Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

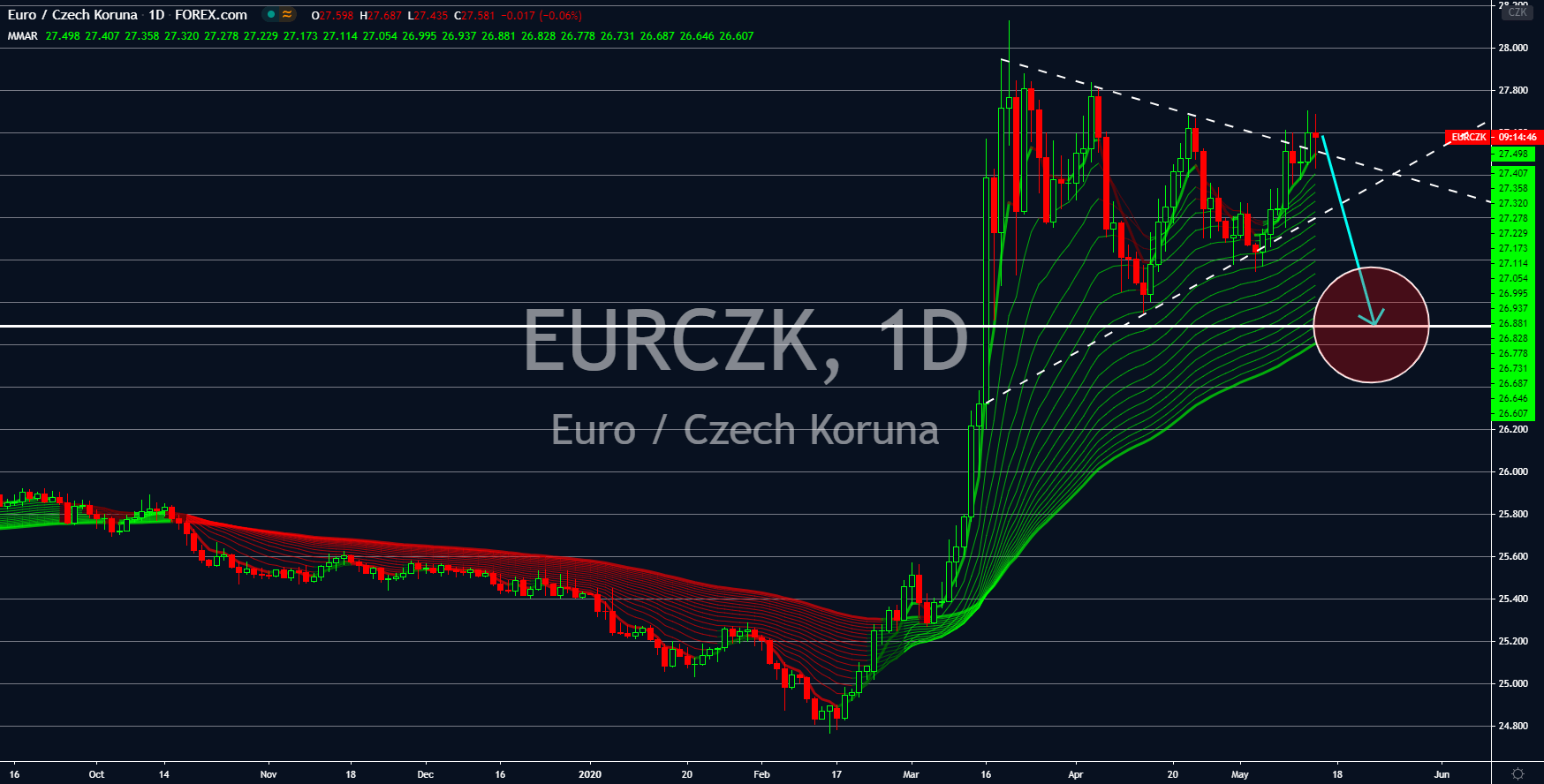

EURRUB

The rise of coronavirus cases in Europe in March saw the single currency to plummet against other currencies paired with it. On March 13, the euro lost almost 4% of its value against the Russian ruble. This was following the announcement by the WHO that Europe is now the epicenter of the coronavirus pandemic. Two (2) months after the announcement, Russia is now emerging as the epicenter of COVID-19. Experts were convinced that Russia made a mistake in underreporting coronavirus related deaths. This is expected to hurt the ruble in the coming months once it releases reports on GDP and economic activity. Despite this, analysts see the euro going down in the coming days. EU member states published and will be publishing reports relating to their economic performance this week. Germany and the European Union are set to release their Q1 2020 GDP today. Analysts were expecting the EU to enter recession once again.

