Brent oil futures was higher 0.37% to $82.08 by 9:48 PM ET (2:48 AM GMT). WTI Futures bounced 0.33% to $79.16 remaining under the $80 mark.

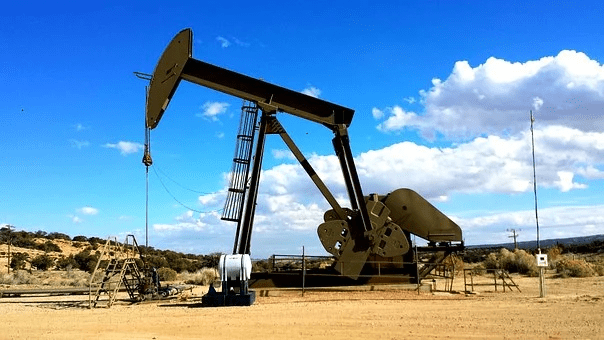

Investors outlined the latest U.S. jobs report, covering non-farm payrolls, released last week. They also drafted a report from Baker Hughes Co. that said the oil and gas rig count rose two to 588 in the week of Jan. 7, its highest after April 2020.

In the Asia Pacific, mass testing took place in China’s northern city of Tianjin, with two community cases proving the omicron coronavirus variant. This could further affect fuel demand in the world’s biggest oil importers.

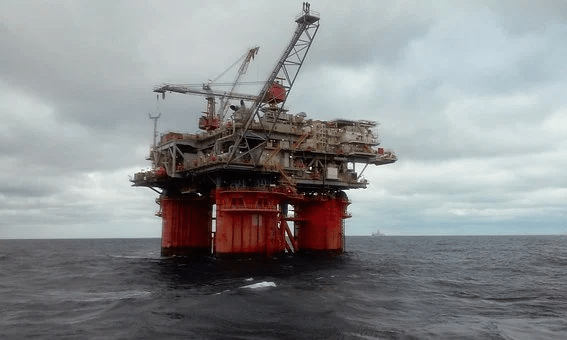

Supply Disruptions Are Possible to Increase the Black Liquid

In Kazakhstan, security forces seemed to have controlled protests in Almaty. President Kassym-Jomart Tokayev stated that they have restored the constitutional order. The protests started in the country’s oil-rich western regions over removing state price caps on butane and propane on Jan. 1.

Production at Kazakhstan’s strategic oilfield Tengiz was declined on Thursday as some contractors disrupted train lines to support the protests, as operator Chevron Corp. (NYSE: CVX) stated. Nevertheless, standard production is now slowly recovering, Chevron added.

Production in Libya also fell to 729,000 barrels per day from a high of 1.3 million BPD in 2021 because of pipeline maintenance work.

Meanwhile, supply from OPEC+ fails to keep up with demand growth. The cartel’s production in December 2021 increased by 70,000 BPD from the previous month versus the 253,000-BPD increase permitted under a supply deal that year.