Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

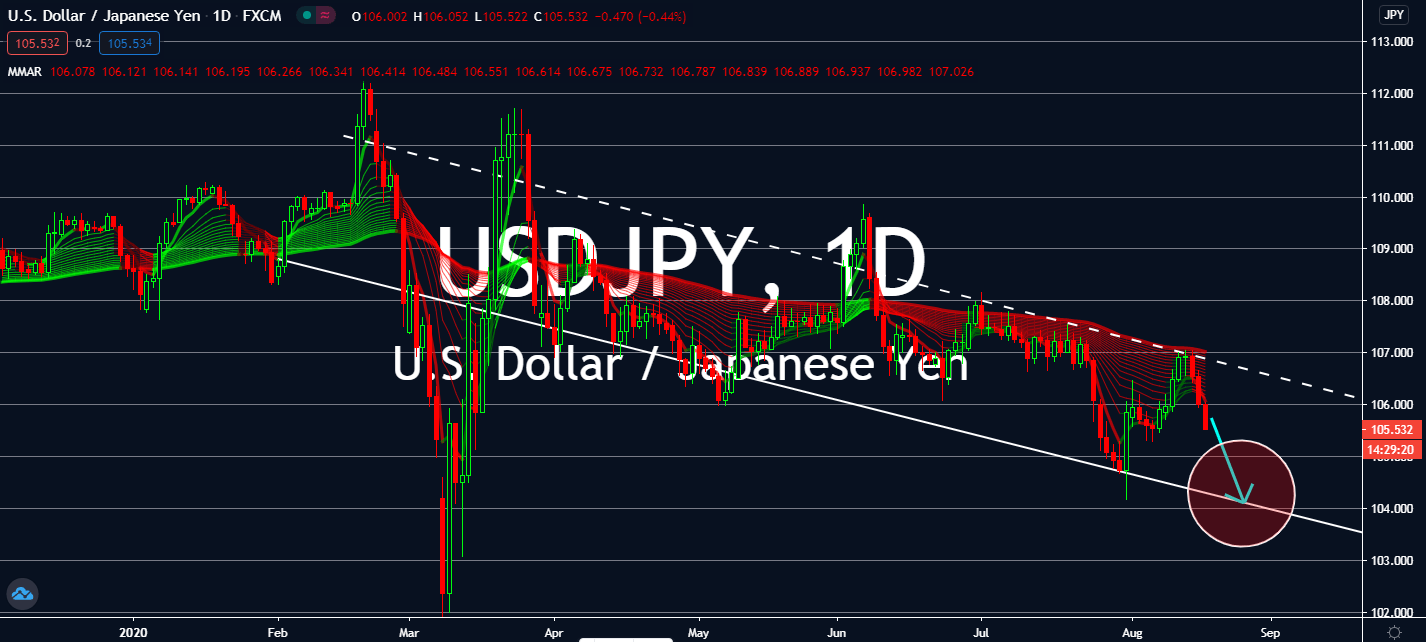

USDJPY

Wednesday’s release of the Federal Reserve minutes is projected to fall further into selling pressure for the American dollar across the currency border. The Japanese yen is one of the “triple threat” in near-term trading with retreating yields, soft US economic data, and risk sentiment to bid well for several greenback rivals. But note that US building permits are projected to report an increase for the month of July from 1.258 million to 1.320 million on a monthly basis. Housing starts are also expected to increase in the same month and comparison from 1.186 million in June to 1.240 million. Until the meeting minutes, investors are more likely to sell the dollar for the Japanese yen. Japan’s export figure could also promote the greenback’s weakness. To be recorded on a yearly basis later today, Japan expects its exports to see -21.0%, up from -26.2% seen in 2019. Its upcoming adjusted trade balance might dampen the decline.

