Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

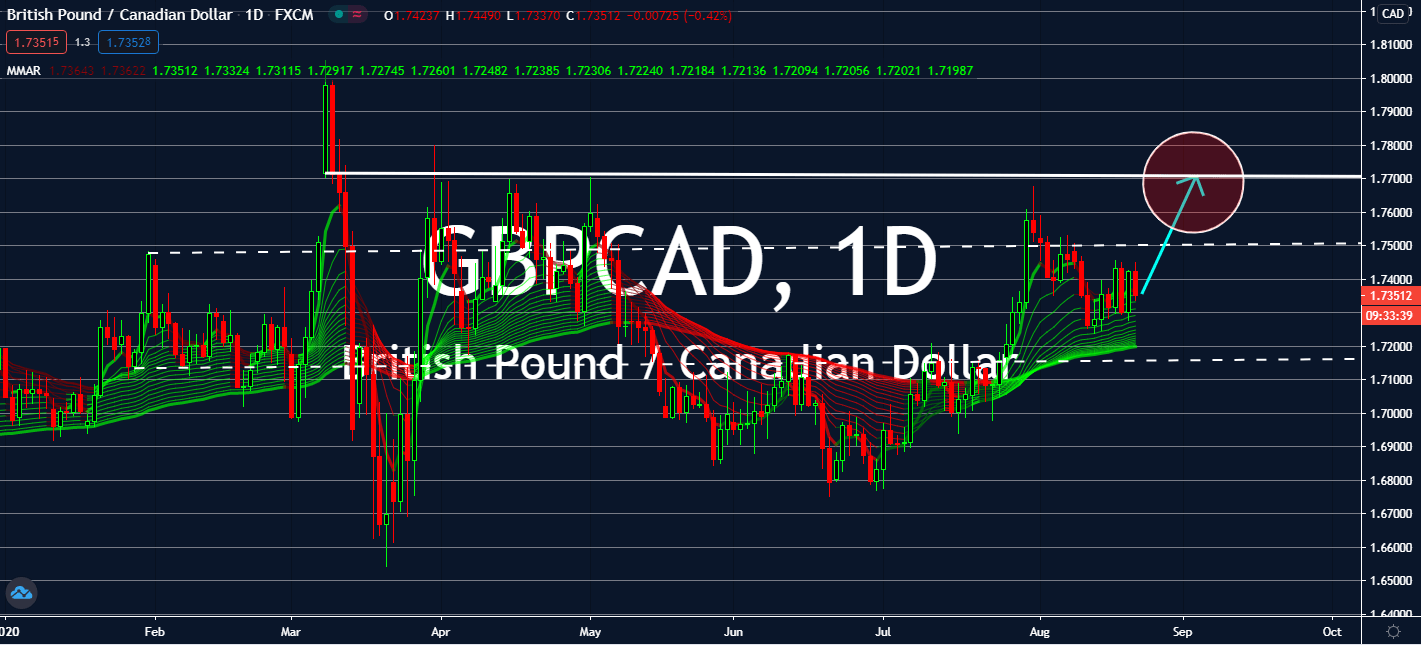

GBPCAD

Thanks to the boosts in UK’s economic data reported in today’s trading, the sterling pound is now expected to rope in bullish investors into its currency over the Canadian loonie near-term. Composite, Manufacturing, and Services PMI figures have surged both against their previous records and market expectations in the UK. Composite PMI went up from 57.0 to 60.3, up from 57.1 expectations. Manufacturing PMI went to 55.3 from the expected increase to 53.8 from 53.3 seen prior, and Services PMI had jumped from 56.5 to 60.1. Although Canada’s core retail sales is projected to record a lift from 10.6% to 15.0% while its monthly retail sales figure is expected to jump from 18.7% to 24.5%, it might not be enough to offset the recent gains seen in the UK market. Canada’s relatively faster growth over the US economy is anticipated to offset some of the sterling pound’s gains, but GBP is still expected to prevail near-term.

