Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

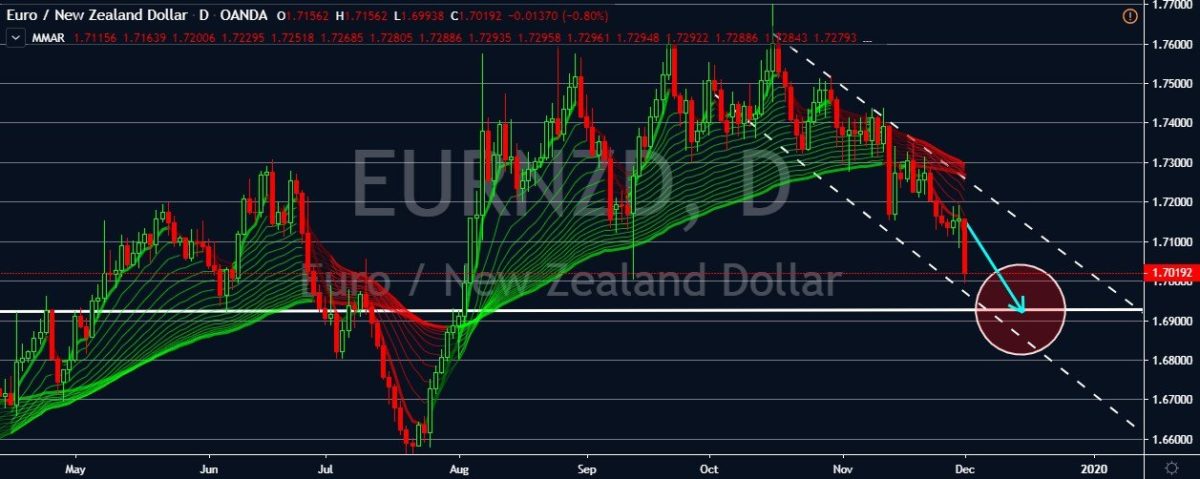

EURNZD

The New Zealand dollar is bound to bring the bloc’s single currency lower to its support levels as positive data from the country continues to strengthen it. Last week, the Statistics office of New Zealand reported progress in the country’s trade balance as it improves from -1,319M prior to -1,013M on a Month-over-Month basis, it topped expectations of -1,621M. Meanwhile, New Zealand’s ANZ Business Confidence report went up to -26.4% from -42.4, exceeding expectations of -30.8% improvement. And just last week, the Reserve Bank of New Zealand damped the hopes that it will reduce its mortgage lending restrictions, insisting its risks to the financial system and the bank’s low interest rates. However, the euro is also receiving strength from the positive results in its economic performance, meaning that it will give the New Zealand dollar a tough time before the EURNZD pair reaches its support.

EURTRY

The lackluster performance in Turkey’s economic activity may cause euro to Turkish lira to gradually pull the higher as the year closes. The pair is currently struggling to gain strong traction, recording only limited gains from the previous months. However, it is still expected that the lira will underperform the euro as Ankara’s GDP weigh on the Turkish lira. The Turkish Statistical Institute found that the third quarter gross domestic product growth went up by 0.4% from the quarter prior. While on a yearly basis, the Turkish economy failed to reach 1% projections as it only expanded by 0.9%. Traders are waiting for further affirmation on the Turkish lira’s potential direction as they wait for the country’s inflation data set to be released tomorrow. Last week, Turkey’s President, Recep Tayyip Erdogan, said that the government will start reducing its inflation rate and will cut interest rates to stabilize the country’s financial position in 2020.

EURSEK

The Swedish krona is drawing closer to its four-month highs as Sweden’s economy shows promising signs of growth in the previous quarter. The good growth figures could then lead the country’s central bank to raise its interest rates, thus strengthening the krona even more. The EURSEK pair is actually not that far from its support levels and is anticipated to reach it mid-way through December. Sweden’s economy grew faster than what the market has projected in the third quarter of 2019, climbing up by 0.3% against 0.2% forecasts. The country’s annual GDP growth also expanded by 1.6% according to the government. Sweden’s central bank is expected to lift its interest rates from the negative territories in the last monetary policy meeting on December 19. However, some traders are still concerned whether Sweden’s central bank will take a different route from other major central banks across the globe like the US fed and the ECB.

EURNOK

The recovering data from the bloc isn’t enough for a breakthrough for the EURNOK, and that is also despite Norway’s contracting manufacturing PMI. Oslo’s DNB Manufacturing Purchasing Managers’ Index went down from 55.3% to 53.7% in November, but it’s still above expectations of 50.2%. In spite of that, the country’s factory sector is still above the 50-mark that separates expansion from contraction. As of the moment, the Norwegian krone is trying to regain some of its losses against the single currency. The pair is projected to go hit its support soon as bears gear up because the Norges Bank will soon tighten its interest rates as the country sees better trade prospects with its allies. After the Norwegian central bank increased its interest rates on September by 25 basis points, traders are still waiting for more despite Governor Olsen saying that the interest rates will remain unchanged.