FTX Founder Admits He Made Mistakes but Denies Ever Committing Fraud

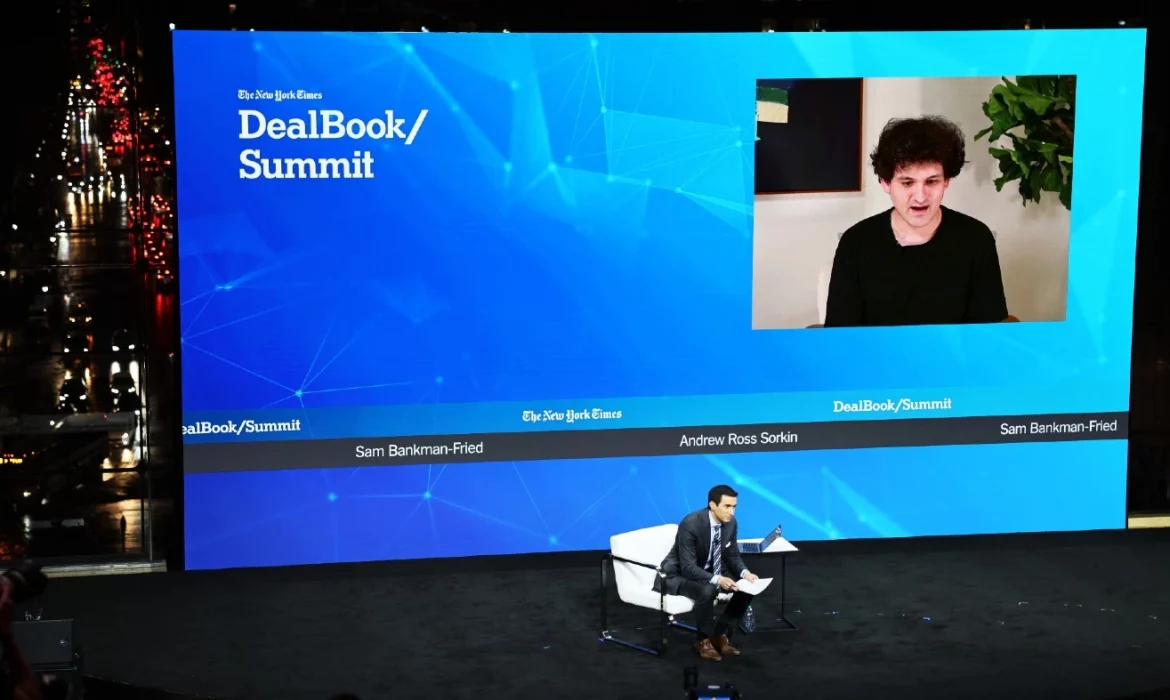

While acknowledging numerous mistakes when in charge of the firm, Sam Bankman-Fried, the disgraced creator of the failed FTX crypto empire, denied trying to commit fraud.

He attempted to shift some of the faults for FTX’s failure away from himself. The argument stated his embarking on a massive public relations effort to wreak havoc on the market. He went on to say that FTX’s international clients might be unable to retrieve their frozen cryptocurrency. However, US consumers may.

Mr. Bankman-Fried has not been seen in public since he left the FTX. The company became the biggest-ever cryptocurrency platform, filing for bankruptcy. Despite its public image of stability, the firm collapsed after dipping into customer money to fund Alameda’s risky bets with billions of dollars in debt.

FTX Collapse Ripples Through the Industry

The collapse of FTX and Alameda has triggered a tsunami of financial ruin for cryptocurrency businesses. It even prompted BlockFi Inc. to default. Their chapter 11 case threatens other platforms’ financial health.

Since the new management recruitment, the company has been sifting through the assets and hunting down those that have fled. Cryptocurrencies that millions of customers have deposited are still stuck on the exchange. There are few indications of how much they will get back or when according to the company.

Following The Wall Street Journal, years before, Sam Bankman-Fried had been subjected to a mutiny by some Alameda workers due to his cavalier approach to risk. According to court documents, he has stayed in the Bahamas since the firm failed, cooperating with local authorities as FTX winds down its operations in the country.

New York and federal prosecutors inform the Securities and Exchange Commission is investigating the firm’s demise. Sam Bankman-Fried is accused of misusing client money. Experts in white-collar criminal law argue that he may be subject to criminal liability.

John J. Ray III, FTX’s new CEO, has slammed Sam for his “erratic and misleading” comments since he left the company. FTX’s new management’s attorneys said in court last week that Bankman-Fried operated FTX like a private kingdom, with minimal corporate control and record reporting.

Mr. Ray added that Bankman-Fried and his colleagues lavished company money on Bahamas homes and that the management could not locate a big portion of FTX’s assets.