Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

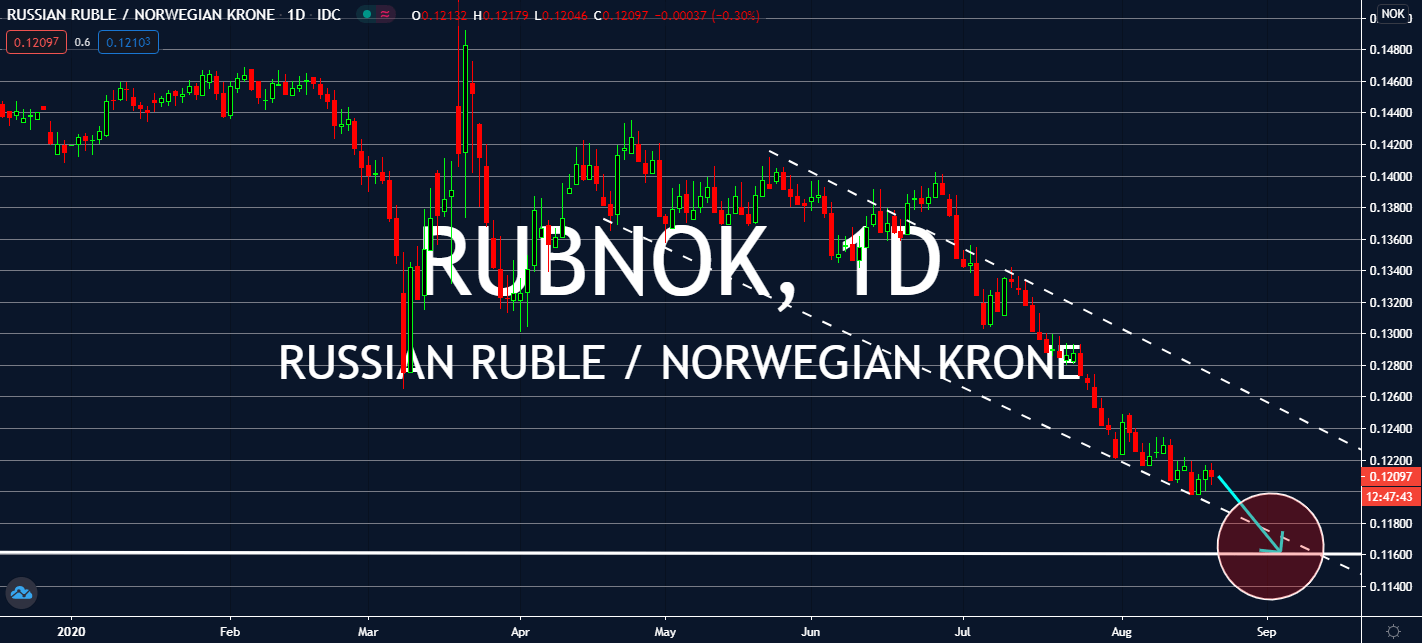

RUBNOK

Russia is going to announce its retail sales, unemployment rate, and monthly GDP records later today. Investors are waiting for its retail sales figure to rise by more than 3 percent from -7.7% to -4.8%. Its unemployment rate on the other hand is expected to inch downward from 6.2% to 6.1%, but the figure wouldn’t be impressive in the markets. Meanwhile, Norway is still enjoying its status as one of the countries that have the lowest fatality rates in Europe as an aftermath of strict lockdown measures. Months after it experienced its biggest unemployment dip since the 1930s, its economy is expected to recover sooner than Russia’s. Its central bank also held its interest rates as it is as per an announcement earlier today. Norges Bank said this information would prove the economic developments made in the country, which is projected to help the Norwegian krone instead of the Russian ruble in upcoming trading sessions.

