General Information

Broker Name: Finantiko

Broker Type: Forex

Country: St. Vincent and the Grenadines

Address: First Floor, St. Vincent Bank Ltd Building, James Street, Kingstown, St Vincent, and the Grenadines.

Customer Service

Phone: +441865679025

Email: [email protected]

Languages: English, German, Polish, French, Slovak, Czech

Availability: 24/7

Trading

Platforms for trading: Sirix Trading Platform

Demo account: YES

Mobile trading: YES

Web-based trading: YES

Bonuses: YES

Account

Minimum deposit ($): N/A

Finantiko Review: Conquer the Markets

with Finantiko

Online trading broker Finantiko offers various financial instruments in different asset classes, including metals, forex, futures, indices, shares, and CFDs, for online trading.

In this detailed Finantiko review, our online broker research team covered some of the most critical aspects for future users to consider when choosing the best broker for their online trading needs.

What is Finantiko?

Finantiko is a new CFDs provider. The Company is in Saint Vincent and the Grenadines. Finantiko is an ECN trading broker that provides its clients with more than 10,000 financial instruments in different asset classes, including metals, forex, futures, indices, shares, and CFDs.

Besides, the broker allows traders to access various trading features, like fast withdrawals without extra fees, secure payment options, and flexible leverage of around 1:400. In fact, several account options can suit each trader’s needs.

Moreover, they allow traders to connect with trade stocks and financial markets, currency, indices, cryptocurrency, and commodities at the highest level of excellence.

Their trading experts are highly trained and have the experience to answer any question, despite its simplicity or complexity. Moreover, they will work with you and help you strategize and improve results professionally, with friendly manners.

The main goal of Finantiko is to serve traders with an optimal trading environment.

They value simplicity, experimentation, and direct innovation to achieve the ultimate trading methodology.

What Do They Do?

Finantiko grew within a decade from a mere idea to an entire trading enterprise.

They continuously help their clients achieve their goals, short- and long-term.

They provide expert assistance and guidance to beginners and seasoned traders. Even if you want to take up trading as a side hustle, they have the tools to optimize your profits and help you enter a proper trading mindset.

Their clients’ success is their success as well.

They never stop improving and implementing strategies and new tools to their platform. With more than 200,000 satisfied clients, they continue to grow and become better and better.

Broker Regulations: Finantiko and MiFID II in Europe

The European Parliament and Council adopted MiFID II – The Directive on Markets in Financial Instruments 2014/65/EU that came into effect on January 3, 2018. It regulates the markets with financial instruments to provide investment services and activities within the European Union and European Economic Area. MiFID II aims to harmonize the governing of financial markets and increase efficiency, increase competition, enhance financial transparency, and offer more excellent consumer protection in investment services.

Under MiFID law, an investment firm might freely provide its services within the territory of another member state or a third country, provided that this investment firm’s authorization covers such services. An authorized company fully complies with Europe-wide requirements of good conduct and transparency. Therefore, it is allowed to provide cross-border services. In addition, this investment firm fully complies with the applicable requirements from MiFID II.

Finantiko Regulation

Finantiko Limited operates as a financial investment company under St. Vincent and the Grenadines laws, where the Company is registered. In fact, the Company’s registered address is Saint Vincent and the Grenadines, James Street, first floor, First St. Vincent Bank LTD Building.

However, you can not find regulatory information on the broker’s website. In fact, most users and traders don’t risk and avoid trading with an unregulated broker if they can not offer the level of protection as a regulated broker can offer.

Finantiko All Over the World: Trading Countries

Finantiko allows traders from different countries to open an account with them if their residence permit permits online trading with international brokers. However, the broker does not offer services to users from some countries, such as North Korea, the Islamic Republic of Iran, and the United States of America.

In fact, some Finantiko products and features mentioned in this Finantiko review might not be available to traders from some countries because of some legal restrictions.

Finantiko Review: Investment Products

Currencies – On the Forex Market, you can trade currencies one against another. You could use one money to speculate on another currency’s value. You will learn basic Forex terms, advanced trading strategies, and end-game trading methodologies with the Company’s advisors.

Stocks – Stocks are tiny portions of the Company. The more stocks you own of a specific business, the more potential profits you gain. Moreover, having stocks related to portfolio diversity is less likely to surprise the market and lose your investment.

Indices – By combining several different stocks, you get Indices. Globally-known indices are Dow Jones Industrial Average, FTSE 100, and CAC 40.

