Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

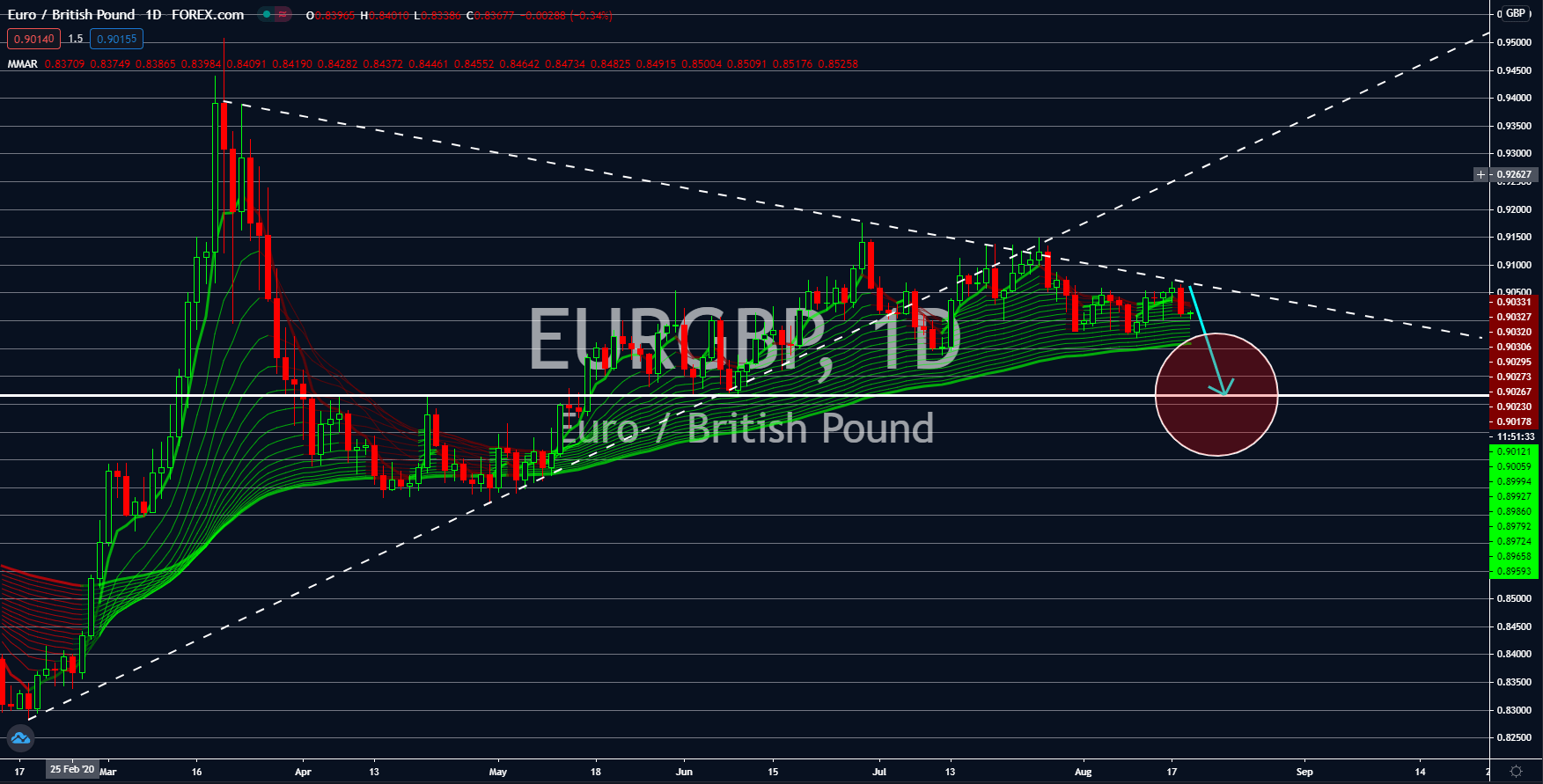

EURGBP

The European Union and the United Kingdom posted several reports today, August 19. Among the reports that are affecting the pair’s performance was the Consumer Price Index (CPI). Investors were baffled after the EU posted a disappointing result. For its July report, figures came in at -0.4%, more than the -0.3% expectations by analysts. This result came amid optimism from investors that the largest trading bloc is starting to recover from the pandemic. Meanwhile, the positive result for the UK’s CPI report surprised investors. The UK earlier disappointed investors with a 20.4 economic decline for the second quarter of 2020 following a 2.2% contraction in Q1. This figure sent the UK economy into a technical recession, the first time since the 2008-2009 Great Recession. Britain recorded CPI growth for July at 0.4%. Analysts were expecting the report to decline by 0.1% while its June’s result was a positive growth of 0.1%.

