Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

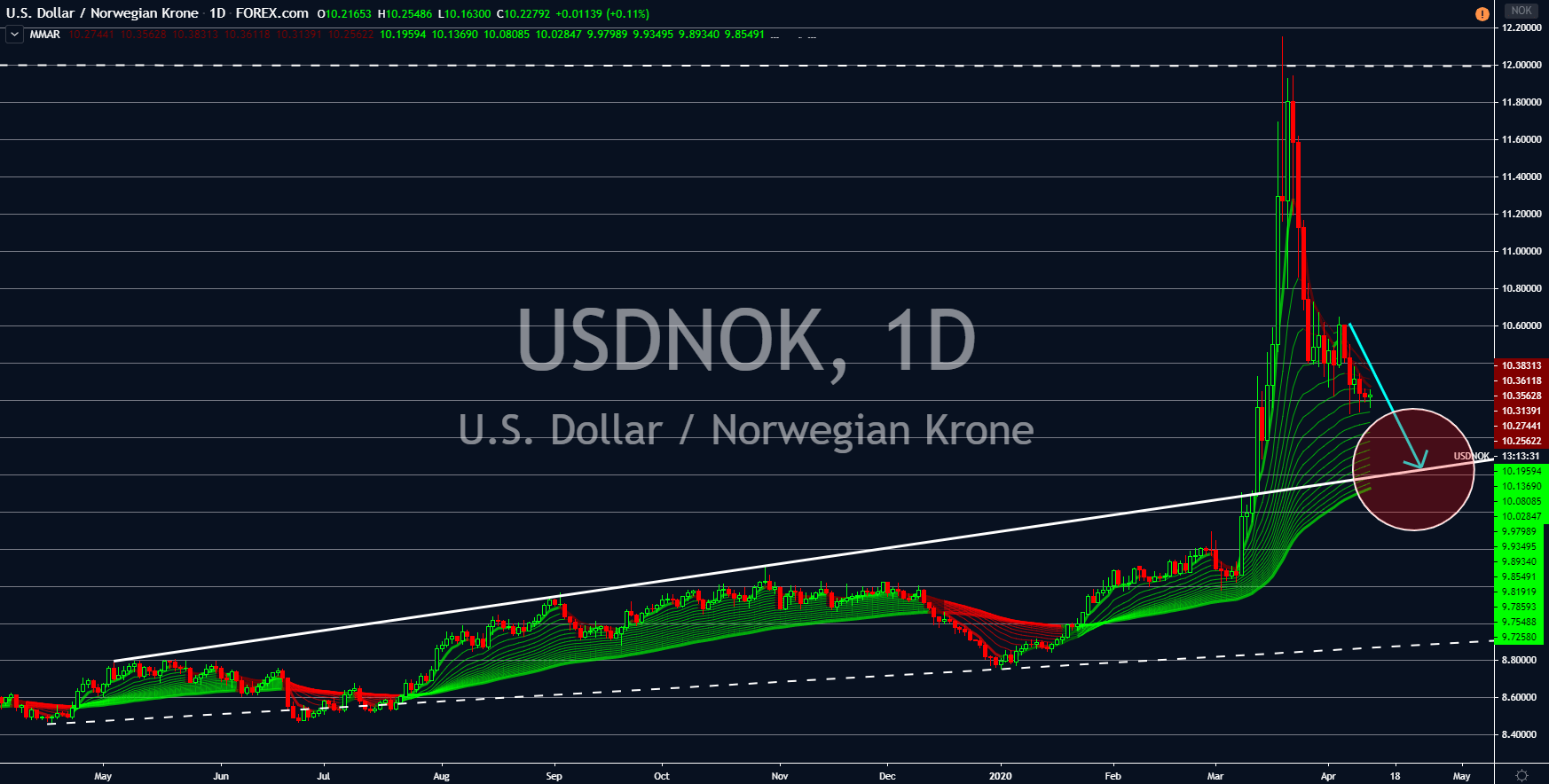

USDNOK

The Norwegian krone will gain momentum in the coming days following the end of the oil price war. Last month, the value of Norway’s currency plummeted against the US dollar amid disagreement between OPEC members and its allies, particularly between Saudi Arabia and Russia. Apparently, members don’t agree on the numbers they should slash for the price of crude and Brent oil to come back to its previous level.

Russia, who previously said it will cooperate with the cut, turned its back and increased its production to cover the losses incurred in the slump of price. Norway’s main export is oil and now that the market is calm investors are expected to ride once again on krone. The US dollar, on the other hand, was not directly affected by the crisis. American is the largest consumer and producer of oil around the world. The imbalance between the demand and supply will only hurt part of the American economy.

