Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

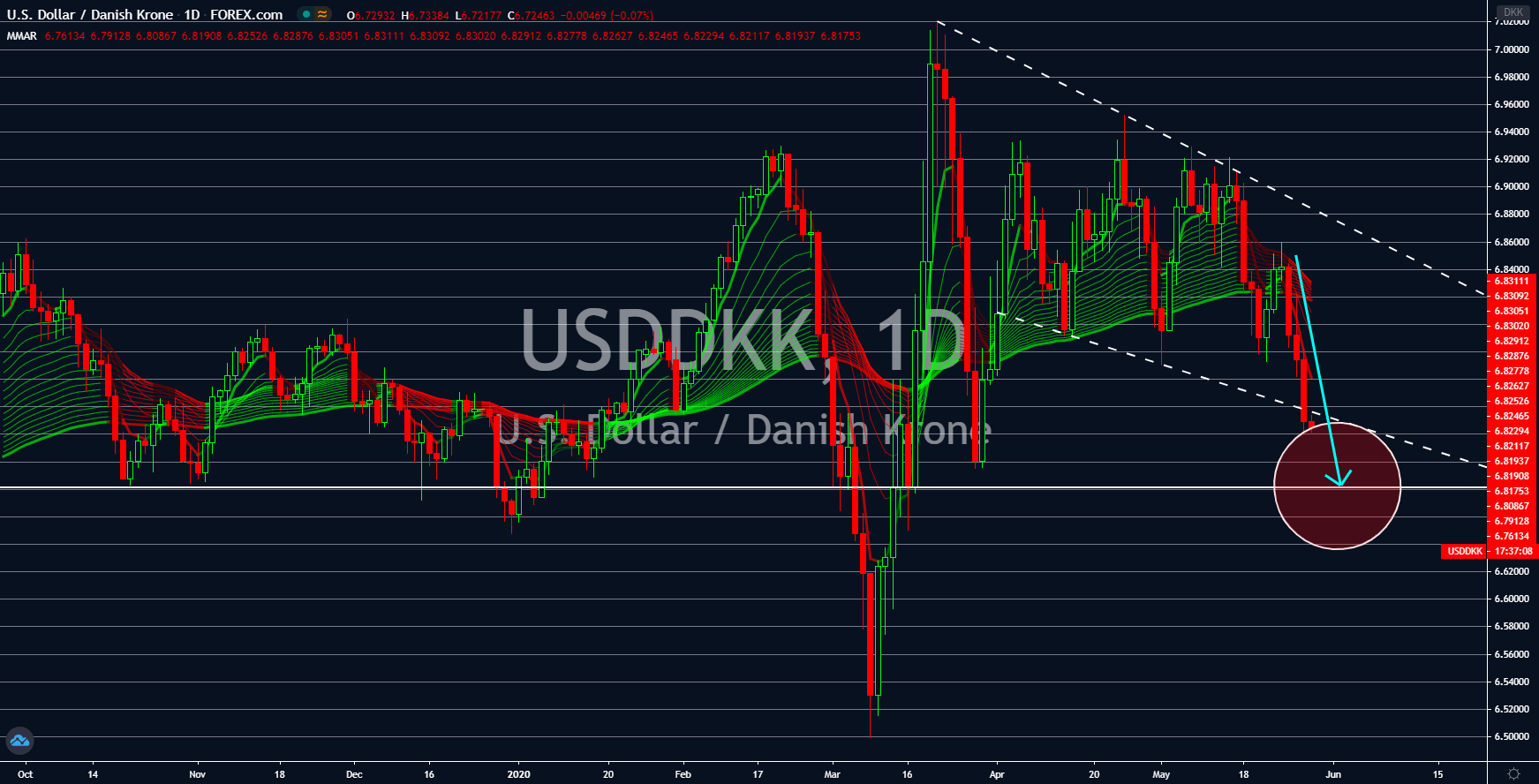

USDDKK

With no concrete plan on how to stop the spread of the deadly coronavirus, the US saw its jobless claims for the past week surging by 2.1 million. This sent the total unemployed people in the US to more than 40 million, which represents 15.7% of the entire US workforce, since the lockdown began. The increasing number of unemployed people in America is expected to take a toll on the country’s NFP report on June 05. The disappointing figures on the US reports are expected to trigger the US government and the Federal Reserves to introduce another round of fiscal stimulus, which will weaken the US dollar. On the other hand, as one of the countries in Europe who introduced an early lockdown, Denmark will reap the benefits with its early lifting of restrictions. Analysts are anticipating Denmark to plunge around 4% on its annual GDP. This is higher that the expected 8% to 12% decline on the entire European Union by ECB President Christine Lagarde.