Commodities – Commodity trading is similar to stock trading. Investors divide commodities into two categories – Soft and Hard Commodities. You can engage them with Futures Contacts, but those are highly speculative.

Cryptocurrency – They are exhilarating, volatile, and carry huge profit potential. With Finantiko, you have access to thousands of cryptocurrencies to trade on crypto exchanges.

Trading Platforms

The Company designed its trading platforms to ease the trading process and allow quicker trading.

- Platform station, along with Platform Mobile and Platform Web, is the Latest PLATFORM Version

- All features are accessible on any device.

- It is User-friendly, with a high level of customization available

- New trading tools, economic calendar, with an option for One-Click trading

Finantiko Broker Review of Trading Education

The broker’s website also contains educational resources that can improve traders’ knowledge and trading skills. Moreover, the broker provides its clients with some free training tools and market analysis. There is also a section for frequently asked questions on the broker’s website that shows instant answers to the common questions that clients might have.

Instruments

The broker allows traders to access online trading of around 10,000 financial instruments in different asset classes, including forex, metals, futures, shares, CFDs, and indices.

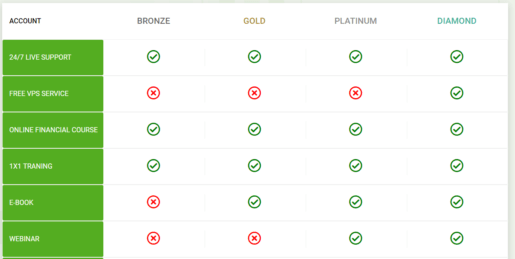

Finantiko.net: Broker Accounts and Fees

The broker offers traders various choices of different trading accounts to satisfy the trading needs of traders of all levels. In fact, it provides each account type operated with varying currencies that traders can choose. However, if your preferred currency or local currency is not available, you might still use the available currencies, and it can automatically convert your deposits and withdrawals. You should also note and accept that the broker can not control conversion rates as they are systematically computed.

Withdrawal and Refund Policy

- A Refund will be made in the same currency and to the same account from which the card initially deposited the funds. The Company can cancel the Withdrawal request in 7 business days if a Client does not provide the Company with the banking account details for a withdrawal request through wire transfer. It must be an official document with the stamp and logo of the Client’s Bank. In fact, the official document must include the following information: IBAN /account number, SWIFT/BIC; routing number, client name, bank name, and address.

- The Company might also charge a commission on deposits to the Trading Account and refunds, including fees for transfers. Depending on the payment solution, the cost will be 25 – 60 Euro for every transfer or withdrawal request.

- You should submit the Withdrawal requests through the Company’s website. It is not the Company’s obligation to process Withdrawal requests transmitted by any other means.

- In case of a Withdrawal request made by the Client, the Company must transfer the requested amount within seven Business Days after the Client was identified by the Company subject to the Margin requirements, as set by the Client Company.

- The Company can also cancel the Withdrawal request if, according to the Company’s discretion after the refund, the remaining balance is not sufficient to guarantee the open trades in the Trading Account.

Additional details

In exceptional defined circumstances, the Company might make refunds to the card from which the funds came from:

After a card transaction, the Client was not verified within 14 business days. Moreover, the Company identifies that a third person made a transaction. In fact, the Brokerdetermines that a Client breaks accepted Client Agreement Terms&Conditions. Therefore, Finantiko also will not deduct any commissions from the card refund.

Finantiko.net Broker Deposit & Withdrawal Options

- Credit/Debit Cards – Visa, MasterCard, and Maestro

- Standard Payment Processors include American Express and more

- The accounts are in USD, GBP, EUR, and AUD.

- Some payment methods might not be available to some specific countries

The transaction limits, fees, and processing time might vary, depending on the payment method or provider

FinantikoRview: Customer Support

The broker also has a dedicated customer service team available 24/5 to answer clients with technical, general, or account-based inquiries. In addition, clients can reach the customer service team via email, telephone, and online Live Chat.

Finantiko.net Broker: Account Opening

Opening a live trading account with the broker is easy that involves three simple steps:

First, click on the sign-up on the broker’s website and fill the form while supplying the required relevant information.

Secondly, one should verify their identity by uploading an identity card and proof of address documents registering to their Bank ID.

Once you receive the approval of your trading account, you can fund and start trading online the various assets the broker offers.

It is essential to know that you read all of the broker’s terms, conditions, and policies when you are going through a broker application. Only continue if you fully understand and agree to the terms and conditions.

