Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

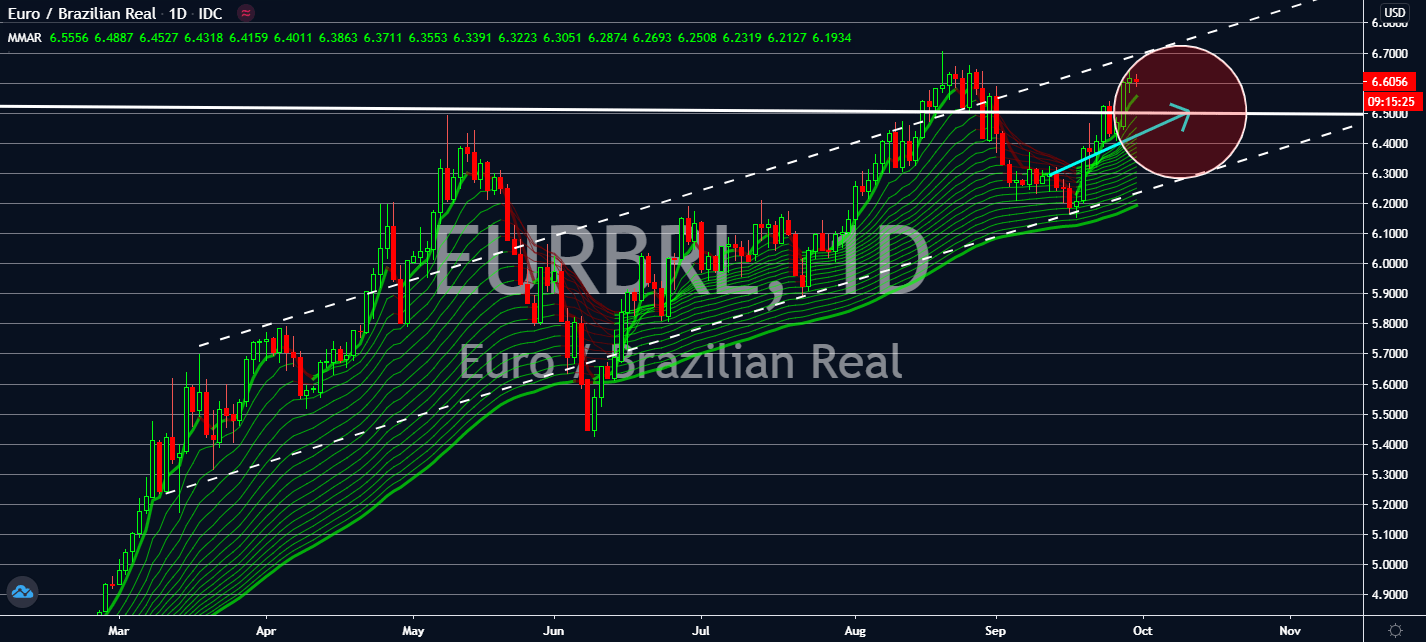

EURBRL

Brazil is in danger of another quantitative easing program. Its government announced a 96.1 billion reais budget deficit in August as its coronavirus cases continued to heighten the need for emergency spending, including interest payments. Although the fall was slightly less than what economic analysts predicted, which was at 98.7 billion reais without interest payments. The deficit totalled 9% of the country’s GDP year-to-date, according to its Treasury department. The news is expected to boost investor’s favour towards the euro near term, especially thanks to relatively tame changes in economic figures in the eurozone today. Despite the market’s fears that Germany’s unemployment rate would keep its previous 6.4% rate, the figure reported a decrease for the month of September at 6.3%. The good news, which came in while coronavirus cases increase in the country, will impress investors and help the euro’s value increase near term.