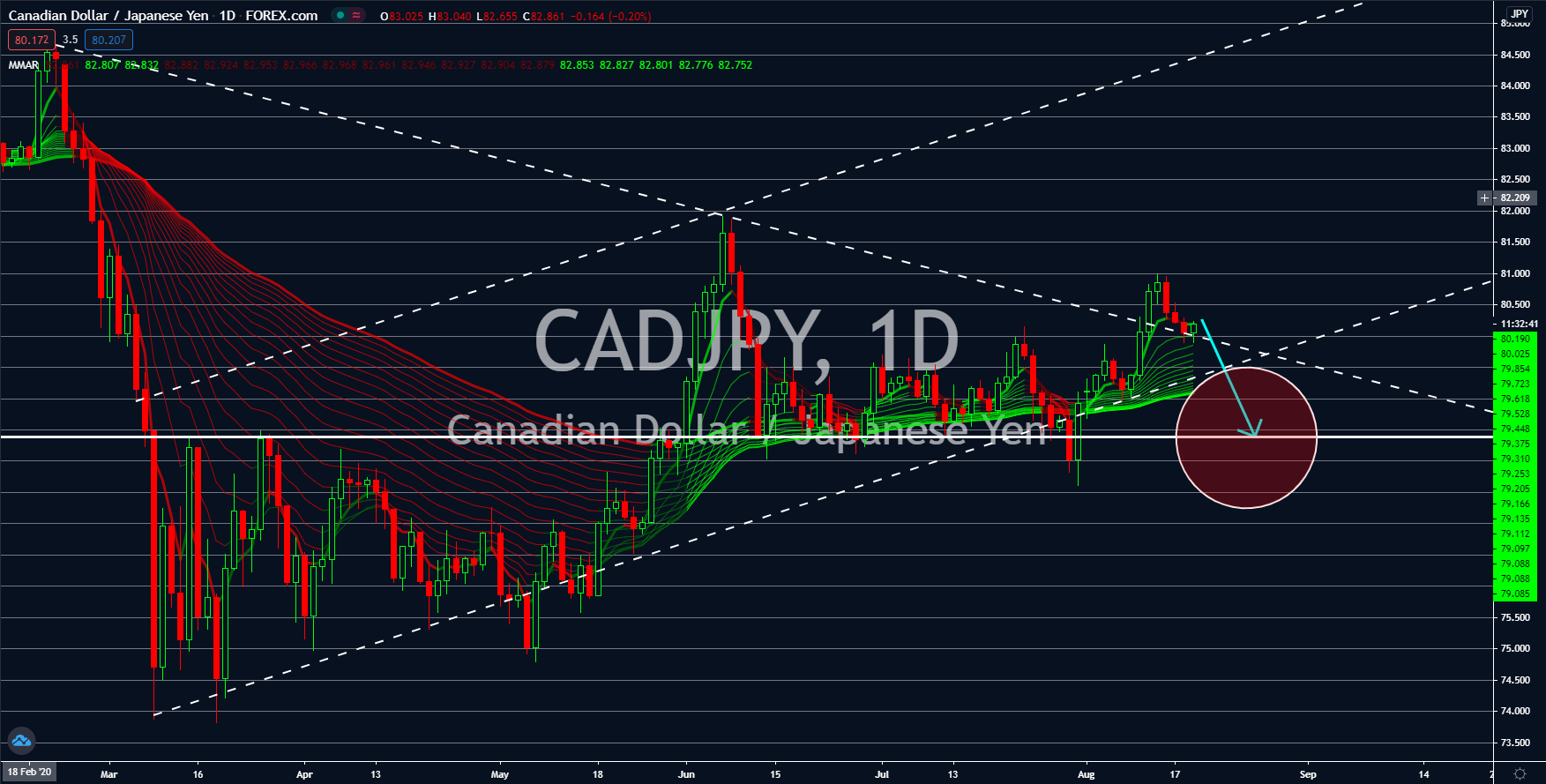

CADJPY

The economic and financial activity in Canada is expected to shrink for this week’s report. On Monday, August 17, the country posted its report for foreign securities purchases. The figure went down from $22.39 billion in May to -$13.52 billion in June. Analysts suggest that this pessimism from Canadian investors was due to the uncertainty in the local and global economy. Meanwhile, its consumer price index (CPI) report is anticipated to slow down to 0.4% for the month of July. Japan, on the other hand, reported a strong surge in exports at -19.2% compared to -26.2% result in June. The increasing economic output from exports is expected to help the country report a better-than-expect CPI report for the coming months. Industrial Production and Capacity Utilizations were also up in this week’s report. Figures came in at 1.9% and 6.2%, respectively. These figures are expected to shrug off Japan’s disappointing Q2 GDP result.