The Review Conclusion

Finantiko is an online trading broker operating from Saint Vincent and the Grenadines. The Company provides clients with more than 10,000 financial instruments in different asset classes. The broker offers traders various trading conditions, including secure payment options, flexible leverage of more than 1:400, and fast withdrawals without extra fees. In addition, they provide different account options to suit each trader’s needs. In fact, the safety of the Client’s capital is the highest priority for the Company, and all customers’ investments are protected. To keep it short, you can consider trading with Finantico if you are looking for a potential broker.

It would be best to consider if your experience and knowledge are suitable for trading derivatives and if you can afford to take all the risks involved in trading.

Reliable signals

Reliable trading signals and accurate market analysis. I can fully trust them, they’re very good in helping me gain good profit.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advise and trading services.

Did you find this review helpful? Yes No

Very responsible

Very responsible brokers and customer service. They attend all appointments.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Great broker

Happy to recommend this broker company. They are very professional and deliver good results.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get desirable trading results. They always go beyond what is expected.

Did you find this review helpful? Yes No

Good experience

Good experience. Highly recommended broker.

Did you find this review helpful? Yes No

Professional brokers

They assist me in all my trading needs and teach me without hesitation. Very professional brokers.

Did you find this review helpful? Yes No

Decent broker

A decent broker. They are very professional in dealing with me and all transactions are smoothly done.

Did you find this review helpful? Yes No

Commendable customer service

Commendable customer service. People from their team are warm and nice. I am happy to recommend them.

Did you find this review helpful? Yes No

Reliable broker

Reliable and great services. I had so many great options to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly process. They are good at providing trading advise and trading services.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get desirable trading results. They always go beyond what is expected.

Did you find this review helpful? Yes No

Great trading conditions

Great trading conditions, minimal slippage, and very minimal losses. I am happy and satisfied.

Did you find this review helpful? Yes No

Excellent broker performance

Excellent broker performance. I am happy and satisfied with the services.

Did you find this review helpful? Yes No

Amazing broker signals

Amazing trading signals. I am so much impressed with the profits I am getting from this broker.

Did you find this review helpful? Yes No

Good profit

I am trading currency at the moment with this broker. Volatile as it may seem but I am gaining profit out of it.

Did you find this review helpful? Yes No

Good broker

Good customer service and great broker signals.I am truly satisfied with services.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly process.They are good at providing trading advise and trading services.

Did you find this review helpful? Yes No

Good broker

They are good in what they do. They never settle for less but maximize their potential earning.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Awesome broker service

Awesome broker services. I am very happy to trade with this broker, they are one of the best.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Good broker

Very minimal slippage and dependable service. I will definitely keep this trading broker.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Great services

I love their services, especially having my personal account manager. I don’t have to wait in the queue whenever I needed help they offer a personal account manager based on the account type.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Highly recommended

Enthusiastic customer service and great signals. Highly recommended broker company.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get a desirable trading result. They always go beyond what is expected.

Did you find this review helpful? Yes No

Good signals

Valuable Forex signals, I am really glad I traded with this broker. Highly recommended forex services.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Leading forex brand

One of the leading brands in forex broker. Among the brokers I have tried, they have the best signals and the greatest services.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Professional broker

They are enthusiastic and very friendly. Assist me gain good profit and are very professional.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get a desirable trading result. They always go beyond what is expected.

Did you find this review helpful? Yes No

Helpful customer service

Very helpful customer service. They are always ready and available to help me with anything about my trading account.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advise and trading services.

Did you find this review helpful? Yes No

Best customer service

The best customer service. They are always prompt and helpful.

Did you find this review helpful? Yes No

Professional brokers

People here are very professional and nice. They are approachable and easy to deal with.

Did you find this review helpful? Yes No

Great broker

I’ve got so many good reasons to keep this broker service. Withdrawal is smooth and trading advise are always accurate. Customer support is always available for help.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get desirable trading result. They always go beyond what is expected.

Did you find this review helpful? Yes No

Amazing services

I love the services, they’re truly great and amazing.

Did you find this review helpful? Yes No

Awesome services

Very affordable trading instruments are offered here. Services are awesome and best of all I am gaining a really good profit.

Did you find this review helpful? Yes No

Perfect broker services

I am glad I found the perfect tools and services to help me succeed in trading online. They are using the most advanced software with so many good features making trading easier and more organized. When it comes to signals and trading advise, all are proven effective. I am overall satisfied with this broker’s service.

Did you find this review helpful? Yes No

Trusted broker

Trusted trading broker. Their advise are proven effective.