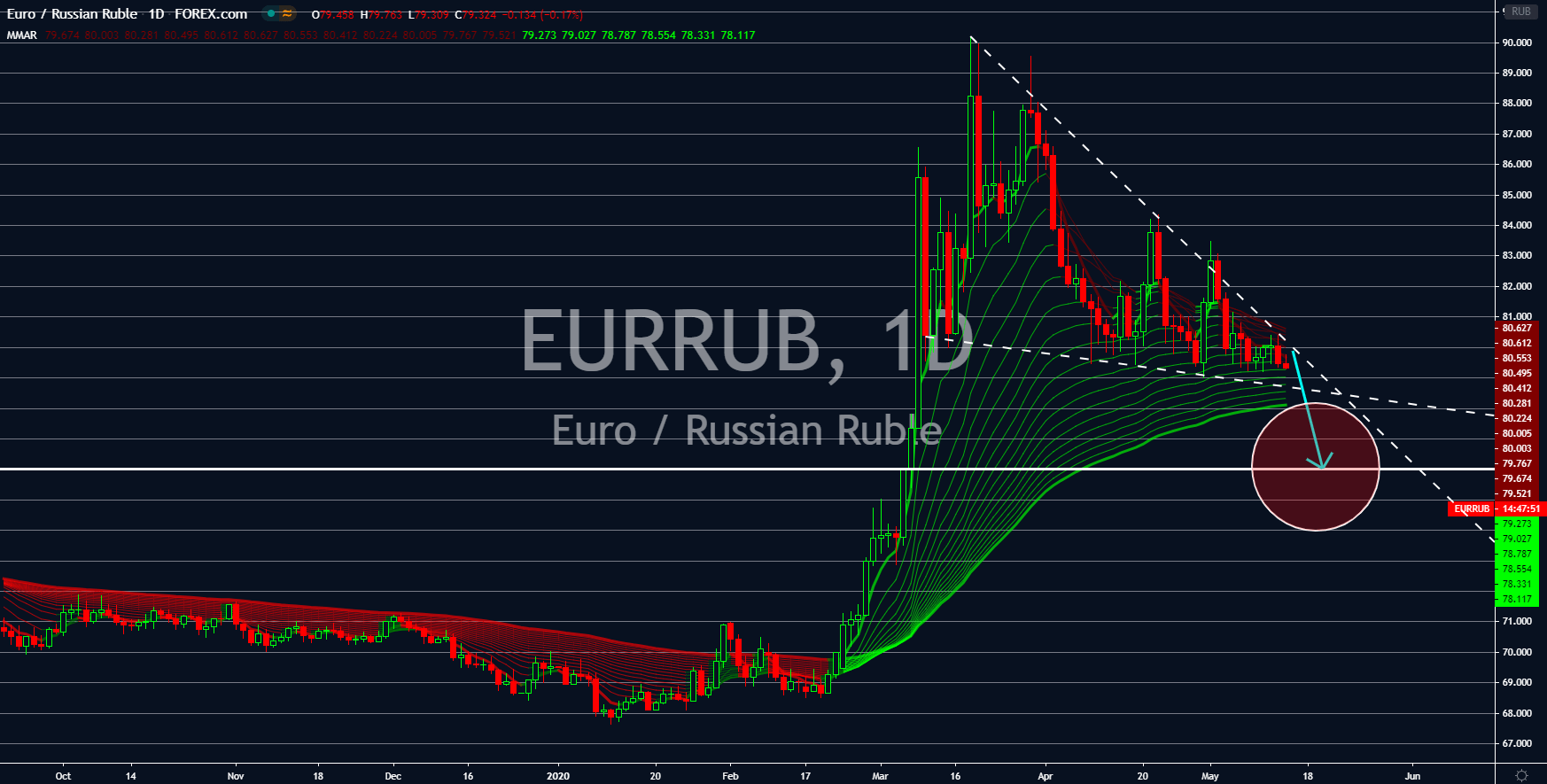

EURPLN

Investors are cheering for the Polish zloty after reports showed Poland being the most resilient economy in Europe. The country’s annual GDP is only expected to contract by -0.5% compared to the -4.0% in Germany in the first quarter of 2020. For the past five (5) years, Warsaw emerged as one of the fastest growing economies in Europe, having its economy grew by 4.1% in 2019. This growth by Poland, along with other eastern European countries, followed the shift of economic power in the EU. Analysts are worried that the slowdown, and eventually a recession, in Germany might drag the single currency to record lows. During the 2008 Global Financial Crisis and 2010 European Debt Crisis, Germany led the efforts to save the Eurozone, particularly Greece. However, now that Germany is the one facing the recession, analysts are in doubt that no one will come to its side and save its economy from an eventual economic depression.

