Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

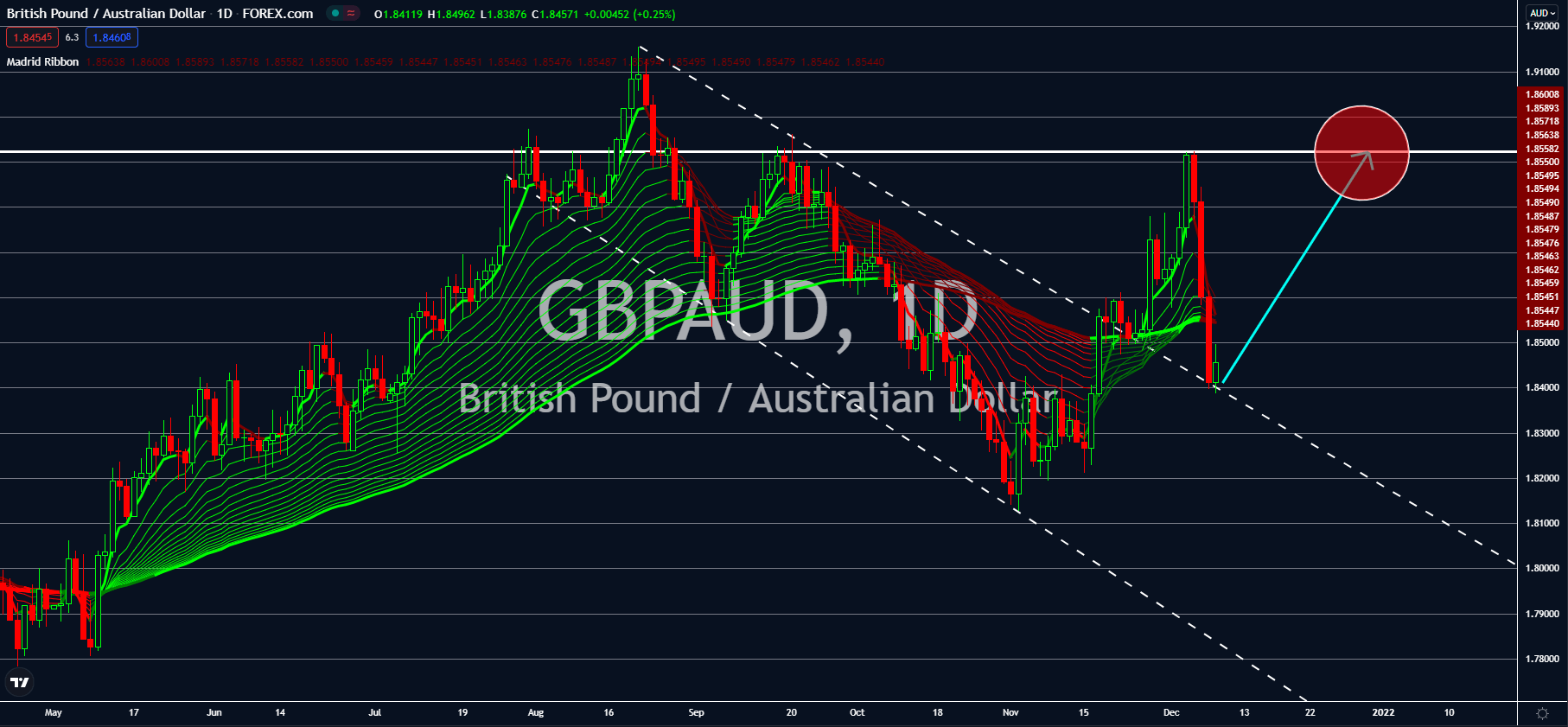

USDSGD

The US trade deficit narrowed to 67.10 billion in October, down from a record high of 81.40 billion previously. The increased exports in the month were the main contributors of a better trade balance data. The figure came at 223.60 billion, up by 8.12% from last month’s 206.80 billion. The recent result is an all-time high record. On the other hand, the imports grew at a slower pace. The 290.70 billion data is a 0.87% improvement from September. Imports also reached its highest level since reporting began in 2018. Meanwhile, a three-decade high inflation pushed the labor cost higher by 9.6% in the third quarter. Analysts anticipate the impressive data to overshadow the disappointing non-farm payrolls result of 210,000 additions released on December 03. Another factor that could impact trade activities is crude oil. On December 08, the Energy Information Administration (EIA) posted 240,000 barrels in deficit. Likewise, the API posted a shortage of oil by 3.09 million barrels.

