General Information

Broker Name: Hk-markets

Broker Type: Forex & CFDs

Country: /

Operating since year:

Regulation: /

Address: /

Broker status: Active

Customer Service

Phone: /

Email: [email protected]

Languages: English

Availability: 24/7

Trading

The Trading platforms: Proprietary

Trading platform Time zone: /

Demo account: No

Mobile trading: Yes

Web-based trading: Yes

Bonuses: Yes

Other trading instruments: Yes

Account

Minimum deposit: $0

Maximal leverage: 1:400

Spread: Floating From 0.0 Pips

Scalping allowed: Yes

Hk-markets Review – Is it scam or legit?

Welcome to our comprehensive Hk-markets review! If you’re looking for a reliable CFD broker with a strong focus on community and continuity, you’ve come to the right place. With nine years of experience in the industry, the broker has established itself as a trusted platform for traders worldwide.

One of the standout features of the broker is its commitment to fostering a thriving trading community. With six offices spread across the globe, they have built a network that connects traders from different backgrounds, allowing for a diverse and enriching trading experience. This emphasis on community sets them apart and creates an environment where traders can learn, share insights, and grow together.

However, community isn’t the only thing we want to emphasize in this Hk-markets review. The broker also understands that trading conditions play a crucial role in the success of their clients. That’s why they offer powerful trading conditions that cater to the needs of both novice and experienced traders.

One notable advantage is the absence of commission fees, allowing traders to focus on their strategies without worrying about additional costs. With over 200 assets available for trading, including forex, stocks, indices, commodities, and cryptocurrencies, there is a wide spectrum of opportunities for traders to explore and diversify their portfolios.

The broker has also made it a priority to ensure user-friendly and reliable trading platforms. Their intuitive and feature-rich interface allows traders to execute trades seamlessly, analyze market trends, and access real-time data.

Stay tuned as our Hk-markets review digs deeper into the broker’s service, exploring their account types, trading resources, and more. In the next sections, we will provide an unbiased and in-depth analysis of this broker to help you make an informed decision.

Hk-markets Review of Pros and Cons

Pros

- Strong community focus 👨👩👧👦

- No commission trading 💱

- Wide range of assets 💸

- User-friendly trading platforms 💹

- Reliable customer support 🫶

Cons of Hk-markets:

- Limited research and educational resources 🎓

- Restricted availability in certain regions 🌐

Hk-markets Review: Is it Safe to Invest With?

Security is a top priority for the broker, and they leave no stone unturned when it comes to protecting their clients and ensuring a safe trading environment. With the commitment to industry-standard safety procedures we’ll see in this part of our Hk-markets review, the broker takes comprehensive measures to safeguard the integrity of their platform and the privacy of their users.

To ensure secure communication and data protection, the broker employs state-of-the-art encryption protocols. This means that all information transmitted between traders and the platform is encrypted, minimizing the risk of unauthorized access or data breaches.

In addition to encryption, it implements additional security layers, such as two-factor authentication (2FA). By enabling 2FA, traders have an extra layer of protection when accessing their accounts, making it significantly more challenging for unauthorized individuals to gain access.

Another essential aspect for this part of our hk-markets.com review is fund segregation. They strictly adhere to regulatory requirements by segregating client funds from the company’s operational funds. This practice ensures that even in the unlikely event of the broker experiencing financial difficulties, clients’ funds remain protected and separate.

The broker also takes proactive measures to maintain the safety of its trading community. They have implemented a robust Know Your Customer (KYC) procedure, which helps verify the identities of their clients and prevents fraudulent activities.

As you can see in this part of our Hk-markets review, when it comes to security, it goes above and beyond to instill confidence in their traders. By adhering to industry best practices, employing advanced encryption, implementing 2FA, segregating funds, and conducting rigorous KYC procedures, the broker demonstrates their unwavering commitment to maintaining a secure platform and protecting the interests of their trading community.

