Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

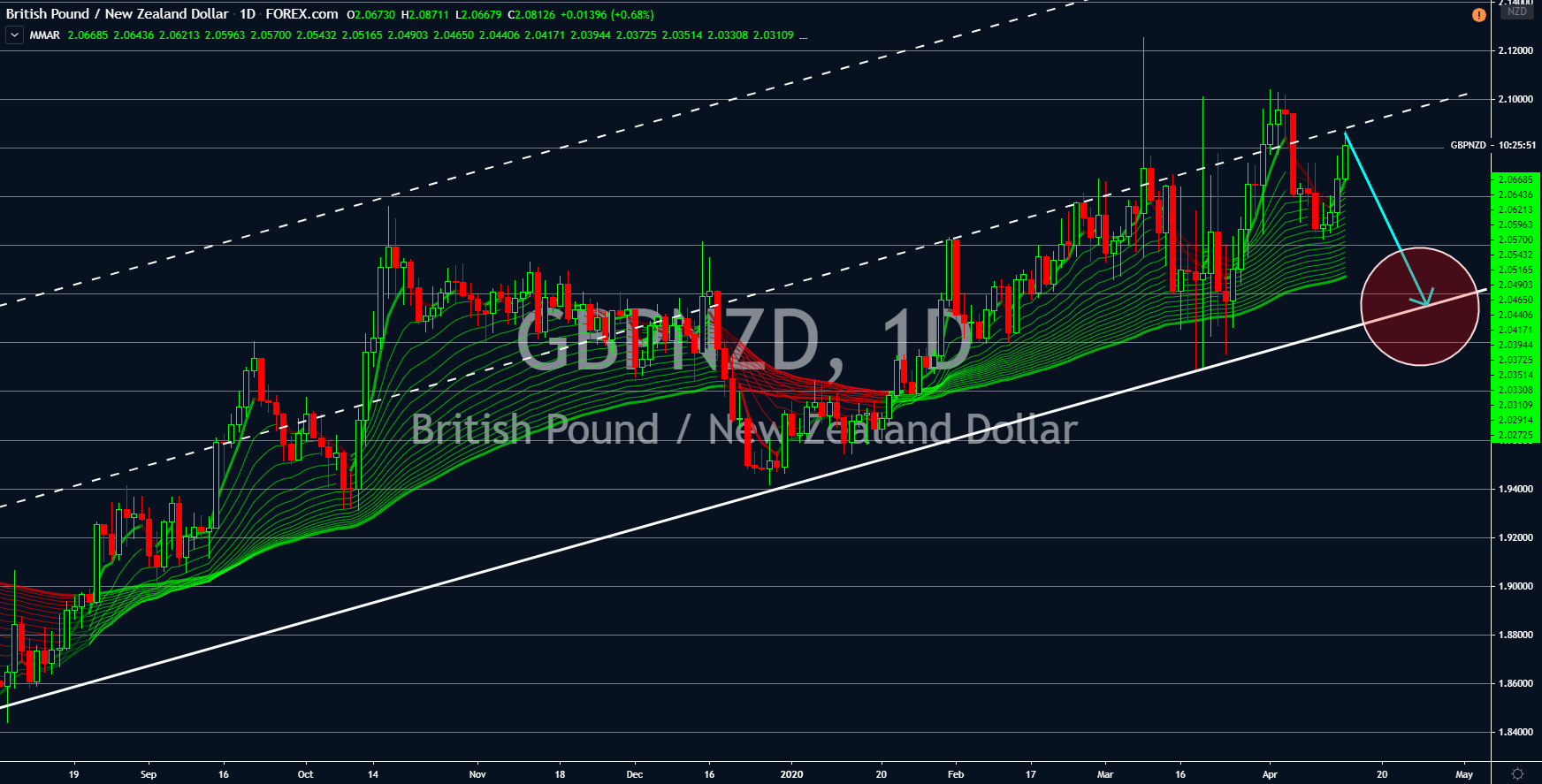

USDCZK

Buying pressure is expected for the Czech koruna as the country became the first in Europe to lift its lockdown. This was amid the country’s successful efforts to contain the coronavirus. Denmark and Austria will follow the country next week. Meanwhile, Hyundai will be the first big company to open its operation in the country. Analysts see this reopening as an advantage for Czech Republic following the slowdown in German manufacturing.

The US, on the other hand, just recently broke the 18,000 mark for coronavirus death. The US government and its central bank have been pumping liquidity to the market since the last week of March. However, analysts worry that these efforts will prove insufficient after the record-breaking jobless claims in the country. In the first week of April, the US had the largest jobless claims in history at 6.8 million followed by 6.6 million last week. Analysts anticipate a weaker reading for tomorrow’s report.