Did you find this review helpful? Yes No

Fantastic brokers

Fantastic broker services. Fast withdrawals and friendly customer service. I am very happy with this broker and I will stay with them.

Did you find this review helpful? Yes No

Great broker service

Great broker services. Withdrawal is fast and easy as if it is real-time. Trading transactions are always seamless and smooth.

Did you find this review helpful? Yes No

Highly recommended

Any issues I ever had are few are quickly resolved. Emails and chats are replied quickly. Withdrawals are always quick and easy. I highly recommend this company.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They always make sure to attend to my trading needs.

Did you find this review helpful? Yes No

Best platform

One of the best platform I have ever used. The features are excellent and helpful.

Did you find this review helpful? Yes No

Good results

Everything here is smooth and easy. People are kind to me. I am so far, getting good results.

Did you find this review helpful? Yes No

Good trading experience

I experience good trading services from this company. Also, I was able to withdraw profit swiftly.

Did you find this review helpful? Yes No

On time withdrawals

My withdrawals are always on time. Good job!

Did you find this review helpful? Yes No

Great trading services

Good trading services and wonderful trading offers.I gain real good profit and have no problem with all of their services.

Did you find this review helpful? Yes No

Highly recommended company

Great trading tools and awesome services. Highly recommended company.

Did you find this review helpful? Yes No

Good signals

Good signals and service. I am happy and overall has a satisfactory trading experience.

Did you find this review helpful? Yes No

Excellent broker performance

Excellent broker performance. I am happy and satisfied with the services.

Did you find this review helpful? Yes No

Progressive profit

I got the best offer from this broker.Initial deposit and per lot price is very affordable.Aside from this, I also get good returns. It is just my 3rd month trading with them but I can see progression on my profit.

Did you find this review helpful? Yes No

Amazing broker

I honestly don’t buy time to leave reviews such this but this brokers deserves one. They are simply amazing. Would surely recommend them.

Did you find this review helpful? Yes No

Good

Services are all good. People are nice and accommodating.

Did you find this review helpful? Yes No

Satisfied

Friendly customer service and reliable brokers. I am happy and satisfied with all of their trading tools and services.

Did you find this review helpful? Yes No

Skilled broker

Skilled forex brokers. Been dealing with them for quite some time and by far I am happy with my trading results.

Did you find this review helpful? Yes No

Good broker company

I was about to give up on my trading account back then but this broker had given me hope to move forward. They have helped me understand forex better and had helped me recover losses as well.

Did you find this review helpful? Yes No

The best broker

The best trading broker I could ever recommend. Signals are worth my money and time.

Did you find this review helpful? Yes No

Quick withdrawals

Quick withdrawal and excellent services. I have been trading with them for a year and got no complaints. Awesome forex brokers.

Did you find this review helpful? Yes No

Fast execution

Fast executions, accurate signals, and easy withdrawals are the reasons I am keeping this broker service to be my partner in forex trading.

Did you find this review helpful? Yes No

Amazing services

I love the services,they’re truly great and amazing.

Did you find this review helpful? Yes No

Professional broker

I am dealing with very professional people. I love the people and I love the services.

Did you find this review helpful? Yes No

Excellent company

Excellent broker company. They really did well in helping me in my trades.

Did you find this review helpful? Yes No

Huge profit

Regarded as one of the best brokers in some reviews I read online. And yes, they really are. I am currently trading with them and am getting huge profits.

Did you find this review helpful? Yes No

Good company

Good company. They have been very responsible and have shown me dedication in helping me make money online.

Did you find this review helpful? Yes No

Interesting services

Interesting trading services and tools. I’m also satisfied with the trading conditions provided here.

Did you find this review helpful? Yes No

The best broker

Nothing but the best. Signals are always accurate. I guess they are really dedicated in doing market research in order to come up with sound trading advice.

Did you find this review helpful? Yes No

Good broker

Good trading terms and good trading services. I am happy and satisfied with this trading company so far.

Did you find this review helpful? Yes No

Highly recommended

The opportunities I had from this broker have greatly helped me gain good profit. Highly recommended.

Did you find this review helpful? Yes No

Good services

I would always choose this broker company. Services are more than good.

Did you find this review helpful? Yes No

Highly recommended

Trading tools are great and signals are always reliable. Highly recommended trading partner.

Did you find this review helpful? Yes No

Superb trading services

Superb trading services. Signals are always reliable and services are great.

Did you find this review helpful? Yes No

Good broker

Good broker for forex trading. I am getting the best services that I need in order to succeed in trading forex.