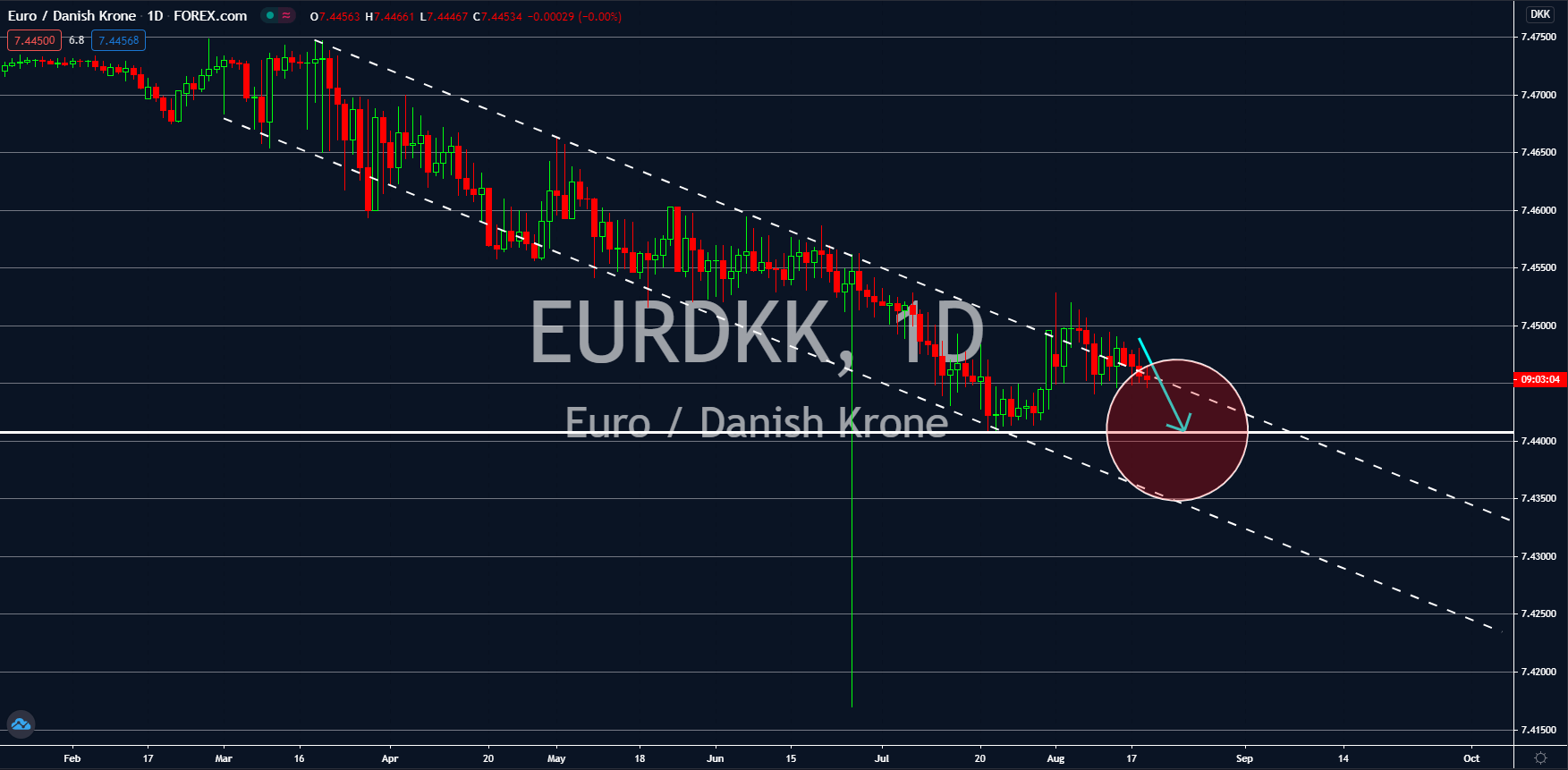

EURDKK

Eurozone’s lackluster economic results will lead the euro-krone exchange further into the bear market in upcoming trading. CPI in the bloc inched upward only by 0.1% from 0.3% in the previous year to 0.4% this year in July. Its month-over-month comparison, on the other hand, went to negative territory and below market expectations. From 0.3% in June, the figure went down to -0.4% in July 2020. In Denmark, the European Commission just approved a one billion-euro stimulus package for affected businesses in the country, which is expected to help boost its economy and currency near-term. The approval states that SAS, a Denmark-based major network airline is expected to help stimulate about 30% and 25% of Denmark and Sweden’s international traffic after suffering a substantial loss from the coronavirus outbreak. More businesses are also reopening in the country, signaling that its economy is improving faster than expected.

