Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

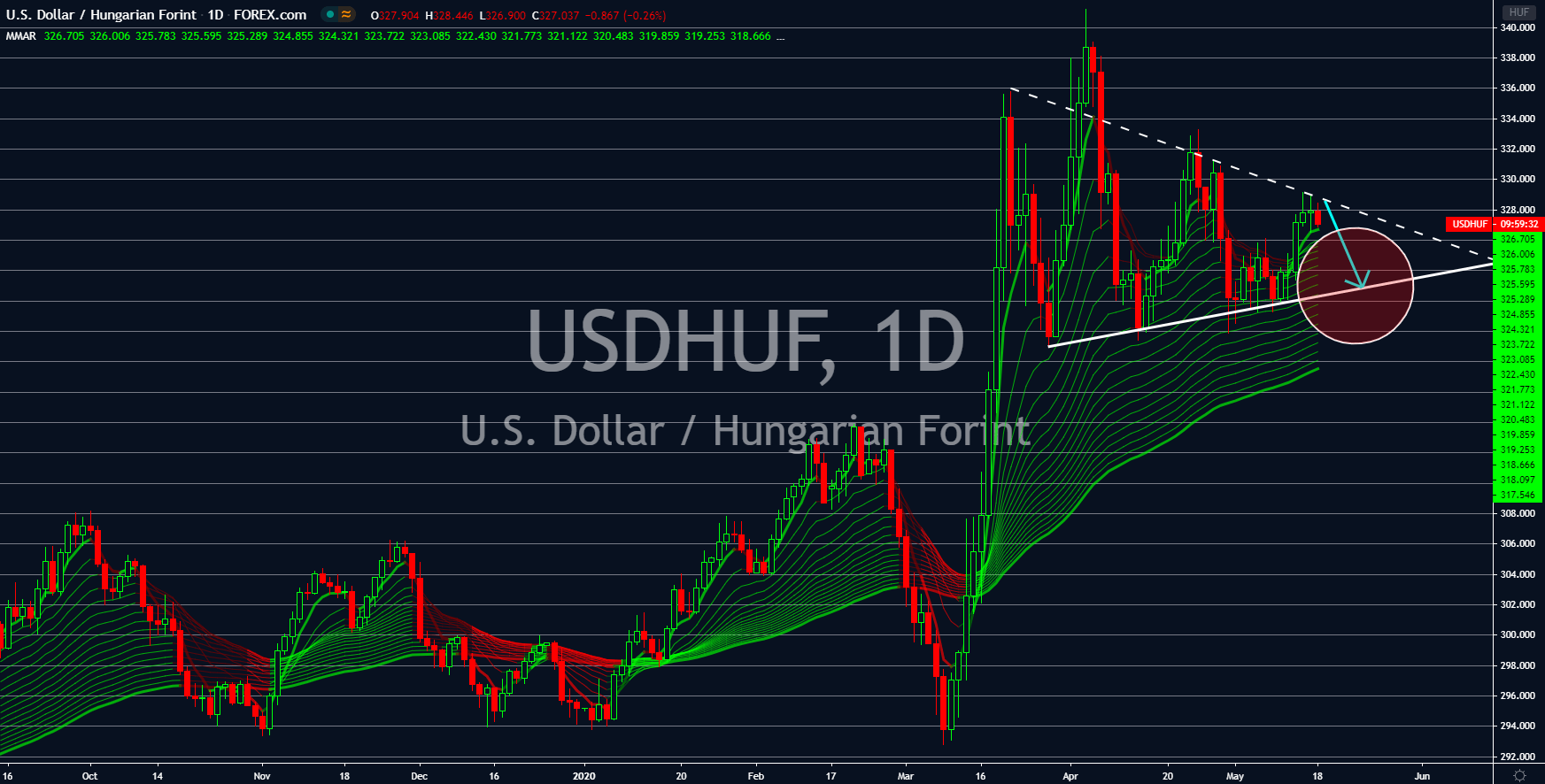

USDHUF

The US dollar will continue to underperform against the Hungarian forint in the coming sessions. The EU member states are expected to record a disappointing figure for their first quarter fiscal 2020 GDP report. This was following the devastating economic and health effect of the coronavirus. Germany contracted by -2.2% in Q1, signaling a technical recession. The same thing is true for France who posted -5.8% growth. Hungary, on the other hand, managed to defy expectations with -0.4% growth. The recovery in the EU and the strong economic performance of Hungary will overshadow the safe-haven appeal of the USD. In the previous months, investors are flocking to the greenback as confidence in the US government and its central bank remains high. However, as COVID-19 continues to disrupt the largest economy in the world, investors are having second thoughts on whether the government can continue to support the American economy.

