General Information

Broker Name: NSFX

Broker Type: Forex & CFDs

Country: Malta

Operating since year: 2011

Regulation: BaFIN, MFSA, ACP, Consob, CNMV, and FINANSTILSYNET

Address: 168 St Christopher Street, Valletta, Malta

Broker status: Active

Customer Service

Phone: (+44) 330 8080 098

Email: [email protected]

Languages: English

Availability: 24/5

Trading

The Trading platforms: MT4, JForex

Trading platform Time zone: /

Demo account: Yes

Mobile trading: Yes

Web-based trading: Yes

Bonuses: No

Other trading instruments: Yes

Account

Minimum deposit: $300

Maximal leverage: 1:50

Spread: Floating From 0.0 Pips

Scalping allowed: Yes

| Markets:

Gold & Metals, Forex, Indices CFDs, Energy CFDs |

Our rating:

3/5 (stars) |

Account Minimum:

$300 |

Contact information:

(+44) 330 8080 098 Available 24/5 |

Platforms: MT4 (Terminal, Mobile, Web)JForex (Terminal, Mobile, Web) |

NSFX Pros and Cons

| Pros | Cons |

| · Regulated broker

· Reasonable Account Minimum · Solid Deposit/Withdrawal Options |

· Low Performance

· Limited Asset Variety in Present Markets · Absence of Crucial Markets (Stocks, Crypto) · Poor Account Structure Th · Slightly Outdated |

Table of Contents |

| · Introduction

· Trust and Security · Getting Started · Accounts and Funding · Account Details · Platforms and Trading · Customer Support · Conclusion · Alternatives |

NSFX Review Introduction and Overview

NSFX is an experienced forex & CFD broker with over 10 years of operating under its belt. It was established in 2011 and has been providing trading services globally ever since. The broker is headquartered in Malta and operates from 168 St Christopher Street, Valletta.

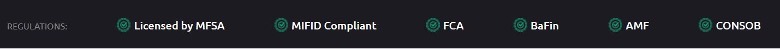

In addition to operating from a safe location, it also carries numerous licenses, as we mentioned earlier in our NSFX review. At the time of writing, the broker is MIFID-II compliant and regulated by BaFIN, MFSA, ACP, Consob, CNMV, and FINANSTILSYNET. That leaves little room for doubt regarding the broker’s intentions. However, we will devote a later part of this review to investigating its security more thoroughly.

It offers three accounts, with the lowest requiring a $300 deposit. On top of that, there is a demo account option that you can use for an in-depth exploration of the broker’s service. However, the options the broker provides aren’t accounts in the true sense. While that may sound confusing, we will elaborate in the accounts section of our NSFX review.

Funding your account with the broker is easy, as it offers numerous options for deposits. The current options are Visa, MasterCard, Maestro, Skrill, Neteller, Fast Bank Transfer. All of these are also available for withdrawals.

The broker offers two platforms: MetaTrader 4 and JForex. Both are solid tools, with MetaTrader being the more popular option by far. However, they both offer dated user interfaces, making them less appealing to newer traders.

Lastly, it’s important to note that NSFX offers its assets as CFDs. Its selection includes forex, indices, metals, and energies. As you can see, it lacks crucial markets, such as stocks and crypto, as well as some commodities.

NSFX Review of Trust: Our Verdict

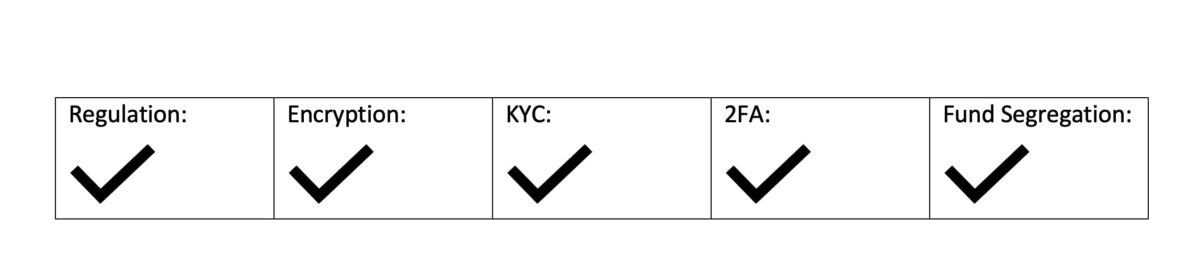

As you can see from the pros and cons section of our NSFX review, security is one of its main strengths. On a technical level, the broker leaves absolutely no room for doubt about its honesty and well-intendedness.