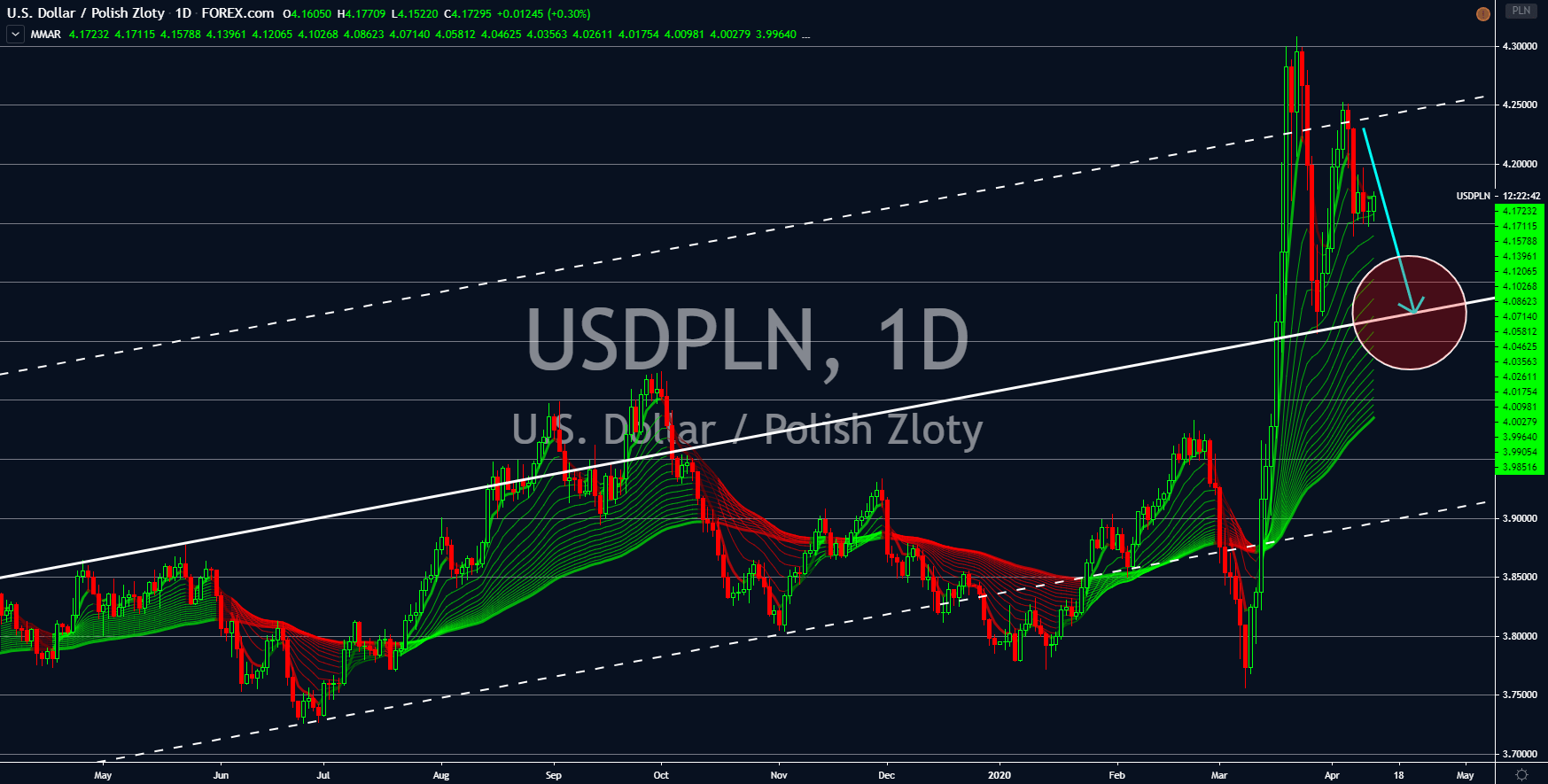

USDPLN

Investors applauded Poland following its bold move to add liquidity in the market before other economies did the same thing. The country injected 150 billion Polish zloty is mid-March. That’s an additional 3% to the 6% fund already allocated to counter the coronavirus. In April 08, the country doubled its liquidity with the newly introduced 100 billion zloty. PM Mateusz Morawiecki said the country is planning to add another 100 billion zloty to further ease the market.

Meanwhile, the US beat all stimulus packages in history with its massive $2 trillion stimulus. The country’s central bank beat this record just last week with $2.3 trillion aid. However, investors are worried that we might just be seeing the tip of the iceberg. Unemployment in the country was now at 6.6 million, representing 10% of the US workforce. This is also the second-largest jobless claim in history since two (2) weeks ago, the US reported a staggering 6.8 million jobless claims.

