Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

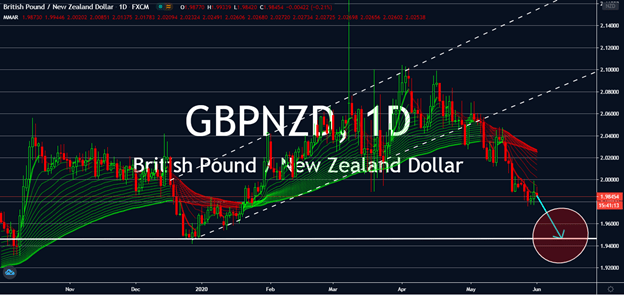

GBPNZD

Risk-on markets boosted the risk-sensitive New Zealand dollar last week following the American biotechnology company Novavax’s announcement that it began human trials for its coronavirus vaccine candidate. Stimulus brought by NZ’s economic reopening will drive the kiwi higher against its rivals. Meanwhile, markets expect the British pound to see losses amid geopolitical issues such as the China-US tension, the rising speculation on Brexit, and monthly figures. All these would be the contributing factors to GBP’s movements, especially Brexit. That said, the pair’s main driver will be the tensions riding between China and the US. If the conflict continues, the kiwi is set to rise, sterling if otherwise. As long as the market doesn’t see an improvement between the top two powers, the Kiwi is set to rise through the near-term, which could change if Britain and the Eurozone reach common ground in trade agreements.

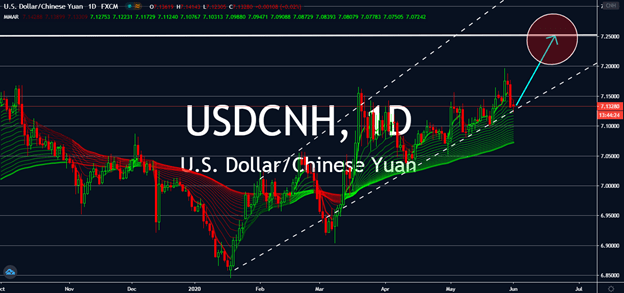

USDCNH

Investors are looking for a higher ISM Manufacturing PMI for the United States this month, but it doesn’t look like it would affect the greenback’s path as much as its tension with China would. From a technical point of view, Wall Street points to the US dollar winning over the Chinese yen over the next three months because of this. Although, it’s important to note that USD’s break out over 7.2000 over the past week might risk a downstream for the currency against CNH near-term. Nevertheless, markets are still looking forward to the dollar in a positive light over its safe haven status against most currencies. Upcoming changes will be triggered by US President Trump’s go-signal for respective sanctions against China, the House of Representative’s recent bill to punish Chinese diplomats involved in the Xinjiang case, and the Trump administration’s threat against the Court of International Trade’s decision to reinstate tariff exceptions from China.

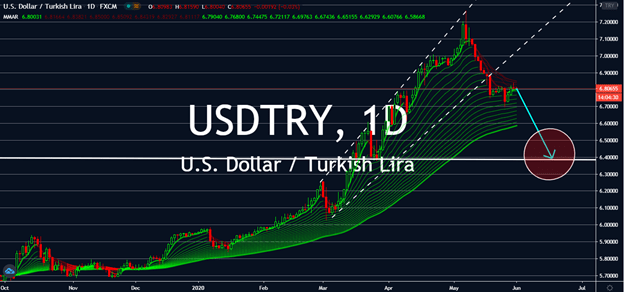

USDTRY

Markets remain bullish for the US dollar when compared to the Turkish lira for the upcoming sessions. Turkey’s GDP announcement last month continues to affect its currency with nothing but technical analyses by its side. Its worst tourist season in decades is expected to see its currency fall with it. USDTRY hit a 2-week high last week after the weak forecast, which is most probably in preparation for an upcoming sell-off for the currency. Turkey’s GDP came in at 4.5% in a yearly comparison, less than the 5.4% forecast, and the 6.0% growth recorded during the same quarter in 2019. The Turkish government now has an external debt of $170 billion, which it would need at least until the end of this year alone. Furthermore, because investors pushed the Turkish Lira down by 15% against the American dollar since the beginning of the year, the outlook doesn’t look optimistic against safe-haven currencies around the globe.

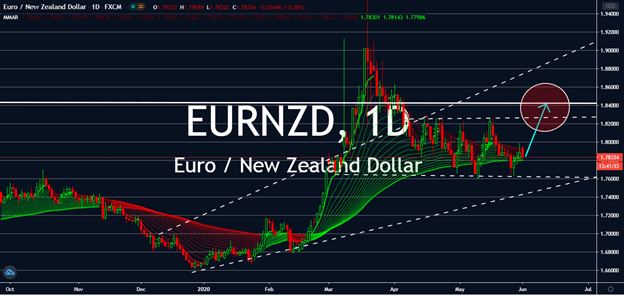

EURNZD

The EURNZD pair currently trades relatively sideways since it met its previous resistance level in April, but it looks like it’s about to break out in coming sessions. Similar to the movements in GBPNZD, the Euro is set to move alongside its progress for trade agreements with the British. The Kiwi, on the other hand, is reliant on how New Zealand’s Finance Minister Robinson could continue to defend its government’s response to the COVID-19 pandemic. Investors are raining support on the NZD for effectively flattening its infection figures with the country on track to be declared virus-free by the end of June. Still, watch out for Australia’s influence on the NZ economy – Aussie media claims that future costs following the implemented measures could drive the kiwi dollar “off a cliff.” Mixed Chinese PMI data might have pushed the NZD higher near-term, but future momentum might claim the opposite in the long run.