Have you ever thought about what pyramidal trading is? Why are many aspiring traders interested in trying something like this for the long term? What is the pyramid trading strategy specifically related to, and how essential is it for achieving long-term profits?

First of all, to achieve significant success in the dynamic, competitive, and volatile Forex market, you must know valuable techniques and strategies to assist you. Pyramid trading is just one of these strategies that are very useful to know.

So, what is pyramid trading all about? How to pyramid in trading exactly? Let’s get to know more about it, shall we?

Pyramid Trading – Definition and Explanation

Pyramid trading is generally called “pyramiding” and refers to a specific trading strategy that includes attaching to an existing position or trade. At the same time, the price goes in the anticipated direction.

With this, the risk levels of a particular investment are reduced, and traders are utilizing relatively little increments that will enable their holdings to grow rather than going big from the beginning. All investors who aren’t lovers of risk and are eager to play it safe love the pyramid trading strategy.

They’re avoiding risks by investing just a single portion of their intentional full position, anticipating the market movement before they decided to grow their hold on these equities that became a significant profit.

Pyramid in trading

Pyramid trading refers to adding to a winning position by using a portion of the profits from that position to enter a new trade in the same direction. The goal is to increase the size of the overall position while also allowing the trader to capture more profits potentially. However, it is important to use proper risk management techniques when pyramiding, as it can also increase the potential for loss if the trade moves against the trader.

This can be most effectively done by using stop-loss orders to limit the downside risk and by scaling gradually rather than adding all at once.

A counter-intuitive strategy

The pyramid trading strategy could be counter-intuitive, where every following entry into the market values more money for the investor than the prior one.

Nonetheless, it all eases avoiding losses at the end of the day, especially if only additional investments are made once the old investments provide profits.

Make sure to distinguish pyramid trading from similar terms.

Pyramid trading is a strategy that’s easily confused with two other things:

- Pyramid schemes: illegal and scam business models mostly

- Pyramid trading points: data-based points

However, it must be distinct from these two terms since it has nothing to do with them.

What does the Pyramid Trading Strategy mean?

If you are a passionate Forex trader, you know how volatile this market is, with approximately 6.6 trillion daily turnovers. As someone who makes money trading currency pairs, he should fully understand what Pyramid Trading Strategy in Forex means.

The main reason ambitious Forex traders should learn Pyramid trading strategy is that there is a huge difference between earning a 100 pips profit in a single trade or 200 pips profit by adding a famous pyramid trading technique.

You may expect additional Forex profits from 100% to 500% in your account. Besides that, you can also expect the specific Pyramid trading technique that enables traders’ profits run smoothly. However, you can only start pyramiding with some trades you acquire.

Nonetheless, there’ll be times when you’ll be able to utilize the pyramid trading technique. In that particular case, you’ll be able to multiply all of your profits if all turns out to be according to plan.

Pyramiding technique – what you need to know

Pyramiding is a trading method in which securities positions are expanded by utilizing gains from profitable trades. Thus, pyramiding employs leverage to amplify one’s assets by taking advantage of the augmented unrealized value of existing assets.

This approach is highly aggressive but can yield substantial profits if done correctly. Since it employs leverage instead of cash to conduct trades, pyramiding is a more dangerous strategy and should only be attempted by seasoned traders.

How does pyramiding operate?

