Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

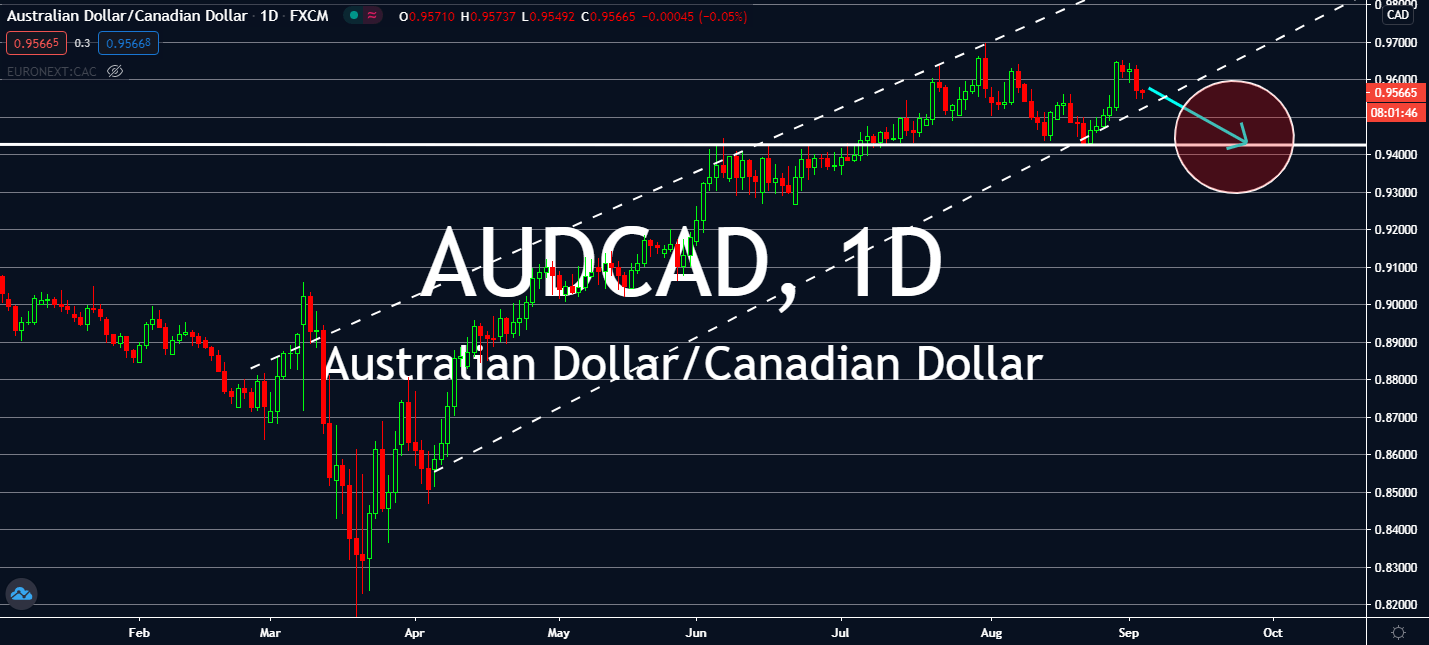

AUDCAD

Australia officially declared its first recession in nearly 30 years, and its budget is in assessment. In three months ending on the last day of June, officials claim the economy shrank by 7 percent. What was lost in its economy is likely to bounce after the crisis subsides. It has only been two days since the Reserve Bank of Australia’s interest rate decision to keep its benchmark rate at 0.25%, and now it looks like the central bank is already reconsidering. Meanwhile, investors projected that Canada might be looking at an increase in trade balance for the month of July, which stood at -3.19 billion in June. Moreover, Canada is likely to see a bigger jobs increase in terms of percentage in other major economies such as the United States. Preliminary signs also suggest that spending and activity generally continued to improve from mid-July to mid-August, showing that the market has been underestimating its regrowth for a while.