It’s regulated by numerous regulators and adheres to the EU’s MiFID regulation, that’s meant to protect traders. We’ve personally verified all of its license numbers and everything is in order, proving the validity of the documents.

Additionally, it employs all standard account protection measures, including 2FA and encryption. As long as you follow internet security guidelines, your account should be safe.

It also follows general safety procedures, such as KYC, which keeps those that would abuse the system away from the broker. And there’s also the fact that it keeps its funds segregated from user funds, protecting customers in the case of a crisis.

And on top of the technical details we mentioned in this part of our nsfx.com review, it simply behaves well. It presents information clearly and doesn’t mislead clients.

However, we will note that we have found reports of the broker preventing withdrawals. Considering the broker’s experience and the presence of numerous regulators, we find the stories doubtful. Such reports are often the result of users misinterpreting their obligations or aiming to hurt the broker due to service dissatisfaction or frustration. Still, we can’t simply ignore these stories, so we do recommend some caution.

| NSFX Warning:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with NSFX. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Getting Started With NSFX

The registration process on NSFX is mostly straightforward and doesn’t require a ton of initial data. Of course, as you verify your account, you will need to show some form of personal ID for the broker’s KYC procedures.

The thing we like is that the registration process allows you to choose your currency right away. That preemptively avoids deposit conflicts and conversion fund losses.

However, we don’t like the fact that you need to choose your account right away. We feel like that puts unnecessary pressure on users and may confuse new traders who haven’t explored the service fully.

NSFX Review: Rating of Accounts and Funding

![]()

As we previously mentioned in our NSFX review, the broker boasts a good range of funding options. It offers deposits and withdrawals via Visa, MasterCard, Maestro, Skrill, Neteller, Fast Bank Transfer. For deposits, all methods are fee-free, but if you wish to withdraw via Skrill or Neteller, the broker imposes a 2.9% charge.

And as we also mentioned, the broker has an account minimum of $300, provided you choose the MT4 Fixed account. If you wish to go for MT4 ECN, it jumps to $3,000, and with the JForex account, it jumps to $5,000.

This is where NSFX’s cracks begin to show, as there are numerous issues with the account structure.

You are locked into one account upon registration – As we mentioned, you choose your account when you register, which creates confusion

They aren’t true accounts – Usually, accounts are there to bring variety to the service and award more loyal users. However, with this structure, the accounts lock you into a platform and a specific type of service.

The prices are steep – Other than the MT4 Fixed account, the prices are high for what you get in return.

Altogether, our main complaint here is that the accounts are there to limit users and stifle the service. Because of that, every account feels like it loses something compared to the other options rather than feeling like a strong standalone tool.

For us, the MT4 Fixed account here is the clear winner, but even it comes with strict limitations. However, in the following part of our nsfx.com review, we will present the account options for you to decide for yourself.

Account specifications at NSFX

MT4 FIXED

-

- Account Minimum: $300

- Lot Size (FX): 100,000 Units

- Minimum Trade: 0.01 Lot

- Maximum leverage 1:50

- Spreads: Fixed

- Instruments: FX Majors

- Deposit Currency: USD, EUR, GBP

- Deposit Options: Bank Wire, Credit Card, Skrill

- Margin Call: 20%/50%

- Mac/Linux Friendly: Web Based

- Live Support: 24/5

- Daily Analysis: Free

- Execution: Instant Execution

- Hedging: Allowed

- Scalping: Not Allowed

- Expert Advisors: Disabled

- Personal Account Manager: Yes

- Commissions on Trades: No Commissions

MT4 ECN

-

- Account Minimum: $3,000

- Lot Size (FX): 100,000 Units

- Minimum Trade: 0.01 Lot

- Maximum leverage 1:50

- Spreads: Variable Spreads

- Instruments: 50+ Currency Pairs, Commodities, Indices

- Deposit Currency: USD, EUR, GBP

- Deposit Options: Bank Wire, Credit Card, Skrill

- Margin Call: 20%/50%

- Mac/Linux Friendly: Web Based

- Live Support: 24/5

- Daily Analysis: Free

- Execution: Market Execution

- Hedging: Allowed

- Scalping: Allowed

- Expert Advisors: Enabled (MQL)

