Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

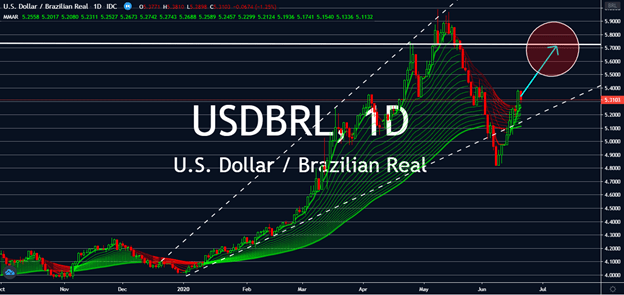

USDBRL

Brazil has seen one of the worst coronavirus surges in the world, most especially in Latin America, according to the World Health Organization. WHO recorded the most single-day increase in the country on Monday, raising investors’ concern of an even longer delay to economic recovery for Brazil. In fact, the country’s central bank is showing signs that it will implement another interest rate cut in the coming weeks, which could prompt a strong sell-off in the near future. Meanwhile, the United States is gaining up on its losses from the past few months. Investors are looking forward to a massive increase in New Home Sales for the month of May, which will go from 580 thousand in April to 640 thousand this month. Other figures such as its manufacturing PMI, Markit composite, and services PMI are all expected to rise tomorrow. Although today saw a small slump in existing home sales, the US dollar would still be expected to gain near- to medium-term.

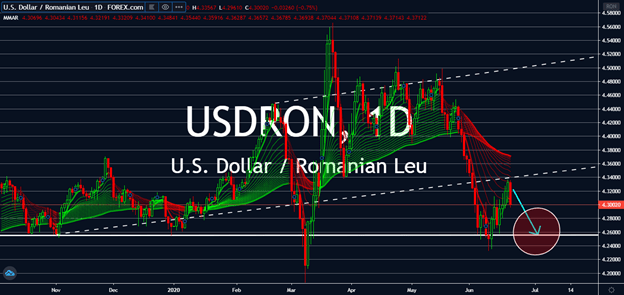

USDRON

The USDRON pair reached a historic high on March 23, but easing global markets other than the United States would mean bad news for the greenback. Continuous protests in the country still affect its economy and currency – Federal Reserve Chair Jerome Powell said the COVID-19 pandemic led to a coin shortage. Powell claimed that the flow of coins stopped since the lockdown, challenging the supply chain that usually flows through uninterrupted. This has led banks and businesses to close down or change inner workings to assure financial stability. The Fed began allocating coin inventories last week, which dominoes into profitability and loss. Investors are worried about the course of the greenback’s economy if this shortage continues, especially if the American government decides to reopen more of its businesses after new coins have been produced by the Fed’s partnership with the US Mint.

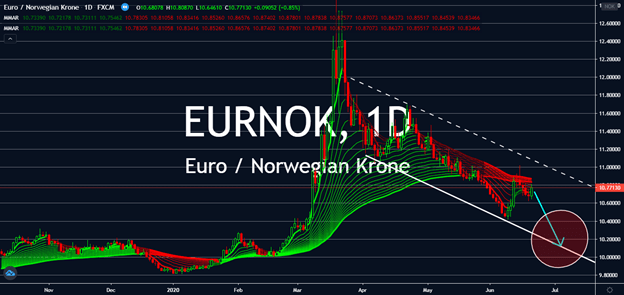

EURNOK

The EURNOK pair has been on a bear market since its fall in late March. Technical outlooks claim the weakness is mostly on bad news from the Euro debt crisis, wherein businesses in the bloc damaged investor confidence causing bond spread to rise to uncontainable levels. These troubles raise the possibility of further fiscal stimulus. Moreover, the eurozone is still in talks with Brexit while it disintegrates with one less partner in the bloc. Trade surplus from German exports is now the majority of the eurozone’s source of income, which already hasn’t been faring well this year, either. The manufacturing capital of the EU is falling into crisis, which adds pressure to the EUR. Populist parties across Europe are also posing as the next major crisis to threaten the EU. Inner conflict in governments within the bloc is worrying investors as more political parties aim to reverse the tide of globalization as we know it.

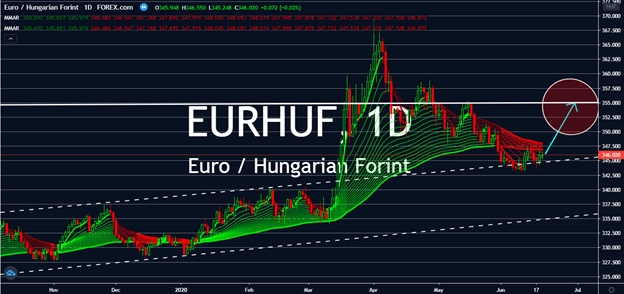

EURHUF

The euro might not be able to recover soon, but the Hungarian forint has it worse. In the middle of a pandemic, Hungary just invested 190 million euros for a racetrack. The country also announced a 600-mil plummet for its trade balance for the euro in April. Meanwhile, although things aren’t looking good for the European economy, some of its members are opening up enough to help its currency lift against rivals like HUF. It’s currently recovering while other countries and regions are forced to close due to second waves and the like. The EU is also in talks with the Chinese to scrutinize inequal levels of transparency and fair competition for its overseas workers, aiming to ensure a level-playing field for the workers. The Commission announced a process to restrict Chinese government-backed firms in the bloc, which could be a driving force for the euro’s direction in the coming days. However, it’s best to trade for EURHUF short-term.