Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

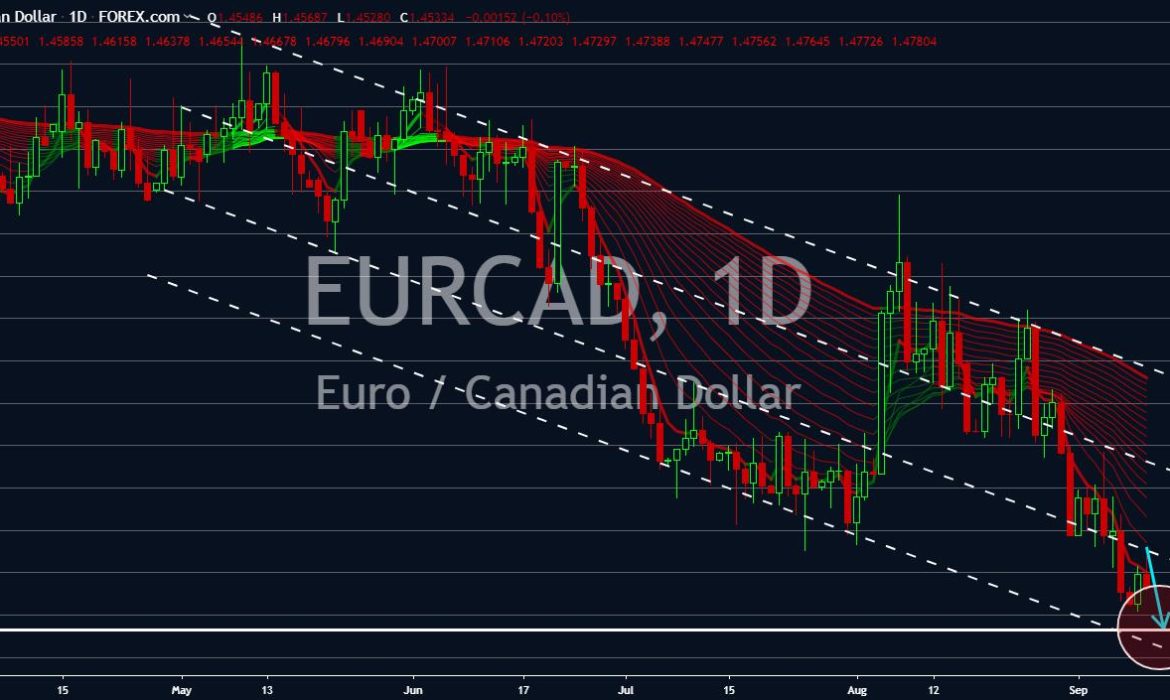

EURCAD

Canada’s labor market surpassed expectations with one of the biggest employment gains in decade, extending its solid results that put the country at odds with other emerging and developed economies. This news has been the driving force behind the strength of the Canadian Dollar in the past few days against the Single Currency. Canada added 81,000 jobs for the month of August compared to analysts’ estimate of 15,000. On the other hand, Germany, which had powered the 28-member bloc’s economy in the past decade, is being crippled by a trade war that is crushing Berlin’s once-booming industry. The impact is set to be far worse than experts predicted as the European Central Bank (ECB) is now also affected. New orders for German products were weak in terms of volume, particularly outside the Eurozone. Germany is predicted to enter recession in the coming months, dragging the Euro lower.

NZDCHF

Despite Switzerland sitting in a negative interest rates, its economy is surging. The country orchestrated several trading agreements with economic powers United Kingdom and China. Swiss Chief Economist suggested the country need neither further interest rate cut nor economic stimulus as the country was able to weigh down global economic and political uncertainty. The prosperity of the banking sector is being affected more and more by the negative interest rates applied by the National Bank of Switzerland to prevent the Swiss Franc from increasing value to much. Unlike other economies, particularly New Zealand, wherein interest rate cut is used to propel the economy, Switzerland uses the interest rate cut to prevent economic bubble. In line with this, the Reserve Bank of New Zealand (RBNZ) sees cutting interest rates close to zero to give the economy a much-needed boost and to meet its inflation target.