Did you find this review helpful? Yes No

Good profit

I gain good profit from the trades. Withdrawal is fast and easy.

Did you find this review helpful? Yes No

Great trading opportunities

I am impressed with the great trading opportunities given to me by this broker. I have tried a few and they’re really very profitable.

Did you find this review helpful? Yes No

Good people

Good people. They explain all things clearly and process my withdrawals smoothly.

Did you find this review helpful? Yes No

Great trading company

Great trading company. Signals are accurate and services are all good.

Did you find this review helpful? Yes No

Good broker company

Good broker company. All transactions are transparent and withdrawals have never been this easy.

Did you find this review helpful? Yes No

Good results

Everything here is smooth and easy. People are kind to me. I am so far, getting good results.

Did you find this review helpful? Yes No

Good brokers

Great trading options, very affordable and profitable. I gain good profit and I owe so much from these brokers.

Did you find this review helpful? Yes No

Swift withdrawals

What I like the most about this broker service is that withdrawals are swiftly processed. No hassles, no runarounds.

Did you find this review helpful? Yes No

Highly recommended company

Great trading tools and awesome services. Highly recommended company.

Did you find this review helpful? Yes No

Great trading services

Good trading services and wonderful trading offers. I gain real good profit and have no problem with all of their services.

Did you find this review helpful? Yes No

The best broker

Processed withdrawals swiftly and attended to my trading needs promptly. One of the best brokers I have traded with.

Did you find this review helpful? Yes No

Great services

Overall, the services are great. They process withdrawals quickly and provide sound trading advice.

Did you find this review helpful? Yes No

Good broker

I love how deposits and withdrawals are quickly processed. They are good at providing trading advice and trading services.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker performance. I always get a desirable trading result. They always go beyond what is expected.

Did you find this review helpful? Yes No

Excellent broker performance

Excellent broker performance. I am happy and satisfied with the services.

Did you find this review helpful? Yes No

Fast and smooth transactions

Fast and smooth transactions. Good customer service and fast withdrawals.

Did you find this review helpful? Yes No

Quick and easy withdrawals

They’ve been very good to me. Services are all good and withdrawals are always quick and easy.

Did you find this review helpful? Yes No

Good advise

Skilled in providing effective trading advice. Signals and analysis are always profitable.

Did you find this review helpful? Yes No

Very responsible

Very responsible brokers and customer service. They attend to all appointments.

Did you find this review helpful? Yes No

Good customer service

Good customer service and excellent trading advice. I gain really good income from their offers.

Did you find this review helpful? Yes No

Warm customer service

This broker was recommended to me by a friend and I’ve got regrets about switching to their services. They have the most reliable platform and signals. And a very warm customer service

Did you find this review helpful? Yes No

Great profit

I am so much thankful to this broker service for giving me really great services and profit.

Did you find this review helpful? Yes No

Good services

I am trading currency pairing and so far it’s good. I haven’t tried other offers but the services are all good.

Did you find this review helpful? Yes No

Great services

Great services, I have gained a good profit for my family because of them. They are a group of highly skilled individuals.

Did you find this review helpful? Yes No

Dependable and honest

This broker is very dependable and honest. They always check on me and back me up on my trades.

Did you find this review helpful? Yes No

Great broker

Great in all aspects. Services are always efficient, signals are profitable and withdrawal is fast. I am fully satisfied with this broker’s service.

Did you find this review helpful? Yes No

Consistently good services

Services and signals are consistently good. I have been trading with this broker for a few months and the profit are progressing.

Did you find this review helpful? Yes No

Excellent services

Services and signals are equally excellent. I never had any problem trading with them, and will definitely recommend this broker.

Did you find this review helpful? Yes No

Amazing broker

Amazing forex trading broker with good trading terms. I am fully satisfied with this broker’s services.

Did you find this review helpful? Yes No

Good broker

Some people complain about slow withdrawals, poor customer services and trading tools etc. I’ve never noticed anything like this with this broker. For over six months, I am fully satisfied and happy.

Did you find this review helpful? Yes No

Transparent broker

They are transparent and trustworthy. I’ve got no issues with withdrawals or any of the services.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth deposit and withdrawal process. I did not encounter any issues in the past few months and I am looking forward to seeing consistency in good services.

Did you find this review helpful? Yes No

Great brokers

Signals are very reliable and accurate. Great forex brokers.

Did you find this review helpful? Yes No

Effective trading advise

My investment has been growing a lot. They have been very dedicated to helping me. Trading advice are all very effective.

