Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

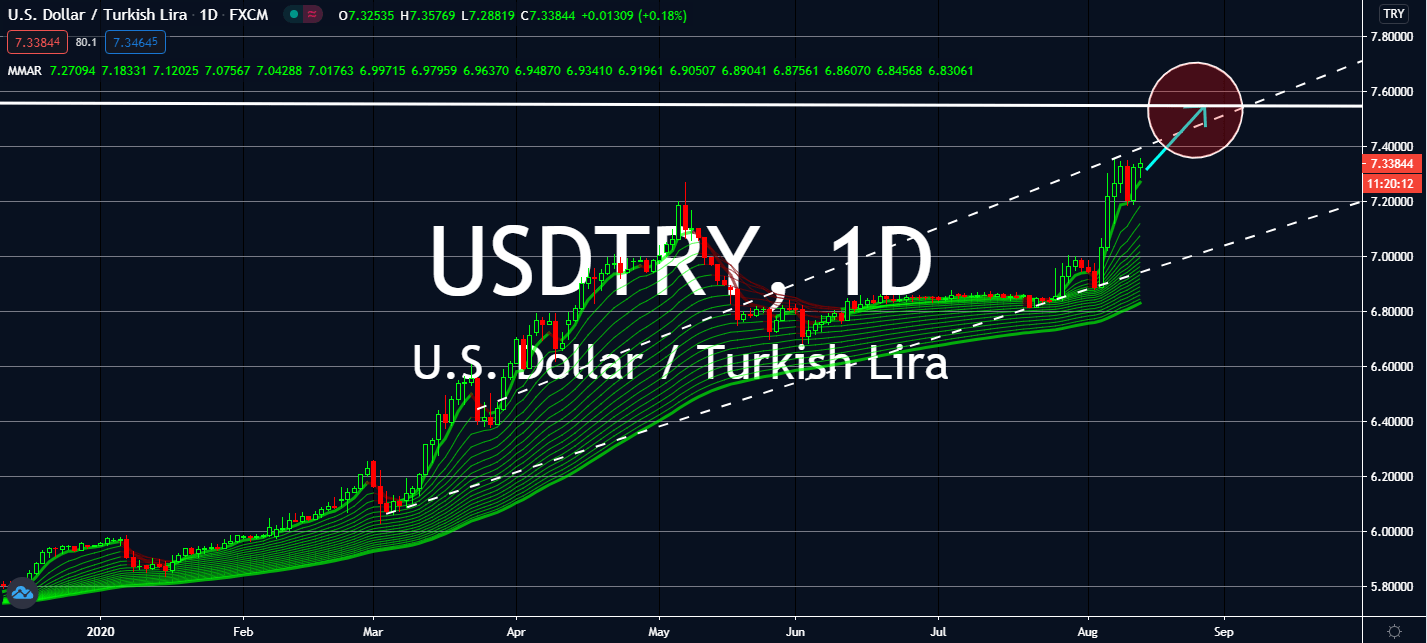

USDTRY

Half a year after the United States and China’s “phase one” trade deal, the top two economies are looking to reevaluate its progress. China had bought less than a quarter of the targeted full-year amount of US goods it had promised, raising tensions as the obligation becomes even more difficult to meet due to travel bans led by the coronavirus outbreak. Markets are also expecting the US to report another million initial jobless claims record this week from 1,186,000 to 1,120,000 this Thursday. Tensions may have been rising, but the dollar’s safe haven status is projected to lead its bullish path against the Turkish lira as more reports claim that the Turkish economy is expected to shrink about 4 percent this year as its official unemployment rates stay at 12.8 percent with experts’ assumptions that the real figures are far higher. Consumer debt in Turkey also increased by 25 percent to more than $100 billion for the past three months.