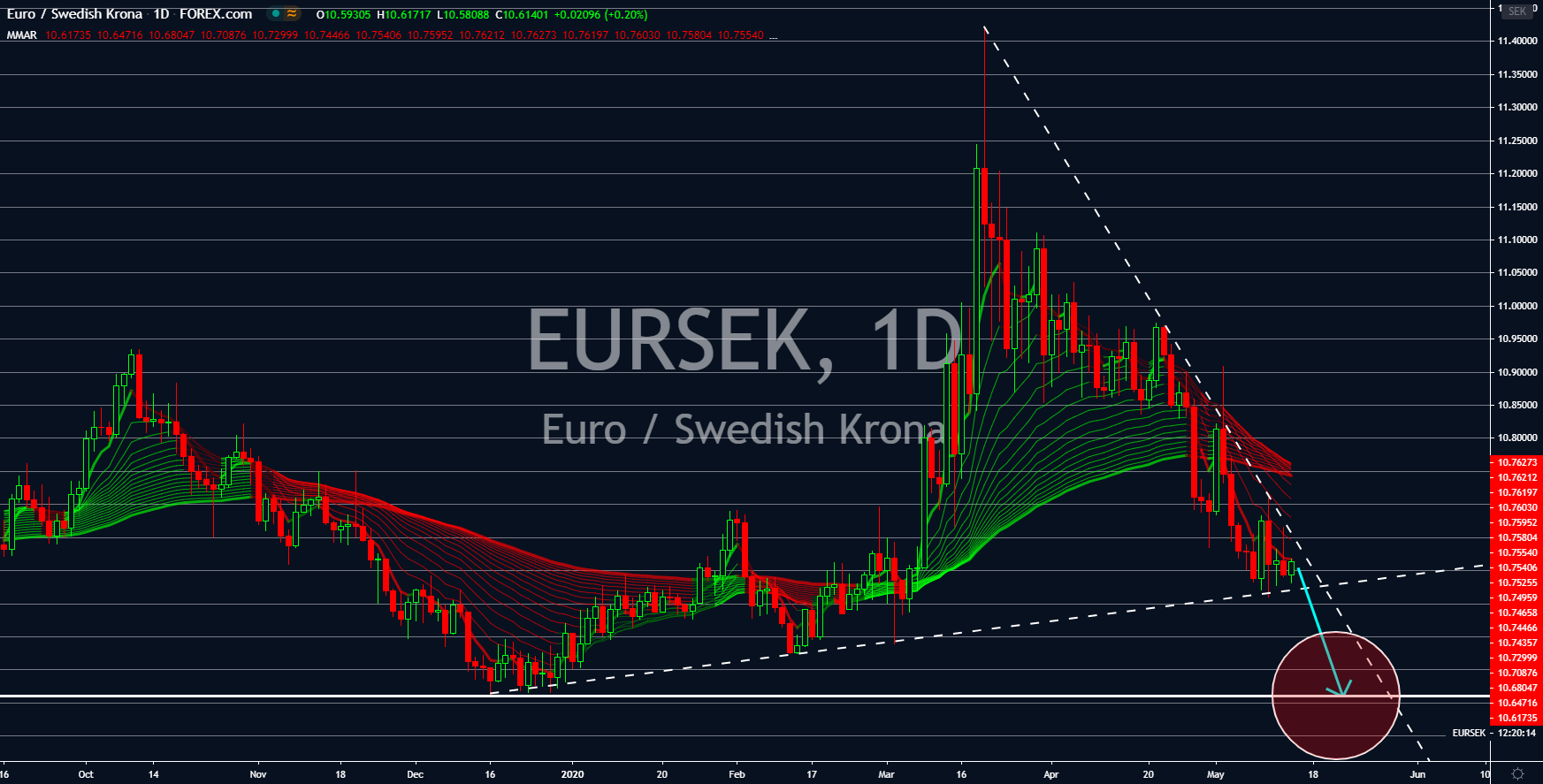

EURSEK

The herd immunity strategy by Sweden had shielded local businesses from the supposed economic impact of the coronavirus in the country. Despite most countries closing their borders and businesses to contain the virus, Sweden encouraged its people to go out and develop a natural immunity against the pandemic. As a result, businesses remained open and analysts were expecting the Swedish economy to outperform other countries for its Q1 and Q2 GDP reports. Meanwhile in other EU member states, the month-long lockdown is expected to take a toll in the Eurozone. The European Union is expected to officially enter recession today. During the fourth quarter of 2019, EU GDP went down by 3.8%. Now, analysts are expecting another drop of 3.8% in the bloc’s gross domestic product. Most EU member states are expected to follow the EU on the negative territory one they release their first quarter GDP for fiscal 2020.

