USDBRL

As the situation around the whole trade war gets better for the United States, the situation worsen for USDBRL bears in sessions. The pair is highly expected to climb its resistance by the end of February, possibly by late-January. However, the economic data surrounding the pair is preventing it from a strong rally, making its uphill climb a gradual journey. The significant improvements in Brazil’s economy is helping bears limit the gains of the USDBRL in sessions. Just recently, the Instituto Brasileiro de Geografia e Estatistica (IBGE) released the annual and monthly consumer price index growth of the country for December showing great figures and overperforming its projections. However, earlier today, the IBGE released the country’s service sector growth which contracted in the month of November but still didn’t reach expectations. Meanwhile, the US Bureau of Labor Statistics is scheduled to release the country’s consumer price index (CPI).

USDPLN

The strong economy of Poland is making it difficult for USDPLN bulls to break past its resistance in trading sessions. The pair widely believed to descend to its lowest level since mid-July, or possibly even before February starts. Bears are holding on to the downward momentum of the pair and are backed up by impressive results from the Polish economy that were recently released. The most recent one is the current account report issued by the National Bank of Poland for November which sharply jumped, giving the Polish zloty a boost in sessions. The country’s current account surged from €529 million to a whopping €1,457 million, catching the market by surprise as they were initially expecting it to drop to about €500 million. Then, just recently, the Polish central bank also announced that it will leave its official interest rates for January unmoved, supporting the zloty immediately after the announcement.

NZDJPY

The improving sentiment around the whole trade war between the two biggest economies in the globe is making it difficult for the Japanese yen to gain against the New Zealand dollar. The pair is believed to hit its resistance before the month ends thanks to the official signing ceremony for the first phase of the trade deal tomorrow. In that case, the New Zealand dollar will be hitting its strongest levels against the Japanese yen last seen in April 2019. The promising results from Japan’s economy is doing very little to prevent the pair from its uphill endeavor. Earlier today, the Japanese Cabinet Office released the country’s economy watchers current index for December which unexpectedly rose from 39.4% to 39.8% in spite of expectations of contraction to 36.9% prior. Aside from that, the country’s current account n.s.a. for November which fortunately didn’t drop as low as projected by the market prior.

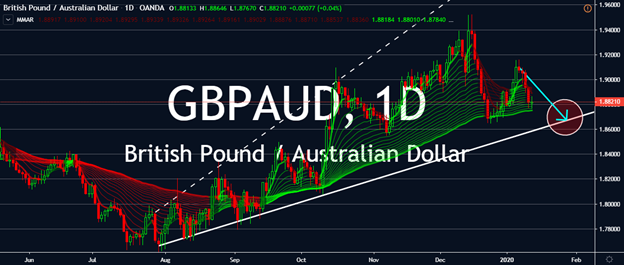

GBPAUD

Despite the tragedy faced by the country of Australia, the Australian dollar continues to overpower the British pound in trading sessions. Following two consecutive sharp drops from the pair, bulls are working hard to keep it steady this Tuesday. Unfortunately, Brexit concerns and BoE news are making it difficult for the British pound to fully regain its footing against the Australian dollar. Investors are getting more and more worried whether the Bank of England will cut its official interest rates later by the end of the month. Just recently, two more policy makers from the central bank said that they are willing to ease the Kingdom’s monetary policy if Britain’s economy fails to recover. Unfortunately, instead of a road to recovery, the UK economy appears to be taking the opposite route. The recent reports from the United Kingdom shows more negative figures rather than improvement, weighing heavily on the British pound.