Commodity Futures Trading Commission Chairman Rostin Behnam said Thursday that lawmakers should pass laws that would place strict standards on cryptocurrency exchanges, including prohibiting or limiting conflicts of interest. Behnam addressed members of the Senate Agriculture Committee. He said he still favors a measure that would give his little agency the power to police bitcoin, ether, and other digital commodities trading. Before the firm’s demise last month, FTX and its creator Sam Bankman-Fried advocated for the law.

The law’s future is currently unclear. The bill’s support by FTX raises doubts about the group’s clout. The Securities and Exchange Commission (SEC), which has the power to draft stricter regulations that most cryptocurrency businesses oppose, was seen as a more friendly regulator than the FTX.

The reports say that Bankman-Fried’s business had misused client money by transferring it to an associated trading firm, Alameda Research. The latter was well known for its risky venture investments. It blew up last month. Even though the former CEO acknowledges his lack of management at the company, he denies any connection with fraud activity.

A way to US regulatory compliance will be created under the law. Crypto exchanges may now have a larger customer base than hedge funds, individual investors, and a few large asset managers who have tried the water. FTX enlisted the services of several former CFTC employees to pave a route via Congress and regulatory authorities.

Ironically, Bankman-Fried Shares Bits of Advice for The Industry

Sam Bankman-Fried had some new advice for investors: place your money on an exchange that doesn’t do business like FTX. They probably wish they had gotten it earlier. Well, of course. Easy to say after his bankrupt crypto exchange lost the funds of what is likely millions of customers.

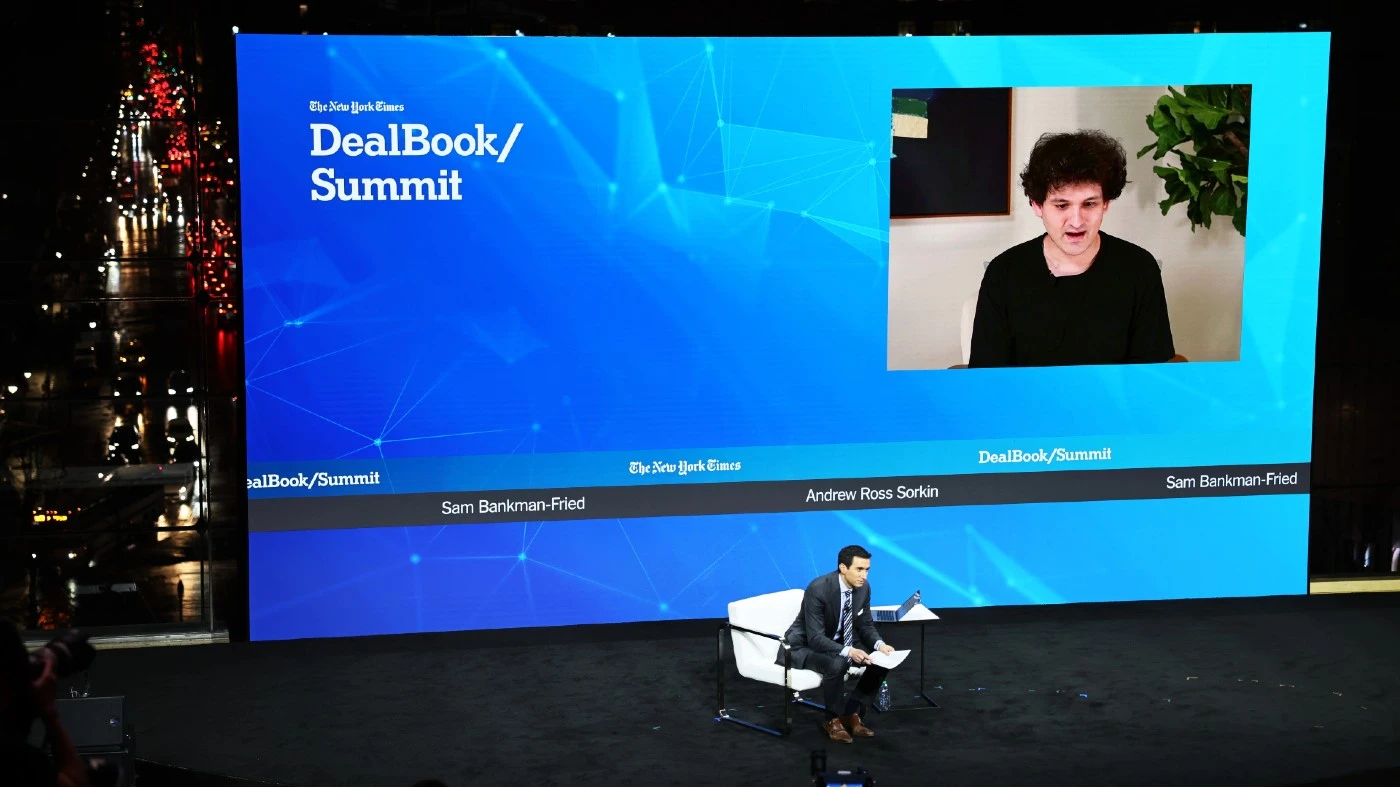

Bankman-Fried spoke at New York Times DealBook Conference on Wednesday. He said crypto investors should seek out “all the features I wish FTX had been capable of supplying” when picking an exchange. He noted proof of reserves and regulatory reporting, such as metrics like customer assets and liabilities.

The disgraced creator spoke with New York Times columnist Andrew Ross Sorkin about the collapse of his crypto empire. FTX’s spectacular and unexpected demise occurred on November 11th. It had a $32 billion valuation before plunging into insolvency, leaving the crypto sector reverberating. Now, widening contagion is expected in the digital-assets industry. It owes $3.1 billion to 50 of its most unsecured creditors.