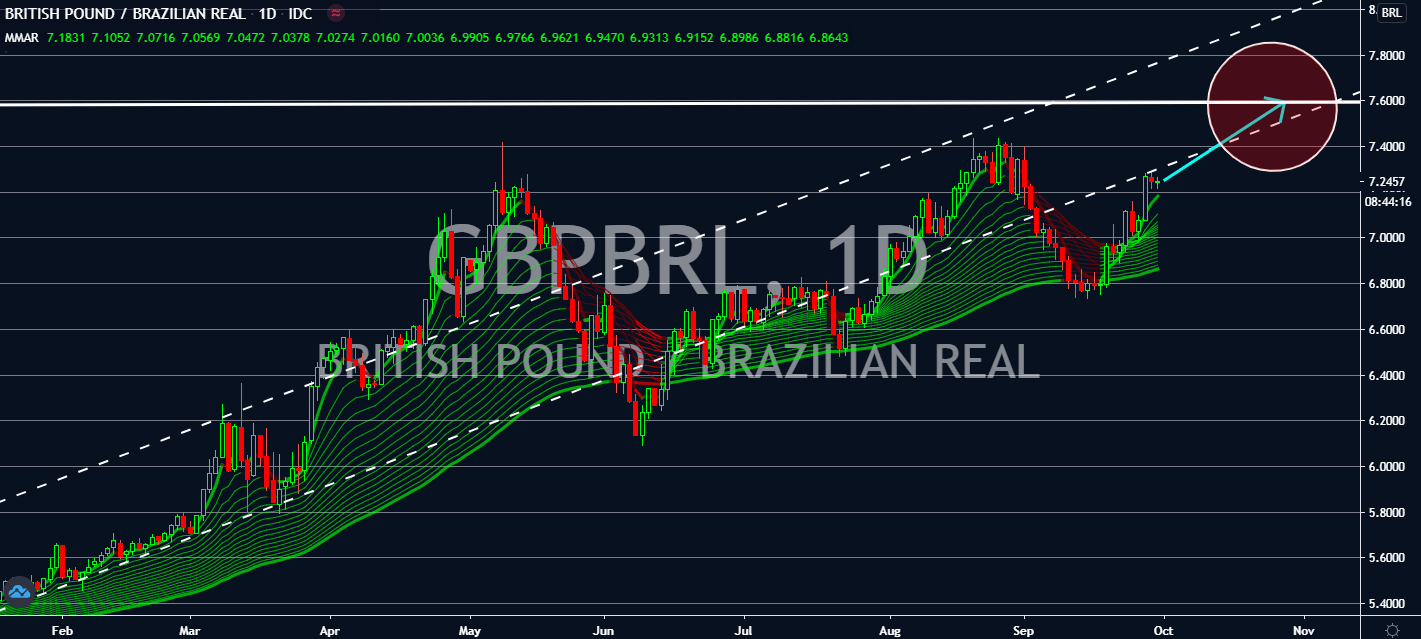

GBPBRL

The UK economy isn’t looking as bad as most economists thought during the second quarter. The City reported a higher housing price index figure in September, both monthly and yearly. The annual rate of 5.0 percent was greater than last year’s 3.7 percent and higher than the market’s projection of 4.5 percent. The increase was a sign that the figure was going to reflect on more jobs and higher wages in the City, although it most likely had to do with pent-up demand and pre-lockdown plans to move. The shift might also be a part of boosting economic activity even after its gross domestic product declined shallower than expected on both quarterly and yearly comparisons. The progress in these areas is projected to boost optimism toward buying the sterling over the dry Brazilian dollar near-term as its budget deficit of 96.1 Brazilian real, a result that continues to stir worries in the financial market.