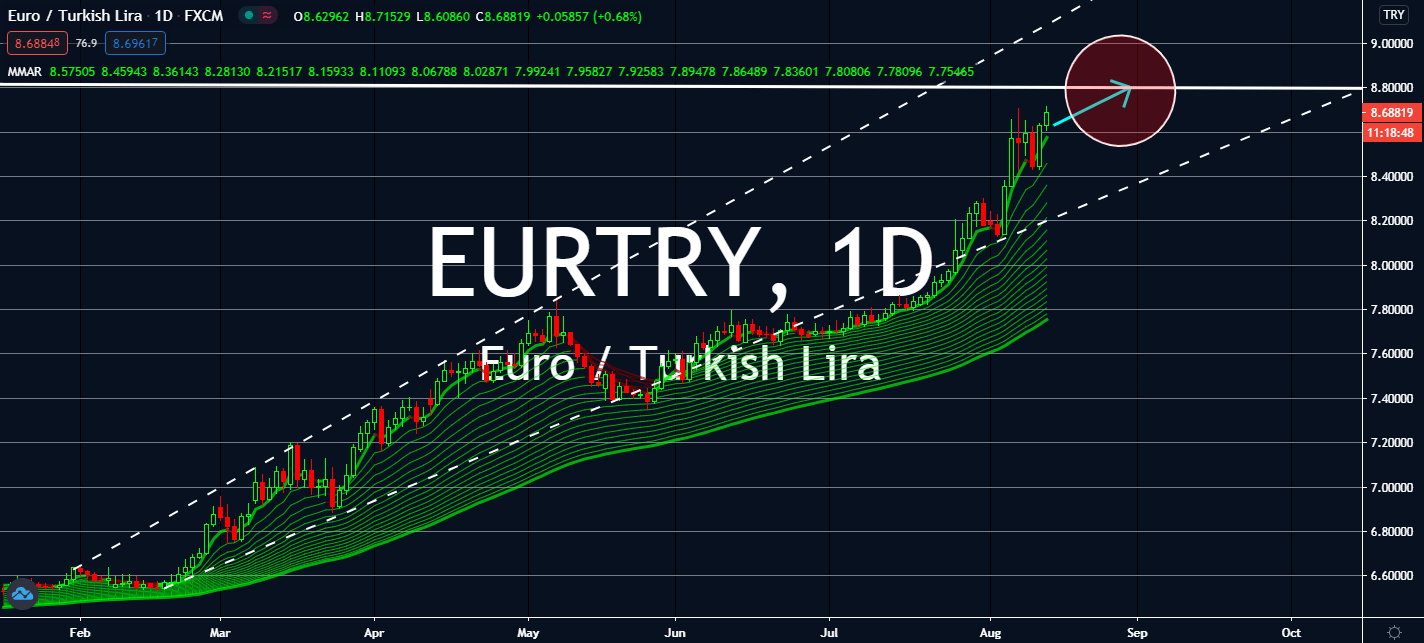

EURTRY

Many of the eurozone’s recorded economic data for today have been showing mediocre results on monthly figures. German CPI reported a decline from 0.6% in June to -0.5% for July. On yearly comparisons, Spanish CPI was only slightly lower in July from -0.3% last year to -0.6% in 2020 while the same country’s HICP inched down similarly at -0.7% from -0.3% recorded in July 2019. The minimized damage will lift the euro currency above the Turkish lira, which has been experiencing the threat of economic collapse. Consumer debt increased by 25 percent for the past three months after interest rates fell from 12% to 8.25% in May, and although it resulted to a surge in inflation, its 12.8% unemployment rate and the possible 4% economic contraction is expected to drive the markets towards the euro instead of the lira as the eurozone starts its own GDP recovery since its 12% plunge during this year’s second quarter.