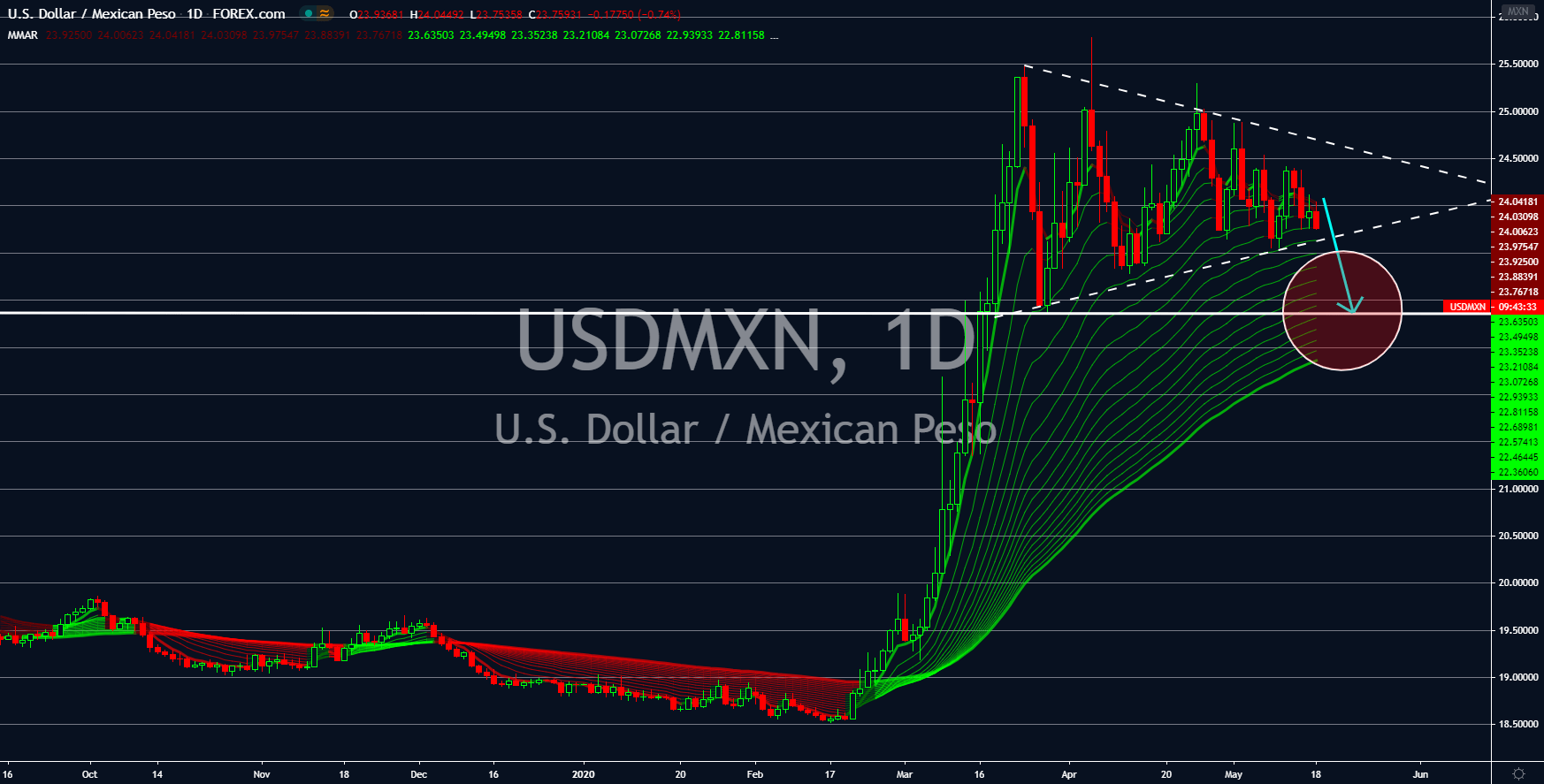

USDMXN

Investors are bullish on the Mexican peso following the reopening of its economy today. This was despite the rising cases of coronavirus in the country and the threat of contagion from the United States. Currently, the US has the largest number of COVID-19 positive cases and deaths in the world at 1.52 million and 90,000, respectively. Worries are also mounting as several US states continue their lockdown. Cumulatively, the total stimulus injected by the US government and its central bank to the US economy is nearing $6 trillion. However, the supply is almost drained out. The government is now preparing to unleash the fourth phase of the economic package in the coming weeks. Economists warned that continued intervention by US institutions in the market could result in a depreciated value of the US dollar. The greenback will continue to underperform against the Mexican peso until a new stimulus has been introduced.