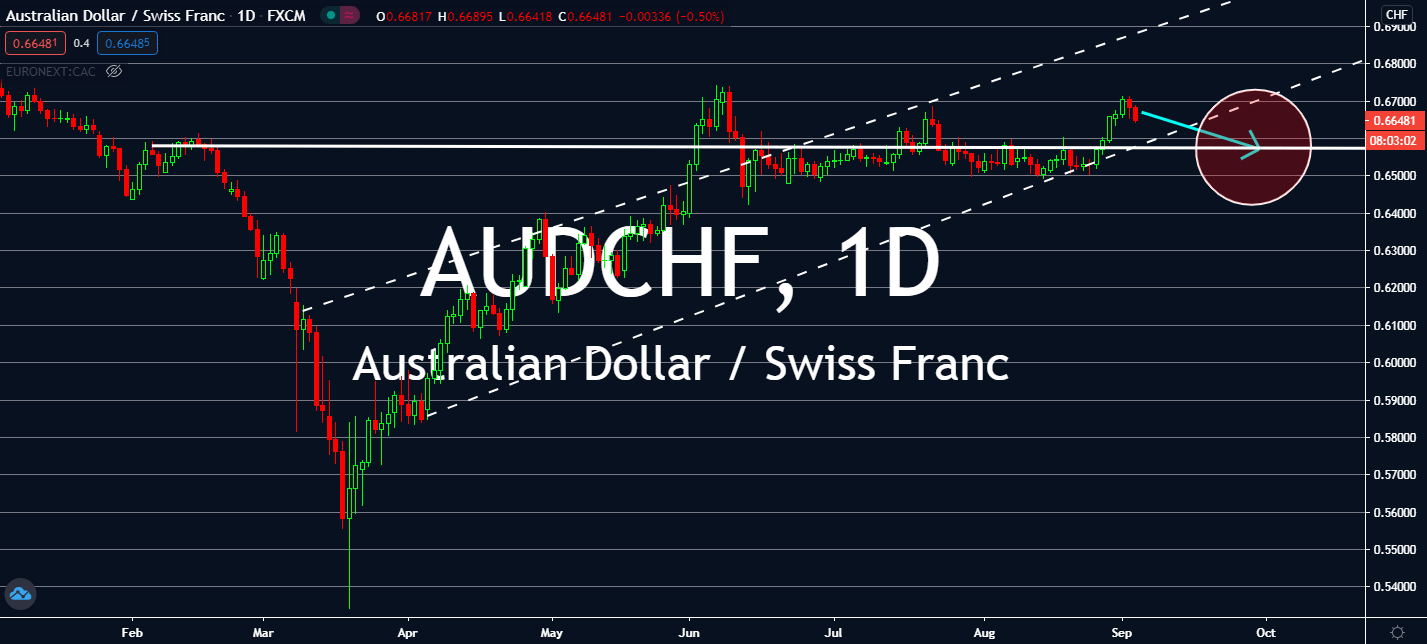

AUDCHF

Australia is still reeling from its worst economic slump from the Great Depression and Switzerland is seemingly faring better than others in the coronavirus pandemic. The Swiss economy saw a slight increase in its Consumer Price Index figure, which came in right around neutral territory from a -0.2% recorded in July to 0.0% for August as per today’s announcement. This seemed to have initially disappointed foreign investors, since it was lower the projected 0.1%. Surprisingly, its year-over-year comparison came in at the same rate as last year for August at -0.9% recorded are the same period. But earlier today, Alpine states are relaxing their lockdown plans to focus on recovering their economies in the next half of 2020 as public health authorities question its lockdowns’ effectivity and sustainability in the long-term. It looks like Switzerland will have to reopen a risk society, but this could be positive for its currency near-term.

