In financial trading, the moving average (MA) emerges as a key analytical companion amidst the turbulence of fluctuating prices.

Its significance transcends its apparent simplicity, profoundly influencing trading strategies. Acting as a stabilising force, it offers traders and investors a clearer perspective amidst market transitions, smoothing the jagged edges of erratic price data.

The moving average can bring order to chaos at its core, providing a dynamic snapshot of market sentiment across diverse temporal landscapes—10 days, 20 minutes, or 30 weeks.

This versatility renders it an indispensable tool for traders, catering to strategies ranging from short-term trades to long-term investments across various time frames.

Why Leverage a Moving Average?

At its essence, a moving average mitigates the noise cluttering price charts, slicing through the din to present a distilled vision of price movement direction. Its upward, downward, or sideways orientation offers a preliminary gauge of market trends, enabling traders to align their strategies with the prevailing wind.

In an upward trend, prices are generally climbing, whereas a downward angle suggests a decline. A horizontal trajectory, meanwhile, hints at a market in equilibrium, caught in the throes of indecision.

Beyond trend analysis, the moving average also moonlights to identify potential support and resistance levels. In an uptrend, for example, key moving averages such as the 50-day, 100-day, or 200-day may serve as a trampoline, propelling prices higher as they encounter these levels.

Conversely, the same averages can morph into a ceiling in a downtrend, capping price ascents and presaging a downturn. However, it’s crucial to acknowledge the moving average’s imperfections—it’s not a crystal ball, and prices may sometimes breach these theoretical barriers, underscoring the importance of flexibility and caution in trading.

Types of Moving Averages

Exploring moving averages uncovers two types: Simple Moving Average (SMA) and Exponential Moving Average (EMA), each with unique characteristics. These pillars of financial analysis each bring their unique approach to smoothing out market volatility and providing insights into price movements:

Simple Moving Average (SMA)

True to its name, the SMA offers a straightforward average, tallying up a set number of recent closing prices and dividing by the count. This creates a fluid line that connects each day’s average to the next, offering a serene view of price movement.

Exponential Moving Average (EMA)

On the other hand, the EMA introduces a layer of complexity, assigning greater weight to recent prices. This responsiveness to new data renders the EMA a sharper tool, capable of capturing swift market shifts with greater agility than its simpler counterpart. When plotted, the EMA’s line, using transition words, closely follows recent prices, quickly reflecting market mood swings.

Yet, it’s imperative to recognise that no one type of moving average reigns supreme. Each has moments of glory, contingent on market conditions and the trader’s temporal focus. Therefore, when deciding between an SMA and an EMA, traders must make a strategic decision informed by their objectives and the specific nuances of the asset or market.

The Strategic Playbook

Employing moving averages in trading strategies can range from simple to sophisticated. At its most basic, a trader might use a single MA as a litmus test for market direction—buying when prices vault above the MA and selling when they dip below. This tactic, while rudimentary, encapsulates the essence of trend following.

For those seeking greater depth, dual moving average strategies involve short-term and long-term MA. Crossing these averages—short over long signalling a buy, long over short a sell—serves as a dynamic indicator of shifting market tides, offering a nuanced perspective to enhance decision-making.

In the trading world, the moving average stands out as a beacon of clarity, guiding traders through the fog of market volatility with its timeless insights. As a trend identification tool, its utility is unparalleled for mapping support and resistance or the cornerstones of complex strategies.

