Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

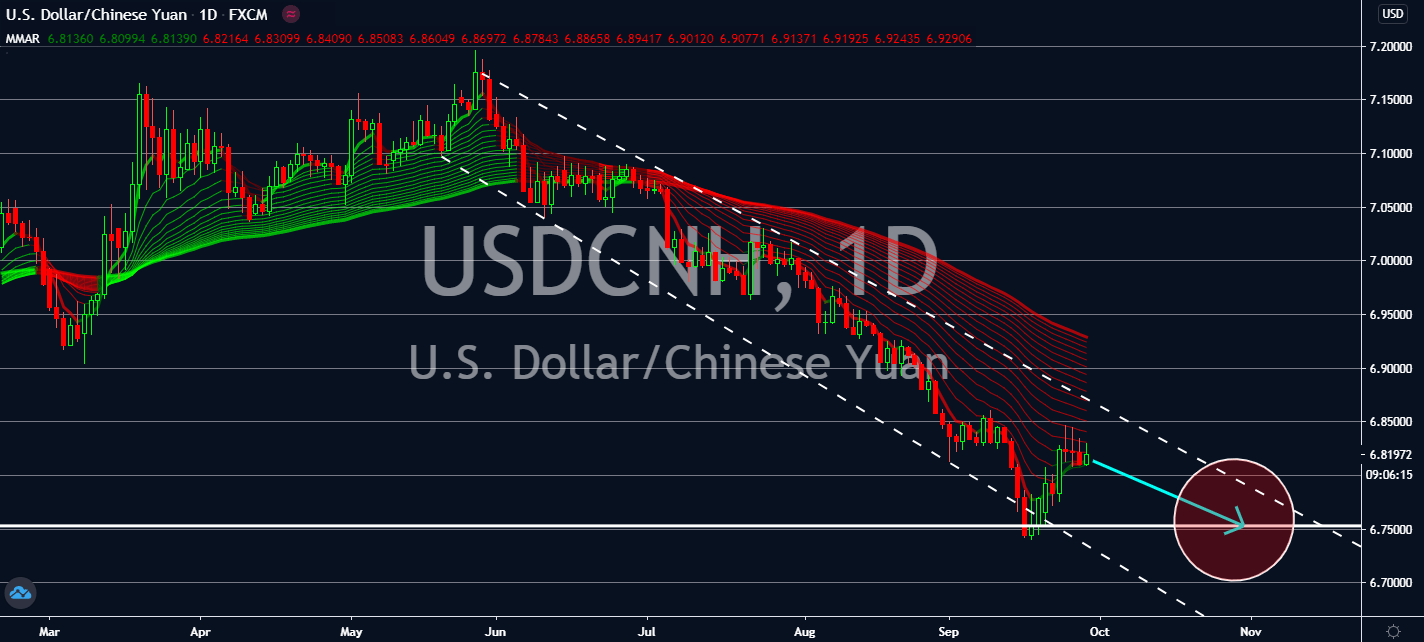

USDCNH

Surveys and announcements are today’s major drivers as several Federal Reserve officials prepare to set the stage for the US economy in its last quarter in 2020. CB consumer confidence, an index that measures consumer spending held within a certain month, is projected to report an uptick for the full month of September. Although the figure might have increased from 84.8 to 89.2 this month, it looks like economic analysts are still holding a dovish stance on the country’s overall growth because not only is it more than 40 points less than pre-coronavirus levels, it’s also much less than last year’s 125. The greenback is expected to side with the bears against Asian markets yet again as investors wait at the edge of their seats for the presidential debate on Wednesday. Meanwhile, the Chinese economy is projected to report more certain boosts in major economic indicators such as manufacturing and composite PMIs.