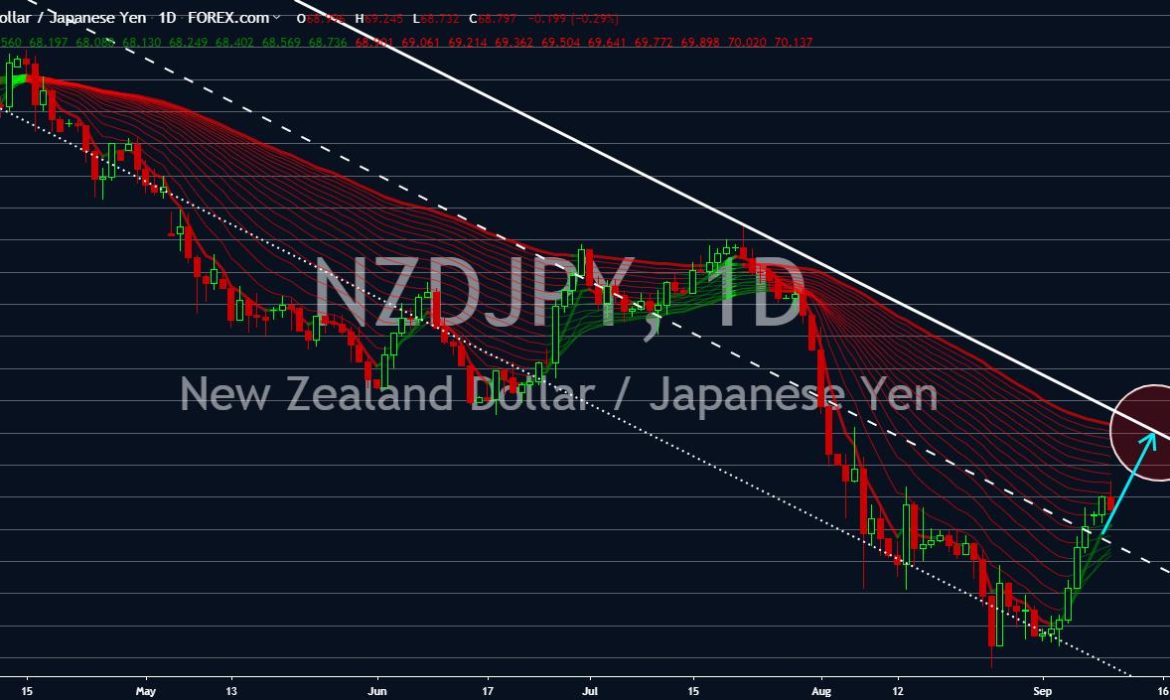

NZDJPY

Japan’s economy grew at a lower pace than initially estimated in the second quarter on the back of softer capital spending, signaling strains on the economy from weaker global growth and the trade war between the United States and China. Weakness in the global economy and trade protectionism have emerged risks to growth and increased pressure from the Bank of Japan (BoJ) to expand stimulus when it meets later this month. Japan’s economy further suffers from its own trade war against South Korea affecting its service sector, which includes tourism. Travel account surplus shrank 0.9% in July from the year earlier to ¥229.3 billion, with South Korea visitors dropping 7.6% from a year earlier. This had dragged Japanese Yen at the beginning of September. On the other hand, a slowdown in New Zealand house price growth has put banks in a stronger position and reduced the chances of a major market correction.

USDSGD

Singapore dodged a recession predicted last August boosting the Singaporean Dollar. Recent data suggest gross domestic product (GDP) will grow in the third quarter after shrinking in the previous three (3) months. This means that the city state will narrowly avoid a technical recession, commonly defined as two (2) consecutive quarters of contraction. Recently, economists have slashed their 2019 growth forecast for the export-reliant economy as the U.S.-China trade war intensifies. Singapore’s government is projecting growth of zero to one percent for the year. Analysts cites three (3) main reasons for mild improvement, which they said will help boost Singapore’s service output and offset the slump in manufacturing sector: front-loading orders; loan growth; and Hong Kong diversion. Its offshore loans rose 7 percent in July, while protests and disruption in Hong Kong have pushed leisure and business tourism to Singapore.