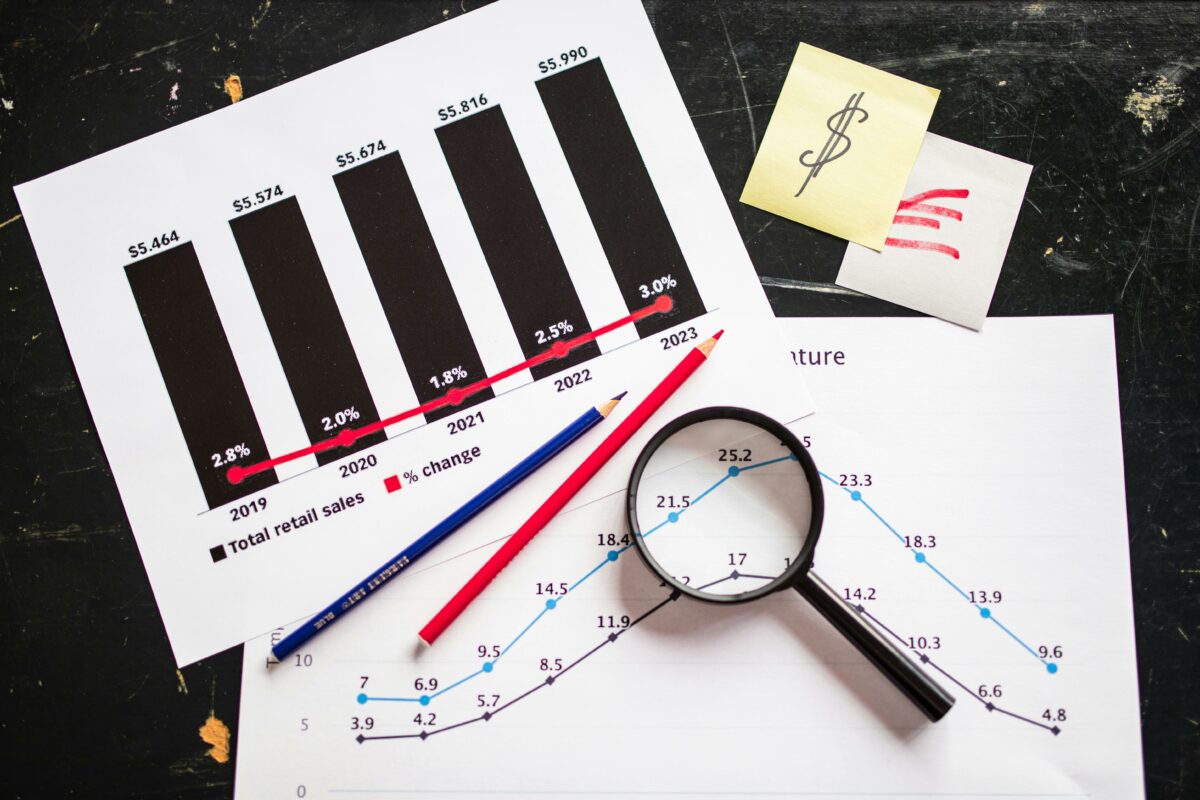

The Science of Moving Averages in Trading

Moving averages are the most utilised technical analysis tools. By smoothing price data, moving averages clarify market direction, aid decision-making, and offer traders a clear perspective.

Common moving average lengths, such as 10, 20, 50, 100, and 200 days, cater to a wide range of trading strategies and time horizons. They are adaptable to any chart time frame—from a minute to weekly charts. This flexibility underscores the significance of choosing an appropriate look-back period, which can dramatically influence an MA’s effectiveness.

The Impact of Look-Back Period

The selection of a moving average’s time frame, or its “look back period,” plays a crucial role in its utility.

Shorter time frames, such as a 20-day moving average, closely reflect recent price movements and swiftly react to changes. This characteristic is particularly beneficial for short-term traders who rely on timely signals to capitalise on market movements.

Conversely, longer look-back periods, such as the 100-day moving average, provide a broader view of the market’s direction, suitable for those with a longer-term investment horizon.

The essence of moving averages lies in their ability to filter out market “noise,” allowing traders to discern underlying trends. However, this comes with a trade-off known as “lag.” Essentially, lag is the delay between a market movement and its reflection in the moving average. While a 20-day MA might offer prompt signals, a 100-day MA, with its slower response time, might need to catch up to actual market changes, though it offers a less volatile and more consistent trend indicator.

Crossover Strategies: Golden Crosses and Death Crosses

Crossovers stand out for their simplicity and effectiveness among many moving average strategies. A crossover occurs when two moving averages of different lengths intersect, signalling potential market shifts.

The golden cross, a bullish signal, occurs when a shorter-term MA surpasses a longer-term MA, indicating an upward trend. Conversely, the death cross, a bearish signal, occurs when a shorter-term MA falls below a longer-term MA, indicating a downward trend shift.

These strategies leverage the dynamic relationship between short-term price movements and long-term trend direction, offering traders actionable signals based on these intersections. However, the effectiveness of crossovers, like all trading strategies, can vary with market conditions.

Challenges with Moving Averages

Despite their widespread use, moving averages have limitations. Being inherently backwards-looking, MAs rely solely on historical data, devoid of predictive power. This historical basis means that their signals, at times, may seem more coincidental than causative, especially in markets that do not respect traditional support and resistance levels.

Moreover, moving averages can perform poorly in choppy or ranging markets. The price might frequently cross the MA in such conditions, leading to numerous false signals and potential losses. Similarly, during market consolidation periods, MA crossovers may occur frequently without a clear trend, complicating trading decisions.

Navigating the Challenges

To mitigate challenges, traders combine moving averages with indicators or adjust MA time frames to suit market conditions better. For instance, incorporating indicators that measure momentum or volume can provide a more holistic view of the market, helping to confirm or refute the signals provided by moving averages.

Furthermore, awareness of market conditions can greatly enhance the effectiveness of moving averages. MAs can be a powerful tool for identifying entry and exit points in trending markets. However, reliance on MAs alone may lead to suboptimal trading decisions in sideways markets. Thus, a flexible approach, adapting strategies to current market dynamics, is crucial for maximising the utility of moving averages.

Conclusion:

With their simplicity and adaptability, moving averages continue to be a cornerstone of technical analysis in financial trading. By selecting suitable MA lengths and understanding limitations, traders can discern market trends and make informed decisions, thus enhancing strategy. While no tool is perfect, the strategic use of moving averages, complemented by other indicators and a keen understanding of market conditions, can significantly enhance a trader’s ability to navigate the complexities of the financial markets.