Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

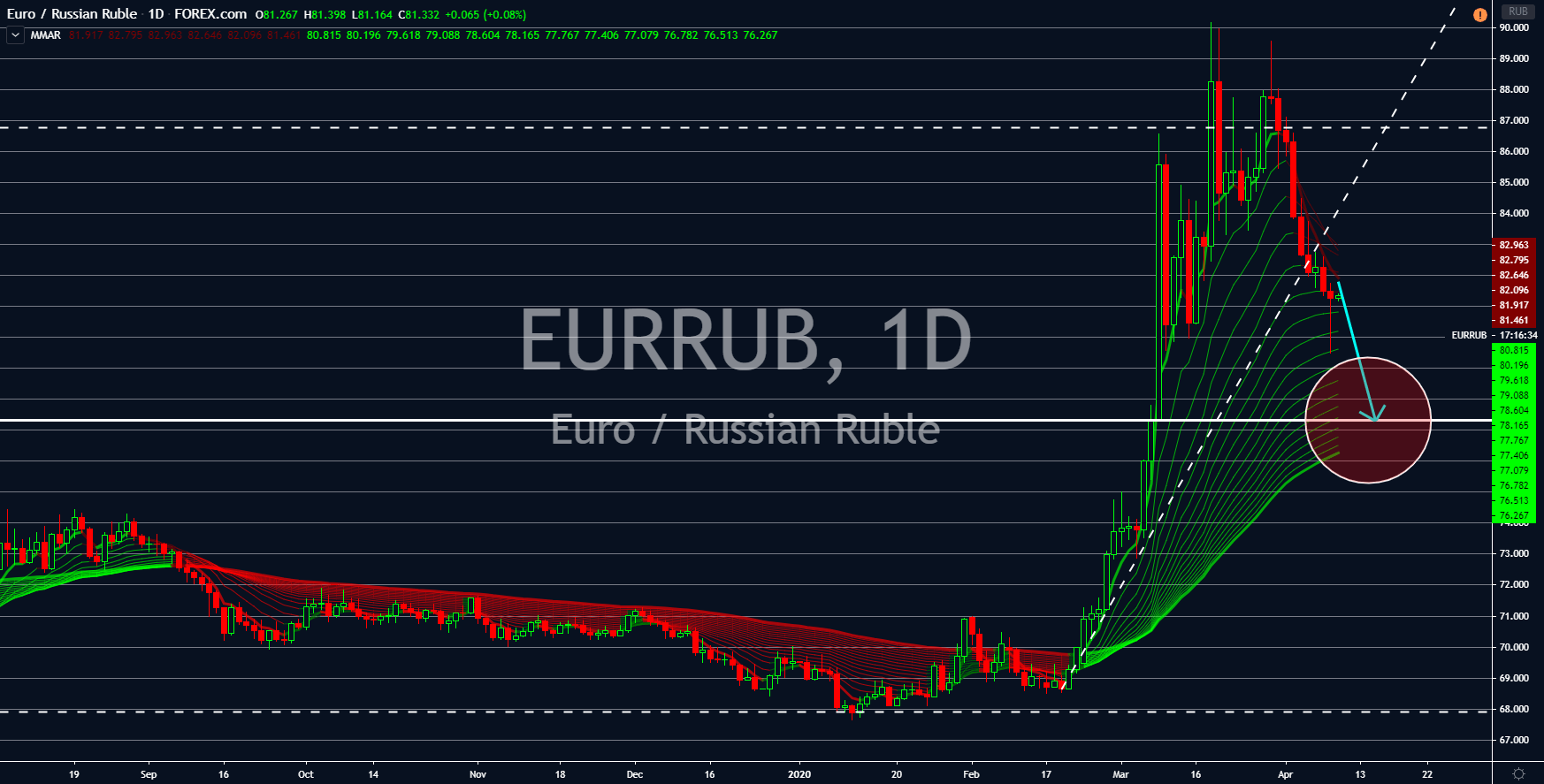

EURRUB

Germany was among the list of countries who defended globalization following the rise of protectionist economies. With its economy largely exposed to other economies, it is without a doubt that Germany will take a toll from any uncertainty in the global market. An example of that was the US-China trade war. The tit-for-tat war between the two (2) largest economies in the world had caused the German economy to shrink.

However, a new crisis emerged, and analysts are expecting the country to enter recession in the coming quarters. Meanwhile, Russia effectively dodge a possible mass infection of the coronavirus. This was following its decision to be one of the countries to close their borders early. Russia has lower cases of COVID-19 despite sharing the same border with China. Germany, on the other hand, had 118,235 cases as of writing. Medical experts warned that the number could further increase in the coming weeks.

