Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

USDJPY

Investors expect the Federal Reserve to cut further 25 basis points later in the month, scaring USD into breaking down against safe haven counterparts. The Fed held its first emergency interest rate chop of the year by 50 basis points in response to the economic risks brought up by the coronavirus while investors challenged the effectiveness of a rate cut in the first place: even the chief economist of Amerhst Pierpoint Stephen Stanley believes that while it’s integral for central banks to move quickly against the crisis, he claims rate cuts would do “next to nothing” to boost the local economy, influencing investors to lose faith in the currency. Furthermore, even if it does go well, he argued that there’s nothing the Fed can do to prevent further adversaries anyway. In Asia, Japanese stocks plummeted just behind oil prices – this will prompt investors to reach for safe havens like the Japanese Yen.

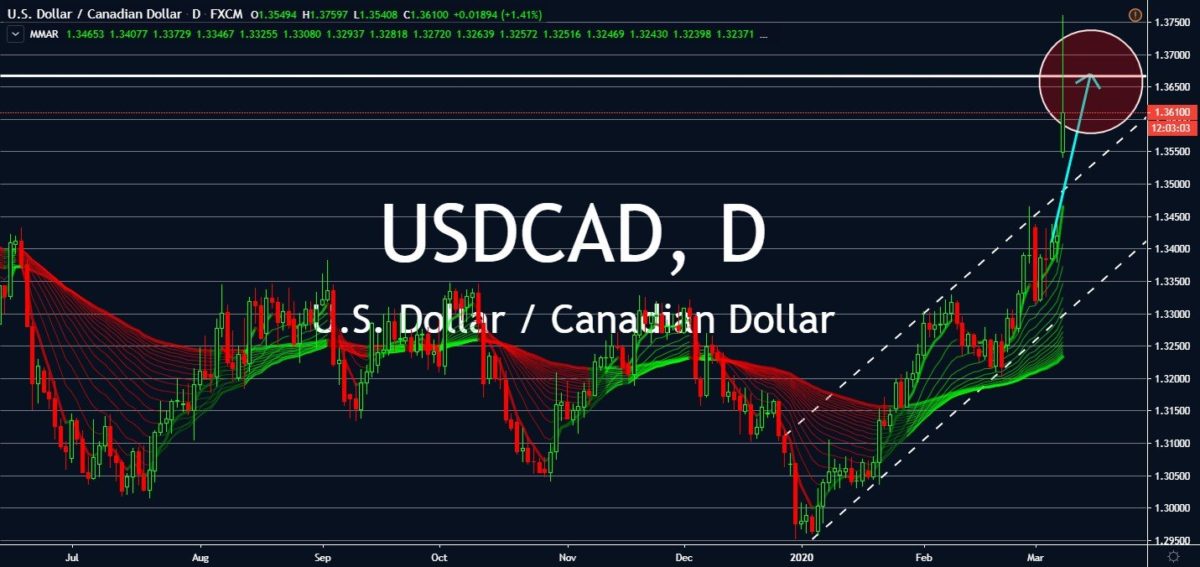

USDCAD

Canada’s reliance on oil exports brought its currency down against the US Dollar. The Loonie saw vulnerabilities late last week following reports that Organization of the Petroleum Exporting Countries (OPEC) allies failed to reach an agreement on production cuts, which could effectively give each participating country the freedom to self-regulate how much crude it pumps. The meeting’s failure in Vienna prompted a 10% plunge in oil prices on Friday. Crude and Brent both traded down 22% to $32 and $35 a barrel, respectively, with both contracts seeing their worst day since 1991. To add insult to injury, Russia recently confirmed the conflict with an announcement that it will not follow the global supply cut accord despite the impact of the coronavirus. Then, Saudi Arabia pushed its selling prices up by $6 to $8 to heap pressure on Russia. The Canadian dollar will continue to suffer the consequences as investors come to terms with these results.

USDNZD

Kiwi is standing strong against the greenback for the sixth day in a row after the Reserve Bank of New Zealand refuses to ride the rate cut bandwagon. The global rating giant Fitch claimed that the country has enough “rainy day fund” for a time such as the economic effect of the coronavirus epidemic, eliminating the need for a rate cut in coming weeks. Contrarily, the Federal Reserve changed fiscal policies this week, which helped the NZ Dollar to rise further. Nevertheless, the firm sees a simultaneous deterioration in asset quality for central banks around the world, signaling global economic recession driven by China. The US dollar also failed to exceed forecast US NFP data with a fresh record low with a 0.66% drop in US 10-year treasury yields and S&P 500 Futures shedding 4.48%. New Zealand is still expected to decrease rates with Australia in the long run, which will cause little movement for NZD against USD.

CADNZD

After the Bank of Canada lowered its interest rates by 50 basis points last week, the Loonie has been fighting a losing battle against the Kiwi. Worries that the Reserve Bank of New Zealand (RBNZ) will suffer the same slump as the Australian dollar prompted the country to refuse lowering its interest rates, which helps the currency against the Loonie. More importantly, Canada’s participation as an Organization of the Petroleum Exporting Countries (OPEC) ally will continue to benefit its Kiwi counterpart as the organization refuses to reach an agreement on oil production cuts required by the economic effects of the coronavirus, following a breakdown achieved earlier in the session. However, the threat of global recession may eventually reach the RBNZ may slow down its reign against a basket of other central banks that lowered its rates to combat the financial losses from the health crisis.