Did you find this review helpful? Yes No

Skilled broker

The brokers are skilled in forex trading. They are competitive and are very friendly, too.

Did you find this review helpful? Yes No

Good and decent broker

I am speaking about this broker using my personal experience as a basis for my opinion. They are good and decent brokers.

Did you find this review helpful? Yes No

Reliable broker

Reliable and great services. I had so many great options to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Professional brokers

They assist me in all my trading needs and teach me without hesitation. Very professional brokers.

Did you find this review helpful? Yes No

Good brokers

I have traded with this broker for about a few months and based on my observation, they’re good.

Did you find this review helpful? Yes No

Good broker

Good people and good trading software. There are so many reasons to keep and recommend the service.

Did you find this review helpful? Yes No

Reliable signals

Reliable trading signals all the time. I am always impressed with my trading results.

Did you find this review helpful? Yes No

Good broker

I can always depend on this broker’s services. Signals are so much profitable and withdrawal is easy.

Did you find this review helpful? Yes No

Highly recommended

The best trading platform and signals. Highly recommended broker.

Did you find this review helpful? Yes No

Great broker

I am confidently trading with this broker. I can always depend on their signals and services.

Did you find this review helpful? Yes No

Easy and quick withdrawals

What I like about this broker aside from its profitable signals is that all transactions here are smoothly processed. That includes withdrawal which is very easy and quick.

Did you find this review helpful? Yes No

Good trading broker

People are nice and are very professional. They do not take advantage of their traders but instead are very dedicated to helping traders like me succeed.

Did you find this review helpful? Yes No

Great source of income

I never write reviews but they deserve to. I was looking for an additional source of income when they were introduced to me. I can say that earning opportunities here are great, I even quit my full-time job cause I really earn well.

Did you find this review helpful? Yes No

Good experience

I am using this broker since a few months back and my experience is good. I started trading with them with no knowledge at all but they are very patient in helping me understand forex and in teaching me what to do and how to do it.

Did you find this review helpful? Yes No

Good broker performance

Good overall performance. I am happy with my profit and satisfied with the services.

Did you find this review helpful? Yes No

Good broker

Good trading broker. They perform very well.

Did you find this review helpful? Yes No

Good trading system

Good trading system. Has so many useful features. Services also work fine.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Impressive broker service

I am impressed by this broker, excellent service, and almost same-day withdrawal. I am truly satisfied with all of the services.

Did you find this review helpful? Yes No

Responsible and professional

Responsible and professional people. They are very transparent on all transactions. I am gaining good profit and satisfied with the services.

Did you find this review helpful? Yes No

Quick withdrawals

Quick withdrawal and excellent services. I have been trading with them for a year and got no complaints. Awesome forex brokers.

Did you find this review helpful? Yes No

Great trading advise

They are very dedicated to providing great trading advise. I have noticed that they do not settle for just good but they go for the best.

Did you find this review helpful? Yes No

Good trading broker

I can vouch for this trading broker. They are indeed one of the best companies I have ever traded with.

Did you find this review helpful? Yes No

Good profit

Amazing services and good profit are my reason for keeping this broker service. I have never traded to brokers as good as this before.

Did you find this review helpful? Yes No

Excellent broker

I joined this broker company last month and as early as 2 weeks I see potential. I must admit they are one of the best among any other broker in the industry.

Did you find this review helpful? Yes No

On time withdrawals

My withdrawals are always on time. Good job!

Did you find this review helpful? Yes No

Great trading broker

I am privileged enough to have them as my trading broker. They never fail to get me some profit.

Did you find this review helpful? Yes No

Superb forex broker

Superb forex broker. In an industry where there are so many negative experiences, we have to carefully choose who to trade with. I am glad I am trading with the right broker.

Did you find this review helpful? Yes No

Satisfied

Friendly customer service and reliable brokers. I am happy and satisfied with all of their trading tools and services.

Did you find this review helpful? Yes No

Good trading software

Good trading software. There are so many good tools that really help make successful trades.

Did you find this review helpful? Yes No

Satisfied

Friendly customer service and reliable brokers. I am happy and satisfied with all of their trading tools and services.

Did you find this review helpful? Yes No

Good experience

Good experience for the past six months. Smooth and fast withdrawals with signals that are so amazing.

Did you find this review helpful? Yes No

Reliable broker

Reliable broker services. I am happy with all of their services.

Did you find this review helpful? Yes No

Good offers

Awesome trading experience. I’ve got no idea how trading works. They have introduced everything to me. I am seeing potential profits on the offers.