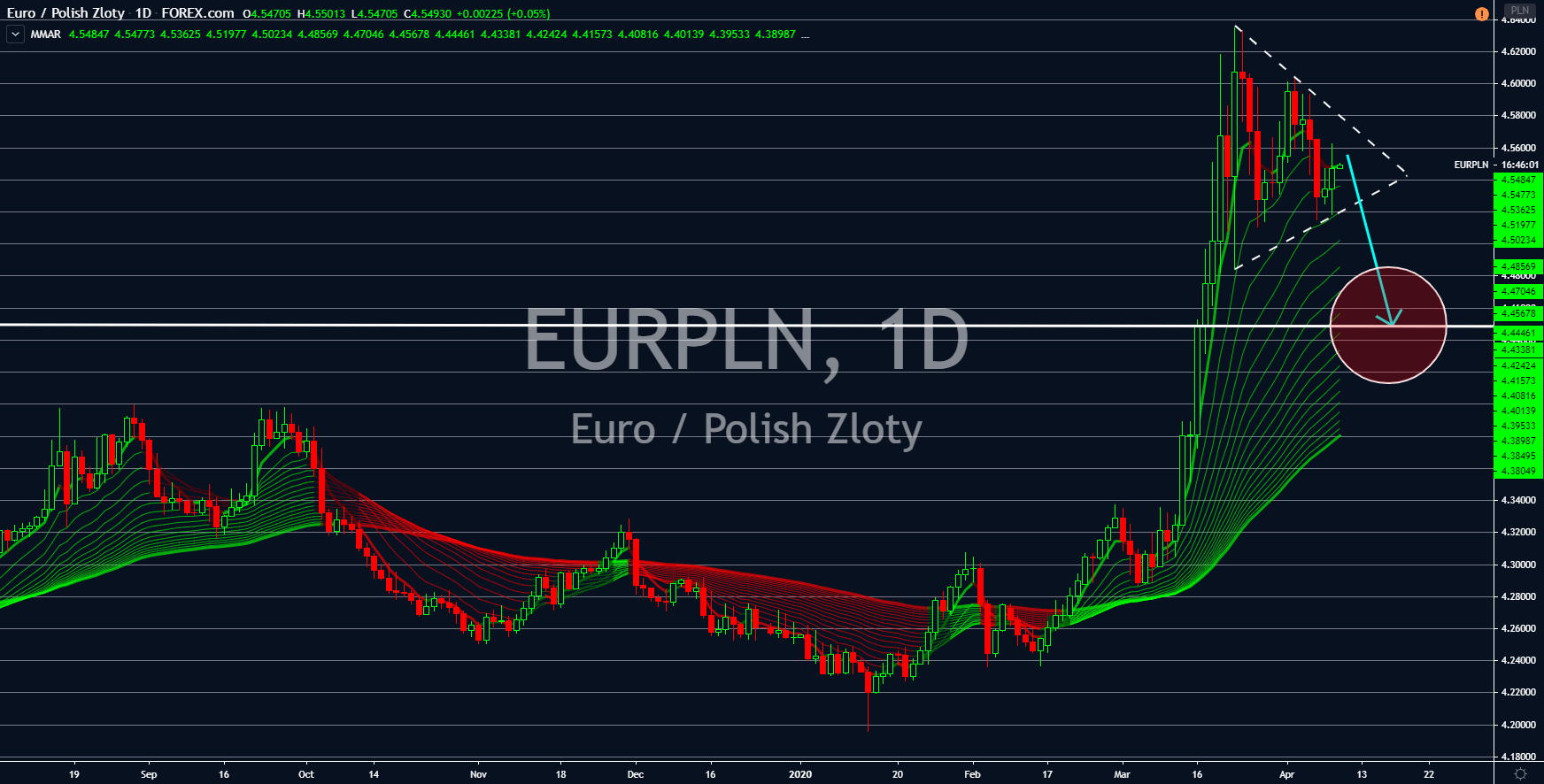

EURPLN

The EU’s economic powerhouse, Germany, will drag the Eurozone and the European Union into recession. Analysts expected Germany to have a deep recession, so deep that it will be the largest for the past 50 years. During the 2008 Global Financial Crisis and 2010 Greek Debt Crisis, Germany led the EU towards recovery. However, questions now arise as to who will save Germany from recession.

The European Central Bank (ECB) was also scrutinized for not easing monetary policy despite the EU entering an unprecedented crisis. The finance minister also failed to secure emergency funds for the entire European Union. Meanwhile, Poland, one of the fastest growing economies in the EU, is trying to save its economy from a total collapse. Warsaw plans to add additional $2.65 billion to its economy to increase liquidity in the market. This is the second phase of the stimulus package introduced by the country.