- Personal Account Manager: Yes

- Commissions on Trades: $8 per lot R/T

JForex

-

- Account Minimum: $5,000

- Lot Size (FX): 100,000 Units

- Minimum Trade: 0.01 Lot

- Maximum leverage 1:50

- Spreads: Variable with Market Depth

- Instruments: 50+ Currency Pairs, Commodities, Indices

- Deposit Currency: USD, EUR, GBP

- Deposit Options: Bank Wire, Credit Card, Skrill

- Margin Call: 20%/50%

- Mac/Linux Friendly: Variable with Market Depth

- Live Support: 24/5

- Daily Analysis: Free

- Execution: Market Execution

- Hedging: Allowed

- Scalping: Allowed

- Expert Advisors: Enabled (Java)

- Personal Account Manager: Dedicated

- Commissions on Trades: $8 per lot R/T

As you can see from this part of our NSFX review, it feels like the broker intentionally limits its accounts to prevent you from getting a service that’s “too good”. For example, the MT4 Fixed account offers fee-free trading, but scalping is prohibited. On top of that, the account can only access forex assets.

As for the other two, they get access to scalping, but the relatively high fees and variable spreads make it an unviable option. On top of that, the prices are ridiculous for what is a sidegrade rather than an upgrade over the cheapest account.

That’s why we believe that the broker’s age is beginning to show. While such account structures were standard in the past, most brokers nowadays offer a much more flexible experience with much higher rewards for luxury investors.

Platforms and Trading Experience on NSFX

By the merit of the accounts being tied to the platform, we’ve already mentioned the platforms a bit in our NSFX review. However, here, we would like to clarify that while we don’t like the accounts, the platforms are good. MetaTrader 4 has been the industry standard for years, and JForex is a nice addition.

Our only complaint is that we would have preferred a more modern platform to supplement MT4. The fact that both platforms are dated interface-wise may deter those used to trading on newer software. However, here’s a comprehensive list of the key platform features that proves they are still potent:

| MetaTrader 4 | JForex |

| · Powerful Charting Tools

· Wide Range of Indicators · Custom Indicators · Alarms and Signals · Expert Advisors |

· Powerful Charting Tools

· Wide Range of Indicators · Custom Indicators · Alarms and Signals · Expert Advisors · One click trading · Pattern Analysis assistant |

JForex is the more powerful tool here, as it’s built on MT4 fundementals, with numerous upgrades. However, we don’t believe it’s worth the $2,000 more the broker requires for it. Of course, that doesn’t apply if you plan to deposit more than $5,000 regardless, in which case, you may as well go for the standard option.

Trading Experience

Unfortunately, as we mentioned earlier in our NSFX review, the trading experience isn’t great. Despite a solid platform setup, the broker’s account structure and overall trading conditions severely damage the service.

First off, the maximum leverage is 1:50, which is often too small for startegies that employ leverage to bolster earnings. On top of that, the market selection is too small to craft a solid portfolio. Additionally, there are no supplementary trading features, even on the more expensive accounts.

And while we hate to sound like a broken record, most of the miserable trading experience comes from the accounts. While the conditions stifle trading, they wouldn’t be too bad if the accounts didn’t put traders in extremely rigid boxes.

You can either choose to have barely any assets with a solid fee structure or to have slightly more assets with horrible charges. The fact that your account choice comes before you even start using the service, along with it locking you into a platform choice, is just the final nail in the coffin.

NSFX Review of Customer Support

In this final part of our NSFX review, we would like to look at how the broker communicates. We don’t have much to complain about here, as the broker covers all the bases with multiple phone lines, live chat representatives, and emails. There are even multiple emails for different purposes, such as marketing and sales enquiries.

The support team is available 24/5, and while we would prefer a 24/7 availability, we realize the former is standard for most of the industry. You can access the broker’s full contact info below.

| Phone Numbers | Emails | Live Chat |

| UK: (+44) 330 8080 098

Spain: (+34) 9 3220 0491 Germany: (+49) 696 4350 0009 Russia: (+8) 800 100 6295 |

Client Support: [email protected]

Sales Enquiries: [email protected] Partners Program: [email protected] Marketing Enquiries: [email protected] |

Available on nsfx.com |

NSFX Review Summary and Verdict

The only thing that NSFX does noticeably better than most brokers is security. Its numerous regulators and overall safety measures all but guarantee that you won’t see any issues. However, a safe but miserable trading experience isn’t nearly worth it in our eyes.

