The irresistible universe of cryptocurrencies and the possibilities that are more than evident on Blockchain technology have recently attracted many public figures, investors, and people in business to trade cryptocurrencies. That’s how Steven Cohen became America’s most profitable trader.

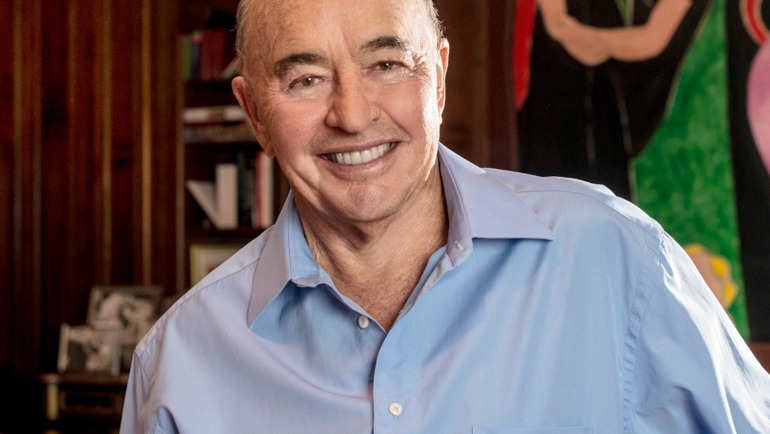

His story is fascinating because it dates back to when he was not just a trader. Steven Cohen has come a long way to be considered one of the most successful traders in the United States today. He’s also an American investor and hedge fund manager.

But before we give you all the information about Steven Cohen and how he has succeeded in his intention to achieve a successful trading career, let’s get to know his life before that, shall we?

The early life of Steven Cohen – get all the crucial information.

Steven A. Cohen was born on June 11 1956, in Great Neck, New York, where he also grew up. As a High School student, he fell in love with Poker, often participating in tournaments and betting his own money. According to him, credits in these Poker games and tournaments were the first important lesson on how to take risks properly.

Steven graduated in 1974 from John L. Miller Great Neck North High School, where he also played on the school’s soccer team. In 1978, Steven Cohen received an economics degree at the University of Pennsylvania.

While in school, he served as a Treasurer in Zeta Beta Tau Fraternity’s Theta Chapter, and he also opened a brokerage account with the help of his friend back then. The account had $1,000 of his tuition money. These were the first indicators of what Steven Cohen was destined to do in the future.

Steven Cohen’s career – how did he progress?

After graduating from Wharton at the University of Pennsylvania, Cohen got a Wall Street job as a junior Trader. At Gruntal & Co. Steven Cohen has managed to make an $8.000 profit, which was a significant amount of money at that time.

He’d eventually go on to earn approximately $100.000 a day for his company. In addition to that, Steven finally managed six traders and a $75 million portfolio. In 1984 at Gruntal & Co. Steven Cohen was successfully running his trading group. He continued running it until he started his own company known as S.A.C.

With his own $10 million and an additional $10 million from outside capital, Steven started S.A.C. Capital Advisors in 1992. The name “S.A.C.” came from the initials of his name. In 2003, the S.A.C. was claimed as one of the most considerable hedge funds in the world that’s known for rapid and frequent trading by the New York Times.

The Wall Street Journal reported in 2006 that “Steven Cohen was once a rapid-fire trader who never held trading positions for extended periods. He now holds an increasing number of equities for a longer time.” His firm managed $14 billion in equity as of 2009.

Understanding Steve Cohen career path

Now that you’re familiar with the way Cohen’s career progressed in the early stages, here’s a deeper understanding of how it all resulted. It’s clear that in 1992 he launched his hedge fund, the famous “S.A.C. Capital Advisors”. Since it was founded with $25 million of its own money, the firm used a high-volume, aggressive trading approach to investment management.

For a couple of days, and sometimes in hours, stock positions were held. In 1999 Steven Cohen suggested that S.A.C. should trade 20 million shares per single day. The result by 2006 was that the firm’s trading accounted for 2% of all stock market trading activity.

Over 20 years, S.A.C. evolved and expanded in its investment approach. That all came thanks to the usage of multiple strategies that included:

- Long/short equity portfolios

- Fixed income

- Global quantitative strategies.

S.A.C. averaged annual returns of 25% for their investors from 1992 to 2013.

Cohen as a High Risk and High Reward Trader

It’s clear that Steven Cohen’s success with his own company was predicated on high risk and high reward trades. In 2007, his company S.A.C. took an incredible amount of $76 million in stock position in Equinix. Its share value grew by 32% after S.A.C. The company released positive earnings just one month after.

