Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

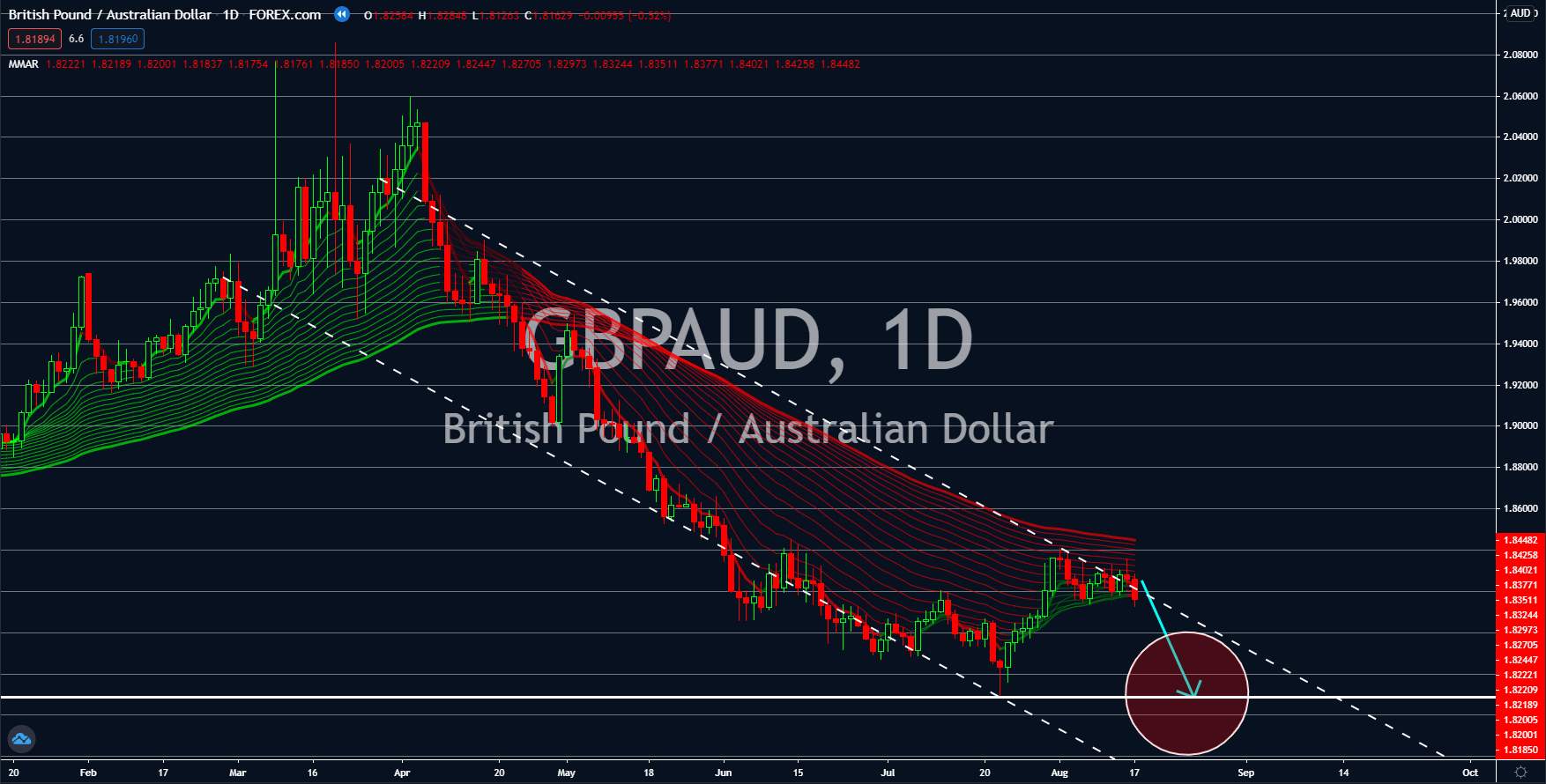

GBPAUD

The coronavirus pandemic has triggered an economic meltdown globally which was last seen during the Great Depression in the 1930s. Among the top economies, the United Kingdom suffered the steepest decline. On its Q2 GDP report, Britain said its economy contracted by 20.4 percent. This was the lowest recorded growth for Europe’s third largest economy since 1955. With its two (2) consecutive GDP growth decline in Q1 and Q2, the country’s economy officially entered a recession. Just like the UK, Australia is also suffering from the impact of COVID-19 in its local economy. Unemployment reached record lows with 7.5% unemployment rate. This represents more than 1 million Australians who lost their job due to the pandemic. Despite this, the Australian dollar is expected to thrive against the British pound. The Reserve Bank of Australia (RBA) said it is ready to expand its monetary easing to support the local economy.