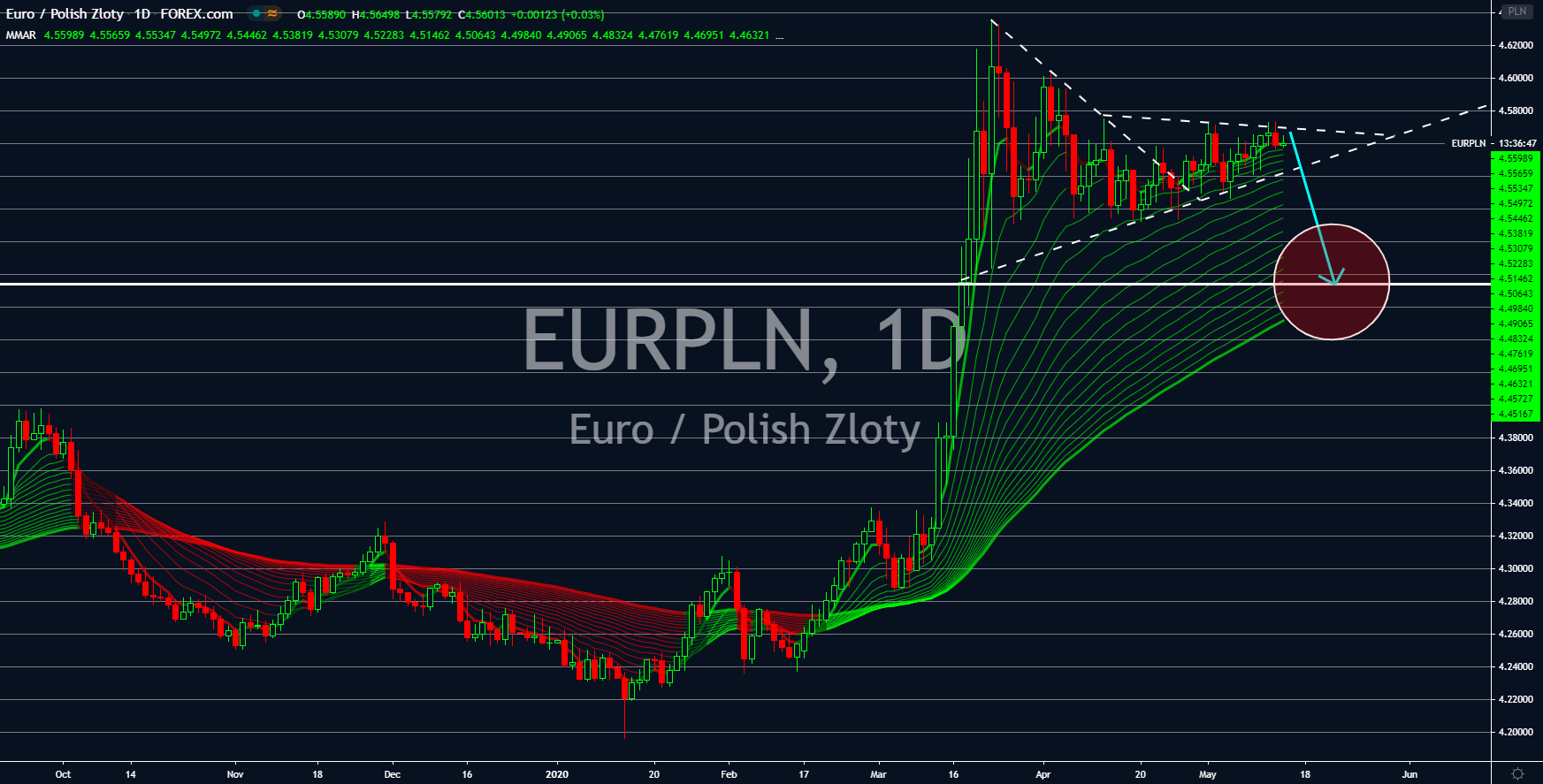

EURCZK

The single currency will experience weakness in the coming sessions as the negative outlook on the eurozone creeps on the euro currency. Major EU economies, and the EU as a whole, are expected to enter recession once they report their figures for the first quarter GDP growth. However, analysts were expecting Western Europe to be hit harder compared to the Eastern Europe. EU economic powerhouses, Germany and France, and its former member, the United Kingdom, will lead the decline in the European region. Meanwhile, economies of the V4 – Hungary, Poland, Czechia, and Slovakia – will outperform other EU member states. For years, these economies were among the fastest growing economies in the European Union. Analysts are expecting the increased economic activity in the V4 nations from the previous years to shield the group against economic uncertainties brought by the deadly coronavirus.