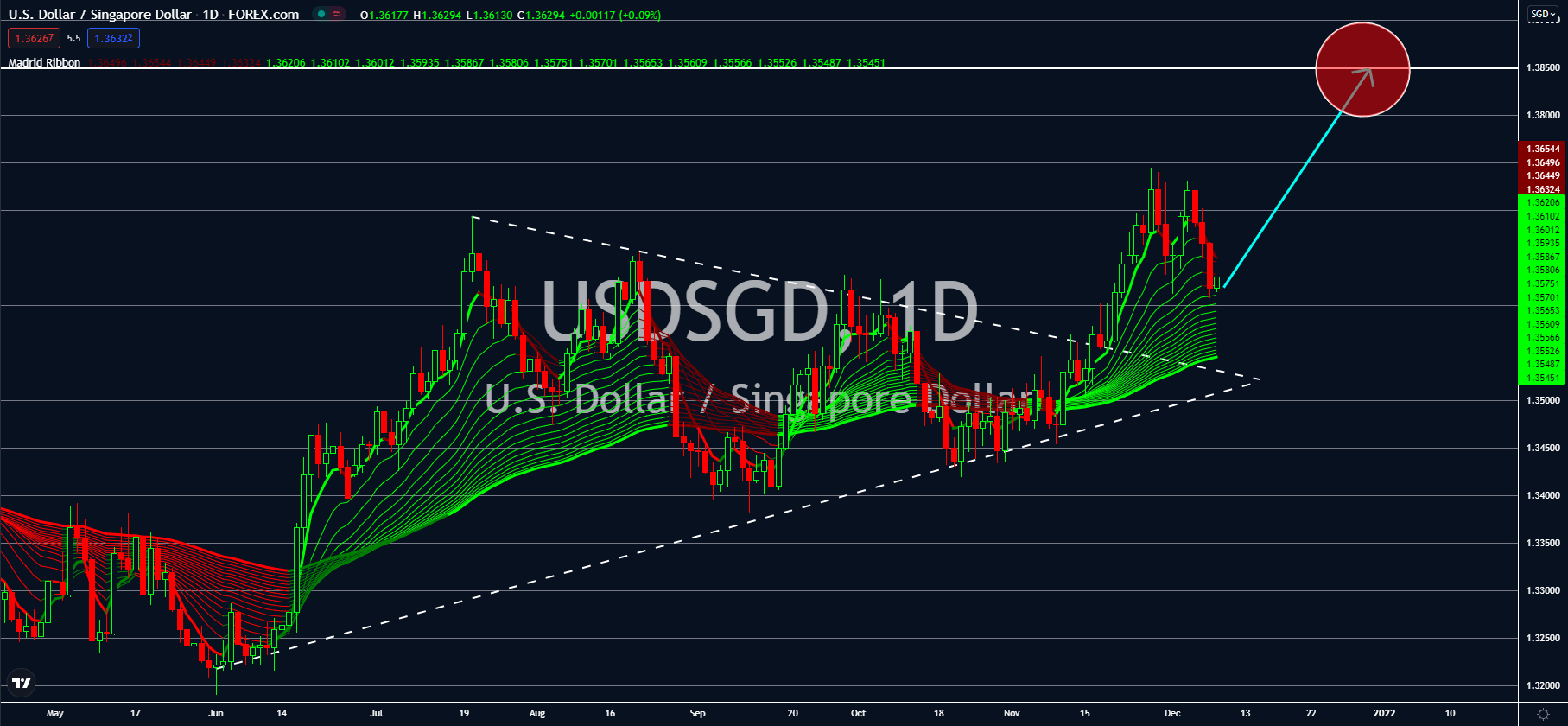

EURDKK

The Eurozone’s preliminary third-quarter GDP beat the market’s consensus estimate. The month-on-month figure settled at 2.2%, in line with expectations. It is also better compared to the previous 2.1% initial record. On an annualized basis, the 3.9% data is higher than a second reading of 3.7%. But the Q3 data deceleration from the second quarter at 14.3%. The QoQ improvement could be attributed to the jump in the labor force. In the quarter ending September, the employment change hiked 0.9%. Meanwhile, the YoY report is up by 2.1%. In numbers, there were a total of 160,973 individuals who landed a job. On the other hand, a forward-looking report showed analysts’ overall optimism in the currency bloc. The ZEW Economic Sentiment jumped to 26.8 points, suggesting a brighter economic outlook in the next six months. However, the Eurozone’s largest economy is saying otherwise. Germany’s result for the same report came at 29.9 points, down from 31.7 points.