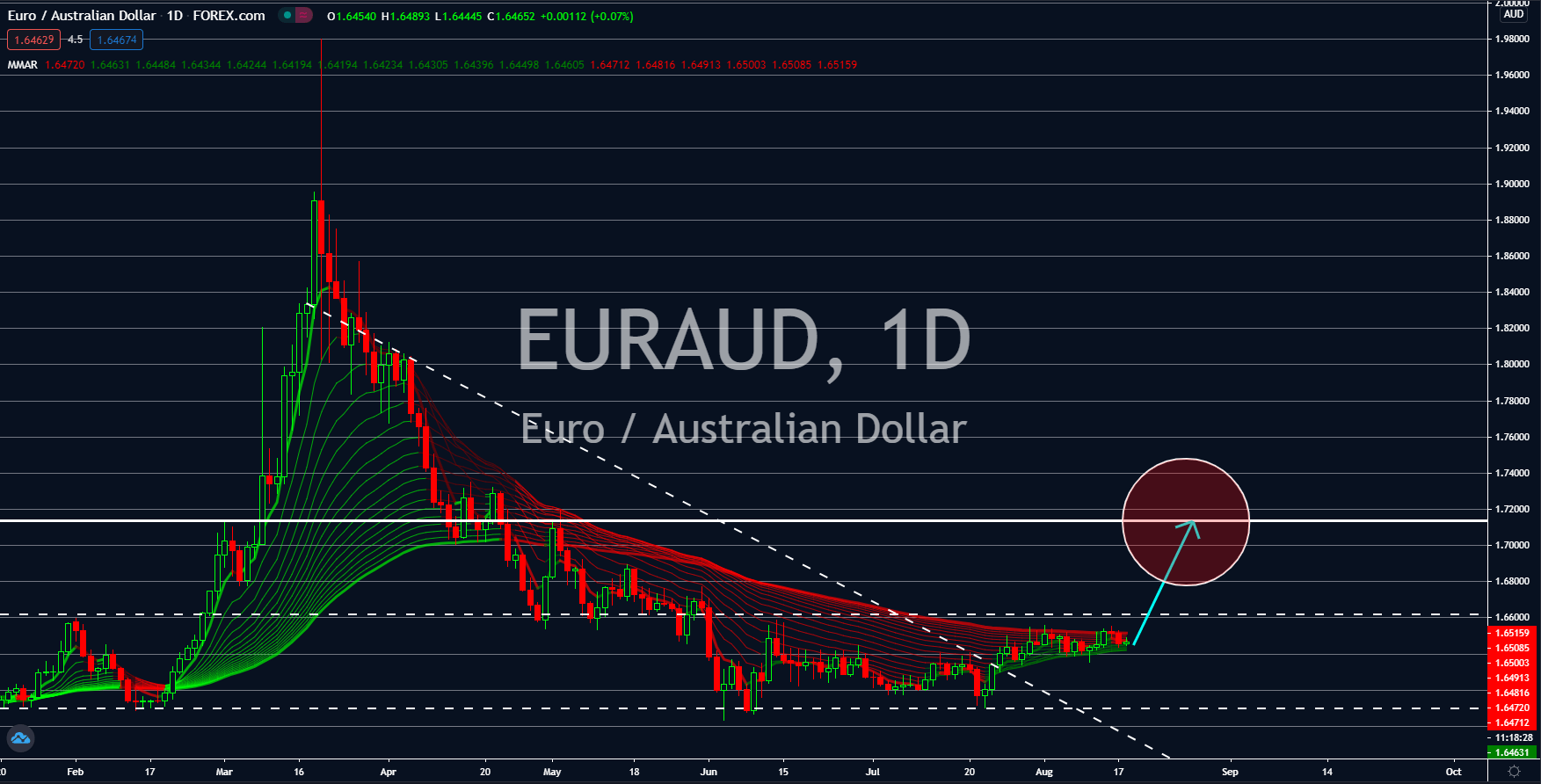

EURAUD

A strong recovery for the European Union is expected during the second half of the fiscal year. On Thursday’s report last week, France posted its lowest unemployment rate in a decade at 7.1%. This was despite the economic turmoil brough by the deadly virus. Meanwhile, the GDP growth of the entire bloc recorded a 15.0 percent decline for Q2 on an annualized basis. This was the same figure posted in July’s report, which gave investors hope that the report is about to reverse back. On the other hand, Governor Philip Lowe plans to support the Australian economy with more stimulus. The central bank is planning to expand its quantitative easing, which Lowe deemed necessary to restart the economy. However, analysts are worried that this will only create short-term relief for businesses and unemployed citizens. They pointed out that the main culprit for the Australian economy was COVID-19 and that the government should focus their effort in containing the virus.