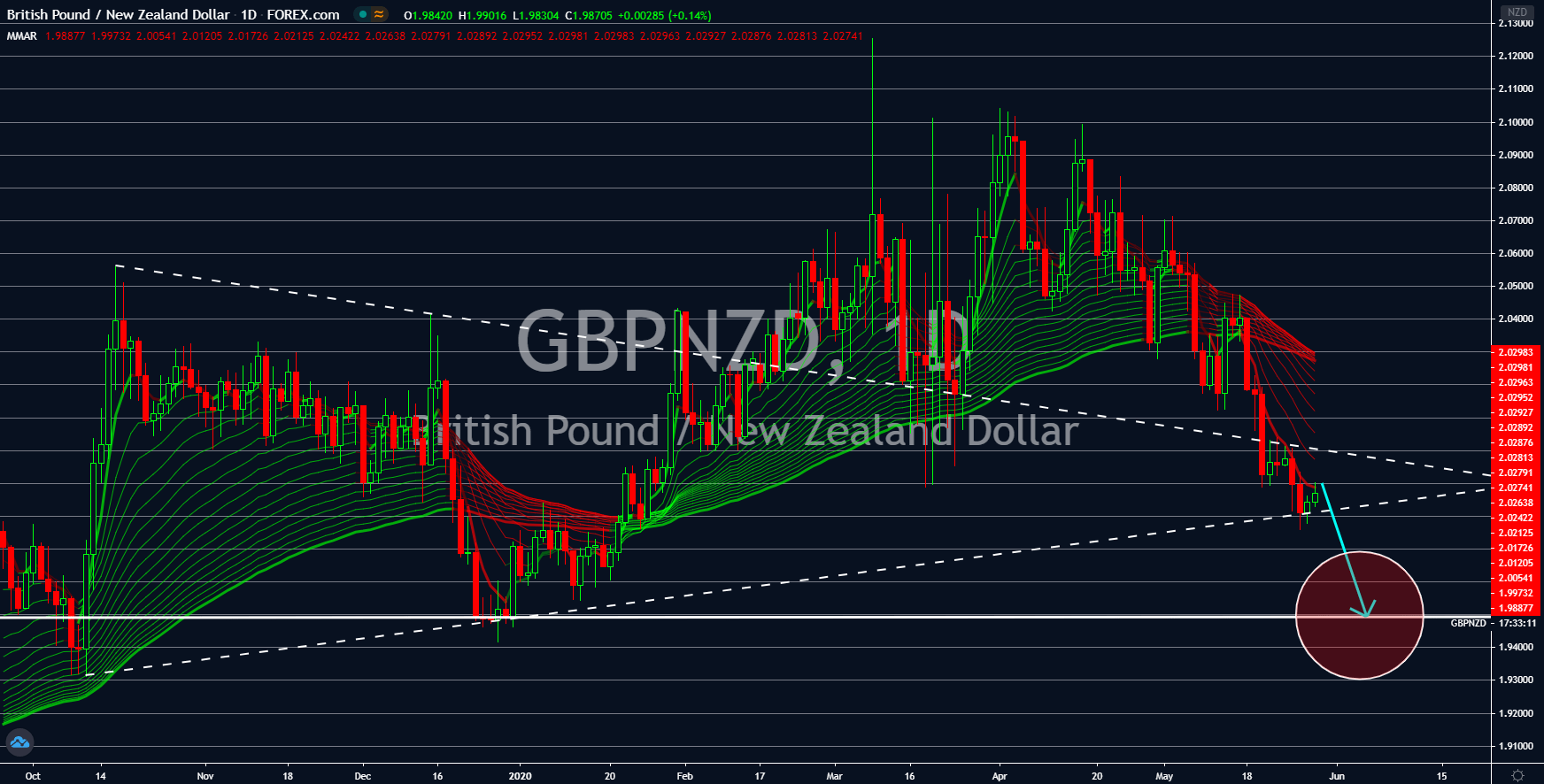

GBPNZD

With Prime Minister Jacinda Ardern lifting New Zealand’s lockdown restrictions last week, a robust recovery in the country is expected. New Zealand was among the few countries who successfully flattened the curve of their coronavirus cases. The country has 1,154 COVID-19 cases while recoveries were higher at 1,481. Meanwhile, its coronavirus related deaths only recorded 22 people. Investors are expected to flock to the NZ economy and currency as businesses start to operate again. On the other hand, the United Kingdom is facing mounting problems. Its coronavirus cases continue to soar despite most of the European countries beginning to see small reports on newly infected cases. As the country remains in a lockdown, its economy is expected to suffer in the coming months. Aside from this, the stalled talks on future relations between the UK and the European Union will further drag the fifth-largest economy in the world.