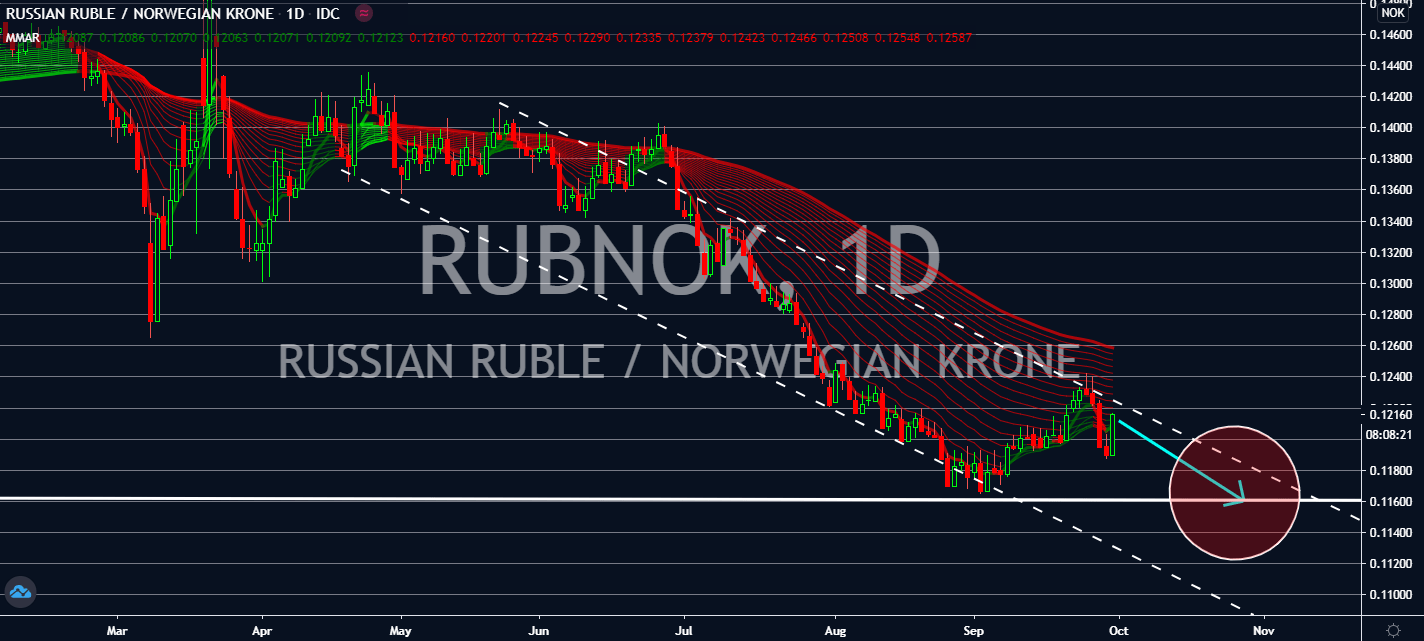

RUBNOK

Russia lost $7 billion in lost tourism revenues due to the coronavirus lockdown that began at the end-March. According to the Russian Tourism Union president, the blocked industry effectively turned away a year’s worth of income. Although it was a double-edged sword for its economy, consequently its currency at the beginning of the summer, economists now have another problem to consider. Russia’s economy will remain volatile and uncertain for the next three months as coronavirus cases surge nationwide. New restrictions are being held across the country, including closing offices and extended school holidays, as investors fear that overall activity is already slowing down. Fears of a possible surge in suffering business are also looming over the ruble with stricter transportation restrictions to contain the virus being the main driver of what could be a steeper decline in the economy over the next few months.

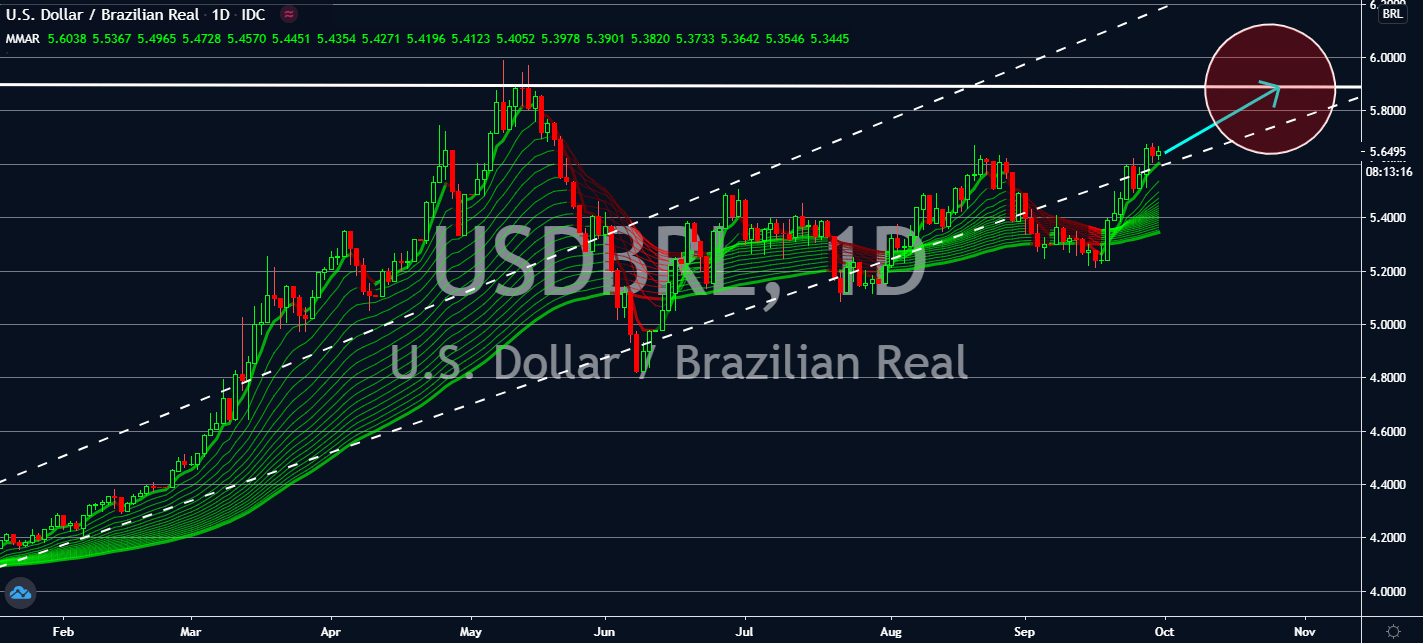

USDBRL

The United States reported an increase in private payrolls from 481 thousand to 749 thousand in September, which was better than economists’ projections of about 649 thousand payrolls. The figure, which came in before the Non-farm payroll data that will be announced tomorrow, will help the US dollar’s safe-haven status against emerging markets like the Brazilian real. Bullish investors are expected to compete with the bears tomorrow if the economy posts better results tomorrow, contrary to the fall analysts are expecting. Even though the world’s largest economy saw an economic contraction of 31.4 percent in the second quarter, down against the 5 percent contraction in the first quarter, the figure wasn’t as bad as the market initially thought. Before the announcement, median expectations went for a 3.17 decrease, instead. Relative optimism and risk aversion are projected to help buoy the greenback.