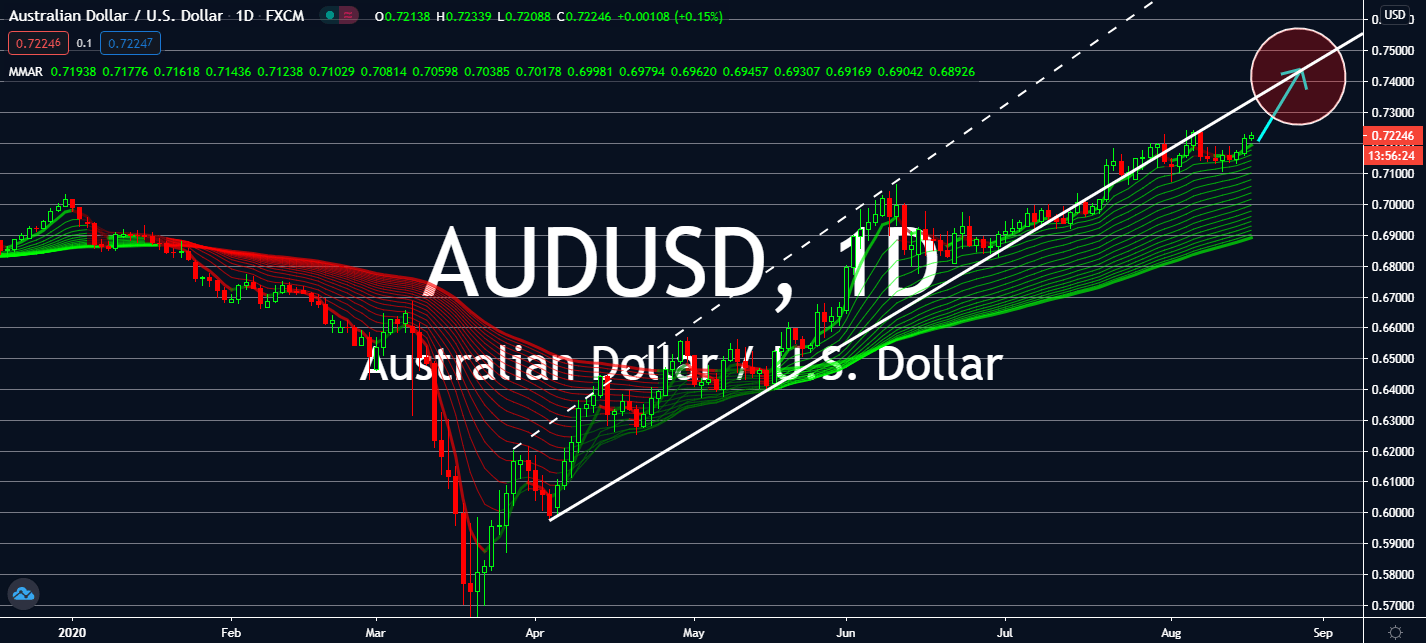

AUDUSD

The Aussie is projected to rise near-term after the Reserve Bank of Australia reaffirmed the outlook of steady monetary policies, although the increase will be dampened by an investigation for importing wine from Australian markets. Its cash rate will remain at its record low of 0.25% after slashing rates to combat the economic effects of the coronavirus pandemic in early March. Notably, the central bank admitted that its recovery would still be slower than initially expected, given the COVID-19 outbreak in Victoria is still affecting the economy. The United States’ Housing Starts announcement later today will muffle the Aussie’s increase, because the figure is expected to report a witnessed increase in July from 1.186 million to 1.240 million. US building permits for the month of July is at the center of attraction, which is expected to see an increase to 1.320 million, 62 thousand more than 1.258 million in June.