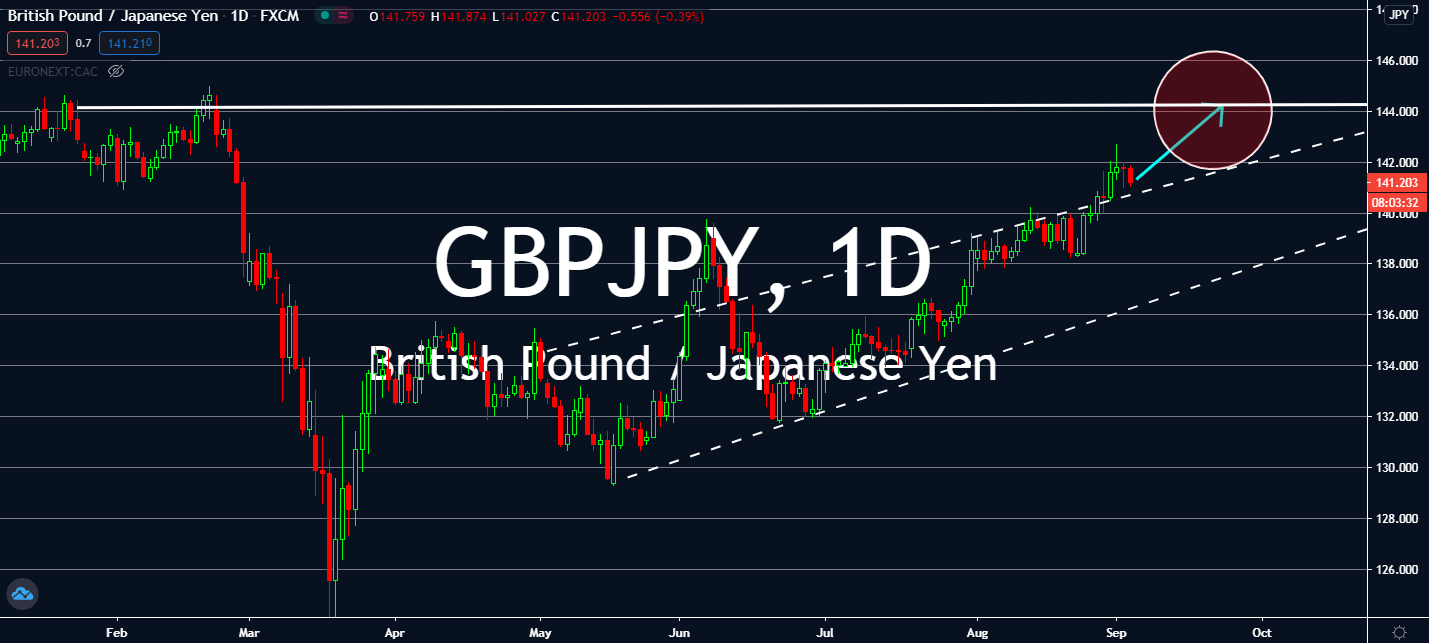

GBPJPY

Japan’s services sector contracted faster than market consensus in August for the first time in four months. The Jibun Bank Japan Services Purchasing Managers’ Index recorded a seasonal adjustment 45.0 in August from 45.4 seen in the previous month, which was triggered by weakening businesses and disappointing figures from domestic business activity. The results will disappoint analysts who have been keeping a close eye on its consumer spending to soothe its economy out of a sharper recession. Meanwhile, the United Kingdom’s equivalent figure is doing rather well. The UK’s services sector just went through its sharpest increase in more than five years last month. IHS Markit found that its own PMI recorded 58.8 in August, more than two points higher than July and much farther than its record low of 13.4 in April this year. Although it was slightly lower than Wall Streets’ estimates, the UK is undeniably still the winner of the pair.

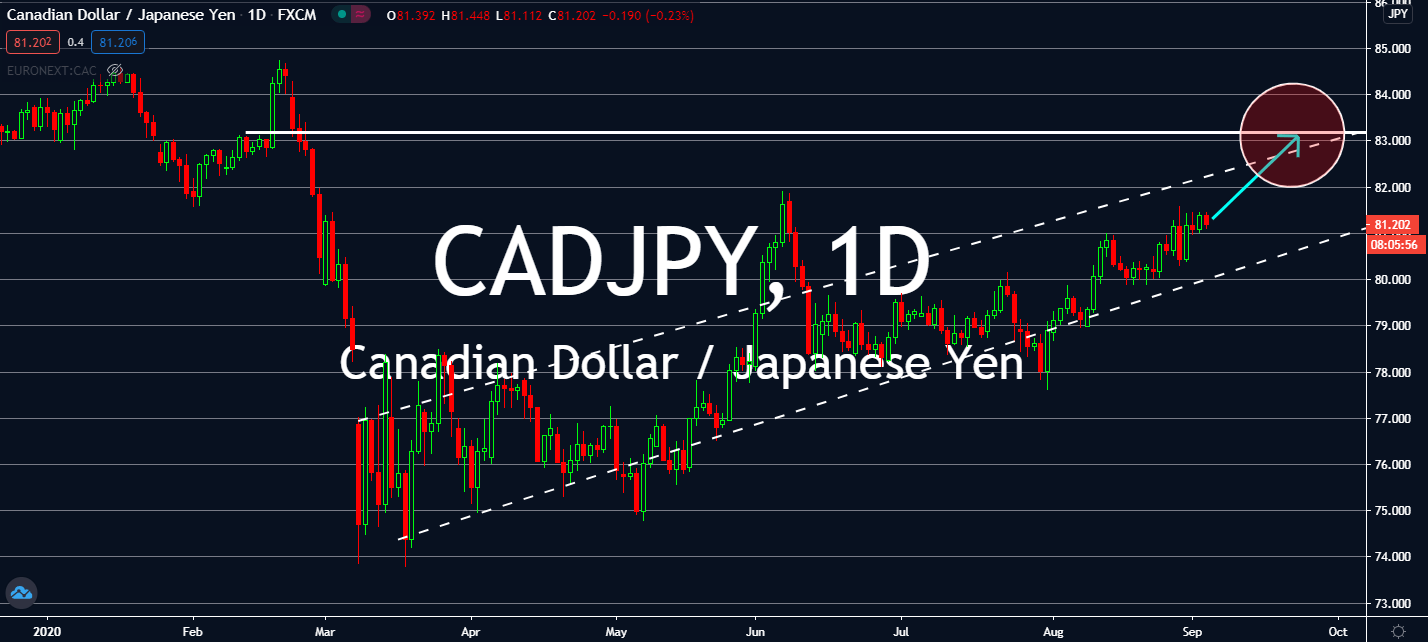

CADJPY

Canada’s economy is growing again, albeit slower than the market expected. After its economy suffered its worst economic decline since 1961, it was seen recovering faster than its peers. BMO chief economist Douglas Porter said that its second quarter decline of 38.7 percent on an annualized basis was shallow than he had expected and even saw a gradual increase from month to June by 4.8 and 6.5, respectively. Meanwhile, the now-former prime minister of Japan Shinzo Abe’s retirement left quite the problem for the position’s front-runner Chief Cabinet Secretary Yoshihide Suga. Japan’s services sector contracted at a faster pace in August, the first time in four months, as the coronavirus pressures its business confidence to reach down at 45.0 for August from 45.4 in the previous month. Both news could lift he Canadian loonie higher against the yen despite the recent contraction in crude prices in the United States.