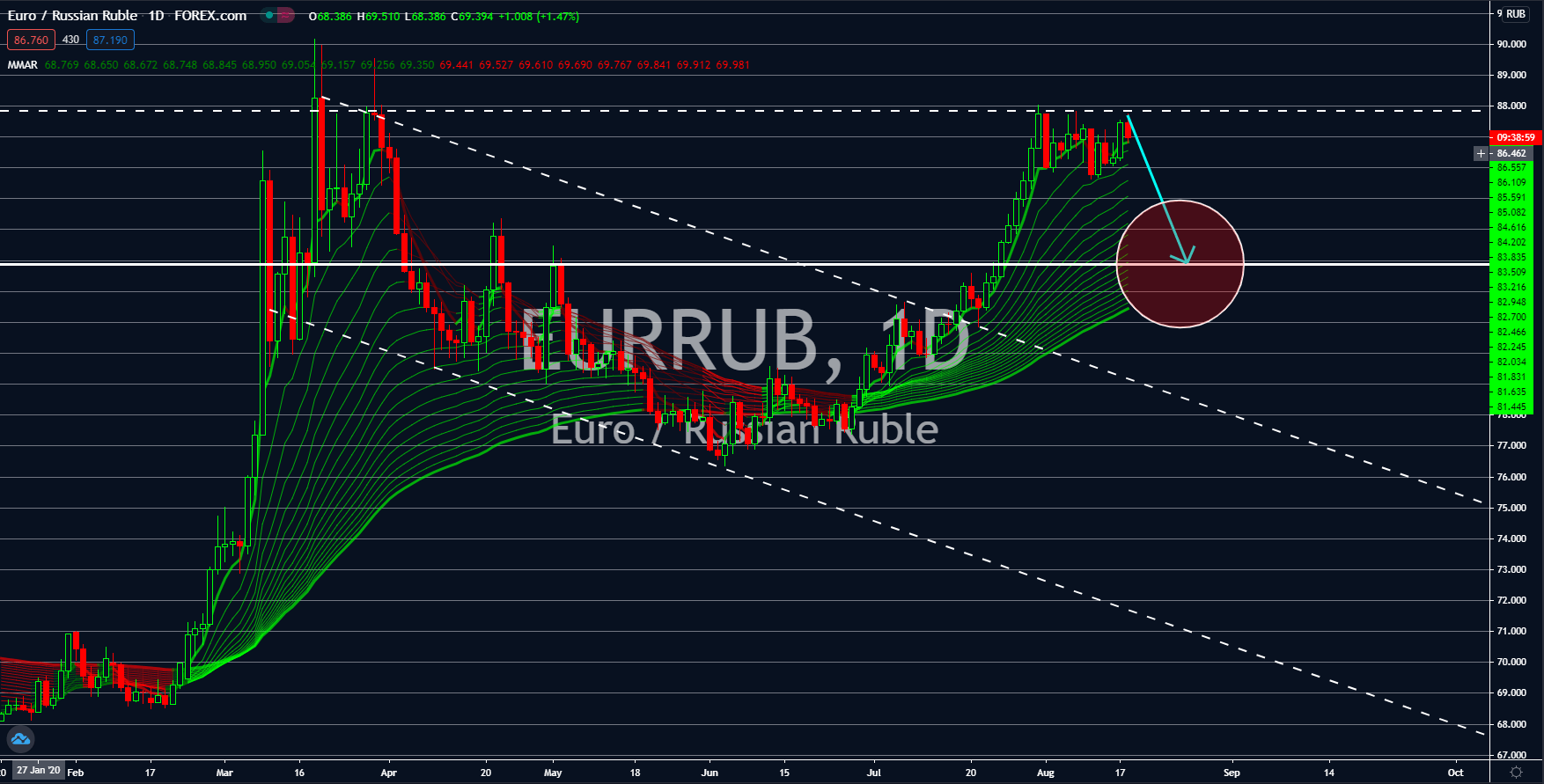

EURRUB

The Central Bank of the Russian Federation hit the $600 billion mark on last Thursday’s report for the USD reserves. The country joins the list of developing economies who are taking advantage of the weak greenback. Russia added $19.7 billion in reserves since March 19. The growing hedge assets of Russia will help the ruble to remain afloat despite the weakness in the local economy. On the other hand, the much larger European Union has only a foreign currency reserves of $922.98 billion. The mixed results from the EU member states’ reports are also taking a toll on the performance of the euro currency. German and Spanish Consumer Price Index (CPI) both went down to -0.5% and -0.9%, respectively. Only France was able to continue its positive data with 0.4% result from 0.1% in June’s report. Another reason for pessimism from investors is the possibility of the EU and the UK to close the Brexit negotiations.

