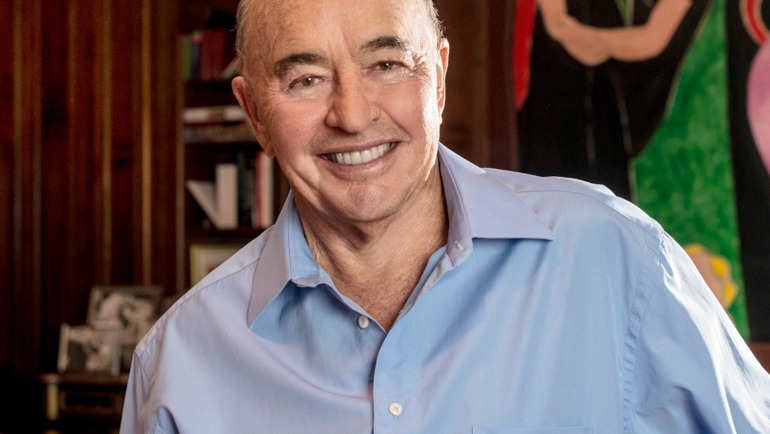

Tottenham owner Joe Lewis, billionaire, British businessman, and investor, exiled in the Bahamas, little known to the world of finance, he made his fortune speculating in the foreign exchange market. According to the reports of the New York Times, Joe Lewis’s net worth of £4.33 billion is estimated as an increase of £338 million from 2020.

Joe Lewis early life

He was born to a Jewish family above a public house in Roman Road, Bow, London. Joe left school at 15 to help run his father’s West End catering business, selling luxury goods to American tourists and also running the West End club the Hanover Grand, where he gave Robert Earl his first job. Later on, he sold the business in 1979 to make his initial wealth.

In the late 1970s, after selling the family business, Joseph Joe Lewis moved into currency trading in the 1980s and 1990s, which led to his move to the Bahamas, where he is now a tax exile.

From September 1992 Lewis teamed up with George Soros to bet on the pound crashing out of the European Exchange Rate Mechanism.

The event, which became known as Black Wednesday, made Lewis very wealthy. It is claimed that Lewis made more than Soros. Lewis is still active in foreign exchange trading.

The foray into Bear Stearns capital

In 2007, British billionaire Joseph Joe Lewis took the markets by storm. He bought nearly 7% of the capital of the American investment bank Bear Stearns a ticket of 860 million dollars in a bank that lost 25% of its value on the stock market during the crisis … and which has acquired more than 17% since the entry of Joe Lewis to its capital.

Consequently, the question arises: strategic or financial investment? Reality is a mixture of the two. Joe Lewis is a close friend of James Cayne, the boss of Bear Stearns. “Its entry into the capital could not be done without the agreement of James Cayne,” assures an official of the bank.

While the market buzzes with rumors about the interest of Chinese investors, Joe Lewis is a pledge of security for James Cayne, who himself owns 4.9% of the bank. Anyway, the undervaluation of Bear Stearns is also a great financial opportunity.

This foray into Bear Stearns capital comes as no real surprise when you take a look at Joe’s past.

How to keep going

“If he is unknown to the financial world, he is a real star on the foreign exchange market on which he has operated for more than twenty-five years,” recognizes a French banker specializing in the sector. Some even say that he passes by Bear Stearns to carry out its trading operations. At 69, he headed his investment group Tavistock, which has multiple financial involvements in the food industry, catering, and real estate.

Self-taught, Joe Lewis left school at the age of 15. In the 1960s, he took over the family restaurant chain that he resold to invest in luxury stores.

He then came up with the idea of opening offices of change for tourists. This is where Joe Lewis takes a liking to speculation. In 1979, he left his native Great Britain to settle in Lyford Cay, a remote island off the Bahamas.

Already rich, he will become even wealthier by concentrating on currency trading. In the basement of his large villa, he is built an automated trading room to monitor his transactions. “He works and receives a lot from his yacht,” said his guests who have already visited him in his floating office. Joe Lewis’s yacht became his own floating trading office according to many visitors.

Bold speculations

Discreet, he is rarely talked about. In 1992, in the midst of the monetary crisis, the pound sterling exited the European Monetary System (EMS) at that time. The businessman speculated on the downside of the currency.

Years later, he did it again by participating in the same way in the devaluation of the Mexican peso. He is one of those few traders who made their fortune on the foreign exchange market, such as George Soros or Marc Rich.

Foreign Exchange Specialist Joe Lewis created a small brokerage platform, HotSpot FX, which his Tavistock group sold for$ 77 million.

Joe Lewis Tottenham

But, after making his fortune with currency, Joe Lewis found other hobbies. In the 1990s, he took part in football clubs like AEK Athens or Glasgow Rangers, and it remains the today majority shareholder of London club Tottenham Hotspur.

The press had even spoken of him as a future buyer of the Girondins de Bordeaux in 1998, a few months before the World Cup in France. Instead, he at the same time resells a third of the capital of the auction house Christie’s to François Pinault for 200 million pounds.

On the other hand, if he has no interest in football, Joe Lewis is passionate about golf. He is also known to have spent $ 2 million to play with world champion Tiger Woods. He Also regularly hit a few balls with James Cayne, the boss of Bear Stearns. Another good way to do business.

Joe Lewis Property

Besides the above-mentioned capital investments, many art collections, Joe Lewis yachts, and villas, the team Tottenham owner Joe Lewis also owns the three golf clubs in Albany that competed in 2013 at Lake Nona Golf $ Country Club.

In the Bahamas, he has built the golf community. Tiger Woods is one of the shareholders in this community. Joe Lewis also made an investment in Bulgarian property worth £70 million.

Furthermore, Joe Lewis cultivated the Lake Nona area. He cultivated it into a large-scale community. Now it offers research and education for children and veterans as well as large residential options.

According to Bloomberg, his wealth is equal to 87.6M barrels of crude oil, 0.0296% of the GDP of the United States, 0.0744% of the total wealth of the 500 richest people in the world. And also equal to 98% of the top 200 U.S. executives’ total awarded compensation.