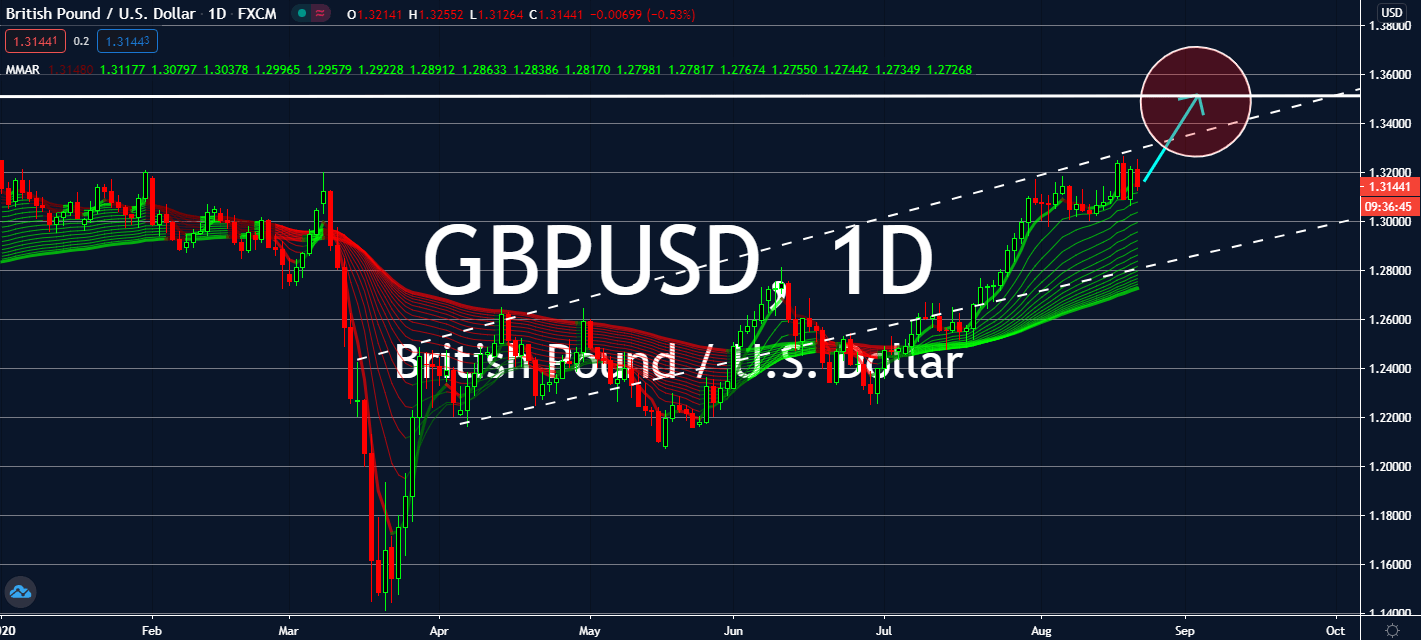

GBPUSD

It’s a week for manufacturing lifts in the forex market with both the United Kingdom and the United States’ announcements sneak around the corner in today’s trading. But the main attractions for the exchange are the US existing home sales in July and the UK’s monthly retail sales figures for the same month. Sales of privately owned homes in the US are expected to surge up to 5.38 million from 4.72 million seen the month prior, another 14.7% increase from the 20.7% lift in June. Inflation-adjusted sales in retail in the UK for the month of July just reported a fall to 3.6%, a figure that was better than expected, but notably still a far fall from 13.9% recorded in June. Notably, both economies are in pressing economic crises, but ultimately, it would be best to side with bullish investors especially after the UK reported better figures in comparison to both market consensus and the prior figures last reported on August 5.

