Tesla stock price is also down despite the EV maker filing to split shares 3-for-1 late Friday. Moreover, the output at Tesla’s Shanghai factory is operating at 100% of capacity again, according to Securities Times.

RBC Capital Markets analyst Joseph Spak upgraded Tesla stock to Outperform from Sector Perform. The upgrade move comes amid a “more favorable near-term set-up and belief that Tesla’s focus on supply chain and vertical integration will be a mid-term competitive advantage.”

Speak is calling for 249,000 delivered electric vehicle (EV) units in Q2 while he sees margins surprising to the upside.

Tesla’s Focus

The analyst is even more bullish on Tesla stock in the mid-to-longer term, given the EV company’s “increasingly favorable” industry positioning.

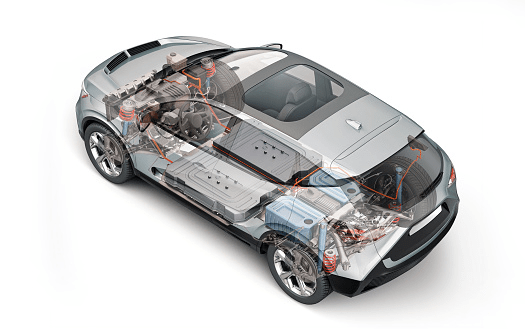

TSLA has solid demand, evidenced by growing vehicle lead times; pricing gains should continue. EVs enter their 3rd phase in the mid-to-late part of the decade; hence, we believe being able to deliver EVs will increasingly depend on the supply chain. TSLA is fairly secretive about the deals they have cut for the supply of raw materials; however, we believe they have done more than other OEMs. TSLA’s early focus on vertical integration (not just batteries/raw materials but also motors, semis, and software) is likely to pay off; especially as the industry supply of critical materials may become an issue in 2027/28. Moreover, TSLA may be able to control more of their destiny. Indeed, it appears Elon’s Master Plan Part 3 is likely to focus on achieving an enormous scale to shift the transportation/energy infrastructure, Spak added.

The fact that Tesla can build out and secure critical materials puts the EV company in “a strong competitive advantage.”

The price target on Tesla stock is now $1,100 per share, down from $1,175.