Did you find this review helpful? Yes No

Great broker

This broker is far better than any other broker I knew off. I get approximately 15 to 20 percent monthly profit and experience really good services.

Did you find this review helpful? Yes No

Great make money opportunities

Great opportunity to make money. Affordable initial deposit with really great returns.

Did you find this review helpful? Yes No

Convenient trading tools

They have the most convenient trading tools and services. I am happy and satisfied.

Did you find this review helpful? Yes No

Fair broker

They deserve more than just 5-star ratings. All the policies are well explained including the risk of forex trading. All is but fair

Did you find this review helpful? Yes No

Good broker

Good customer service and great trading signals from the brokers.

Did you find this review helpful? Yes No

Awesome customer service

Awesome customer service. I never had any problem communicating with them. They are also very prompt in attending to my trading needs.

Did you find this review helpful? Yes No

Highly recommended

Everything here is nothing but great. Highly recommended.

Did you find this review helpful? Yes No

Great broker company

Extremely happy about my trading results. I gain good profit and get good services from this broker company.

Did you find this review helpful? Yes No

Good services

Have delivered good services consistently. I am delighted to leave a short review for them in return.

Did you find this review helpful? Yes No

My ideal broker

I had no problem dealing with them for about a year. This is my ideal broker, profitable and smooth withdrawals.

Did you find this review helpful? Yes No

Trusted broker

Trusted trading broker. Their advice is proven effective.

Did you find this review helpful? Yes No

Good broker

Good customer service and great trading signals from the brokers.

Did you find this review helpful? Yes No

Convenient trading tools

They have the most convenient trading tools and services. I am happy and satisfied.

Did you find this review helpful? Yes No

Great trading profit

I chose to trade with this broker and after a few months, it became quite promising for me. I now live a good life and it is all because of the profit I am getting from this broker.

Did you find this review helpful? Yes No

Passive source of income

A good passive source of income. I wouldn’t have to spend more time on this, I just have to place trades and wait for results.

Did you find this review helpful? Yes No

No withdrawal delays.

I get my money on time.No no hassles and no delays.

Did you find this review helpful? Yes No

Good broker

This for me is a very good broker for online trading. Signals are profitable and withdrawal is fast.

Did you find this review helpful? Yes No

Fully satisfied with this broker service

I am fully satisfied with all of their services including profit. They are very professional in all transactions and show genuine respect for clients like me.

Did you find this review helpful? Yes No

Great broker

I gain approximately 10-15 percent profit, a strong start I may say. I am hoping for consistency.

Did you find this review helpful? Yes No

Good signals and services

Good signals and services. I am happy to deal with them.

Did you find this review helpful? Yes No

Hassle-free withdrawals

Very transaparent on all transations. They also process withdrawals swiftly and hassle-free.

Did you find this review helpful? Yes No

Good broker

Has so many good things to offer. Great trading broker and good customer service, too.

Did you find this review helpful? Yes No

Good trading company

Good trading company. I never fail to get my withdrawals on time. Signals are profitable and services are good.

Did you find this review helpful? Yes No

Good trading services

So many trading instruments to choose from. Signals are good and so are the services.

Did you find this review helpful? Yes No

The best forex broker

It is probably the best broker for forex trading. I have used so many brokers in the past but I prefer to keep this one.

Did you find this review helpful? Yes No

Profitable trading

All of their services are reliable and effective. I love trading with them, very profitable.

Did you find this review helpful? Yes No

Good advice

Skilled in providing effective trading advice. Signals and analysis are always profitable.

Did you find this review helpful? Yes No

Spot on signals

Excellent trading advice. Always spot on signals.

Did you find this review helpful? Yes No

Great trading partner

Great trading partner. They always check on my trades and come up with effective advice.

Did you find this review helpful? Yes No

Great broker

Glad to have them as my broker. Signals and services are both great.

Did you find this review helpful? Yes No

Good broker

Easy to deal with people. They listen and attend to all of my concerns promptly.

Did you find this review helpful? Yes No

Profitable trading

All of their services are reliable and effective. I love trading with them, very profitable.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker. I am pleased with all of their services.

Did you find this review helpful? Yes No

Great broker

I stay with this broker for more than a year, I have no problem with their services. Very fast trade execution, friendly customer service, easy deposit, and withdrawals.

Did you find this review helpful? Yes No

Fast withdrawals

Easy and fast withdrawals. Great customer service also.