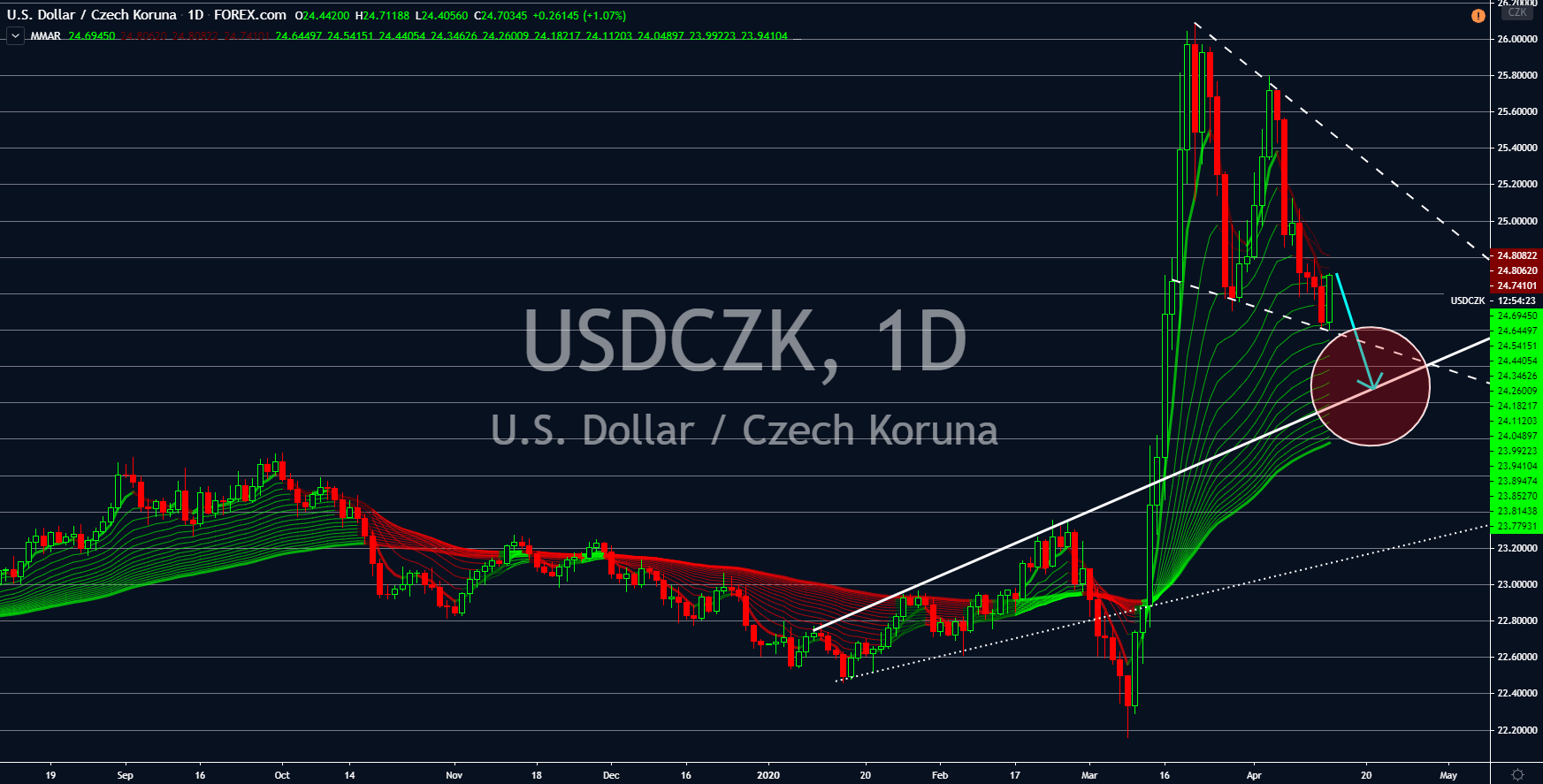

NZDUSD

New Zealand dollar will continue to trade lower against the US dollar following reports from the IMF (International Monetary Fund). The global institution said New Zealand’s economy might contract by 7.2%. In addition to this, the country’s Treasury Department said it is expecting the unemployment rate in the country to drop up to 26%. The country, along with Australia, is also planning to extend the lockdown to prevent the second wave of coronavirus cases. However, analysts worry that this decision could be a major blow to the country’s economy.

The US, on the other hand, said it is expecting to reopen its economy by May. The decision by US President Donald Trump roots from the economic impact of the coronavirus to the largest economy in the world. He also signed a $2 trillion stimulus package to support the economy. On top of the, the Federal Reserve also allotted $2.3 trillion to aid the economy.