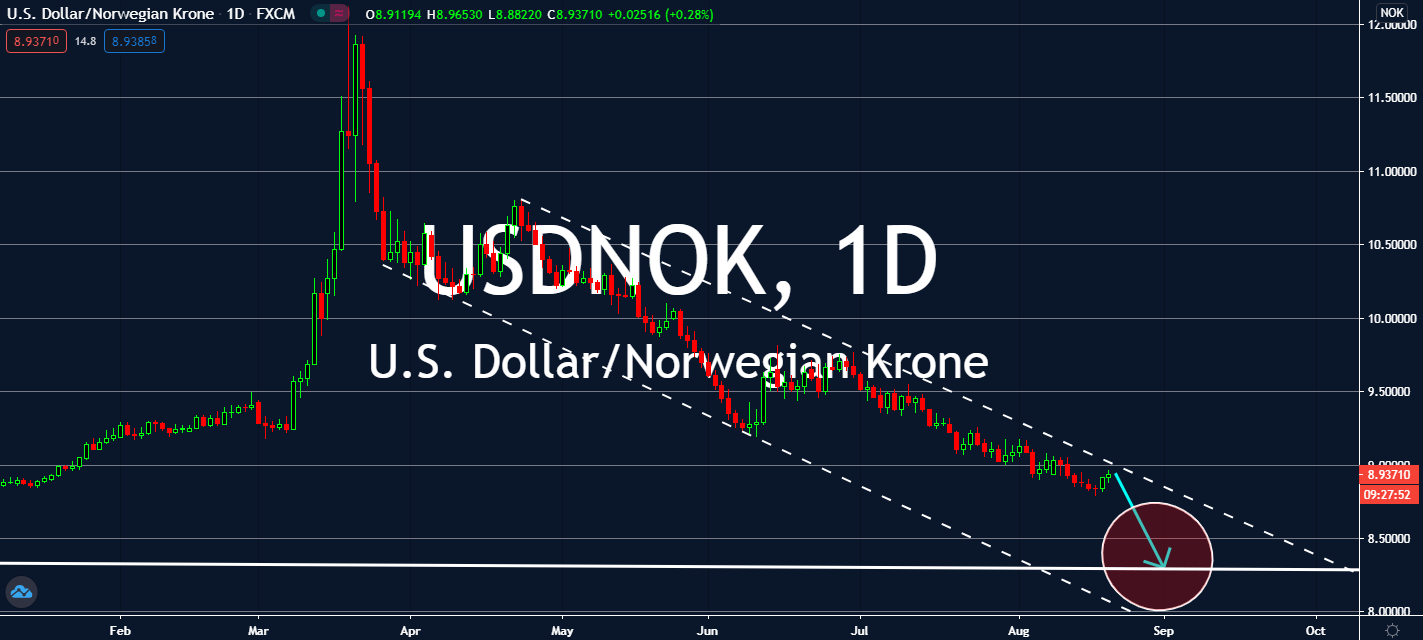

USDNOK

The US Philadelphia Fed Manufacturing Index is projected to fall back to 21.0 in August. Knowing that the figure is projected to become the second fall since it fell to 24.1 in June against 27.5, the US dollar is bound to see selling pressure near-term. Moreover, the recent Federal Open Market Committee’s meeting showed that the US economy will have a hard time recovering from the economic effects of the coronavirus outbreak. And US central bankers hesitated to show the future of its benchmark interest rates. Fed officials are scheduled to meet again mid-September, but investors are keen on rooting for the Norwegian krone from the uncertainty of the US economy as the virus weighs heavily on it, or as the FOMC claims. It looks like the US dollar is still bound to fall after it reported a massive pitfall of an annualized “most severe” downturn in Jerome Powell’s lifetime at a 32% decline between April and June.

