Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

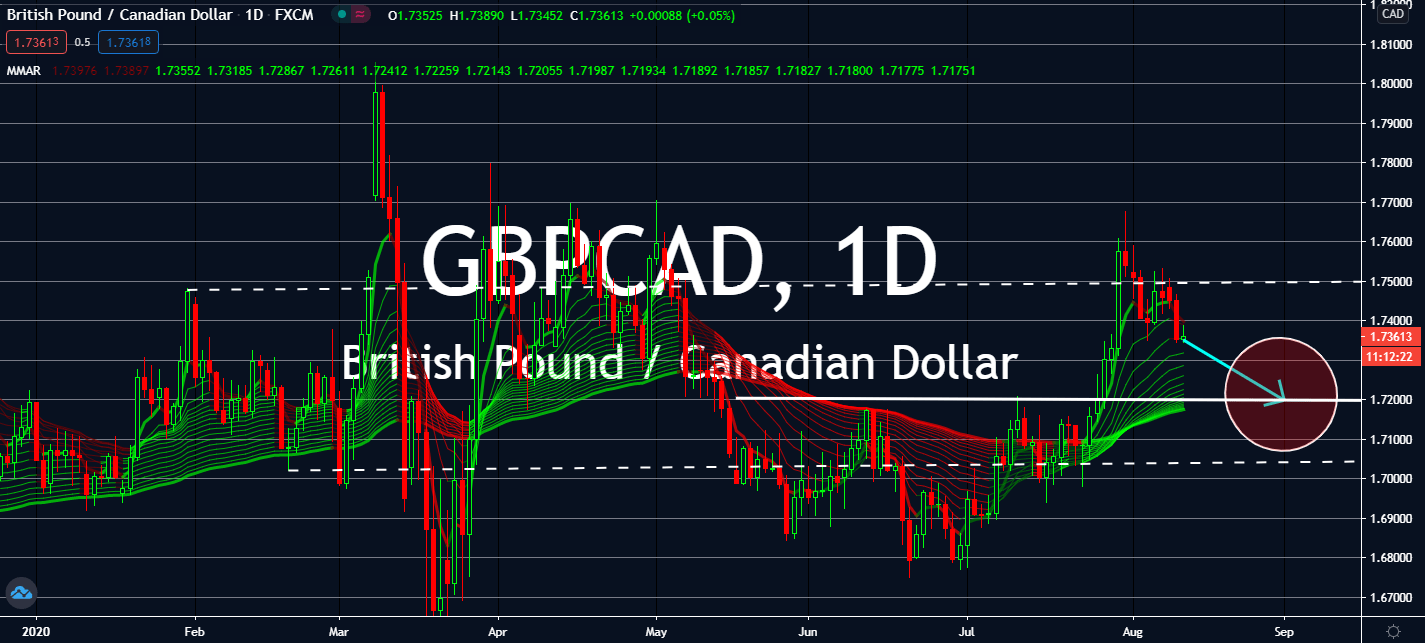

GBPCAD

Although the figure came in better than expected, the UK’s gross domestic product for the second quarter plummeted to its lowest in history. Against the initial slump in the first quarter that came in at -2.2%, quarter-over-quarter GDP fell to its lowest -20.4%, slightly higher against economists’ expectations of -20.5%. Although the same figure upped on a monthly basis from 1.8% to 8.7% in July, showing a slow recovery but faster than market estimates of 8.0% prior to the announcement. Investors are getting worried about its economic rebound, especially after the massive job losses year-to-date. Meanwhile, Canada regained 55% of the 33 million jobs lost to coronavirus lockdowns since April. This was an additional 419,000 jobs in July in comparison to June, showing a growth rate of 5.8 percent. Housing starts in Canada also added on a monthly basis in July, which came in at 245.6 thousand against 212.1 thousand in June.