Did you find this review helpful? Yes No

Great broker

Great like no other. I love what I am getting from this broker.

Did you find this review helpful? Yes No

Good broker

Fast withdrawals, I never had any problem with their services. I am satisfied and happy with my profit.

Did you find this review helpful? Yes No

Honest brokers

Trustworthy and honest brokers. They do not hide anything and explain things clearly, too.

Did you find this review helpful? Yes No

Excellent services

They’ve got really very excellent services and professional people. Pricing and terms are both fair. I get to process withdrawals 3 times and never had any trouble.

Did you find this review helpful? Yes No

Perfect forex broker

This is a perfect broker to trade forex. They did a good job in providing me with profitable trading advice.

Did you find this review helpful? Yes No

Pleasing services

I am delighted to trade with this broker. I get really good income and I am very pleased with the services.

Did you find this review helpful? Yes No

Skilled broker

When it comes to forex trading, this is a highly skilled broker service.Their excellence has been proven and tested by me and the other people I know whose using heir services.

Did you find this review helpful? Yes No

Good trading company

Good trading company. They pay profit on time and I never had any problem with the services.

Did you find this review helpful? Yes No

Good broker

Signals and services are very effective. Good trading broker to deal with.

Did you find this review helpful? Yes No

Good profit

No regrets about joining. I get good profit.

Did you find this review helpful? Yes No

Great customer service

The best customer service, they are willing to help me anytime. Very resourceful and efficient.

Did you find this review helpful? Yes No

Excellent signals

Excellent signals. I have traded with several broke in the past but this one got the best signals.

Did you find this review helpful? Yes No

Good customer service

Great customer service and fast replies. I get good returns and had a good overall experience.

Did you find this review helpful? Yes No

Good broker

Great services and smooth withdrawals. I never had any problem dealing with this broker for more than six months.

Did you find this review helpful? Yes No

The best broker

The best trading broker partner. I am earning good profit and I am fully satisfied with the services.

Did you find this review helpful? Yes No

Amazing profit

Great trading signals. I am surprised by the amazing profit I get every time.

Did you find this review helpful? Yes No

Best broker

They are willing to help you anytime, any day no matter what. Best brokers and support.

Did you find this review helpful? Yes No

Good signals

Spot on signals. Profitable broker to trade with.

Did you find this review helpful? Yes No

Highly recommended

Not only offer great trading opportunity but also offers free trading education. I highly recommend this broker.

Did you find this review helpful? Yes No

Good services

Fair pricing and good customer service. I am happy trading with the services so far.

Did you find this review helpful? Yes No

Great brokers

Great support and reliable trading signals. Execution is also fast and customer service is prompt.

Did you find this review helpful? Yes No

Fast withdrawals

I never had any problem with withdrawals. It has always been fast and easy.

Did you find this review helpful? Yes No

Efficient services

Efficient services and signals are good. I am gaining profit and will surely recommend them.

Did you find this review helpful? Yes No

Helpful customer service

Very helpful customer service. For over a year of trading with them, they always satisfy me every time I call.

Did you find this review helpful? Yes No

Amazing broker

I honestly don’t buy time to leave reviews such as this but this broker deserves one. They are simply amazing. Would surely recommend them.

Did you find this review helpful? Yes No

Amazing broker signals

Amazing trading signals. I am so much impressed with the profits I am getting from this broker.

Did you find this review helpful? Yes No

Profitable signals

I got awesome profits from this broker and still getting some more. Good and profitable signals.

Did you find this review helpful? Yes No

Good broker

Good brokers. Very prompt customer service and are very transparent in all transactions.

Did you find this review helpful? Yes No

Excellent

Excellent broker for forex trading. I am contented with my profit and happy with the services.

Did you find this review helpful? Yes No

Good broker

I am happy with the services I am getting from this broker service. All transactions are smoothly processed. I never had any single issue trading with them.

Did you find this review helpful? Yes No

Happy with this broker

I am happy with the services. Signals bring good profit and withdrawal is smooth and fast.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended forex brokers. They have helpful customer service, fast withdrawals, and productive signals.

Did you find this review helpful? Yes No

Affordable trading instruments

Affordable and profitable trading instruments. They’ve got a wide selection of trading instruments and offer great trading services.

Did you find this review helpful? Yes No

Good platform

I am comfortable with their trading platform. I find the interface user-friendly. When it comes to services, I am fully satisfied by far.

Did you find this review helpful? Yes No

easy and flexible platform

Good broker, easy and flexible platform. Happy trading with them

Did you find this review helpful? Yes No