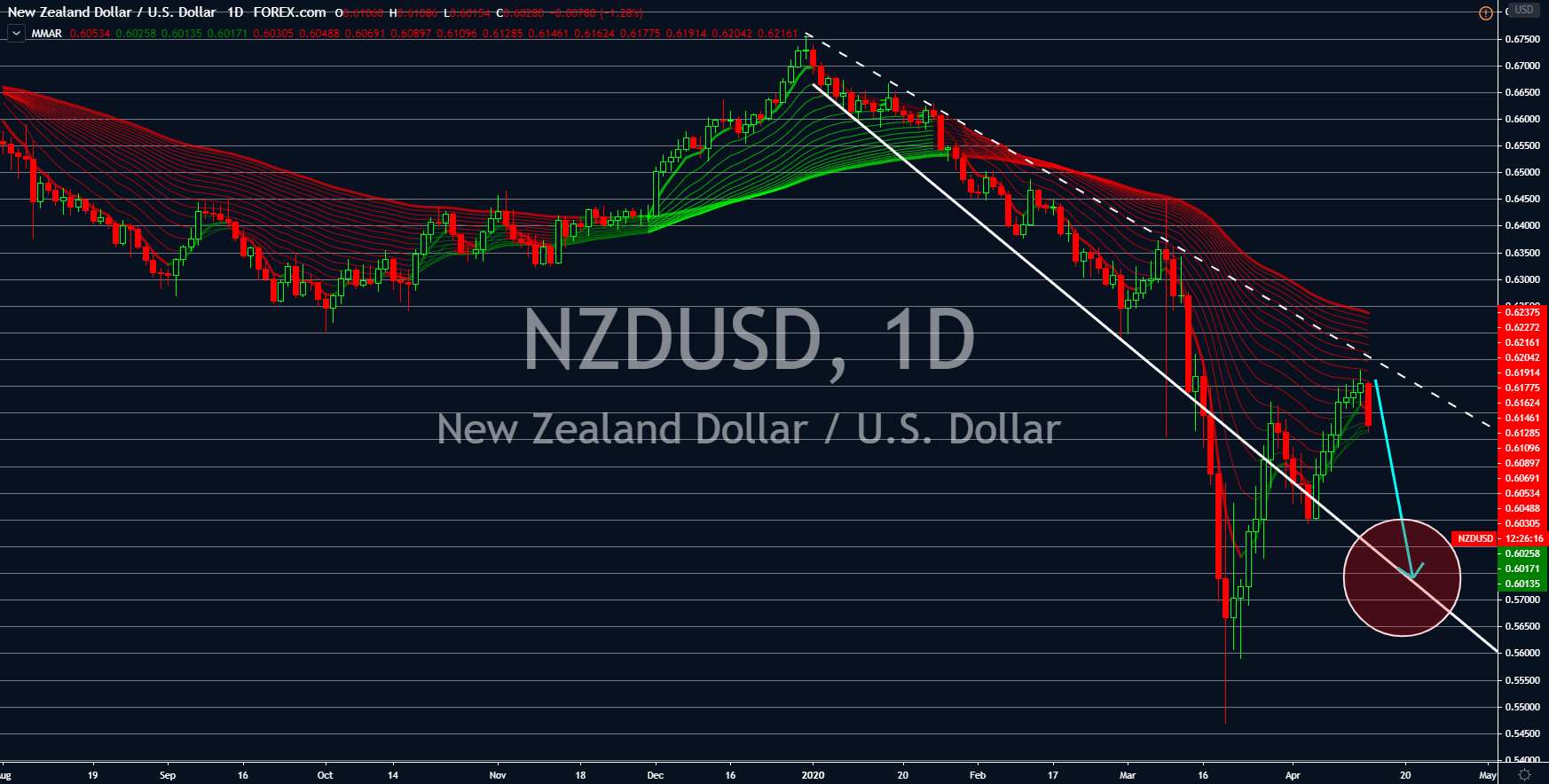

AUDJPY

Analysts set the Japanese yen for a steep decline together with the overall Japanese economy. An analyst warned that the coronavirus pandemic could be the final blow to the local economy. The analyst discussed that the slowdown in the Japanese economy began in 2018. Pressure further increased after it took a blow from the US-China trade war in 2019. And the coronavirus could potentially break the third-largest economy in the world this 2020.

The country’s prime minister, Shinzo Abe, is also under pressure from his political party after members proposed an additional budget for cash handouts. Earlier, Abe set aside $1 trillion, which is equivalent to 20% of the country’s annual GDP, to help households and small businesses. However, members of the party are proposing to increase this amount which could dry up government funds. On the other hand, Australia kept on defying expectations after it posted strong employment for the month of March.

