying the pair as of writing. Unfortunately, though, it’s not enough to push the pair upwards. Bears are also tuning in for the scheduled speech of US President Donald Trump due later today. It’s believed that Trump’s words could help give the greenback a boost to force the EURUSD pair further downwards. But aside from the 45th president’s scheduled address, there are no incoming reports today. Then, for tomorrow, bears are waiting for the US existing home sale results for December, which is expected to hike, giving the buck another lift.

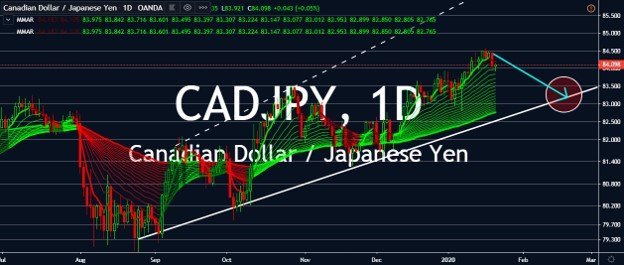

CADJPY

Weak results that are projected to be issued on Canada’s economy is giving way for the Japanese yen to steadily pull the pair downward in sessions. On top of that, the recent decision of the Japanese central bank to leave its official interest rate unmoved earlier this week and the alarming economic growth forecasts of the IMF is giving the Japanese yen a hand. The Ottawa’s consumer price index will be issued by Statistics Canada later today, and unfortunately for the Canadian dollar, the country’s CPI is projected to show stagnant figures for the last month of 2019. Also, the Bank of Canada’s interest rate decision is scheduled later on today. Meaning, if the BOC actually leaves its interest rates unmoved at 1.75%, CADJPY bears will have a tougher time reeling the pair lower in coming sessions. But that doesn’t assure that the Canadian dollar will have enough strength to pull itself upward in the market.

GBPCHF

A horizontal trend formed as the British pound struggles to overpower the Swiss franc in the market. Meaning that the GBPCHF pair would actually stumble to its support levels by mid-February. Headlines about the rapidly spreading epidemic of a coronavirus that is pneumonia-like in China is expected to give the Swiss franc a boost in coming sessions. The negative sentiment in the market during these times of fear and uncertainties on the virus and global growth is reinforcing safe-haven assets such as the Swiss franc in the market. However, the British pound, despite not being able to rally, is still putting a fight against the franc. Britain’s good average earnings index for November, the positive claimant count change for December, and the impressive employment change for November are supporting the British pound. Unfortunately, those figures are not enough to cause the GBPCHF to rally.

USDJPY

The US dollar remains determined to keep its upward momentum against another safe-haven asset, the Japanese yen, in the foreign exchange scene. The pair is widely believed to reach its resistance by the end of the month or on the first few days of February. However, the Japanese yen is giving the US dollar a run as it fights hard to prevent the buck from pulling it higher. Bulls are hoping that the virus spreading in China and some countries in Asia will attract fewer investors to the Japanese yen, a prominent Asian safe-haven asset. The epidemic has spread in the Chinese city of Wuhan and has already recorded cases of death. Countries in the nearby region are closing their borders and are restricting foreign tourists from entering the country. Later today, the scheduled speech of US President Donald Trump is expected to help the buck secure more gains against the Japanese yen in the market.