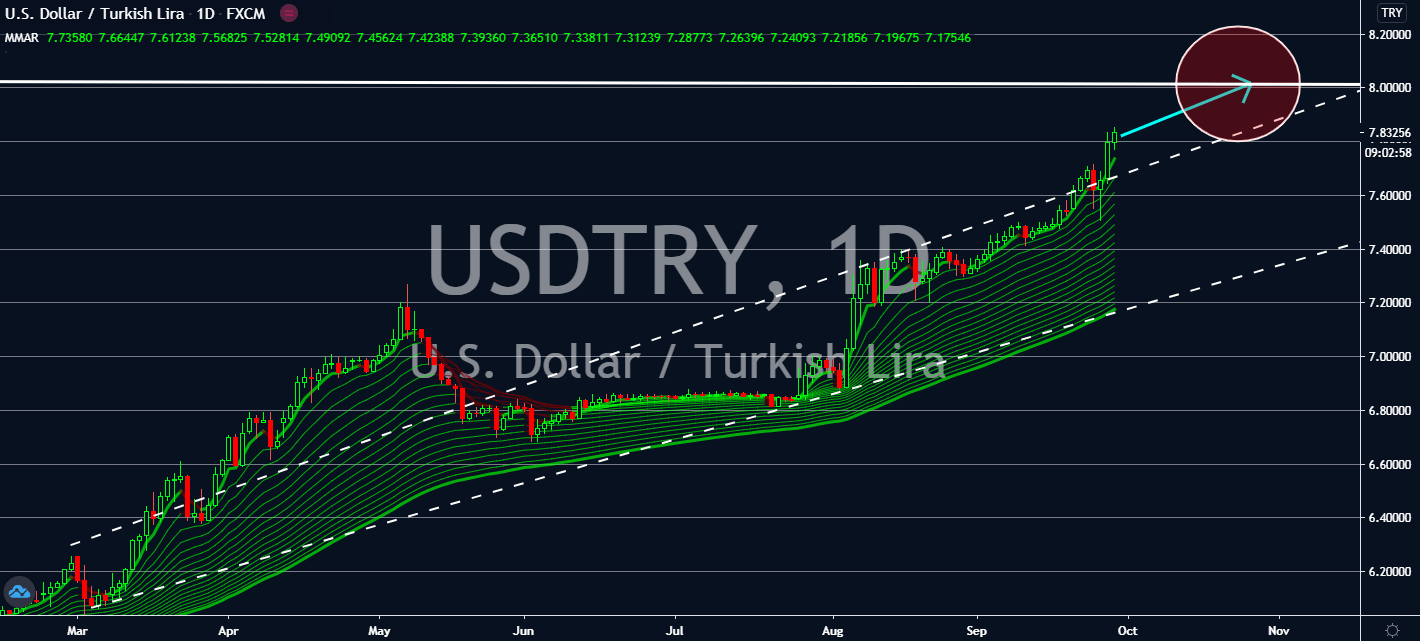

USDTRY

The greenback is projected to benefit from overall risk aversion in the market despite its weakness against most major currencies. Although Turkey reported an increase in economic confidence for the month of September by 3.1 percent at 88.5 to 85.9, engagement on construction and retail trade readings fell in negative zones by 2 percent and 1.5 percent respectively. The data wouldn’t be enough to help lift its currency against the much bigger greenback as the market waits for its presidential debate on Wednesday. Consumer confidence for the US economy is also projected to increase for the same month from 84.8 to 89.2. Despite the relatively dry day for technical indicators in the US, it’s going to be an eventful day for several officials from the Federal Reserve to gauge how the economy is faring so far in the pandemic. For now, the outcome from the speeches will determine the greenback’s track in the medium-term.