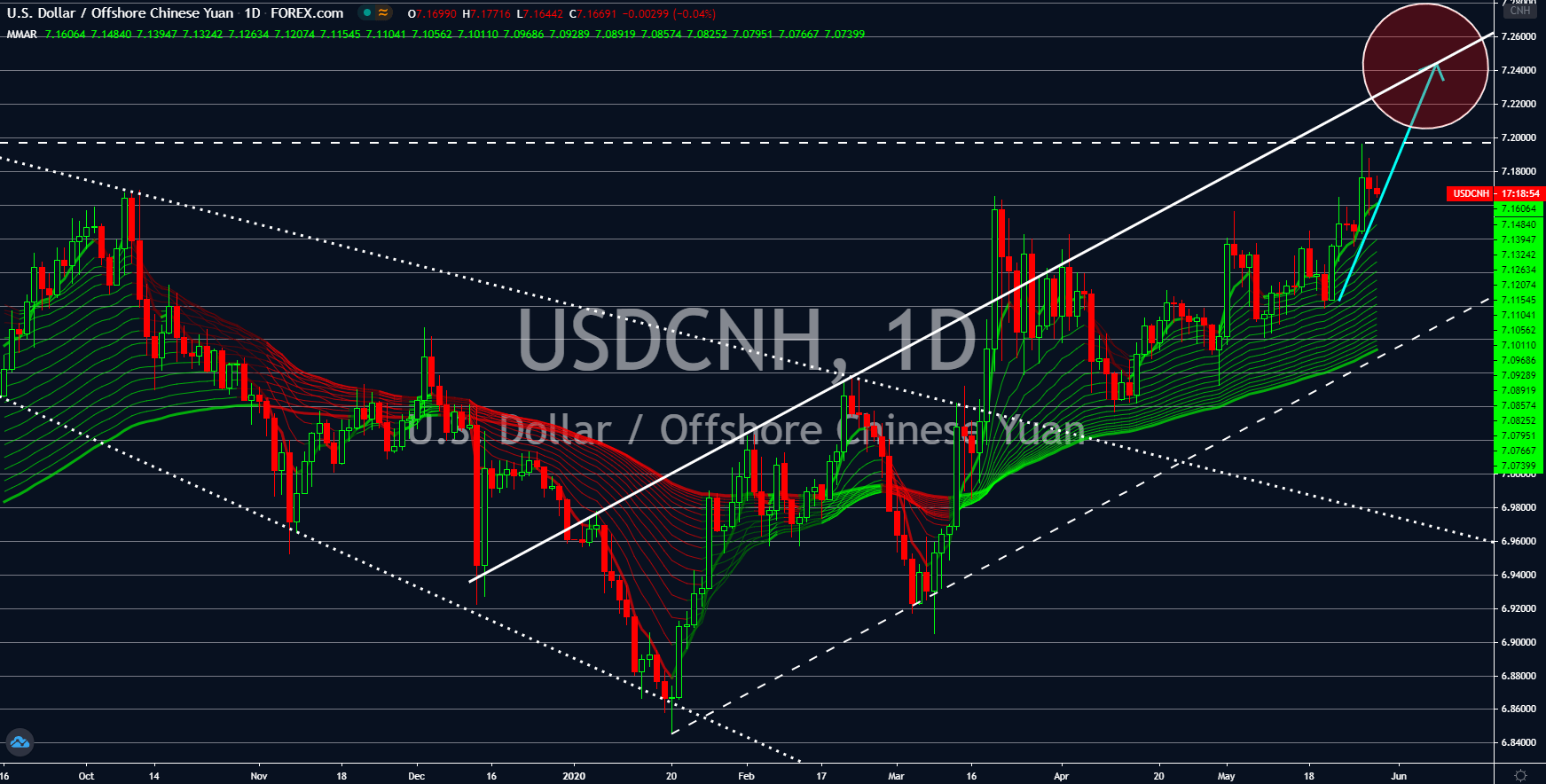

USDCNH

The Chinese yuan will see its value plummet to its lowest level in its history. The announcement by President Xi Jinping last week shows what his priorities are. The Chinese leader increased its military budget by 6.6% at the expense of other departments. This was despite the fact that China just incurred a negative growth of 6.8% in the first quarter of 2020, its first time in almost 25 years. In addition to this, a renewed tension between the United States and China is brewing due to the coronavirus. The US accused China of intentionally creating the virus to be used as a bioweapon. President Donald Trump warned that he is looking to impose sanctions and tariffs to China. The US has now banned several Chinese technology companies. It also introduces a law that might delist Chinese companies in the US stock market. China hits back by passing a bill which will end the status of Hong Kong as a special administrative region (SAR).

