Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

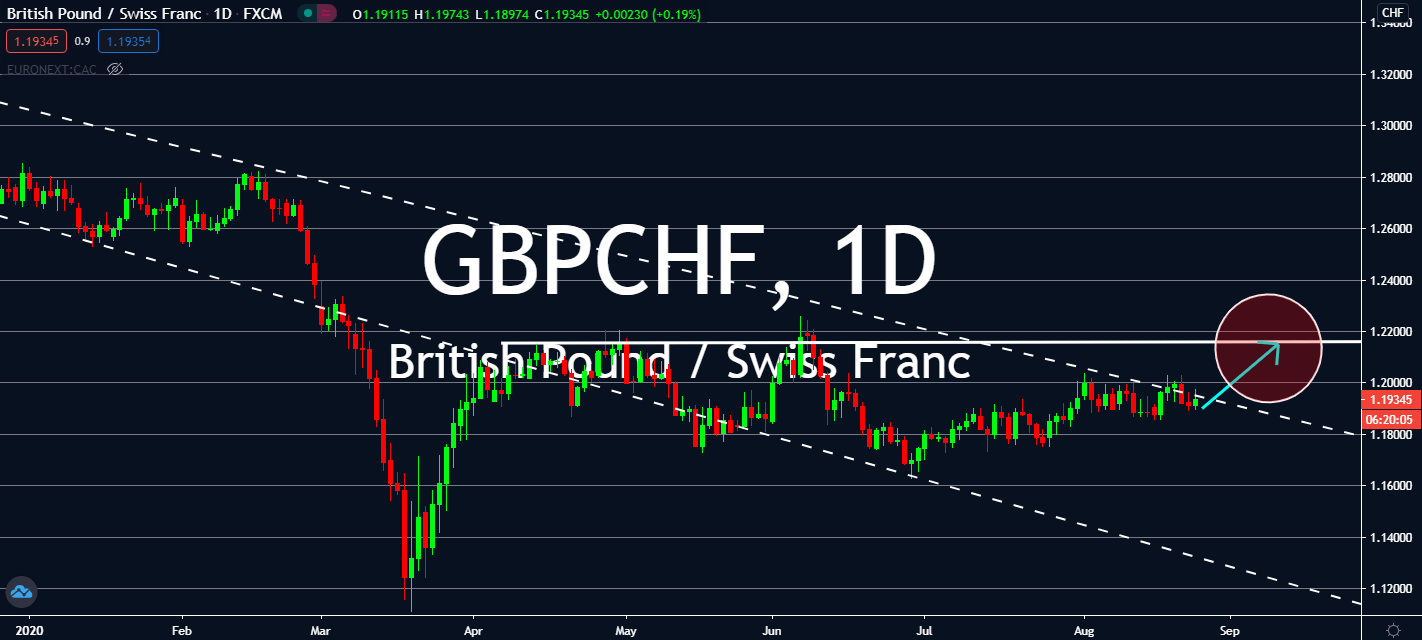

GBPCHF

Switzerland’s employment rate report is reported to push the Pound sterling into a bullish market. The figure went down from 5.132 million three months ending April, to 5.095 million in the quarter ending June. Although the Swiss economy is, by comparison, doing better than most European countries, recent developments in the British-Japanese trade deal are projected to help imports and exports in the agricultural and technology sector of the City that would ultimately help its economy. Moreover, markets claim that Britain seems to be on course to a record-breaking economic recovery in the upcoming quarter thanks to consumer spending and a scheduled reopening for some schools. The figure had seen an increase during the first two weeks of August to an even better record than the same period one year prior. City of London analysts project a GDP increase of 14.3% in the third quarter.