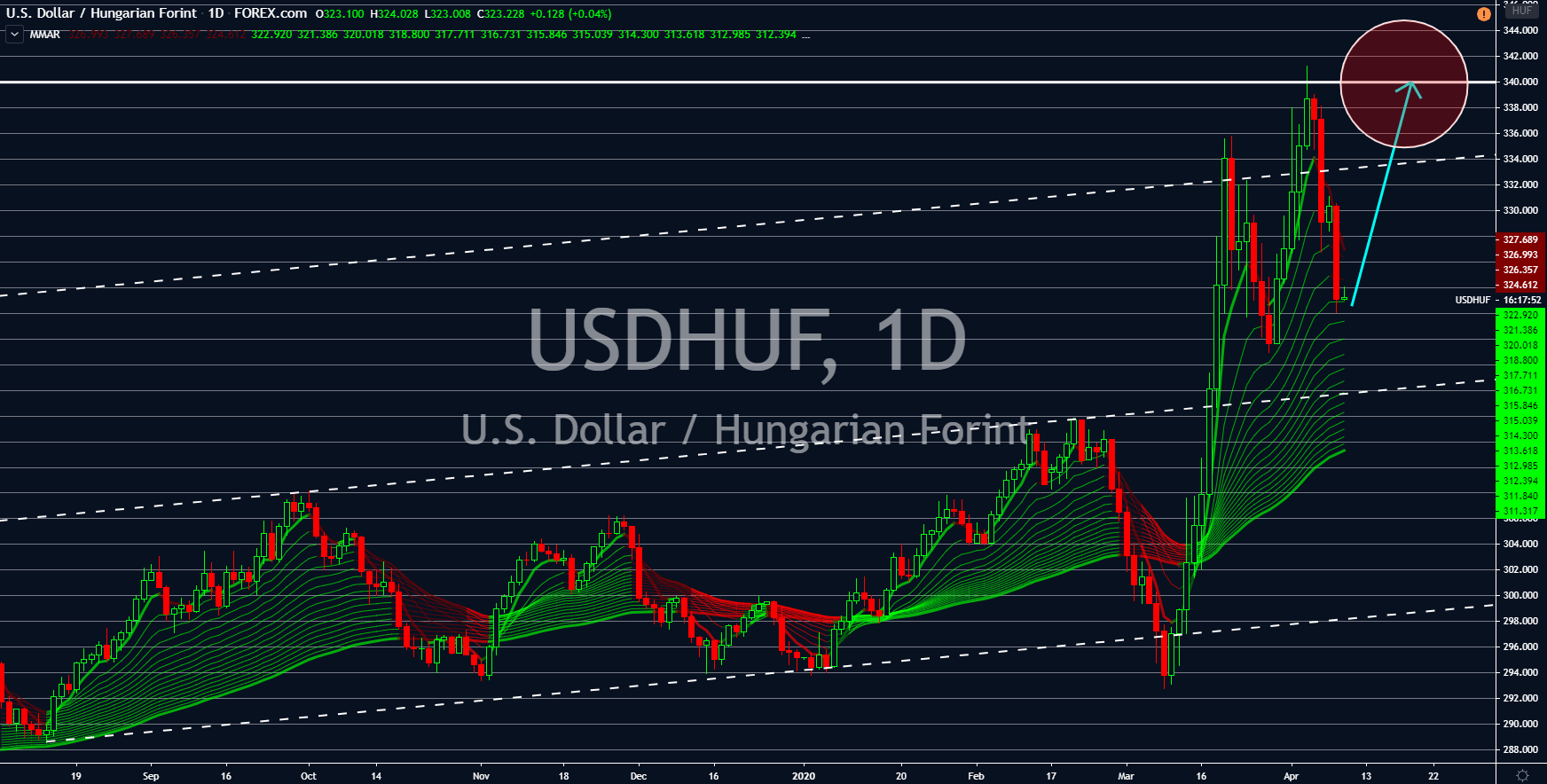

USDHUF

The Federal Reserve is stepping up its game after it unveiled the largest fiscal stimulus package in history at $2.3 trillion. The amount was bigger from the $2 trillion package recently signed by the US government. Furthermore, Fed Chair Jerome Powell said that recovery will be robust once they contain coronavirus. Currently, the US has the largest coronavirus cases in the world with 468,887. This represents almost 1/3 of the total cases around the world at 1,604,900. Moreover, America has now the second-largest number of coronavirus related deaths at 16,697. Also, the total confirmed cases in the US represents 1/6 of the total person tested for COVID-19.

Hungary, on the other hand, was able to contain cases despite Europe being at the center of the pandemic. Budapest recorded 980 cases as of writing, while deaths came in at 66. The Hungarian government already introduced a $30 billion stimulus package to aid the economy.

USDMXN

Banks and credit rating agencies are lowering their economic forecast for Mexico’s GDP growth. Standards and Poor expect Mexican economy to experience some weakness until the year 2023. Meanwhile, Credit Suisse sees Mexico’s economy contracting by 4% this year with an optimistic view of mere 0.7% growth. On the other hand, Bank of America has the lowest projection for Mexico with negative 8% growth. Mexico just contracted in 2019 and analysts suggest for Mexico to grow 4.5% this year to cover the recent losses on its economy.

However, investors and traders believed that the country would not be able to achieve the figure. On the other hand, the US central bank surpassed the US government stimulus package after it introduced a $2.3 trillion package. This is the largest in the country’s economy. Unlike other currencies, stimulus is beneficial for the US dollar as investors and traders prefer cheap dollars.