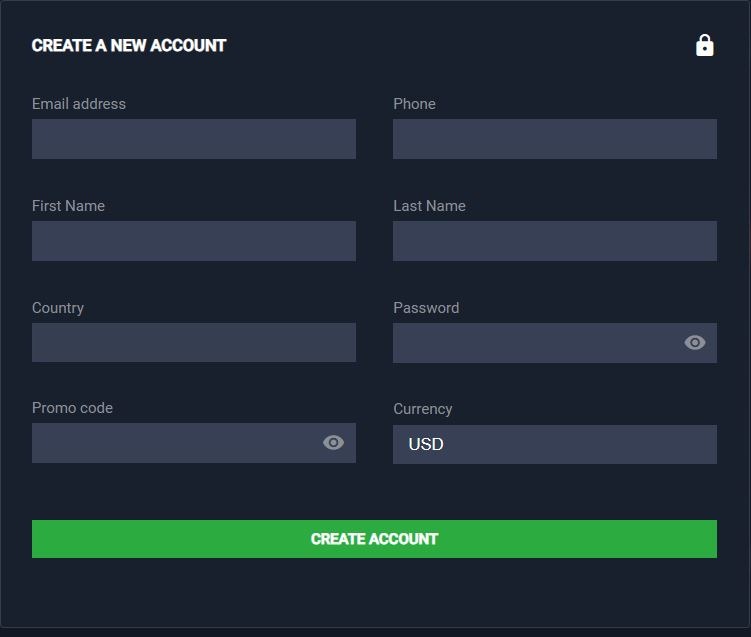

Hk-markets Registration

Registering with Hk-markets is a straightforward and hassle-free process that ensures you can quickly start your trading journey. To begin, simply click on the registration button on their website and fill out the required information. The fields only require basic info, so you won’t be expected to hand over any sensitive personal data.

During the registration process, you have the opportunity to set your base currency, allowing you to trade in your preferred currency right from the start. This customization feature adds convenience and flexibility to your trading experience.

Additionally, if you have any promo codes, you can enter them during the registration process to take advantage of any available bonuses or promotions. As we said earlier in our Hk-markets review, it values its clients and often provides promotional offers to enhance their trading opportunities.

Once you have completed the registration form, you will need to undergo a verification process. The broker’s team works fairly quickly, as verification should be done within 72 working hours at most.

Hk-markets Accounts

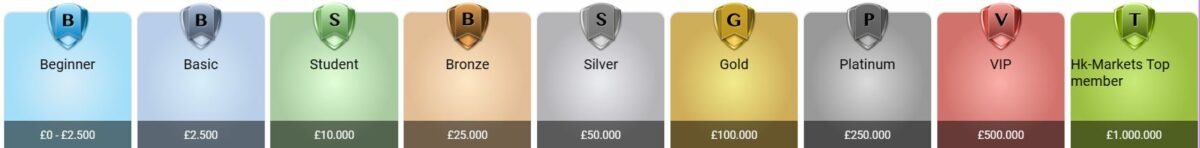

Like most online brokers, Hk-markets has different account types to accommodate for different trading styles and budget preferences. However, it takes a distinct approach which sets it apart from most similar companies.

Namely the first difference is that the broker doesn’t have a minimum deposit. Its first account ranges from 0-2,500 of a supported currency. Granted, you can’t trade with $0, so the effective minimum is 1. That, along with the fact that there isn’t a withdrawal minimum, makes the broker much easier than its peers to try out.

However, the second thing that we want to emphasize in this part of our hk-markets.com review is the account structure. Normally, you have scaling conditions that sometimes feel intentionally omitted from lower accounts to force you to deposit more. However, with this broker, the only the leverage scales, as the rest of the features are maximized from the start.

There are two aspects that we particularly like about this approach. First off, it provides a direct and easily measurable incentive to upgrade. Choosing an account is easy when you measure against what you’re willing to deposit and the leverage you want. Similarly, upgrading your leverage is a meaningful proposition without creating a massive imbalance in the service.