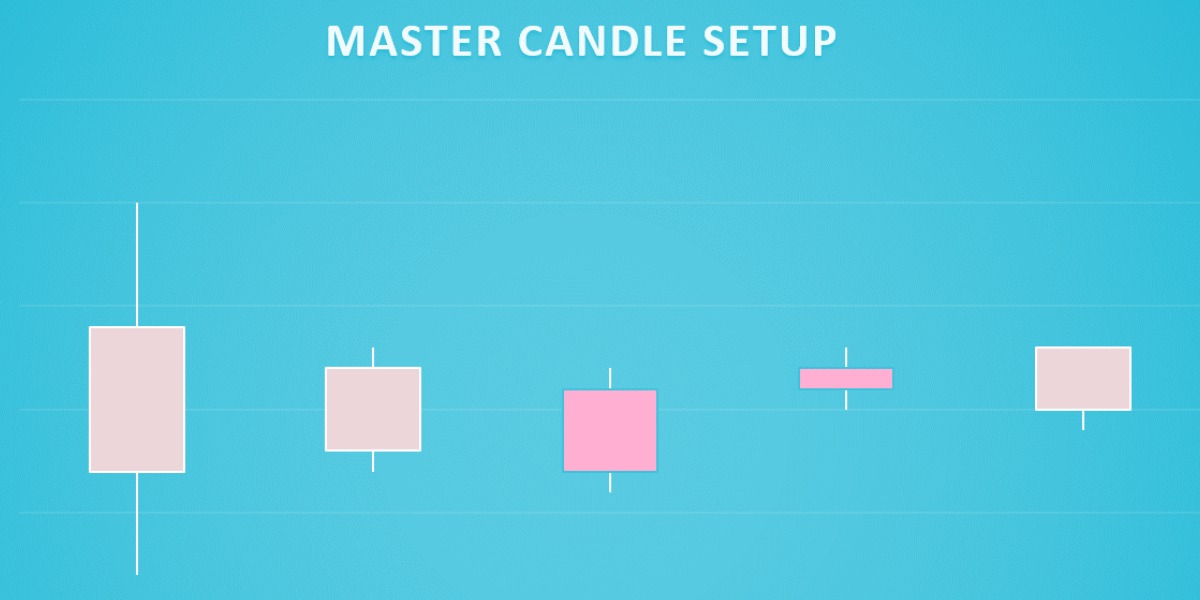

Pyramiding operates by initiating with a minor stake, then supplementing it as the commodity demonstrates excellence and maintains growth potential. This implies that traders augment their holdings with multiple positions.

As a result, traders can reap substantial gains as their stake increases. Individuals who employ pyramiding utilize supplementary leverage from the escalating value of the security in their investment portfolio to acquire more of the same commodity.

Pyramid trading is better explained.

Pyramid trading represents a technique in which you can continue to attach to their successful trades as a trend or a price moves in their favor. What’s most beneficial with the pyramid trading technique is the fact that it enables traders to acquire larger profits without any potential risks involved successfully.

How does pyramid trading function exactly?

As mentioned above, pyramid trading refers to a specific trading technique that functions by attaching to profitable positions. Suppose that the EURUSD currency pair is currently trending. Thus, you possess a trading strategy that enables you with a purchase signal:

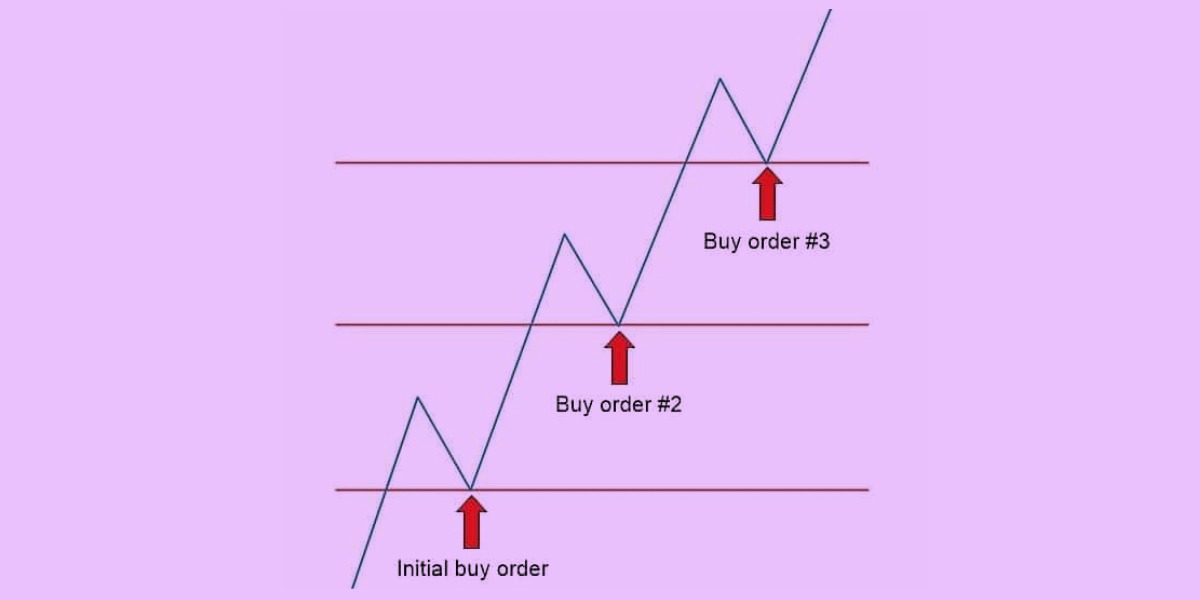

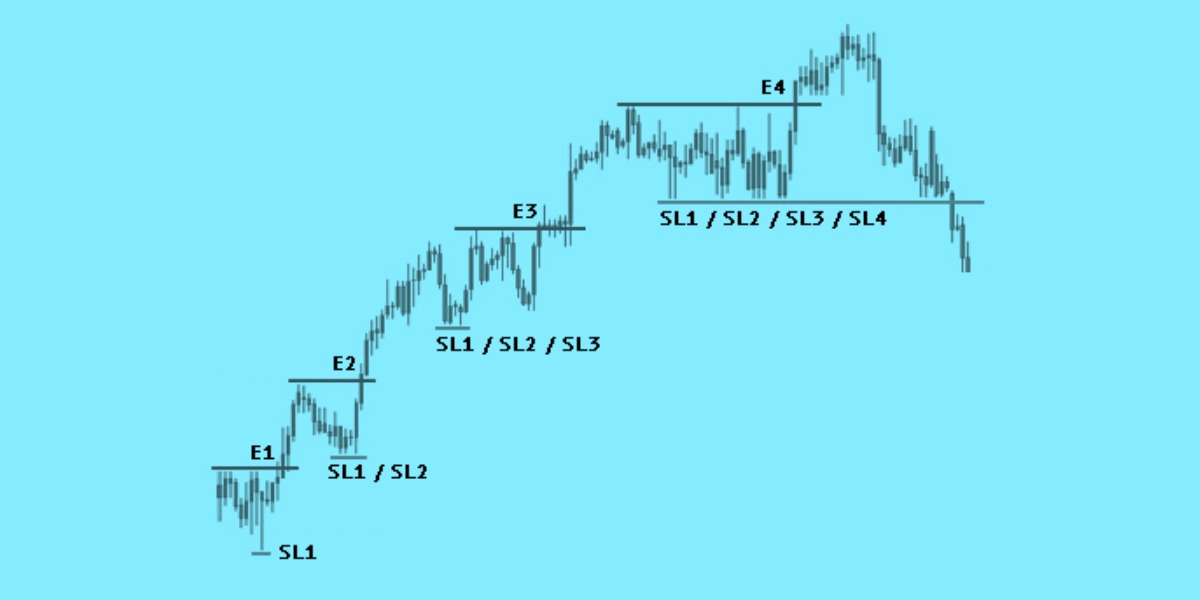

- You begin your trade with one contract, placing your stop loss. That represents your very 1st trade now.

- The trading system you possess enables you with a specific signal to purchase. In this case, you get to purchase another contract, and then you get to place your stop loss. It represents your 2nd trade.

- Afterward, it’s time to transfer the stop loss and locate it at the same level where you’ve set the stop loss of the 2nd trade. In this manner, you’ll only possess 1 risk that represents a certain risk that is placed on the 2nd trade. However, it doesn’t include any risk on the 1st trade.

- In the end, you’ll spot a purchase signal and get a third trade. You’ll then place a stop loss. Now it’s time to pass the trailing stop losses of the 1st and 2nd trades and then place them at the exact level where the 3rd trade stop loss is placed. Considering this, trade1 has managed to lock in many profits and trade to 0 risks. Remember that your single risk, in this case, will be a trade3 risk.

What are the main pros and cons of pyramid trading?