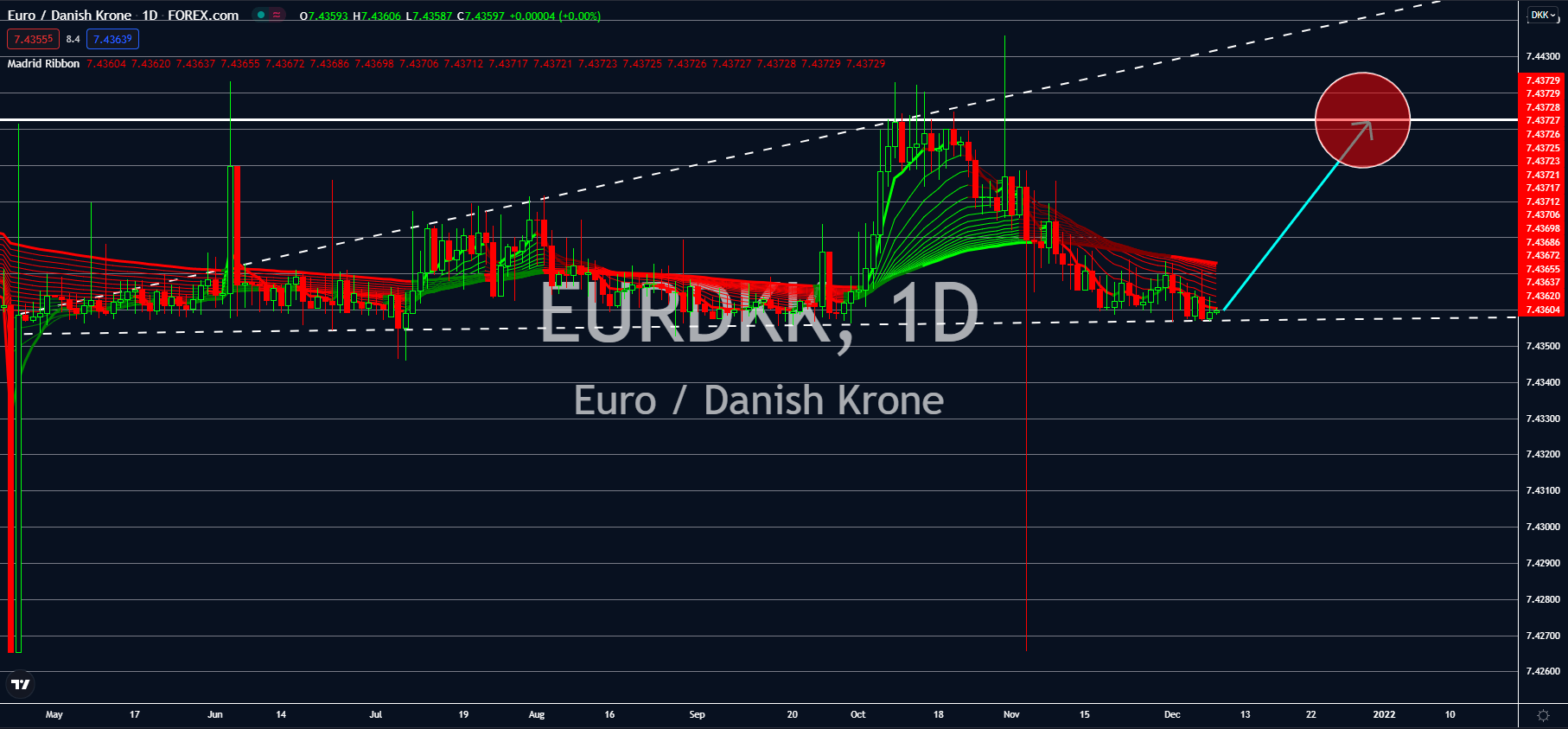

EURTRY

The Turkish lira would extend losses against the euro due to rate cuts amidst soaring inflation. In the last three months, Turkey’s central bank cut 300-basis points on its benchmark interest rate to 15%. President Tayyip Erdogan’s dovish stance continues to negatively impact sentiments on the lira. Despite the local currency’s fall to record lows, international trades and certain sectors benefit from a weak lira. Turkey’s account surplus inched higher to 2.4 billion in October due to its strong exports data. Meanwhile, the country’s auto industry is nearing its pre-pandemic level. Car exports are up 16% year-to-date to 26.4 billion. The government plans to end fiscal 2021 with 29.0 billion. In 2019, the annual data was 30.0 billion. Its improvement is in contrast to rival France, which saw deceleration in the business by 11% to 291 million in November. The United Kingdom’s data also fell by 16% to 224 million. In comparison, Turkey’s figure is 392.0 million, up by 12% from 2020.

