Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

EURRUB

Europe has been experiencing a series of successes for the past few days. Its PMI figures remain in focus with better than expected manufacturing, market composite, and services PMI figures announced last week. Moreover, its second-largest economy is helping buoy the economic consequences of the coronavirus pandemic. This will help boost the European currency while Russia’s inner conflicts will bring optimism towards alternatives of its currency, lowering engagement to the ruble. Moreover, retail sales and unemployment rates recorded worse than expected figures on a monthly comparison. On the other hand, interest rates stayed as-is from the Russian central bank. Plus, Russia is seeking to reopen businesses despite rising coronavirus cases in the country, which will nail the coffin for the ruble near-term.

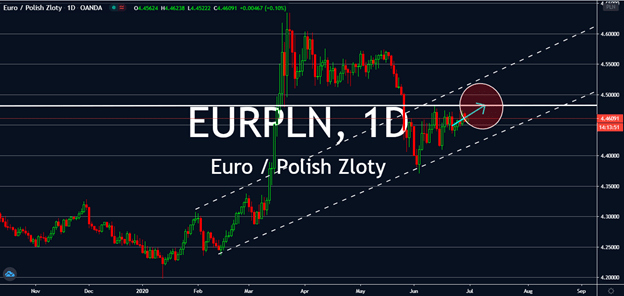

EURPLN

Investors are looking forward to the Polish prime minister Mateusz Morawiecki’s announcement that he expects the country’s economy to achieve a “v-shaped” recovery from the damage caused by the coronavirus. It looks like the first thing that will help the reopening is the surge in retail sales figures, which surged in Poland for the month of May on a yearly basis. Local investors are also looking forward to the upcoming first round of its presidential elections on Sunday which could affect more of the country’s progress amid the COVID-19 economy. The euro is also expected to gain against the zloty to a sideways pattern near-term as more countries reopen in the bloc, in addition to good news from its PMI figures that are in focus for the week, such as its services and manufacturing PMI that grew better than expected for the month of May, but Poland is expected to gain more in the near-term.

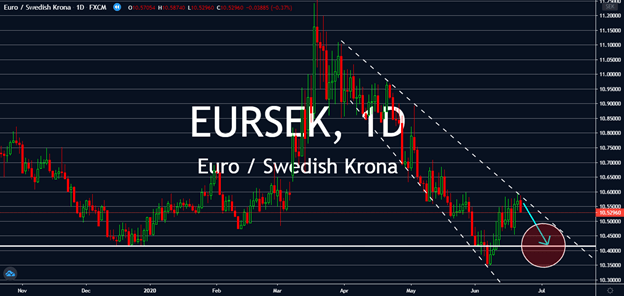

EURSEK

After Sweden announced that its economy is conracting less than it previously expected, the EURSEK pair is bound to sell in the next sessions. Reopening in the Eurozone will benefit its currency with high volatility, but charts claim that this is in preparation of the pair stabilizing back into pre-coronavirus levels near term. This volatility will be led by investors’ focus on several economic factors, such as PMI in manufacturing, Markit composite, and services PMI for the month of May. On the other hand, Sweden will render the lesser-than-expected contraction of 6 percent by the end of 2020 instead of the expected 8 percent Sweden also didn’t record a GDP contraction for the first quarter of this year, which will also benefit the krona in the upcoming sessions. Two key eurozone economies are then expected to plummet much further than the Swedish economy would, which will greatly affect the course of this pair in upcoming sessions.

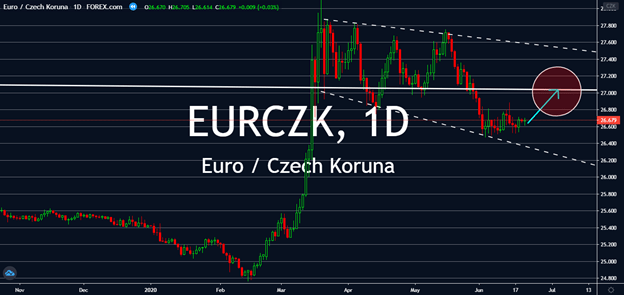

EURCZK

The Czech Republic saw more than 110 new cases of the coronavirus today, which proves as bad news for its economy. The markets are now waiting for the country’s upcoming interest rate decision, to arrive tomorrow, while the European Union continues its gradual reopening. Important economic figures have finally seen the results of their efforts with indicators such as manufacturing, services, and Markit composite PMIs have seen increases against both expectations and previous monthly records for the month of May, which will help boost the eurozone despite market’s uncertain anticipation for a deep economic decline in larger countries in the EU by the end of the year. For now, the French economy’s wider reopening will lift the single currency against the Czech koruna near-term, or until the Czech government starts to see much fewer coronavirus cases than it announced earlier today.