Additionally, it shows more of the user care we emphasized earlier in our Hk-markets review. By restricting leverage for users on stricter budgets, the broker limits the chance of them exceeding their risk tolerance. We’ve all heard margin trading horror stories, and it’s good for the broker to be proactive about that issue.

Account specifications at hk-markets.com

Beginner

-

- Min. Deposit: £0

- Fx Majors leverage 1:50

- Fx Exotics leverage 1:25

- Commodities leverage 1:5

- Indices leverage 1:5

- Stocks leverage 1:5

- Crypto leverage 1:1

Basic

-

- Min. Deposit: £2.500

- Fx Majors leverage 1:50

- Fx Exotics leverage 1:25

- Commodities leverage 1:5

- Indices leverage 1:5

- Stocks leverage 1:5

- Crypto leverage 1:2

Student

-

- Min. Deposit: £10.000

- Fx Majors leverage 1:100

- Fx Exotics leverage 1:50

- Commodities leverage 1:10

- Indices leverage 1:10

- Stocks leverage 1:10

- Crypto leverage 1:3

Bronze

-

- Min. Deposit: £25.000

- Fx Majors leverage 1:200

- Fx Exotics leverage 1:100

- Commodities leverage 1:20

- Indices leverage 1:20

- Stocks leverage 1:10

- Crypto leverage 1:4

Silver

-

- Min. Deposit: £50.000

- Fx Majors leverage 1:300

- Fx Exotics leverage 1:200

- Commodities leverage 1:50

- Indices leverage 1:50

- Stocks leverage 1:15

- Crypto leverage 1:5

Gold

-

- Min. Deposit: £100.000

- Fx Majors leverage 1:400

- Fx Exotics leverage 1:300

- Commodities leverage 1:100

- Indices leverage 1:100

- Stocks leverage 1:50

- Crypto leverage 1:6

Platinum

-

- Min. Deposit: £250.000

- Fx Majors leverage 1:500

- Fx Exotics leverage 1:400

- Commodities leverage 1:200

- Indices leverage 1:250

- Stocks leverage 1:100

- Crypto leverage 1:7

VIP

-

- Min. Deposit: £500.000

- Fx Majors leverage 1:500

- Fx Exotics leverage 1:400

- Commodities leverage 1:200

- Indices leverage 1:250

- Stocks leverage 1:100

- Crypto leverage 1:8

Hk-Markets Top member

-

- Min. Deposit: £250.000

- Fx Majors leverage 1:500

- Fx Exotics leverage 1:400

- Commodities leverage 1:200

- Indices leverage 1:250

- Stocks leverage 1:100

- Crypto leverage 1:9

Hk-markets’ Platform

As we already emphasized earlier in our hk-markets.com review, the broker’s platform emphasizes accessibility and function. On the broker’s website, it lays out the main features of the platform, so it’s easy to understand how it looks and feels.

One standout is the direct deposit via the platform. You won’t need to redirect to five different web locations just to put down money into your account. The direct deposits smoothen the trading experience and make it more linear, also making good opportunities easier to capitalize on.

The broker also has numerous analytical sources and tools within its platform. As such, you’ll be able to read news and get signals while utilizing a wide array of visual indicators for your analyses. It’s a Swiss army knife-type platform where it covers a lot of different trading tools.

Additionally, it’s available both as a web platform and a mobile platform, on top of the more traditional trading terminal. That allows traders more freedom when it comes to how they wish to experience the service. On top of that, as we once again emphasize user-friendliness in this Hk-markets review, it makes the service more suitable for those that tend to trade in the move.

Hk-markets Pro and Con Explanation

Before we end this review, we would like to once again recount the positives and negatives of the broker. That way, we can paint an accurate picture of the totality of the broker’s service before we make our final verdict.

The broker is extremely focused on its trading community, which is the biggest advantage a broker can even have. It shows us time and time again that it values its users and cares about the long term. Its nine years of experience while maintaining are a testament to that, and user care is ingrained in every part of the service.