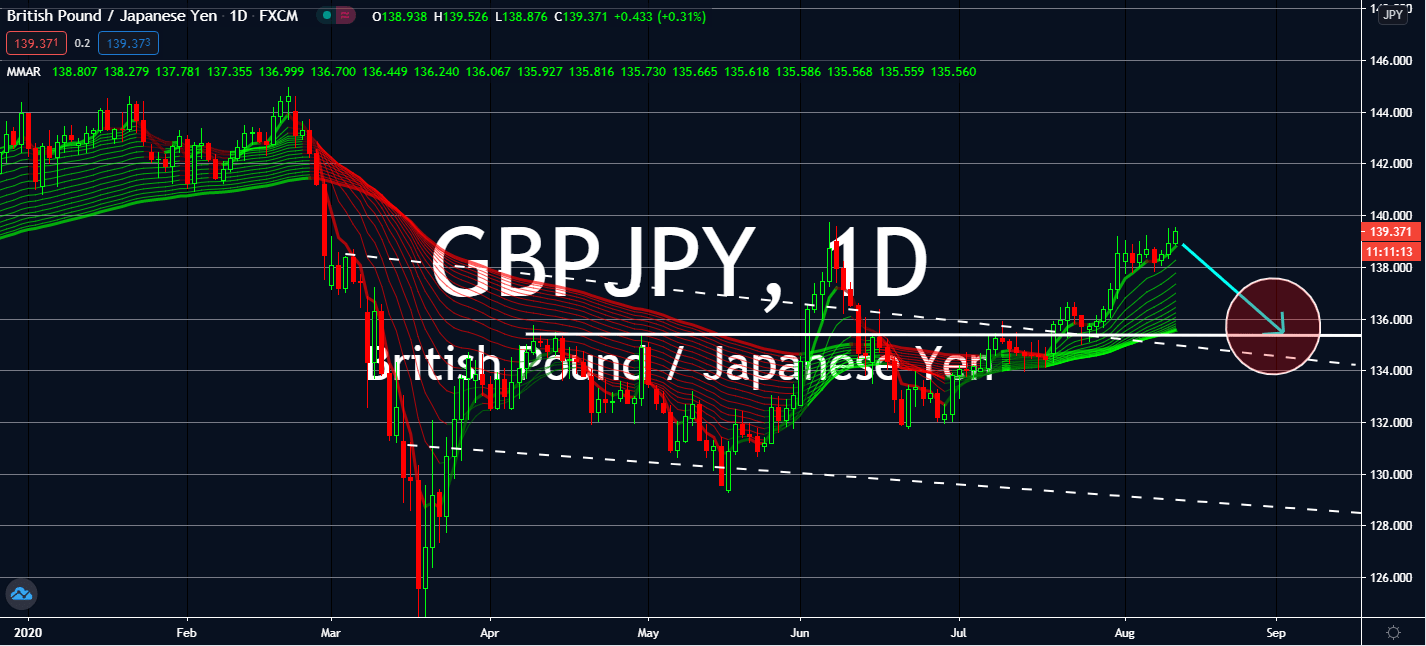

GBPJPY

Investors are expected to turn to the Japanese yen’s safety near-term as they consider their plans for its sterling rival. The UK reported a massive fall for business sentiment during the second quarter at -31.4% against the -2.5% expected and -0.3% recorded prior. On a yearly basis, the figure fell to -31.3% from 0.8% last year and the -8.8% recorded during the same period last year. The Bank of England also admitted a highlight of concern for its labor market during the second half of 2020. The number of employees on payrolls went down around 730,000 in comparison to March. Meanwhile, Japan’s labor ministry is working to extend an employment subsidy to help firms keep its workers on its payrolls for the six months through the end of September. The daily payment went up to 15,000 yen per employee, up from 8,330 yen prior. The government set aside about 1.6 trillion yen for the 2.36 million people so far, and provided 585.1 billion yen in July.