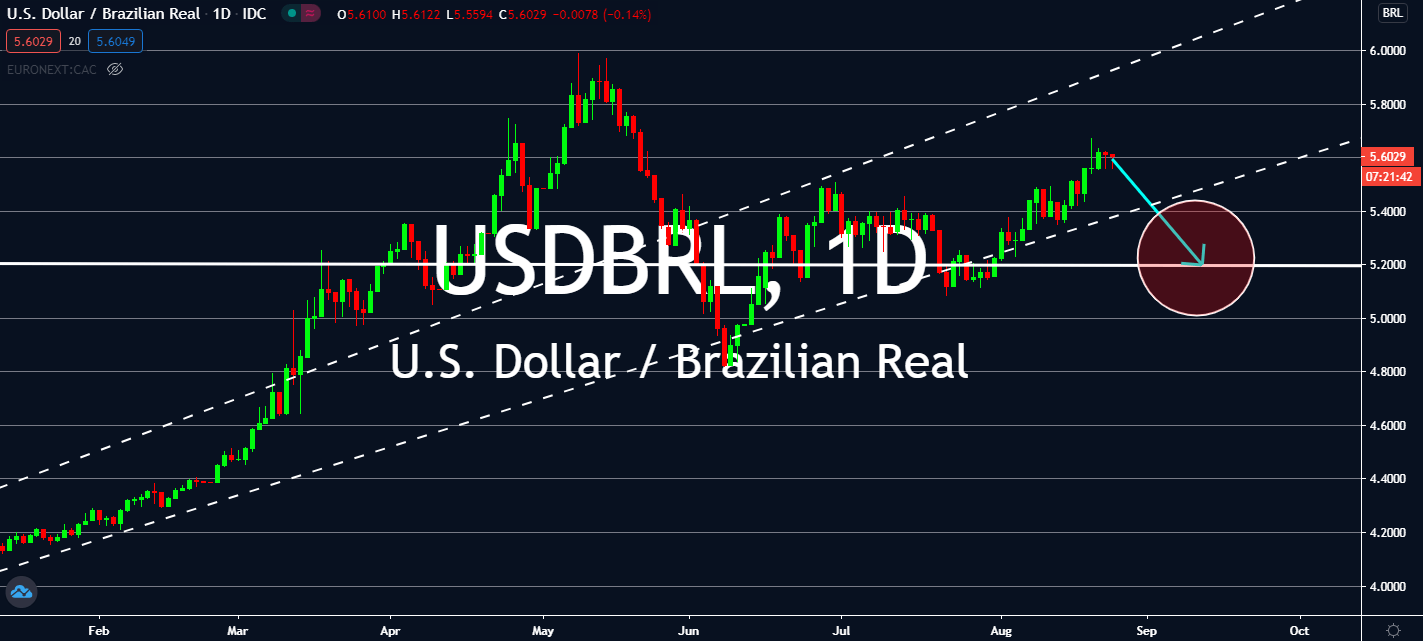

USDBRL

Brazilian authorities claim that its economy is back up its pre-coronavirus levels. Internal data showed that it had stimulated most of its activity last month as isolation measures lifted across the nation despite having the second most severe coronavirus outbreaks in the world with over 3.6 million registered cases and about 115,000 deaths total. But economists are still optimistic of its economy when compared to surrounding countries. The Brazilian real is then projected to push the USDBRL exchange rate down. This is also from its mid-month CPI record of 2.28% in comparison to 2.13% seen in August 2019. In the meantime, investors are waiting for CB consumer confidence for August as well. The figure is expected to inch upward from 92.6 to 93.0, which isn’t likely to resonate with investors while they wait for the Federal Reserve’s chairperson Jerome Powell to announce the central bank’s outlook on the US’ yearly inflation this year.