In 2009 and 2010, S.A.C. took long positions in Whole Foods for $49 million and $78 million. As a final result, both times, the stock price soared. Over two decades, the firm also sustained several significant losses on the bets. Throughout the 2000s, a series of multimillion-dollar long positions on pharmaceutical companies were ultimately unsuccessful and extremely expensive to the portfolio.

In early 2012, Steven Cohen made a $26.7 billion bet on Ardea Biosciences. After AstraZeneca purchased the company less than a month later, the acquisition increased Steven’s position on Ardea to approximately $40 billion.

Steven Cohen Net Worth – statistics

It is evident that everyone is eager to know Steven Cohen’s net worth. According to Forbes Magazine, in 2016, the estimated fortune of Steven Cohen was around $13 billion. He was ranked the 30th richest man in the United States of America. The Wall Street Journal claimed Steven to be “the hedge fund king” in 2006.

In February 2015, the magazine Forbes listed Steven Cohen as the highest-earning hedge fund manager of 2014. Cohen’s New York penthouse was listed for sale for $98 million a year before that. In 2020, according to the Institutional Investor, Steven Cohen earned an estimated $1.7 billion that year.

In 2021, Steven Cohen will be worth $11 billion, according to Bloomberg Billionaires Index.

Steven A Cohen Insider Trading Charges

We need to look back on Steven A Cohen insider trading charges from 2012. On November 20, 2012, Steven Cohen was involved in an alleged insider trading scandal that involved Mathew Martoma, an ex-SAC manager. The S.E.C. brought charges against numerous S.A.C. employees from 2010 to 2013. The outcomes were various.

For instance, Mathew Martoma was convinced in 2014 and proclaimed to be “the most profitable insider-trading conspiracy in history.” The S.E.C. also brought a civil lawsuit against Steven Cohen, charging his failure to supervise Mathew Martoma and Michael Steinberg, known as a confidant of Cohen’s and a senior employee.

In January 2016, Steven settled his civil case with regulators. The final agreement with the S.E.C. prohibited Steven from managing outside money until 2018.

Capital Advisors of S.A.C. pleaded guilty to insider trading charges in 2013. As a result, they had to pay $1.8 billion in penalties and stop handling investments for outsiders. Despite being the breathing and living heart of the S.A.C. Capital Steven Cohen “escaped criminal indictment himself”.

However, Gilman, the witness against Martoma, stated that F.B.I. agents told him that Steven Cohen was the ultimate target of the investigation. In a January 2017 New Yorker Article, a famous article titled “When The Feds Went After The Hedge-Fund Legend Steven A. Cohen”.

Cohen’s Art Collection

Steven Cohen’s art collection was reported to be worth approximately $1 billion. He’s a huge admirer and collector of “trophy art – signature works by famous artists”. Cohen’s art collection includes some of the most remarkable works by the following artists

- Pablo Picasso

- Edvard Munch

- Lucio Fontana

- Alberto Giacometti

- Jeff Koons

- Willem de Kooning

- Andy Warhol:

The philanthropy of Steven Cohen

Extremely successful and wealthy people have always been socially responsible and cared for those who need help the most. That is how Steven Cohen is known for his philanthropic work. He has donated $175 million to charitable causes throughout his entire life. These causes included charitable giving to veterans and children’s health.

He is also famous for serving on the board of trustees of the Robin Hood Foundation in New York. The Cohens have donated the projects involved in education, health, culture and art to the New York community via the Steven & Alexandra Cohen Foundation.

Donation of money for health and art

In 2014 his foundation provided funding for the study of traumatic brain injury and posttraumatic stress via the New York University Langone Center. The same year Steven Cohen also donated approximately $100,000 to the Bruce Museum of Arts and Science.

In 2019, his foundation contributed $50 million of more than $400 million raised for the Museum of Modern Art in New York. Two years before that event, the museum announced that MoMA’s most extensive contiguous gallery would get the name “The Steven and Alexandra Cohen Foundation enter for Special Exhibitions”. It’s evident that Steven Cohen is on the MoMA and LA MOCA board.

In 2016, Steven Cohen committed $275 million to the Cohen Veterans Network. His primary goal was to establish mental health centers for veterans and their families across the United States. The plan was to establish 20-25 centers by 2020. Steven also founded Cohen Veterans Bioscience which conducts research into the effects of posttraumatic stress disorder on combat veterans.

Steven’s donations to the Politics

Steven and Alexandra Cohen Foundation donated $2.5 million to the Super P.A.C. called America Leads that supported Chris Christie’s presidential candidacy. He and his wife donated $1 million to Donald Trump’s inauguration.

In 2021, Steven Cohen and his wife donated $1.5 million to a Super P.A.C., supporting Eric Adams and $500,000 to the New York City Democratic mayoral primary, supporting Andrew Yang’s candidacy.