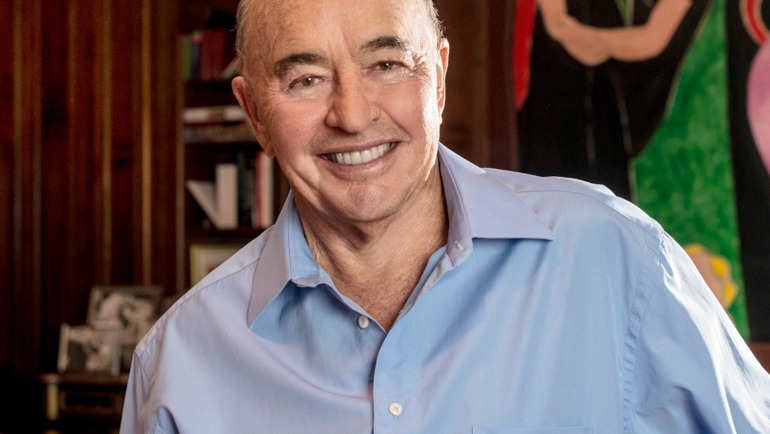

He is known as a prominent supporter of democratic ideas, subject of conspiracy theories, philanthropist, and unparalleled Forex trader. People from Forex circles have kept admiring this man for so long. His Open Society Foundation exists in more than 100 countries today. So, you have a hunch now. We recall the history of George Soros, forex trader and one of the most successful philanthropists of all times.

Who is the forex trader George Soros?

He was born in 1930 under the name György Schwartz, in Eastern Europe, in Budapest, to a middle-upper class Jewish family. The war made him and his family change their name to hide from the Nazi occupation and Anti-Semitic prosecutions at the time. However, in these disastrous conditions, Soros managed to help his relatives survive the whole second world war. At the age of 17, George managed to immigrate to England.

George Soros – Early life and education

When a Hungarian-born 17 years old immigrant arrived in England, the next step was to find his way to enter college. George Soros began studying philosophy under the famous philosopher Karl Popper. And he decided to join LSE, the London School of Economics. To support his studies, he also worked as a part-time railway porter and as a waiter.

Also, since he stayed with his uncle, he managed to enter one of the most prestigious universities at that time.

He became increasingly interested in economics as he started to work in Singer & Friedlander bank. After years of studying, practising, and finally graduating as a Master of Science at LSE, George Soros went to the United States, New York, where his real adventures began.

He never left the philosophical paths drilled into him by his ex-professor. It made him think in philanthropist and human-centric ways.

His first hedge funds as a part of Soros forex trading strategies

After working as an analyst and arbitrage trader speculation on the European stock market at many Wall Street banks and institutions, at the age of 37, he founded his first offshore fund. It was named First Eagle Fund.

At that time, he was about to experiment with many trading strategies. Finally, he founded the Second Eagle hedge fund, which in 1973 had about 12 million investors money, assisted by his colleague Jim Rogers. He decided to leave and create a new fund called Soros Fund. It was afterwards renamed the Quantum Fund, which had grown to $380 million in nine years.

As an influence from escaping the horrors of the war, he became involved in philanthropy. A good portion of his wealth was distributed to those in need and helped other people. It was at the age of 54 when he established the Open Society Foundation.

This Soros funds management has a network of foundations in more than 100 countries now. It is related to the development of education, public health, business, human rights, and freedom of speech development and implementation around the globe. In 2017, George Soros turned $18 billion to Open Society Foundations, according to officials.

George Soros forex trading system – The days of glory

He is also known as the man who broke the bank of England. One of the most glorious deeds of George Soros Forex trader. Sounds intriguing, right?

On September 16, 1992, the American financier George Soros became “the man who blew up the Bank of England,” taking advantage of the weaknesses of the European monetary system to carry out a speculative attack.

In October 1990, the United Kingdom decided to join the “Exchange Rate Mechanism” and its membership of the European Monetary System (EMS).

The exchange rate mechanism then obliged the central bank of the participating country to defend a central exchange rate, intervening in the market if necessary. The underlying idea of the English was that joining the exchange rate mechanism would help reduce inflation and bring stability to exporting companies by controlling the exchange rate to limit its volatility.

The Pound sterling then enters the exchange rate mechanism at a relatively high rate. That compared to the historical rate of the English currency. The pound was overvalued. It made it possible to calm inflation (because it reduces the price of imports, for example, the cost of raw materials and energy). Still, this strong Pound sterling will quickly penalize exporting companies.

George Soros and his bright idea

To keep the Pound sterling in the banks of fluctuations authorized by the EMS and to avoid forced devaluation, the Bank of England, therefore, had to either thwart the attacks by using/selling its foreign exchange reserves or increase the interest rates to attract foreign capital and counter depreciation. The problem is that the first solution limits the number of available reserves. And that the second would impact the level of investments and, therefore, on growth (inverse relationship between interest rate and investment).

If Soros and his potential partners succeeded in depleting the Bank of England’s reserves by selling the Pound sterling short and ensuring that the Bank of England did not have enough to cope with this attack, then England’s only solution would be devaluation (a significant rate hike that seems unthinkable in a period of recession).

George Soros and all the funds and banks that participated in the attack could then repay the loans they had contracted in sterling. But with a pound devalued against the dollar. By selling short, that is to say, by betting on the fall of the Pound sterling, Soros’ capital gain on this operation reached around $ 1.1 billion.

Soros Forex trading strategies – Bet against the Baht and the Yen

During the Asian financial crisis in 1997, he allegedly made a massive bet against Thai baht.

He supposedly bet $1billion that the currency would implode. It eventually happened since the Banks ran out of ammunition to fend off short-sellers and support the currency. Later on, the Prime Minister of Malaysia accused George Soros of attacking their currency, making many Anti-Semitic comments against Soros hedge funds.

Another large bet was against the Japanese yen. It was in 2014, and these netted George Soros approx $1 billion. He knew the Japanese prime minister would engage in overall monetary easing to kick off the country’s stagnant economy. It had a devaluating effect on the Japanese yen.

Meanwhile, George Soros was long the Japanese Stock Market. As the Japanese yen weakened and Japanese stocks rallied 28 per cent, the Soros interment fund managed $24 billion, posting a return of 24 per cent.

The American billionaire George Soros still gives his vision on many economic subjects. Only a few weeks ago, he also declared, “Germany should leave the eurozone if it is not ready to take a more decisive lead in helping the euro zone’s some nations escape a spiral of increasing economic decline.” Soros thinks that Germany must leave the eurozone if it is not ready to take the lead in helping troubled eurozone countries escape the spiral of debt and economic decline.