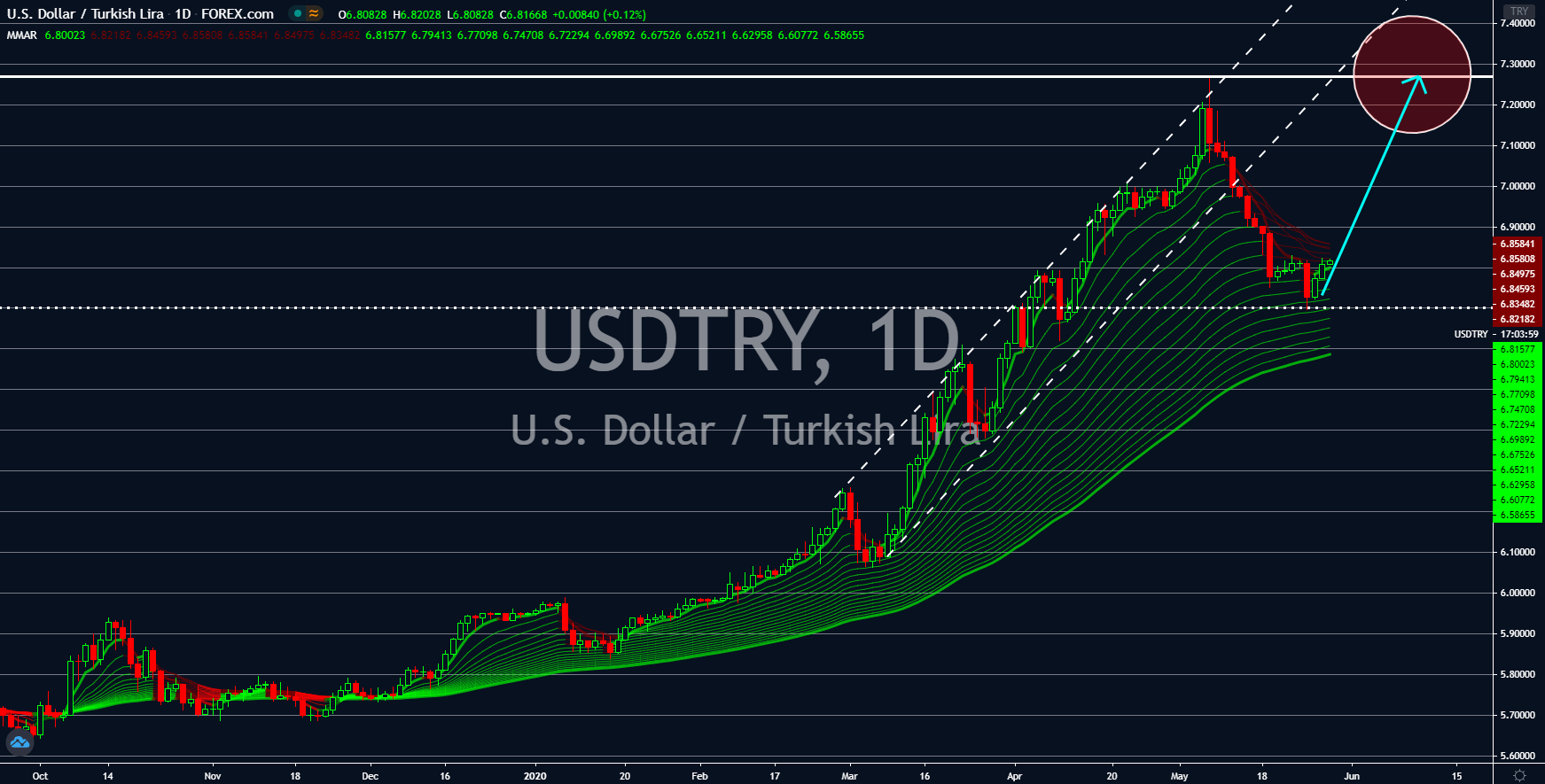

USDTRY

The bullish momentum of the Turkish lira is about to end. In the previous weeks, the Turkish currency saw its value increase against the US dollar after it allowed some US investment banks to trade the lira with other currencies. Turkish President Recep Tayyip Erdogan previously accuses the US and its banks operating in the country of intentionally dragging the value of the lira. However, this optimism quickly faded as Turkey now faces a bigger problem. The country has $169 billion foreign debt obligations in the next 12 months but the country’s foreign reserves including gold only amounts to $84 billion. Economists are calling for President Erdogan to seek loan from the International Monetary Fund (IMF), an institution made by the US and other countries. If the country will not able to resolve this problem, analysts are expecting for the country to record a negative growth on its GDP.