Brent crude futures were higher 14 cents, or 0.2%, at $87.02 per barrel by 1008 GMT. U.S. WTI crude futures increased 5 cents, or 0.1%, to $81.27 per barrel.

Brent and WTI had fallen earlier in the session but were en route for their first weekly gains, the most significant in two months at about 4% and 6%, respectively, after three straight weeks of descent.

Sending bullish signals, China is positioned to report an easing of its coronavirus quarantine protocols within days. Sources informed Reuters this would be a major shift in policy in the world’s second-largest oil consumer. Nevertheless, analysts warn a substantial economic reopening is probably months away.

The dollar, which normally moves inversely to oil prices, also hit a five-month low, supporting oil prices.

Price Cap on Russian Oil

Meanwhile, EU governments have tentatively reached a compromise on a $60-a-barrel price ceiling for Russian offshore oil, with a regulatory mechanism to keep the ceiling below market prices, diplomats and a document seen by Reuters described.

This still demands formal consent before the bloc’s embargoes on Russian crude rush in on Dec. 5. Russian Urals crude traded at around $70 a barrel on Thursday afternoon.

An EU diplomat expressed that Poland, which had driven the cap to be as low as feasible, still needed to verify that it would support the deal.

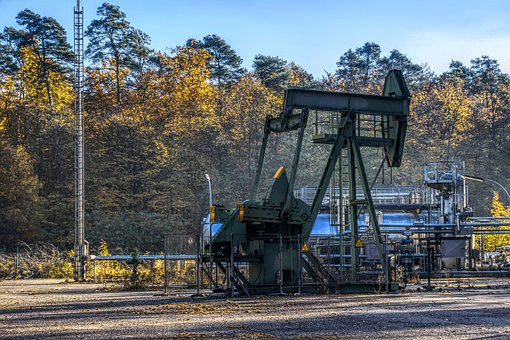

OPEC+ is widely anticipated to adhere to its latest target of reducing oil production by 2 million barrels per day (BPD) when it encounters on Sunday. Still, some analysts consider that crude prices could drop if the group does not make additional cuts.