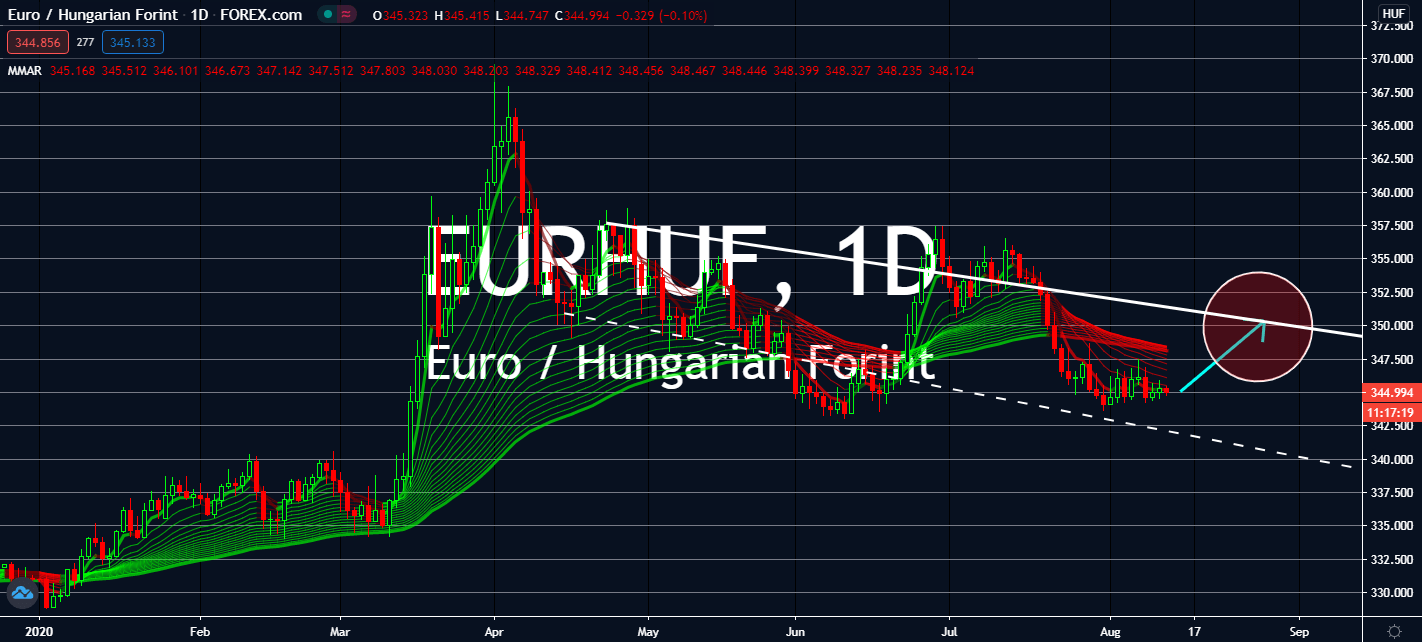

EURHUF

Hungary’s finance minister Mihaly Varga expressed an even more pessimistic view about the country’s economic outlook for the rest of the year recently. Earlier forecasts projected a 3% fall in GDP, but expectations have changed to a recession of about 5%. Hungary’s jobless average figure for May also went up from 12.8% to 12.9% while industrial output dropped by 30.7% in the same month, even after a 36.8% fall in April mostly driven by the decrease in car manufacturing. The worry came in alongside the fact that its open economy depends on this sector which halted in March. Car factories have since then reopened, but not in full capacity. The Turkish central bank is still expecting a growth of 0.3% to 2% year-end, but economists predict the economy would shrink to 4.35% this year. Recent and only slight losses in German’s CPI for July will help the euro currency lift against the falling Hungarian economy for the second half of 2020.

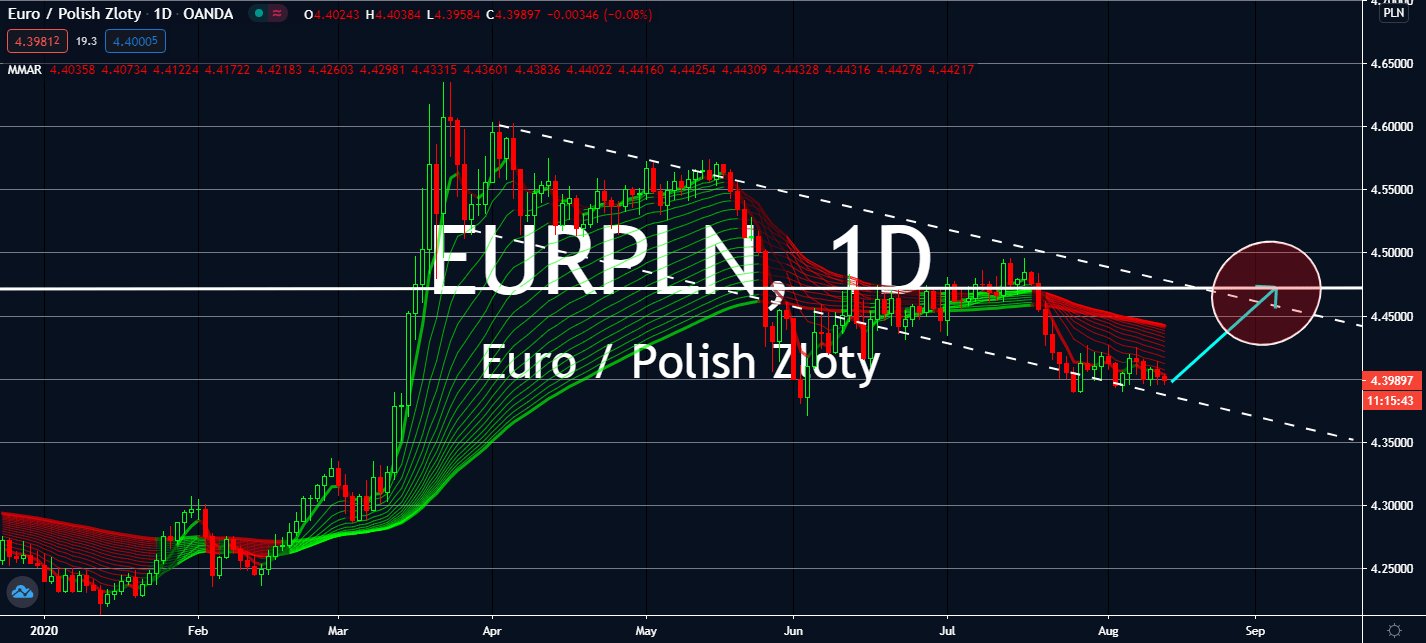

EURPLN

Poland’s GDP for the second quarter of 2020 is expected to fall by 9.2% from -0.4% in Q1 to -9.6% in Q2. Its CPI is also projected to lower from 3.3% last year to 3.1% this year, while the monthly comparison for the figure would fall from 0.6% to -0.1%. The average gross monthly salary in Poland was also lower by over PLN 300 in the second quarter of this year compared to the previous one. The number of confirmed coronavirus cases reached above 53,500 even while the country reopens its economy and international borders, raising concern that this could trigger an even higher wave. But since Deputy Prime Minister Jacek Sasin ruled out a new national lockdown, the country could experience a more long-term decline in GDP to be seen by the end of this year. Although the eurozone economy shrunk by 12% in the previous quarter, its recovery from the coronavirus will drive the euro currency up against the Polish zloty.