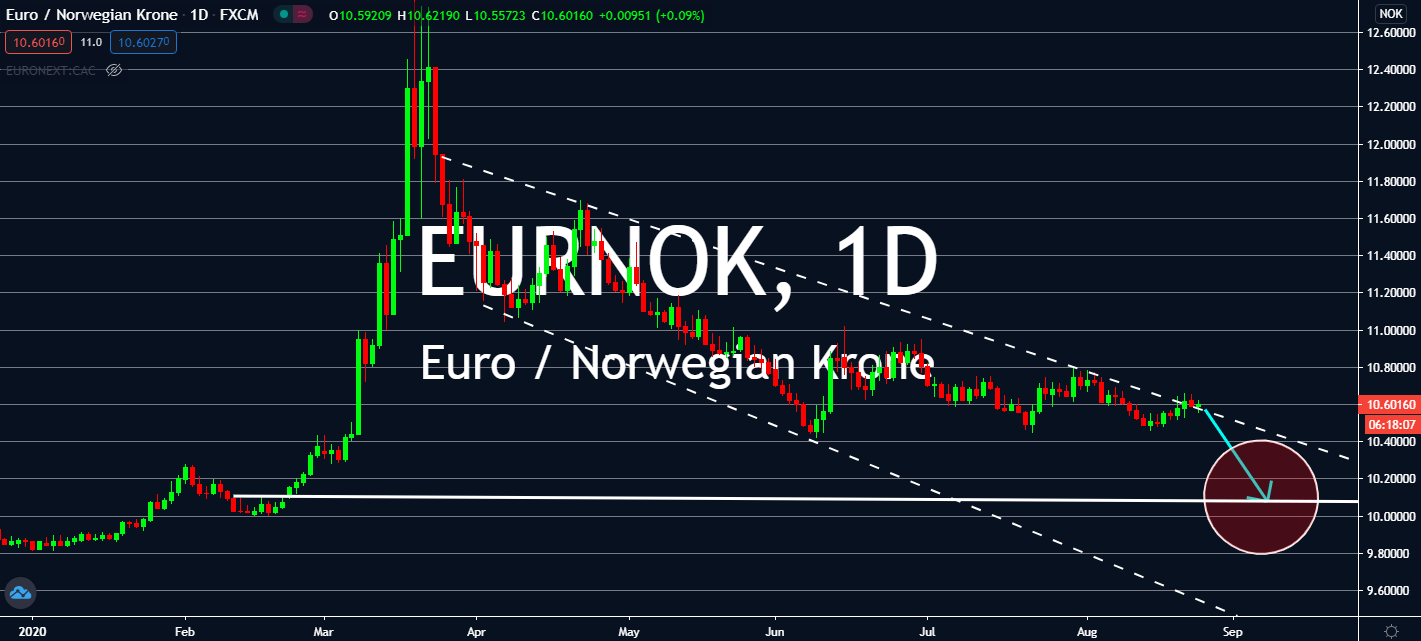

EURNOK

The Norway economy is officially in recession after it recorded the deepest ever decline it ever recorded. Its second consecutive quarterly fall in GDP was a drop of 2.2 percent, which was further down the 2.1 percent drop anticipated prior. However, the fall is still notably shallower than that of its European counterpart even while the bloc is in recovery from coronavirus-led lockdowns. Germany reported a 9.7 percent decline in GDP for the second quarter compared to the 2 percent decline seen in the first quarter. Although the figure is better than the 10 percent decline expected prior. In a yearly comparison, Germany’s economy didn’t fall as much as Wall Street had anticipated, but it won’t take away the fact that it still saw an 11.3 percent decline that was much worse than the 1.8 fall seen in the same quarter in 2019. This will push the euro down in the EURNOK pair near-term as economies suffer from resurging coronavirus cases in the bloc.

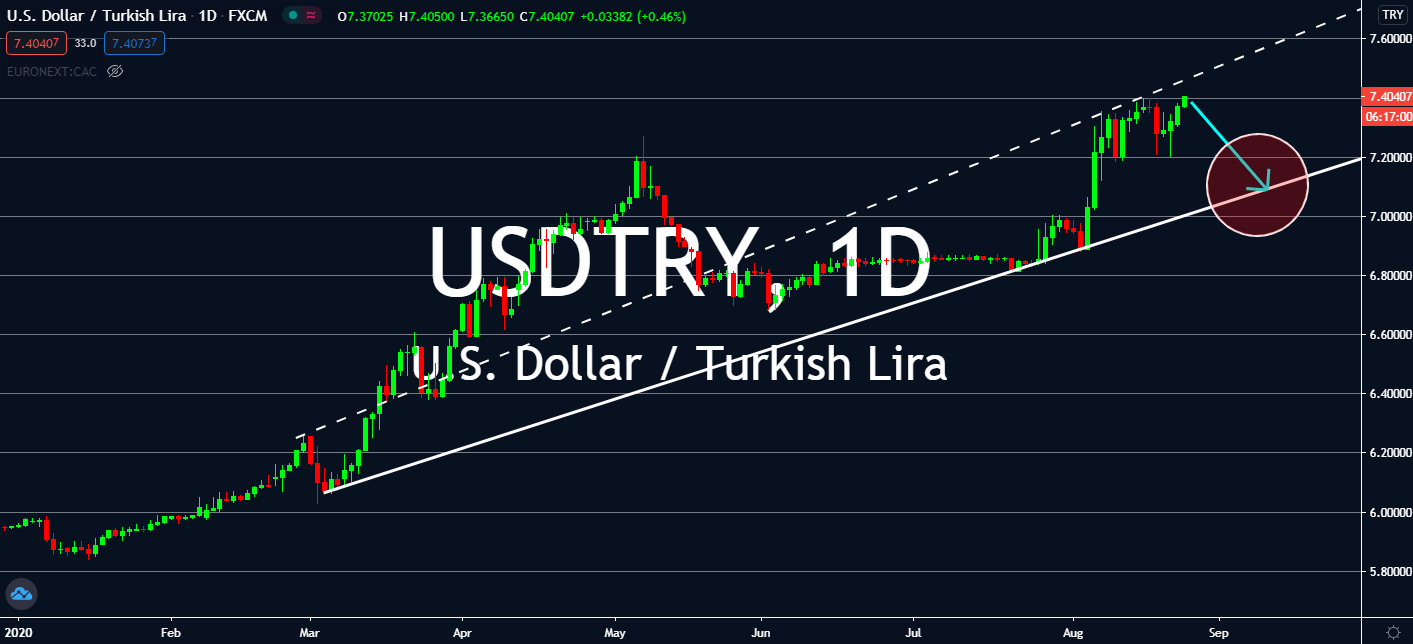

USDTRY

Despite expectations that the US Consumer Confidence for August will inch upward in today’s trading, the greenback is still expected to meet the bears against its Turkish counterpart. Industrial confidence in Turkey reached back up pre-coronavirus levels, which surprised markets around the world. Confidence rose to 106.2 points from 100.7 in July, according to its central bank in recent trading. Before the country announced its first Covid-19 cases in March, it had stood at 106.9 in February. Total orders reached 113.5 points in August, way up against 81.2 seen in the previous month. Sentiment in the services industry also increased to 70.5 points this month, up from 66.7 seen in July. Retail only stepped up to 94.9 from 94.6. As the market waits for the Federal Reserve’s Jerome Powell to report the agency’s outlook on the United States’ inflation outlook for the full year of 2020, the greenback is set to reach even lower.