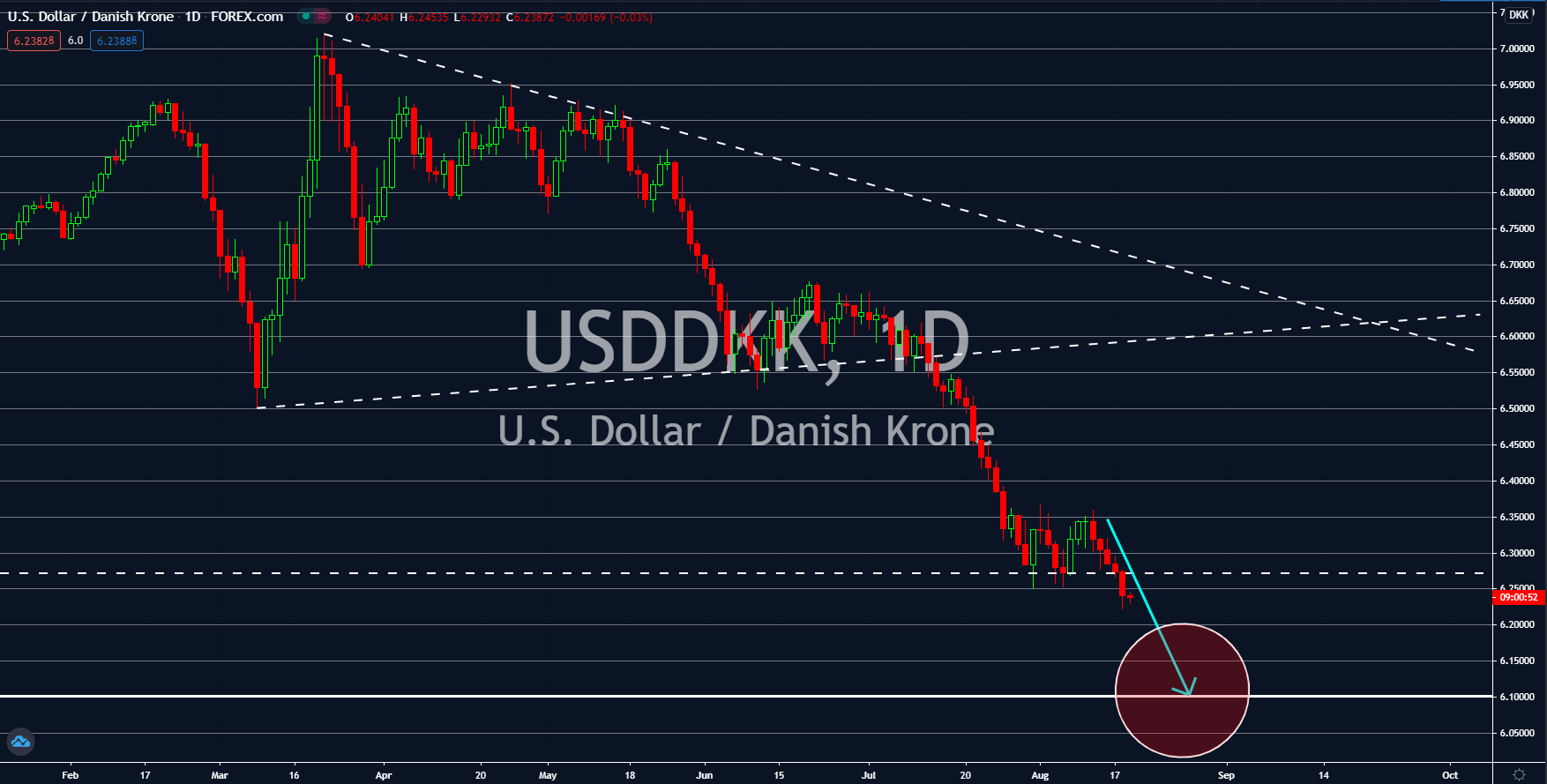

USDDKK

The expected crude oil inventory increase this week will push the greenback down against its Danish counterpart. Risk sentiment is expected to root for the krone after the European Commission confirmed its approval of a 1 billion-euro stimulus package to help revitalize their affected economies in the pandemic. Although the Federal Reserve recently announced that it plans to loosen its view on inflation, markets are worried about the promise’s execution. The Federal Open Market Committee’s meeting minutes for July will be released in late trade. This record is anticipated to make a bigger impact on the Danish krone, but when comparing both economy’s GDP status for the second quarter, the latter currency is expected to draw bear markets in for USDDKK. In the second quarter, the US saw a 32% decline in its economy. Meanwhile, Denmark saw a comparatively timid decline of 7.4% during the same period.