The registration process is needlessly complicated, making you choose an account straight away. The accounts are limiting, locking you out from certain features straight away. Additionally, they aren’t nearly powerful enough to make up for that.

The platforms, while solid, are dated, with numerous more intuitive and better-looking options out there. The nature of the platforms also locks mobile and web users from accessing their key features, making the non-terminal experience rather rudimentary.

That, mixed with limited asset choices, weak leverage, and a lack of any extra features, places the broker in the slightly below-average category. Its safety is impressive, but there are numerous brokers that are just as safe while offering much more to traders.

Alternatives to NSFX

Here are some of the brokers that share NSFX’s strong points while also performing well where it’s weak. You should look through these, as we consider them a better choice for most traders.

Enthusiastic customer service

Enthusiastic customer service. They always show compassion and enthusiasm in dealing with me.

Did you find this review helpful? Yes No

Transparent broker

Terms are well explained at the start including possible risks. I don’t see any gray areas, transactions are transparent.

Did you find this review helpful? Yes No

Excellent signals

Excellent trading signals. I am getting good profit monthly. I would definitely keep their services.

Did you find this review helpful? Yes No

Easy withdrawals

Easy to withdraw money, no hassles and easy requirements for verification.

Did you find this review helpful? Yes No

Great and trusted

Good and trusted company for forex brokerage. They are experienced and skilled in the forex market.

Did you find this review helpful? Yes No

Good services

Good overall service. I will surely keep them as my trading partner.

Did you find this review helpful? Yes No

Happy with my profit

Easy deposit and withdrawal process. No much hassles and no fancy documnets to provide. I am happy with me profit so far.

Did you find this review helpful? Yes No

Good trading software

Good trading software. There are so many good tools that really helps make successful trades. Signals are also spot on.

Did you find this review helpful? Yes No

Excellent broker company

Excellent trading company. They do not guarantee profit but I get good profit consistently.

Did you find this review helpful? Yes No

Good profit

I was lucky enough to have them as my trading broker. I gain good profit.

Did you find this review helpful? Yes No

Great brokers

They are worthy of my trust, money and time. Responsible, honest and dedicated trading brokers.

Did you find this review helpful? Yes No

Good broker

Fun trading environment. I have no complaints with all of the services.

Did you find this review helpful? Yes No

No regrets joining

No regrets joining the team. Trading terms are fair, good leverage and tight spreads, too.

Did you find this review helpful? Yes No

Good trading broker

I am happy to see progression on my trades. It is one of the best brokers I have dealt with. Signals are always good and services are, too.

Did you find this review helpful? Yes No

The best

I can consider this as one of the best forex brokers. Services are very reliable and signals are profitable.

Did you find this review helpful? Yes No

Great trading experience

This broker handled trading matter seriously to make sure I will have great experience trading with them. I am glad to use them as my main broker now, spread is competitive, execution is fast, deposit and withdrawal are seamless.

Did you find this review helpful? Yes No

Extraordinary brokers

Extraordinary brokers. They are well-versed in the forex market. I am so lucky to have them as my trading adviser. They really are a great help.

Did you find this review helpful? Yes No

Affordable trading instruments

They’ve got affordable trading instruments offered here. Services are awesome and best of all I am gaining good profit from my trades.

Did you find this review helpful? Yes No

Good services

I am done with my first withdrawal. It is smooth and fast. Hope services will be consistently good.

Did you find this review helpful? Yes No

Good broker

They are good in what they do. They never settle for less but maximize the potential earning. I continuously gain profit from my currency pairs.

Did you find this review helpful? Yes No

Excellent services

I can rate the services as excellent. Withdrawals are always fast and easy. Customer service is also efficient.

Did you find this review helpful? Yes No

Happy with profit

Decent broker to start off. Signals are consistently reliable. I am happy with my profit.

Did you find this review helpful? Yes No

Good broker advise

I never worry of losing money. I confidently place my trades becaused I am getting good advise from the broker.

Did you find this review helpful? Yes No

Extraordinary brokers

Extraordinary brokers. They are well-versed in the forex market. I am so lucky to have them as my trading broker.

Did you find this review helpful? Yes No

Perfect broker company

Prompt responses from customer service and easy withdrawal process. I am glad, I have picked a good broker to trade with.

Did you find this review helpful? Yes No

One of the best

I can consider this broker as one of the best forex brokers. I got a good profit and was able to withdraw it quickly. All services from this broker are always good.