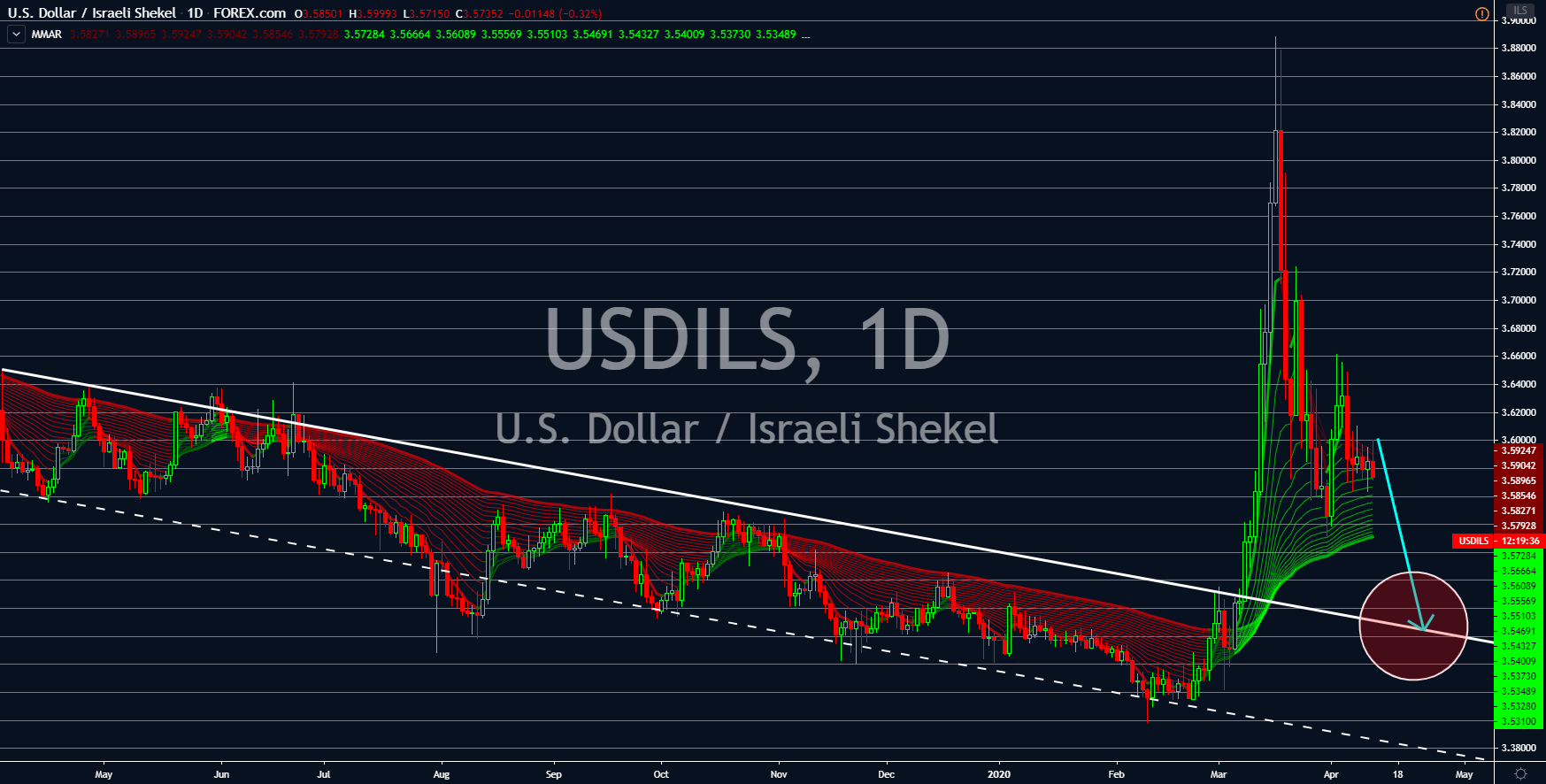

USDILS

The Israeli shekel will suffer from the economic and political turmoil in the country. For the first time since Israel’s establishment in 1948, the country has had 2 prime ministers simultaneously – incumbent PM Benjamin Netanyahu and Speaker of the Knesset, Benny Gantz – on a rotational agreement. The 2 politicians failed to form a coalition government, paving way for their parties to agree on sharing the term.

This agreement will end Netanyahu’s 21-year reign. He has served as the country’s prime minister since 2005. He previously held the same position from 1993 to 1999. Netanyahu also led for the closer US-Israeli ties. The agreement could be a blow to the two (2) countries’ relationship. The country is facing problems with its economy due to coronavirus. Investors are not thrilled over Israel’s decision to sell $25 billion worth of bonds. The action was supposed to investors on Israel’s confidence with the local economy.