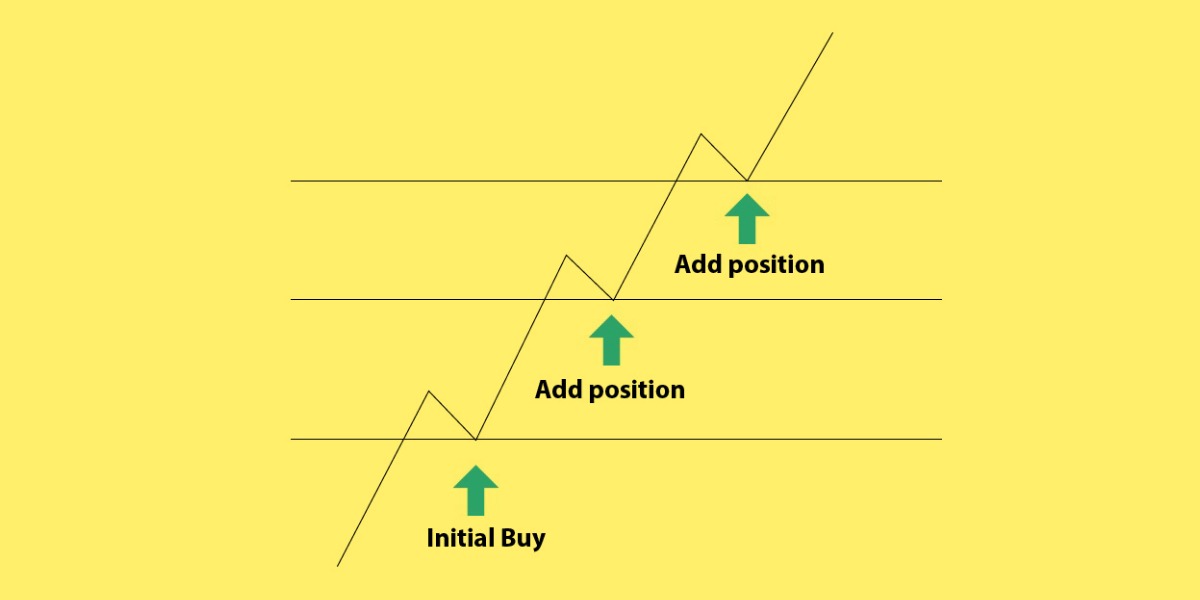

One of the main advantages of pyramiding is that it allows traders to capitalize on strong market trends by adding to their positions as the market moves in their favor. This can result in larger profits than possible with a fixed position size. Additionally, pyramiding can help reduce overall risk by only adding to a position when it is in a profitable state.

Instead of exclusively having one trade that enables 50 pips of profit, traders are able to include more than one trades that generate much more profit. It also refers to one of the most effective techniques that quickly provides a Forex trading account in a short period.

Another advantage of pyramiding is that it can help improve a trade’s risk-reward ratio. By only adding to a position when it is profitable, traders can increase their profits while limiting potential losses.

Cons of pyramid trading

However, pyramiding also has several drawbacks. The main disadvantage is that managing multiple positions simultaneously effectively can take time and effort. This can lead to mistakes and emotional trading decisions, resulting in significant losses. Additionally, pyramiding can lead to over-leveraging, magnifying losses in a losing trade.

Another drawback of pyramiding is that it requires discipline and a strong understanding of market dynamics. Traders must be able to effectively manage their positions and make sound trading decisions to succeed with this strategy.

Additionally, pyramiding is risky, and traders should be aware of the potential drawbacks before employing it.

What is reverse pyramiding?

Pyramiding in trading is the strategy of augmenting a profitable trade by investing a portion of the proceeds from that trade into a new trade in the same direction. The aim is to amplify the overall position and earn greater returns.

Nonetheless, it’s crucial to employ appropriate risk management methods when pyramiding, as it could also increase the possibility of loss if the trade moves against the trader. This can be achieved by using stop-loss orders to limit potential downside and gradually scaling in rather than adding all at once.

On the other hand, Reverse pyramiding in trading is the tactic of increasing a losing trade by putting a fraction of the capital from that trade into a new trade in the opposite direction. The objective is to reduce the overall position and lower the overall loss.

Employing appropriate risk management is essential.

However, it’s essential to employ appropriate risk management methods when Reverse pyramiding, as it could also increase the possibility of loss if the trade continues to move against the trader.

This can be achieved by using stop-loss orders to limit potential downside and gradually scaling out rather than exiting all at once. It’s important to note that pyramiding, whether in the regular or reverse way, is a high-risk strategy and unsuitable for all traders. It should be used with caution.

Bottom Line

In conclusion, pyramiding is a trading strategy that can potentially result in larger profits, but it also comes with significant risks and requires discipline and market understanding to be successful. Traders should carefully consider the potential pros and cons before using this strategy.