However, that’s not nearly the end for this part of our Hk-markets review. The broker also has a wide range of powerful tools and conditions that help traders succeed. There are no commissions, making the trading experience entirely transparent, and the broker boasts a wide array of assets. On top of that, its account structure allows users to employ an appropriate level of leverage in their trading.

All that together makes for a universally fantastic trading experience. However, what elevates it beyond regular brokerages are also the small things that make the service feel much more meticulously crafted. For example, there’s no minimum deposit, so literally anyone with a dollar to their name can enjoy the broker. On top of that, the smoothness of the platform and the support team’s care and responsiveness guarantee a pleasant experience.

Cons

As for the cons, they are fairly minor, especially in the face of everything we just mentioned. The first, as we mentioned earlier in our Hk-markets review, is that it does have some geographical restrictions. Check before you try and sign up, but if they don’t apply to you, this isn’t a con at all.

There are also some limitations on the broker’s educational materials. We should note that they are present but not as robust as with some other service providers. However, we usually suggest keeping your trading education and your brokers separate anyway, so we don’t consider that a significant drawback either.

Hk-markets Review Conclusion

As we outlined the main advantages and disadvantages in the previous part of our Hk-markets review, there’s not much left to say. The broker is one of the best places to trade right now, as it doesn’t only provide a safe trading environment with powerful tools but shows extraordinary user care.

Altogether, we’d expect that the vast majority of traders will be extremely satisfied with what the broker offers. Its lack of minimum deposit and withdrawal amount makes it extremely easy to try out, and we urge you to do so.

Skilled broker

I am dealing with skilled trading brokers. I also love the tools and I love the services.

Did you find this review helpful? Yes No

Quick support

They have quick and understanding trading support and skilled brokers. recommended.

Did you find this review helpful? Yes No

Amazing signals

They are one of the best trading brokers to deal with. Signals are amazing.

Did you find this review helpful? Yes No

Consistently profitable

One of the best brokers for forex. They are transparent and enthusiastic. Consistently profitable.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker. I was able to withdraw profit monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

Satisfied with this broker service

Good customer service, a stable platform, fast execution, and hassle-free withdrawals.Overall satisfied with this broker’s service.

Did you find this review helpful? Yes No

The best broker

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Satisfied

I am fully satisfied with what I get from this broker. It is a good source of income.

Did you find this review helpful? Yes No

Good broker performance

Good overall performance. I am happy with my profit and satisfied with the services.

Did you find this review helpful? Yes No

Great offers

They have a really good mobile application to make money online. I love the offers, the results are really great.

Did you find this review helpful? Yes No

Good broker to trade with

The best choice to trade forex with. Signals and services are all worthwhile.

Did you find this review helpful? Yes No

Happy with this broker

I am dealing with very responsible brokers and good customer service. I am overall satisfied and happy with this broker company.

Did you find this review helpful? Yes No

I can't thank this brokerage enough

I can’t thank this brokerage enough for the invaluable educational resources they provide. I’ve learned so much about trading strategies and risk management, which has significantly boosted my confidence.

Did you find this review helpful? Yes No

They are very responsive.

They are very responsive. You can chat directly with your account manager and get any information you want immediately. They are also prompt and attentive to all my trading concerns. I’m glad trading with them

Did you find this review helpful? Yes No

Good currency trading signals

Awesome currency trading signals. It made trading easier for me. I can fully rely on this to get me good profit.

Did you find this review helpful? Yes No

Great broker signals

I like trading with this broker. withdrawal is always smooth. Been with them for more than a year and the signals are really great.

Did you find this review helpful? Yes No

Good broker

This is the place for investments. There are so many great opportunities. Both services and results are good.

Did you find this review helpful? Yes No

Good broker

I had fun trading with this broker. I get good trading returns and I am dealing with good customer service.

Did you find this review helpful? Yes (1) No

Great broker

Great brokers. Excellent signals. They never fail to amaze me with good trading results and great profits.

Did you find this review helpful? Yes (1) No