Brent crude futures dropped 25 cents, or 0.3%, to $86.72 per barrel by 0430 GMT, while U.S. WTI crude futures reduced 17 cents, or 0.2%, to $80.38.

The benchmark oil contracts recompensed higher by over $2 on Wednesday amid a softer dollar and optimism over Chinese demand retrieval.

The analysts counted that the market is also preparing itself for the influence of European embargoes on Russian oil.

OPEC+ is ready to meet virtually on Dec. 4.

The conclusion to hold its meeting virtually signals little probability of a policy change, sources informed Reuters on Wednesday, as the group considers the influence of the imminent Russian oil-price cap on the market.

Meanwhile, the presumption was raised by the shift in China’s zero-coronavirus strategy, which increases optimism over Chinese oil demand healing.

Announced Easings

China’s Guangzhou and Chongqing announced the easing of COVID-19 curbs on Wednesday, a day after protesters clashed with police in southern Guangzhou in a series of protests against the world’s strictest COVID restrictions.

A new outbreak in China may be a sign of short-term activity, but the International Monetary Fund said on Wednesday there is room for a safe readjustment of coronavirus policy to allow economic growth to pick up in 2023.

Nevertheless, official PMI data revealed on Wednesday that Chinese business activity dropped further in November, raising suspicions about next year.

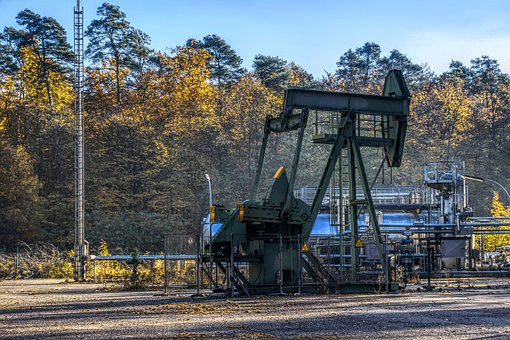

A drop in {{8849|U.S. crude oil inventories also determined price falls on Thursday.

As stated by the Energy Information Administration, the crude inventories dropped by 12.6 million barrels in the week to Nov. 25, higher than earlier analysts’ anticipations for a 2.8 million-barrel drop.