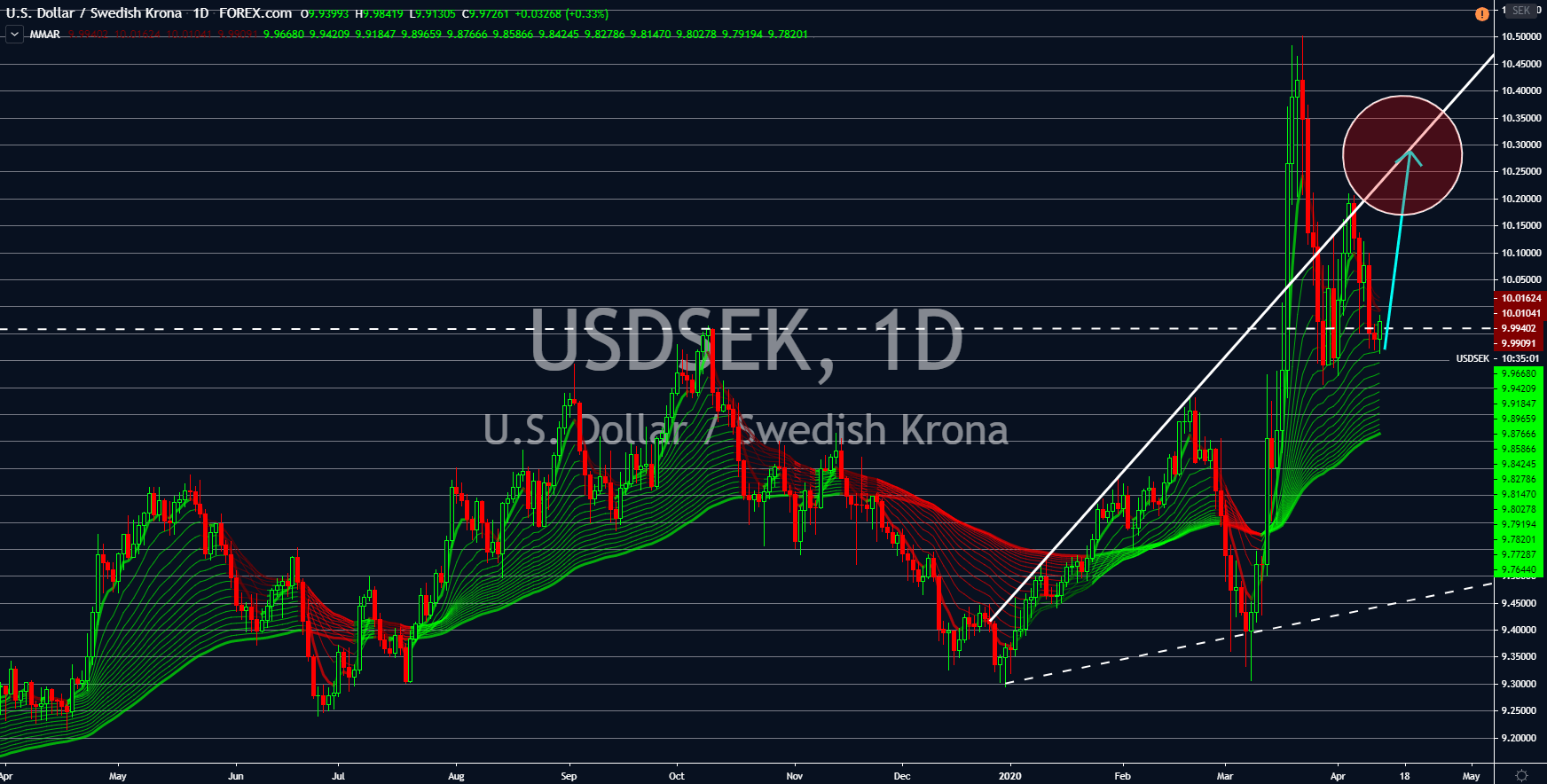

USDSEK

Sweden is in trouble. In December, the country ended its 5-year negative interest rate experiment. However, just a few months after this decision, the coronavirus pandemic had shaken the world economy. This might force Sweden to reassess its monetary and fiscal policy. In addition to this, the country drew scrutiny from around the world over its decision to keep businesses open. Sweden is doing another experiment by exposing its citizens to the deadly virus to develop natural stamina.

However, this could backfire in the government soon. If the experiment proved unsuccessful, borrowing could explode and pave way for Sweden to once again devalue its currency by lowering rates. On the other hand, the United States surpassed China and Italy to have the most number of coronavirus cases and deaths, respectively. The government and central bank already introduced the largest fiscal stimulus package in history.