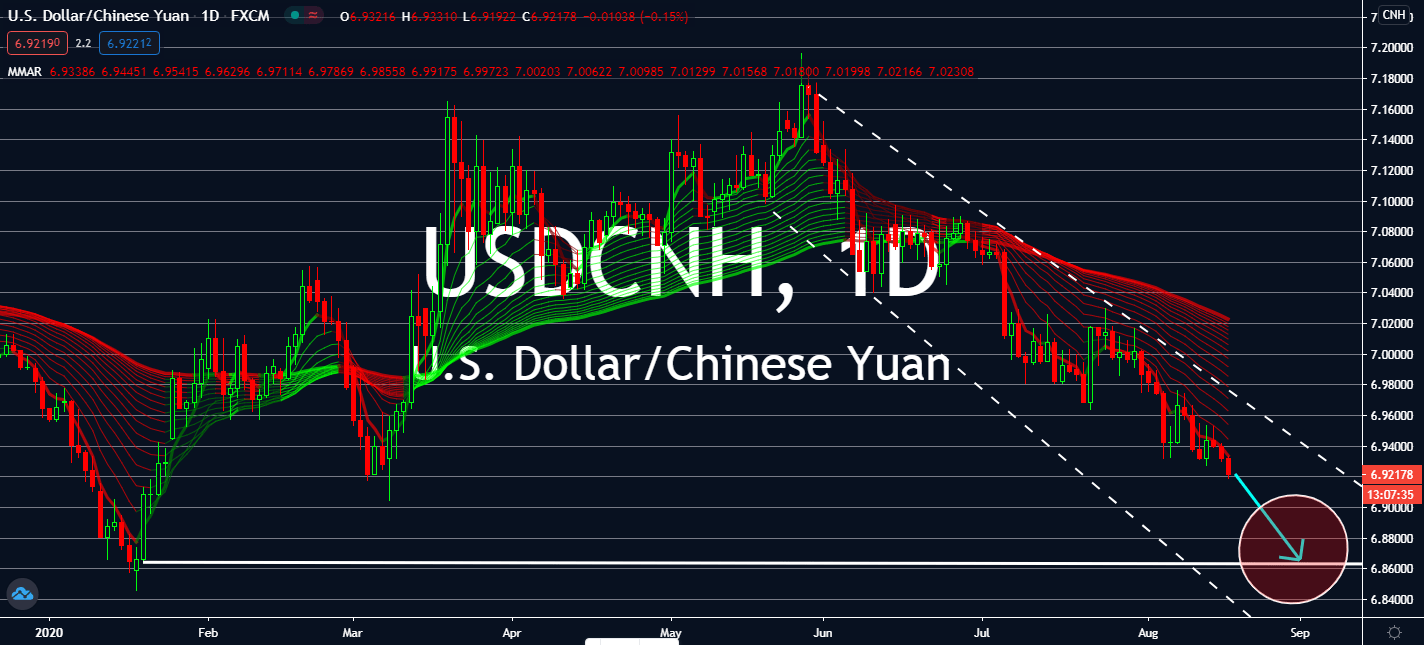

USDCNH

The Chinese yuan recently hit a level unseen since March 9 against the US dollar in recent trading. When rivaled against the manufacturing capital in the world, the greenback will inevitably lose once it sees a less-than-expected figure. After the NY Empire State Manufacturing index reported a massive fall for August from 17.20 to 3.70, which is way lower than the 15.00 figure expected prior. The market is now waiting for Wednesday’s record for the Federal Reserve’s meeting on how the US economy is faring in the coronavirus outbreak. Now that the coronavirus death toll topped 170,000 and the total cases surpassed 5 million, the greenback is now projected to reach even further down to pre-coronavirus levels with heightened risk sentiment in the general market. Otherwise, if the Federal Reserve reports good news on Wednesday, then the greenback might see an increase against the Chinese yuan, although it wouldn’t be enough to break the bearish pattern.

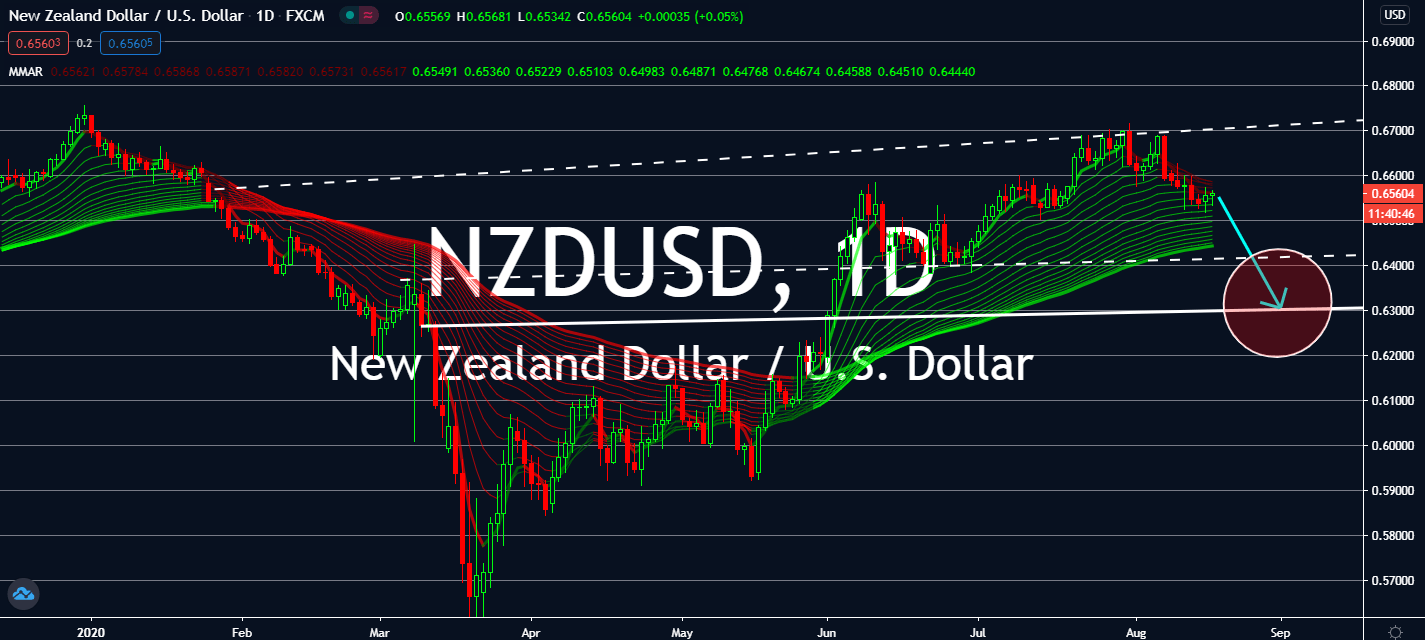

NZDUSD

New Zealand had gone virus-free for more than 100 days. But it saw a resurgence of coronavirus cases in its largest city in recent days, which prompted authorities to lock down the city again last week. The Reserve Bank of New Zealand Governor Adrian Orr said that the central bank is considering the option of negative rates as part of a package to counter the economic effects of the coronavirus crisis. The central bank maintained its official rate at 0.25% last week, but then it said the pandemic is still affecting much of its domestic economic outlook, which is highly uncertain. The kiwi economy shank by 1.6% in the first quarter of this year, which was its largest drop in nearly 30 years. Lowering interest rates tends to encourage businesses and individuals to invest and spend more, which could help the kiwi dollar in the long term, but worried investors are buying the US dollar given its recent agreement with China.