Did you find this review helpful? Yes No

Outstanding software

Outstanding broker signals and good trading software. They’ve made trading easier and more productive for me.

Did you find this review helpful? Yes No

Good and reliable

A good & reliable company. I’ve opened a minimum account here and began to trade. After a month of trading, I ordered a withdrawal, it was received quickly, after another month I sent an application for the second one, it also came in time, and now after six months of regular withdrawals, I never had any trouble getting my money.

Did you find this review helpful? Yes No

Reliable signals

Reliable signals and good services. So far, for the past eight months, I am fully satisfied with the services. I was able to observe minimal slippage and they also offer competitive spreads.

Did you find this review helpful? Yes No

My favorite broker

This has been my favorite broker. SIgnals and services are all worth it.

Did you find this review helpful? Yes No

Good broker

They have really good mobile application to make money online. I love the offers, results are great.

Did you find this review helpful? Yes No

Swift withdrawals

What I like the most about this forex broker is that they process withdrawals swiftly. I never encountered any problems on all of my withdrawals.

Did you find this review helpful? Yes No

On time withdrawals

I was able to get my withdrawals on time and no hassle at all. The signals are worthwhile, it gives me good profit.

Did you find this review helpful? Yes No

Good broker company

Good broker company. No withdrawal issues.

Did you find this review helpful? Yes No

Extremely good broker

Extremely helpful customer service and great trading signals. I am so much happy with my profit and satisfied with their tools and services.

Did you find this review helpful? Yes No

Overall very impressed

I am overall impressed with all of the services. The signals are profitable and accurate.

Did you find this review helpful? Yes No

Good broker

Good trading broker. I can give them the highest ratings possible based on the trading results they give me.

Did you find this review helpful? Yes No

Good profit

I am lucky to have them as my forex brokers. I have been gaining a really good profit. And had no withdrawal issues so far.

Did you find this review helpful? Yes No

Fast withdrawals

I get my withdrawals on time and sometimes earlier. Their customer services are enthusiastic and brokers are highly skilled in the forex market.

Did you find this review helpful? Yes No

Impressive broker

Impressive broker signals and services. I have just started trading with this broker sometime last month but as early as now I can see good profit and it progresses.

Did you find this review helpful? Yes No

Good broker

A good broker service I have ever experienced. Customer service are always prompt and attentive. Sound broker signals and efficient tools as well.

Did you find this review helpful? Yes No

Happy to recommend

Never had any issues with the services so far. Happy to recommend.

Did you find this review helpful? Yes No

Excellent

Services are always excellent and effective. I never had issues with any transactions.

Did you find this review helpful? Yes No

Good trading company

Good trading company! Have traded with them for a while now and I am fully satisfied with the services and profit.

Did you find this review helpful? Yes No

Outstanding brokers

Outstanding forex trading broker. The signals are profitable and services are efficient. I get good leverage and tight spreads.

Did you find this review helpful? Yes No

Withdrawal transparency is important

Withdrawal transparency is important to me, and this broker has consistently provided clear records.

Did you find this review helpful? Yes No

Updated trading tools and features.

This broker’s emphasis on continuous improvement reflects well in their updated trading tools and features.

Did you find this review helpful? Yes No

NSFX's brokerage ensures a seamless withdrawal process

NSFX’s brokerage ensures a seamless withdrawal process, reflecting their commitment to client convenience

Did you find this review helpful? Yes No

I've found the profit projections to be realistic

I’ve found the profit projections to be realistic, setting reasonable expectations for my trading outcomes

Did you find this review helpful? Yes No

The withdrawal process is straightforward

The withdrawal process is straightforward and doesn’t involve unnecessary delays.

Did you find this review helpful? Yes No

The support team is attentive

The support team at this platform has been attentive and courteous in assisting me.

Did you find this review helpful? Yes No

The trading tools' user interface is intuitive

The trading tools’ user interface is intuitive, making navigation and execution seamless.

Did you find this review helpful? Yes No

Nice broker overall

The support team’s knowledge and guidance have been valuable in enhancing my trading strategies.

Did you find this review helpful? Yes No

different trading styles.

I find the trading tools on this platform to be versatile and adaptable to different trading styles.

Did you find this review helpful? Yes No

NSFX's support team has been responsive

NSFX’s support team has been responsive and helpful in addressing my inquiries and concerns.

Did you find this review helpful? Yes No