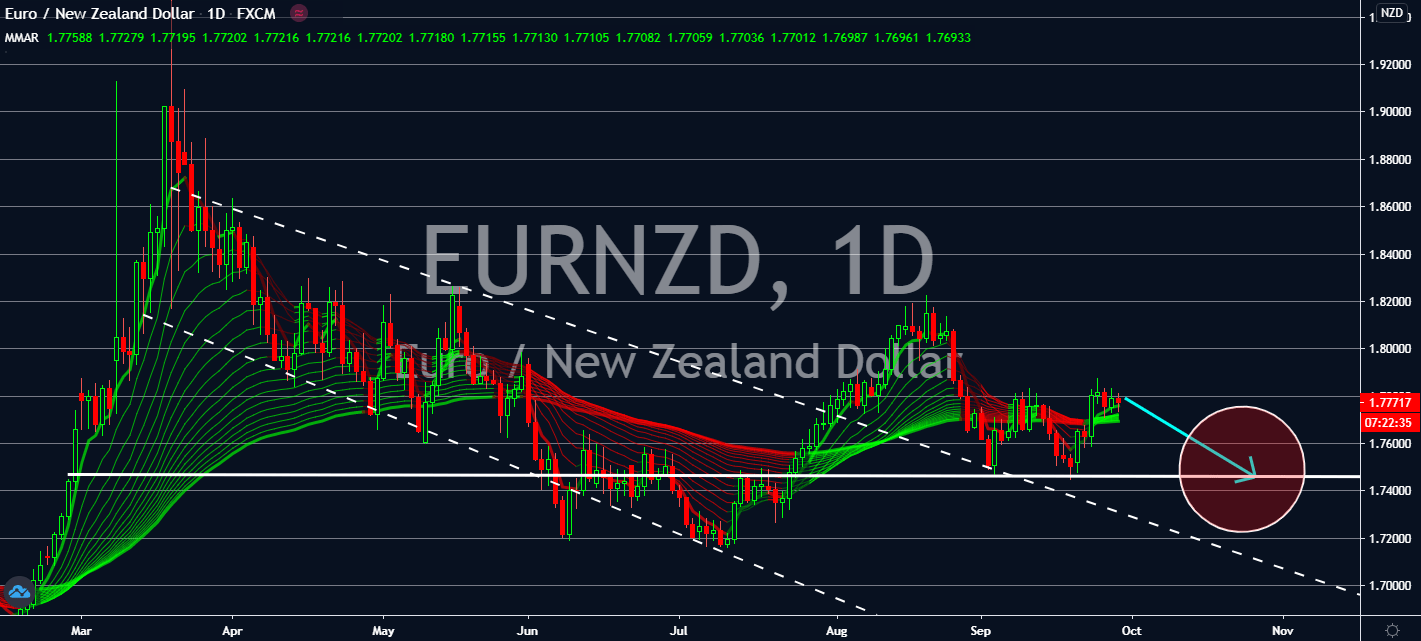

EURNZD

It looks like Germany is carrying the eurozone’s economy on its back, but even then, it’s not looking as good as it used to. Confidence in the euro currency is gradually falling with every new coronavirus case in the biggest economy in the European Union. Inflation in consumer goods and services in September was worse than both the market’s expectations and its record in August, which came in at -0.2 percent against expectations of a stagnant -0.1 percent. The same figure also fell yearly, which was stagnant at 0.0 percent last year. Against expectations of a step lower to -0.1 percent, it fell further down to -0.2 percent, as well. Even the figure’s adjusted index calculated specifically for the quarantine had fallen on both a yearly and a monthly basis. Against last year’s -0.1 percent rate, the figure had seen a fall to -0.4 percent, a fall from the expected -0.1 percent. These figures are projected to fall against the kiwi dollar’s safe haven status.

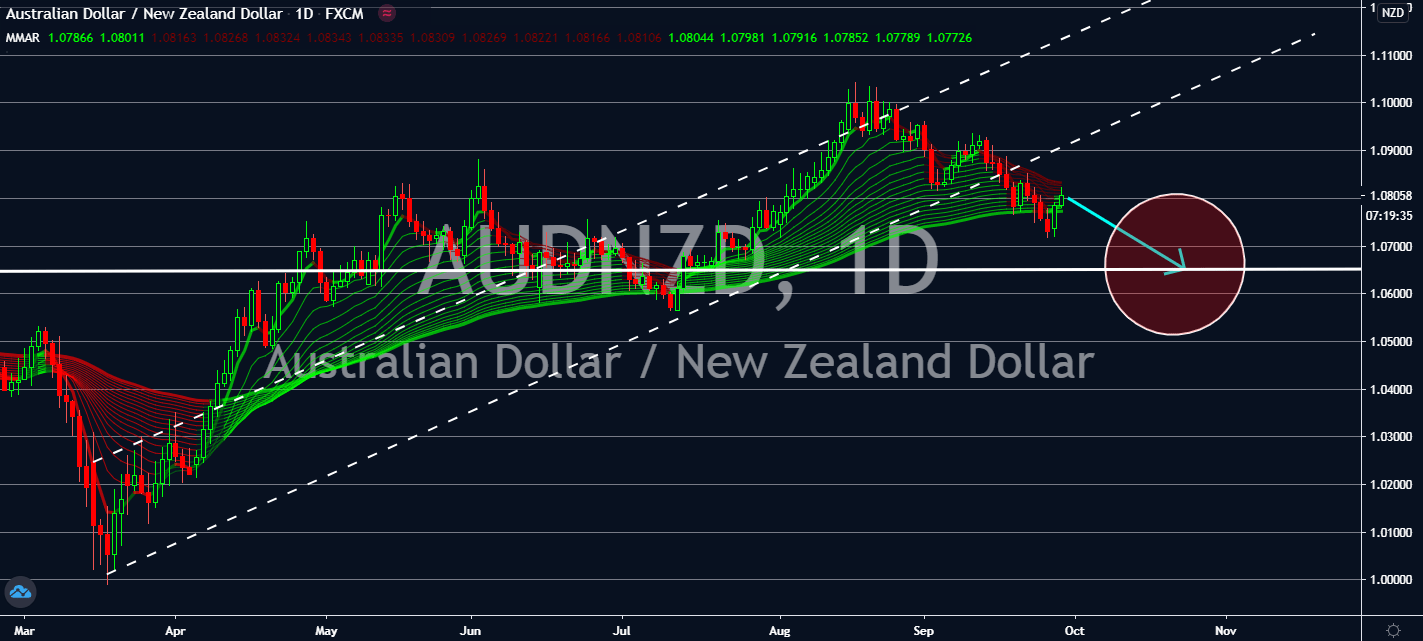

AUDNZD

Australia’s monetary easing from last week is still taking a toll on its economy. The Reserve Bank of Australia eased its lending rules to free up credit last week, which hopes to lighten financial burdens and reduce cost and time by consumers and small businesses that want to access credit. Although the move was to help Australia’s economy in the long run, it looks like its currency will have to take the fall as risk sentiment evaporates in the forex market. Although its Covid-19 hotspot, Victoria, saw one of its lowest count of new daily coronavirus cases recently, New Zealand’s more recent reopening is projected to help keep the kiwi dollar’s status as a safe haven. Risk sentiment is projected to help the near-full reopening of New Zealand’s economy after coronavirus cases began to plummet, especially as the deadline for its biggest city’s restrictions are still expected to loosen as soon as next week.