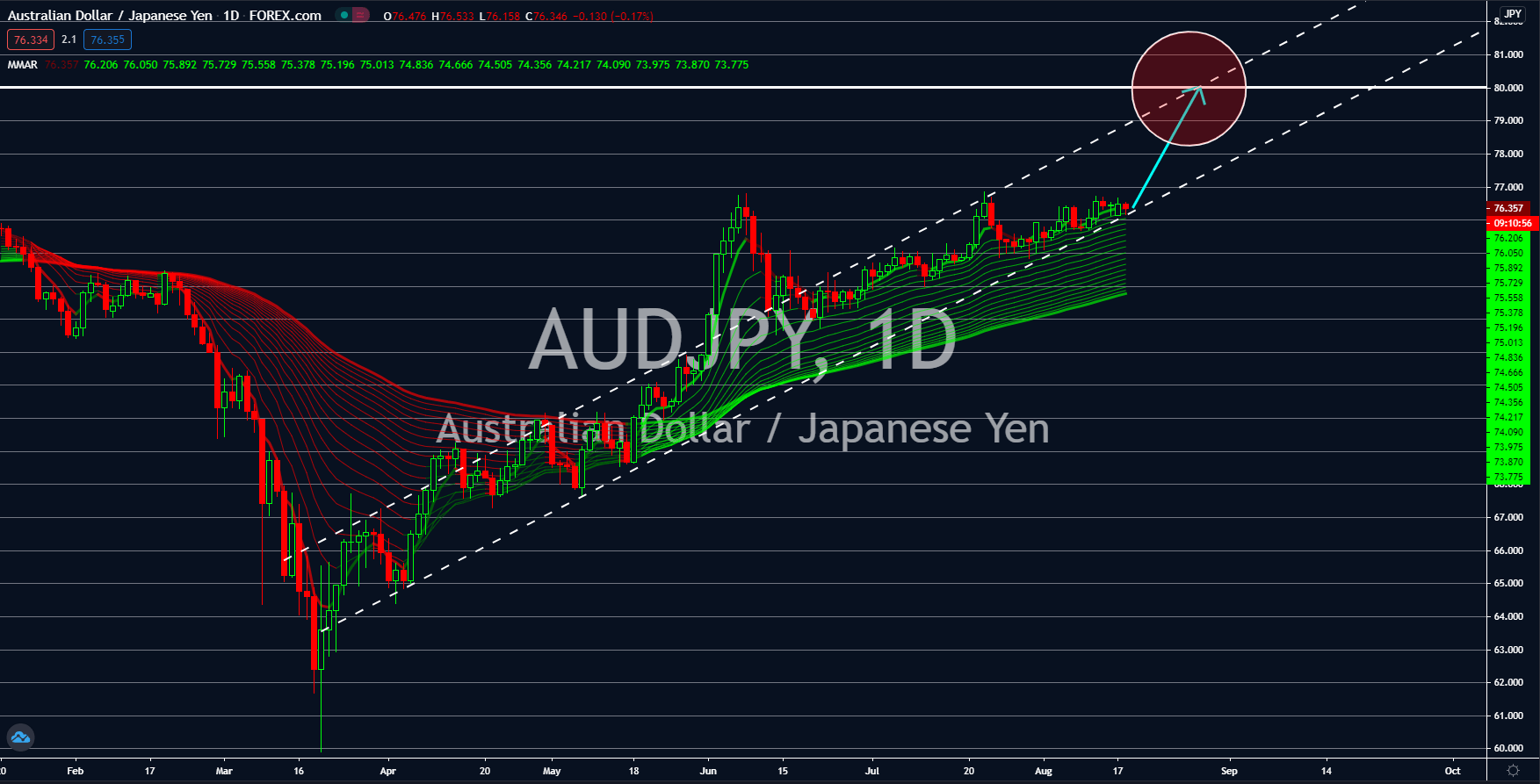

AUDJPY

Just like the UK, Japan dealt with a major blow on its second quarter GDP result. The country’s economy contracted by 7.8% on a quarterly basis and 27.8% on an annualized basis. These figures were the worst result in the country’s history. Aside from that, the rising number of coronavirus cases in the country is threatening to derail its economic recovery plan. The country has 56,717 confirmed cases as of writing. Japanese Prime Minister Shinzo Abe also warned that the country cannot afford another national emergency as it will be a catastrophe to businesses. Due to the pandemic, the government unleashed its biggest stimulus to date at $1 trillion. However, this has caused the Japanese yen to enter record lows. Meanwhile, the Reserve Bank of Australia is considering expanding its quantitative easing to extend its support to businesses and unemployed people. This will be beneficial to the Australian dollar in the short-term.