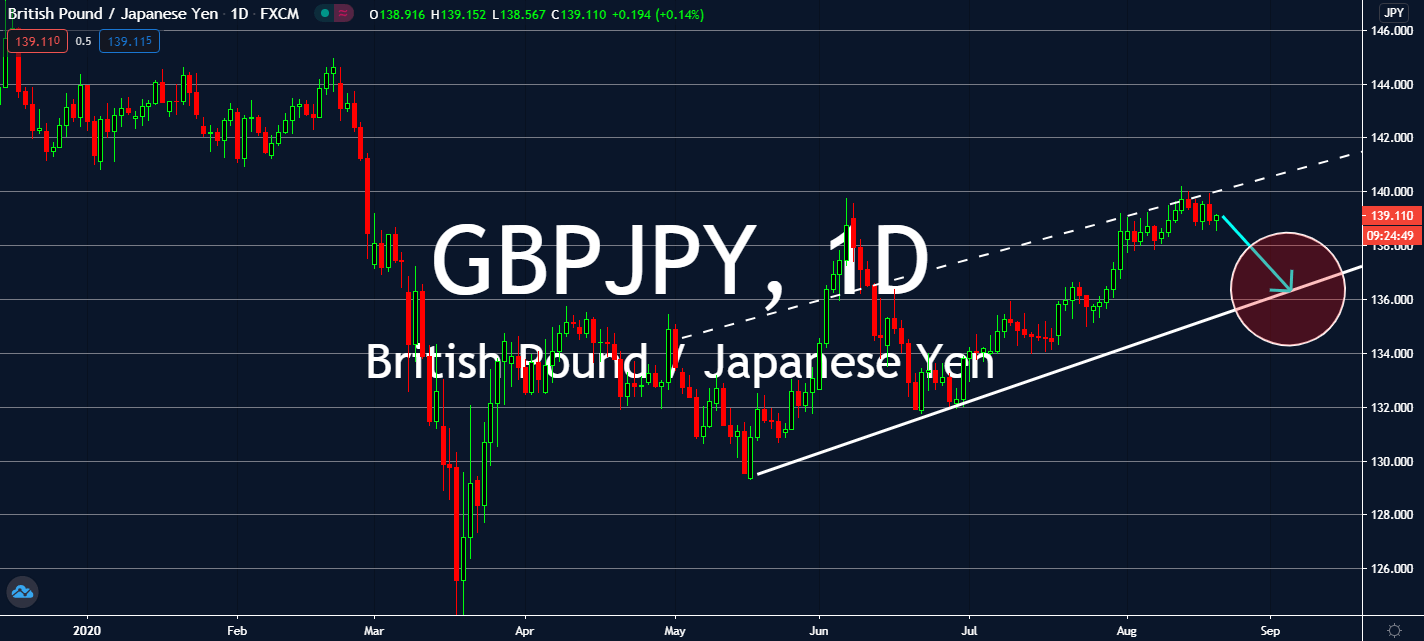

GBPJPY

The UK is witnessing history come to life once again. In the span of a few months, its GDP plummeted so far down, it obliterated 18 years’ worth of economic growth to levels last seen before it started considering being a part of the European Union. The recession is the worst of all G7 states besides Spain at 25% between February and April. Since the coronavirus first took over, national debt had exceeded 100 percent of its GDP for the first time since 1963 while the full year’s budget deficit is forecasted to rise up to 322 billion pounds, higher in comparison to the 153 billion equivalent seen in the financial crisis between 2009 and 2010. Not only that, but 4.5 million jobs in the City also remain dependent on the government’s fiscal stimulus. Although Japan’s GDP fell 7.8% on a quarterly basis for the second quarter of 2020, perhaps it’s safe to say that the sterling pound wll decrease against the Japanese yen near-term.

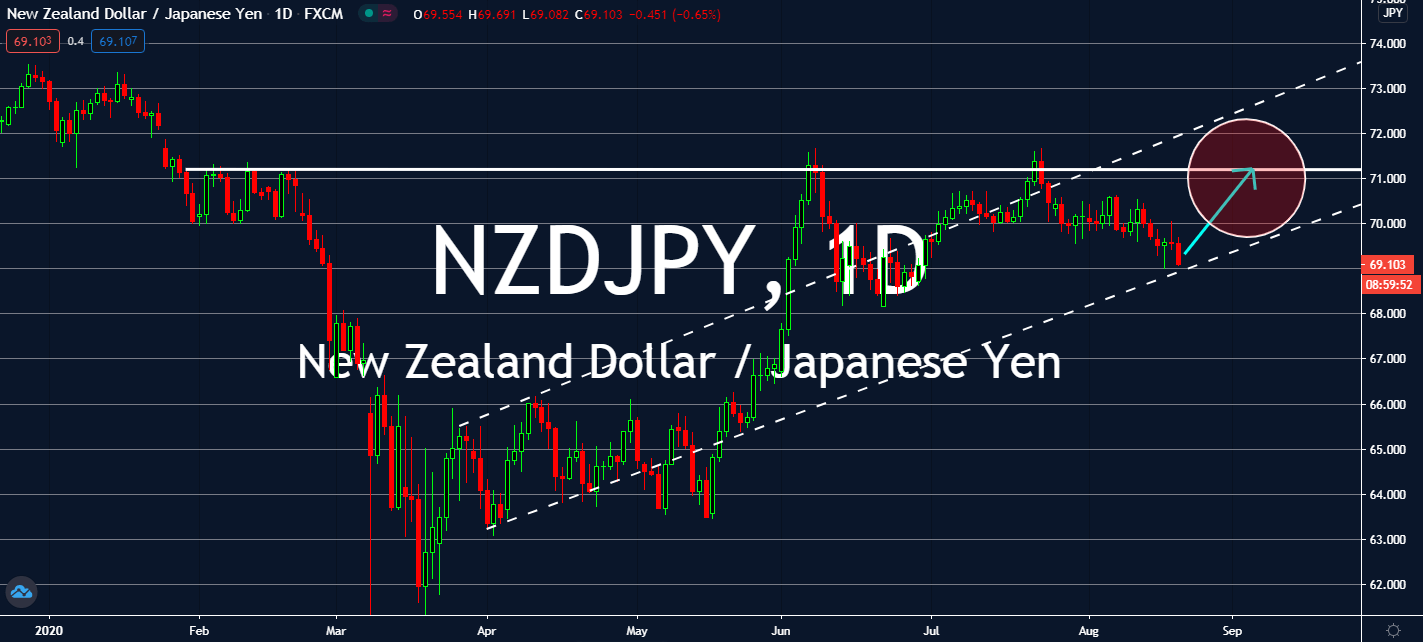

NZDJPY

Japan just experiences its steepest quarterly fall in GDP in 30 years. For the second quarter of this year, the country shrank by 7.8% on a quarter-over-quarter basis, translating to a 27.8% fall in an annualized basis. Consumption also fell 8.2% for the quarter when the country shuttered for a six-week emergency lockdown between April and May. The downfall emphasized the country’s vulnerability to negative stimulus as economists warn investors that its earlier fiscal stimulus will expire in September. The worry is going to benefit the recovering New Zealand dollar near- to medium-term even with New Zealand’s second lockdown in the most populous cities in the country. Auckland, a city of 1.5 million people, will remain closed for 12 days to counter the spread of the coronavirus. Both investors and economists are optimistic despite the lockdown as some speculate that it will experience not more than a 6% decline in GDP in H2 2020.