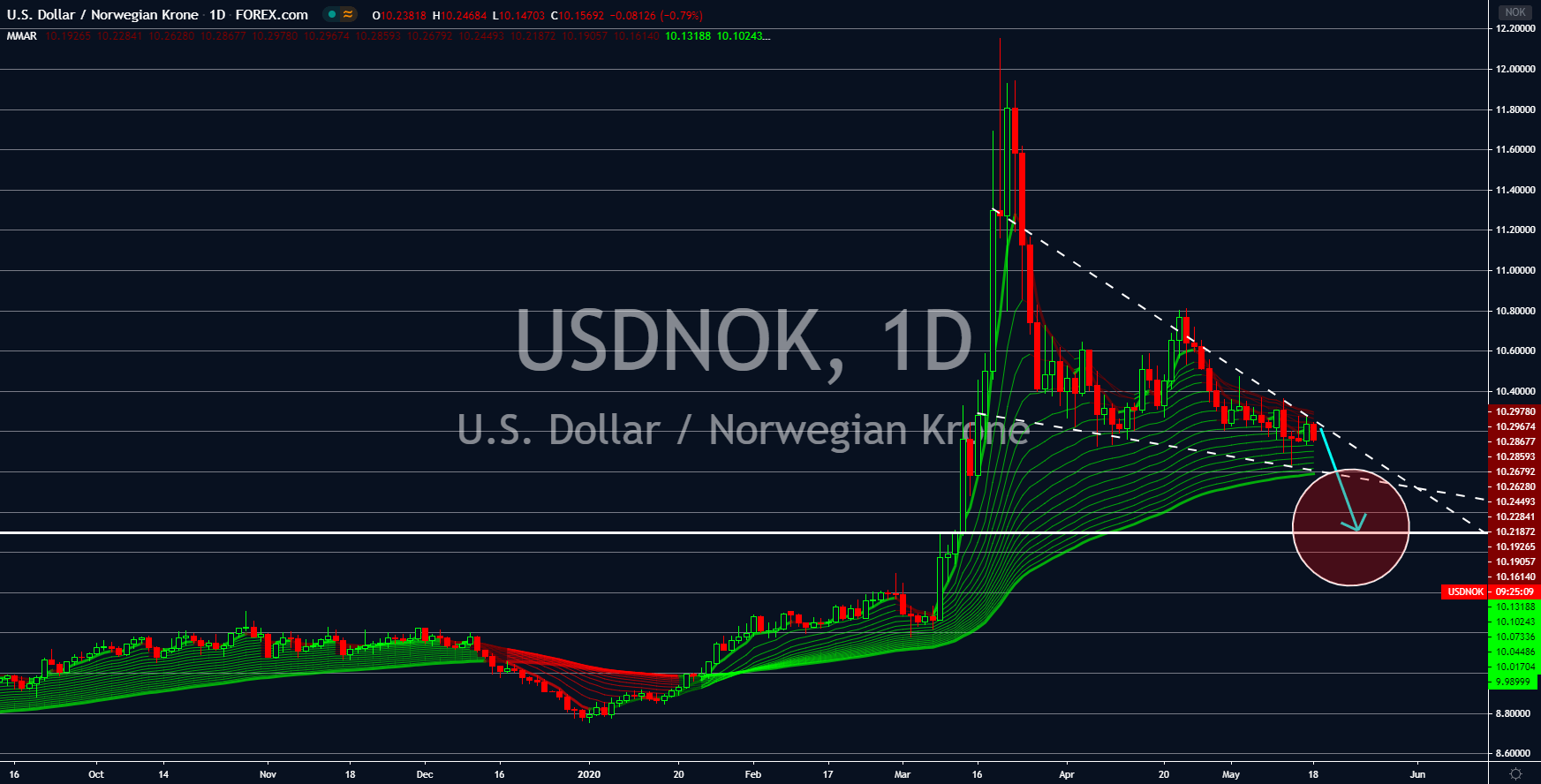

USDNOK

Investors continue to show support and confidence with Norway’s economy. This was despite the recorded 1.5% contraction in the local economy for the first quarter of fiscal 2020. The reason for the optimism in Norway’s economic performance was its sovereign wealth fund. Norway’s $1 trillion fund was founded on the surplus from its oil exports. The fund can act as an added liquidity in the market. This means that Norway can tap its fund to keep its economy afloat and not rely on debts just like what other countries are doing right now. On May 12, it was reported that Norway withdrew a record of $37 billion from the fund. The move was timely as the oil market continues to recover from its recent slump. Meanwhile, the US is now preparing its fourth phase of economic stimulus to continue its support with its local economy. However, the added liquidity in the market was due to quantitative easing. QE is printing money without the backing of gold.