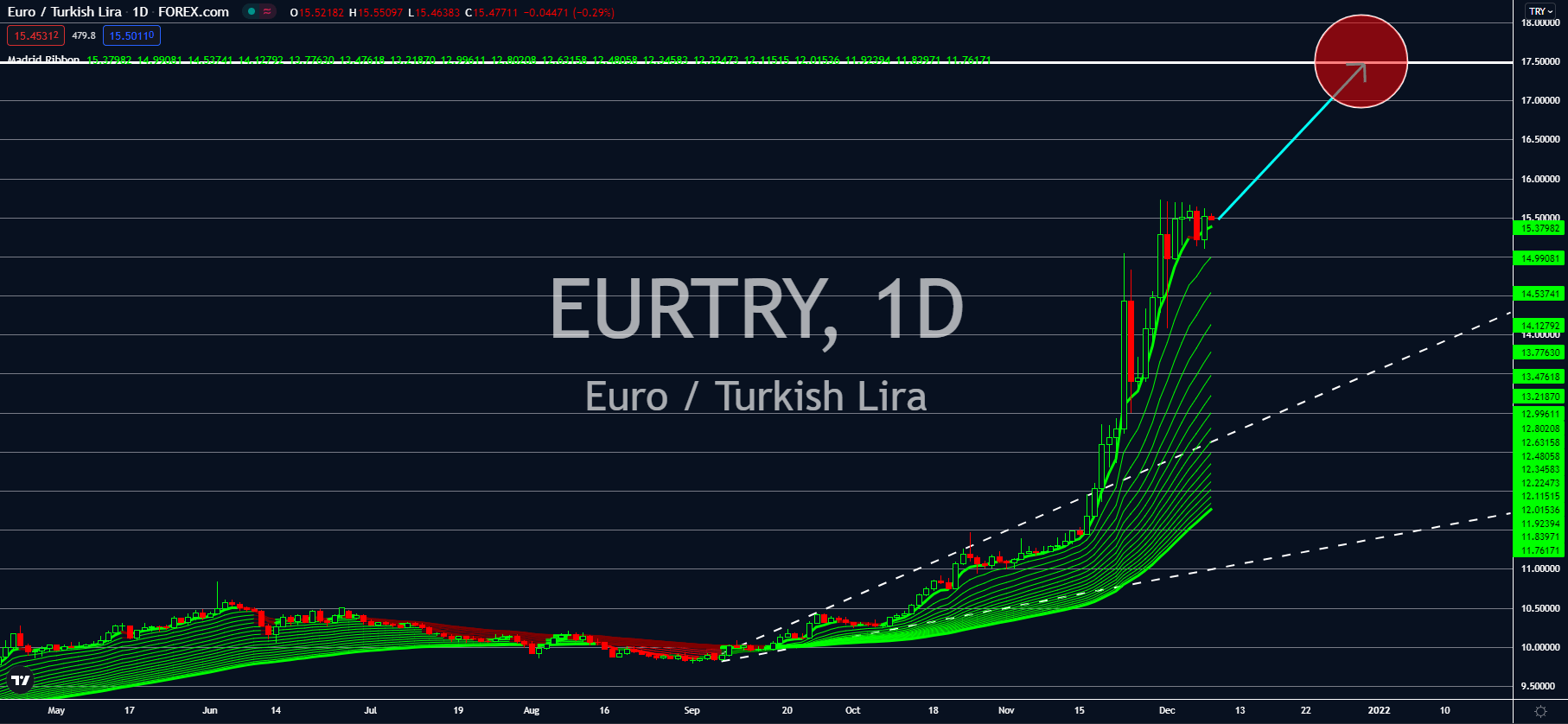

GBPAUD

The Reserve Bank of Australia reaffirmed its commitment to maintaining a record low interest rate of 0.10% until 2024. On the contrary, analysts anticipate the Bank of England to either raise rates by December 2021 or February 2022. For Australia, the latest economic indicators supported the decision to maintain an accommodative policy. Building approvals tumbled 12.9%, extending the prior record for October of -4.3%. Meanwhile, the House Price Index slowed down to 5.0%. Still, it is in line with analysts’ expectations. As for the services sector, the AIG Services Index improved to 49.6 points. However, it is still below the expansionary level of 50.0 points. On the other hand, the United Kingdom’s reports maintained a steady growth. November’s Halifax House Price Index came at 8.2% YoY, while the monthly figure is up 1.0%. The report beat estimates and posted the same data from last month. Meanwhile, Construction PMI advanced to 55.5 points fom54.6 points.