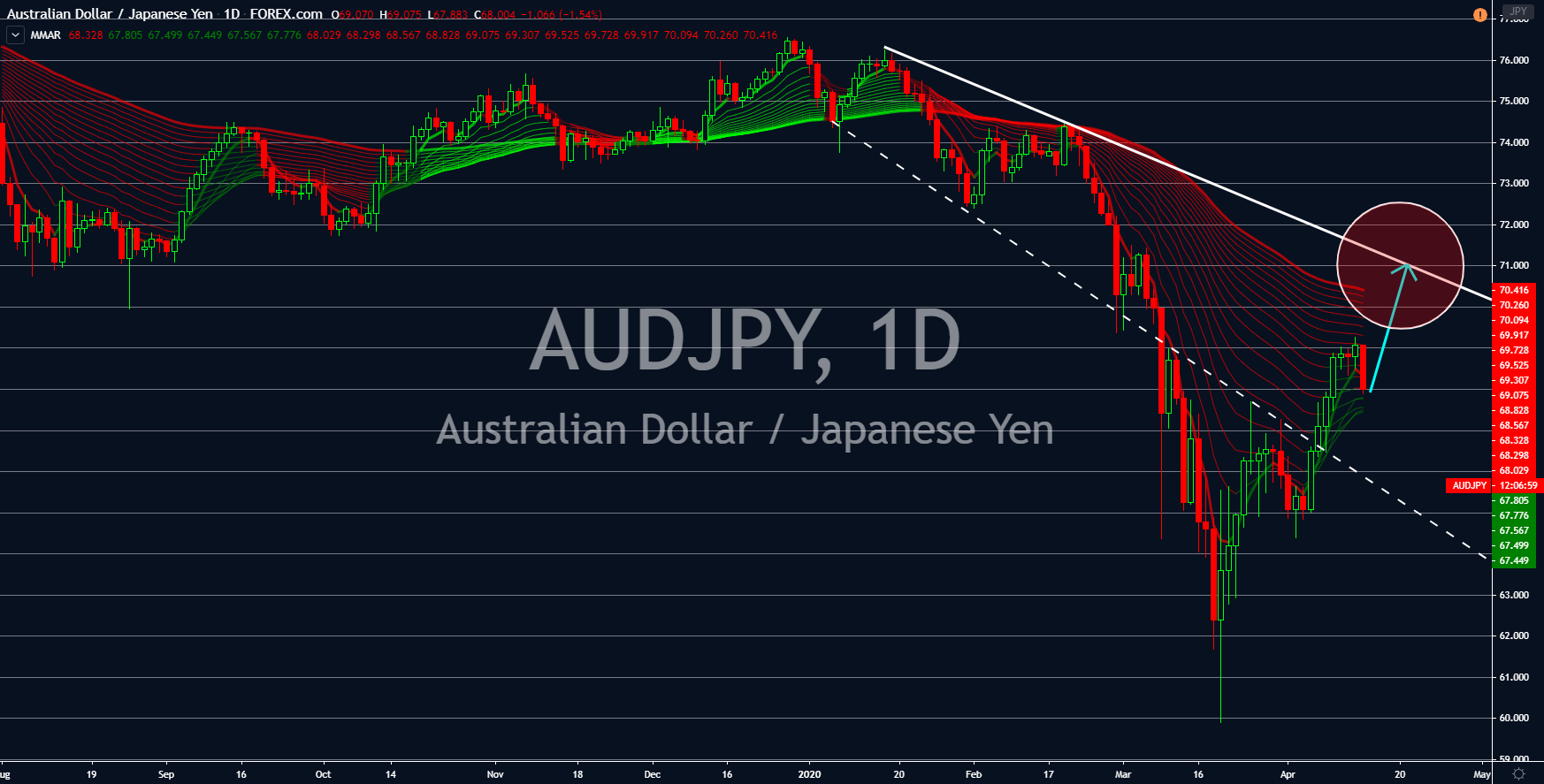

GBPNZD

Major investment banks and global institutions have already warned about the depth of coronavirus impact in the global economy. However, for the United Kingdom this could be worse. The country decided to finally leave the European Union last January 31. Just a month after this, coronavirus has spread worldwide, putting Europe at the center of the pandemic. This resulted in countries posting lower figures for their economic reports. However, a report shows Britain’s economy already slowing down prior to the deadly virus. This means that its divorce with the European Union didn’t end well for its economy. A dire warning was also issued for the UK economy.

The government’s independent economic forecast said the UK economy could shrink by as much as 35%, the biggest in 300 years, and unemployment above 2 million. This is expected to hurt the British pound against a basket of major currencies in the coming sessions.