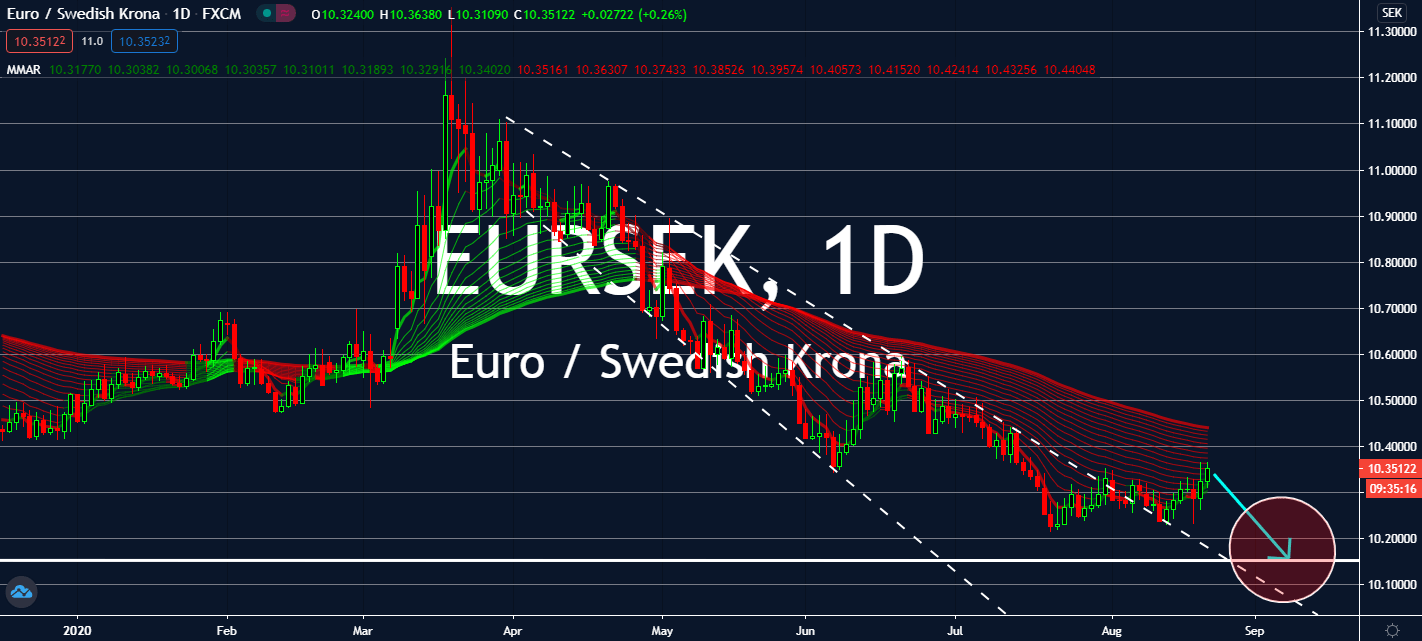

EURSEK

The Eurozone is reporting red in all borders. Many French economic data reported lower numbers for their August records, which are anticipated to bleed into the euro currency in upcoming trading. Manufacturing PMI went down from 52.4 to 49.0 this month, down from an expected increase of 53.7. Markit Composite PMI also went down to 51.7 from the previous 57.3 and the expected 57.3 figure. Services PMI also went down from expectations and prior records at 51.9 from 56.3 and 57.3, respectively. Germany, on the other hand, reported a services PMI of 50.8, down from the expected 55.1 figure and the prior 55.6 seen in July. Both figures were major contributors to the eurozone’s overall fall in all three figures, which came in worse in both expectations and prior records, as well. Meanwhile, the Swedish krona is expected to benefit from it considering it just reported a lower unemployment rate for July from 9.8% to 8.9% in July.

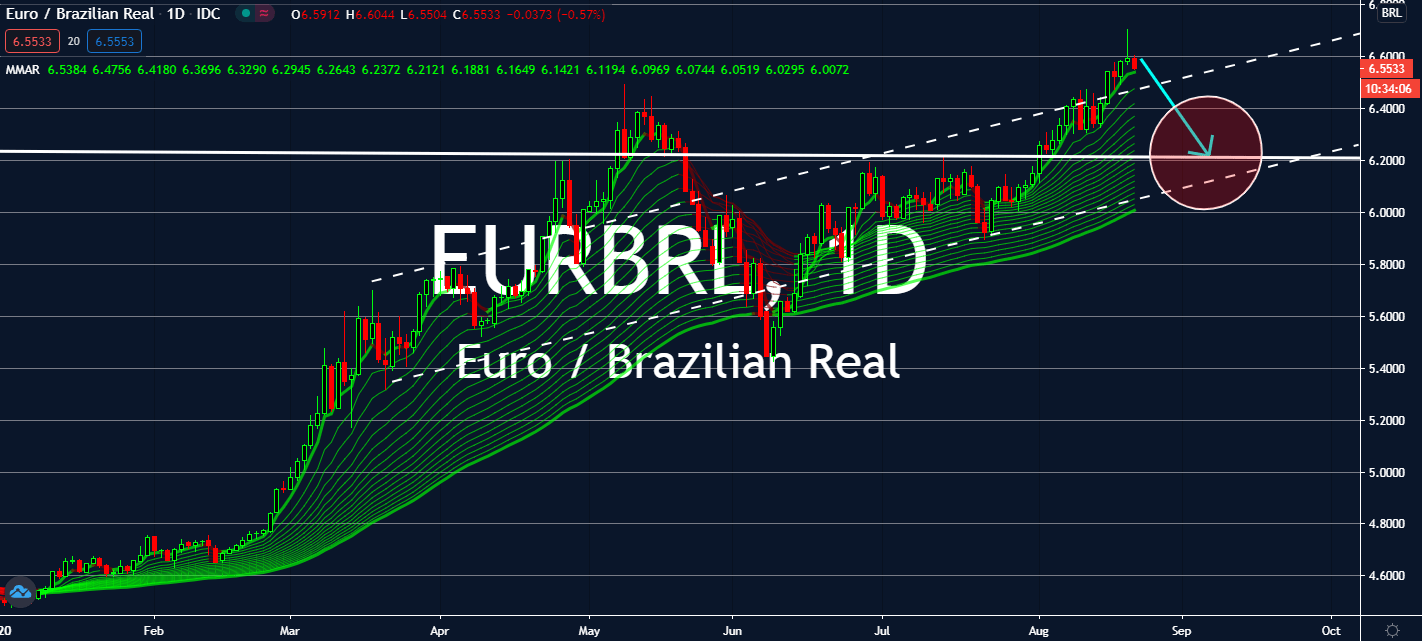

EURBRL

Brazil reportedly had Latin America’s shallowest economic recession this year, even as it stands as the country with the most Covid-19 cases in the region. Thanks to a faster reopening compared to its neighbors, economists see its GDP to contract only by 5.6% this year, a lower number in comparison to other countries such as Mexico and Argentina. Moreover, Brazil’s services sector activity rose in June for the first time since before the pandemic began. Meanwhile, the eurozone is bound to suffer from several reports held today such as its overall manufacturing, Markit, and services PMI figures for August, which all fell lower than Wall Street estimates and prior records held the month before. Investors are now waiting for Brazil’s Federal Tax Revenue announcement later today, which came in at 86.30 billion announced in the last week of July. Although if it does report a lower-than-expected reading, it wouldn’t change much for the exchange rate.