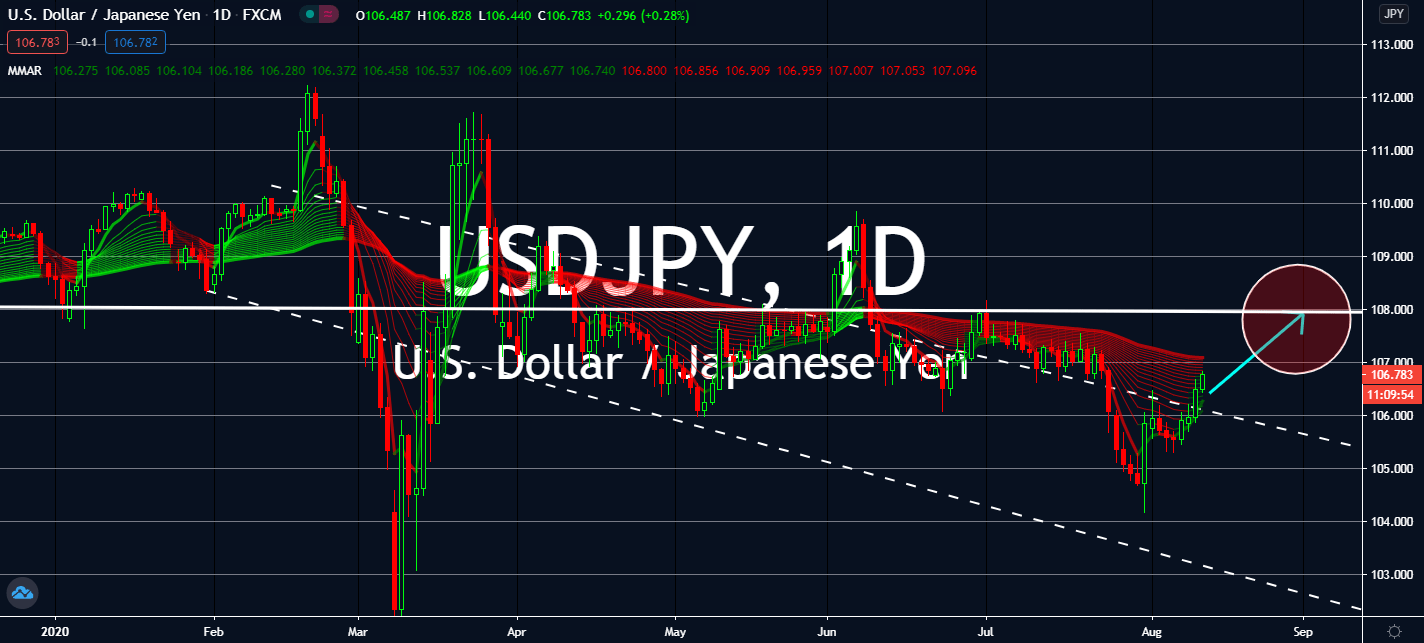

USDJPY

The US dollar is extending its recovery against the Japanese yen after a two-year low. Tad optimism surrounding the Phase One of the US-China trade agreement is going to raise sentiment for the greenback in the near-term. The US’ Core CPI is expected to report retention for the figure on a monthly basis at 0.2% in July. The same figure is projected to see only a small decrease from the same month last year from 1.2% to 1.1% in July. Crude oil inventories are also projected to see optimistic results this week at -2.875 million, down from the -7.37 million recorded prior. Japan’s total coronavirus cases topped 50,000 on Monday and increased 10,000 in a week with urban and highly populated cities in the countries continue to see high levels of infections since the government implemented another nationwide state of emergency in late May. Positive news from the US’ relationship with China will push the greenback further up.

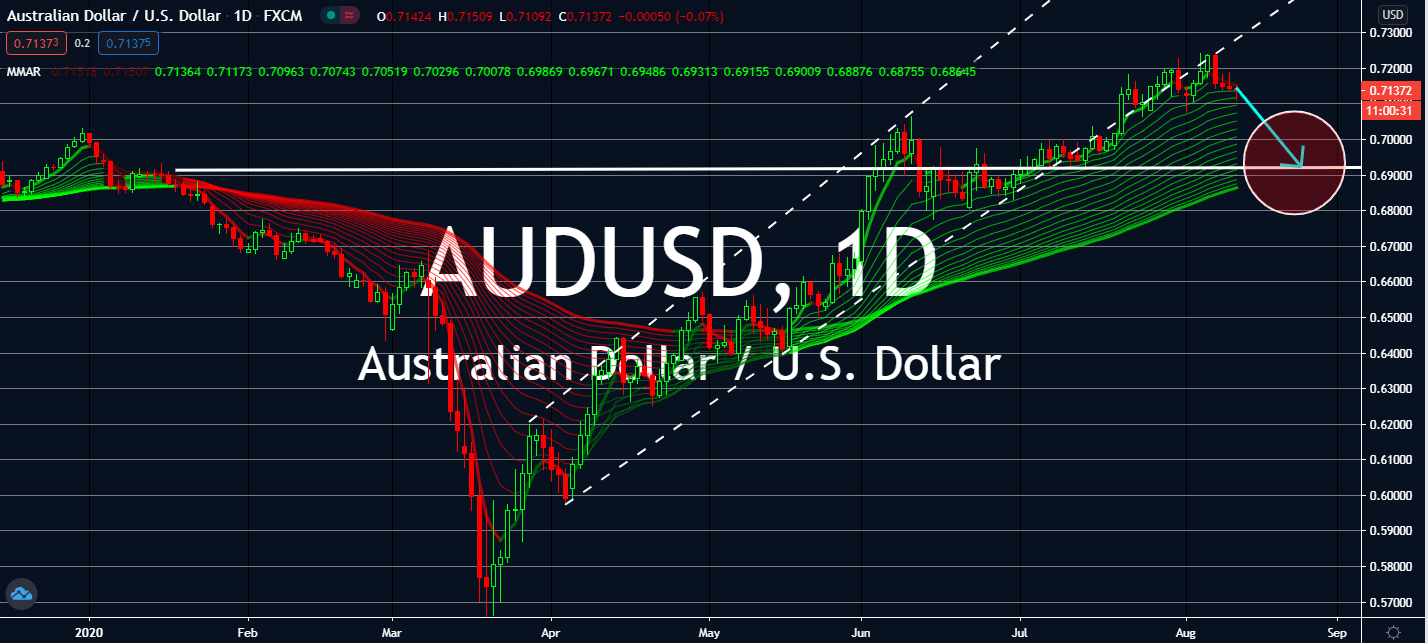

AUDUSD

Australia’s employment change is projected to fall from 210 thousand to 40.0 thousand in July on a monthly basis. Its unemployment rate is also expected to lower for the same month at 7.8% from 7.4% from last July. The report will come days after the region reported a lower quarterly wage price index figure on both a yearly and a quarterly basis, which came in at 1.8% against the Q2 2019’s 2.1% and 0.2% against the previous quarter’s 0.5% figure. After both figures were reported lower than what the market expected, the Australian dollar is now projected to continue its decline against its American counterpart with projected retention for its 0.2% figure for core CPI MoM in July. On a yearly basis, investors are bracing themselves for only a slight fall of 1.1% from 1.2% recorded in June. Crude Oil inventories will also help USD boost against AUD with an increase from -7.373 million to -2.875 million to be announced today.