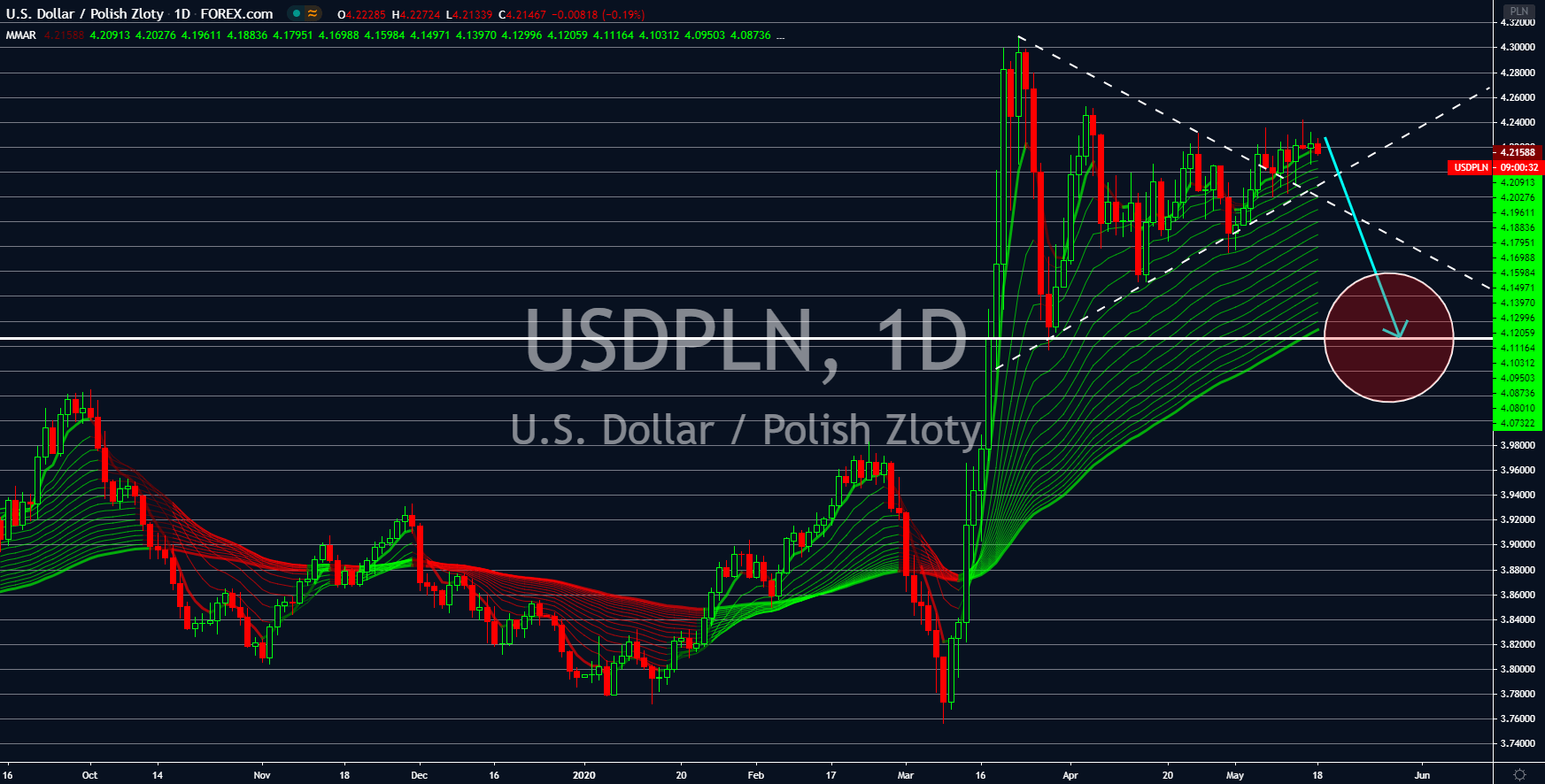

USDPLN

Poland had its largest decline of economic growth for more than two (2) decades. The European country recorded a -0.5% contraction for the first quarter of fiscal 2020. Despite this, the slump in the data is still better than the average Q1 2020 growth of the EU member states. Germany and France, the EU’s economic powerhouses, both contracted by -2.2% and -5.8%, respectively. On the other hand, eastern European countries are weighing down the impact of the coronavirus. Hungary, another member of the Visegrad Group which includes Poland, contracted only by -0.4%. Analysts projected that the eastern European countries will catch up with the economic prosperity in western Europe in the coming decades. The traditional alliance between Europe and America will face challenges with the V4 nations as they seek to strengthen ties with China. The US had already invested billions of dollars is eastern Europe to deter Chinese influence.