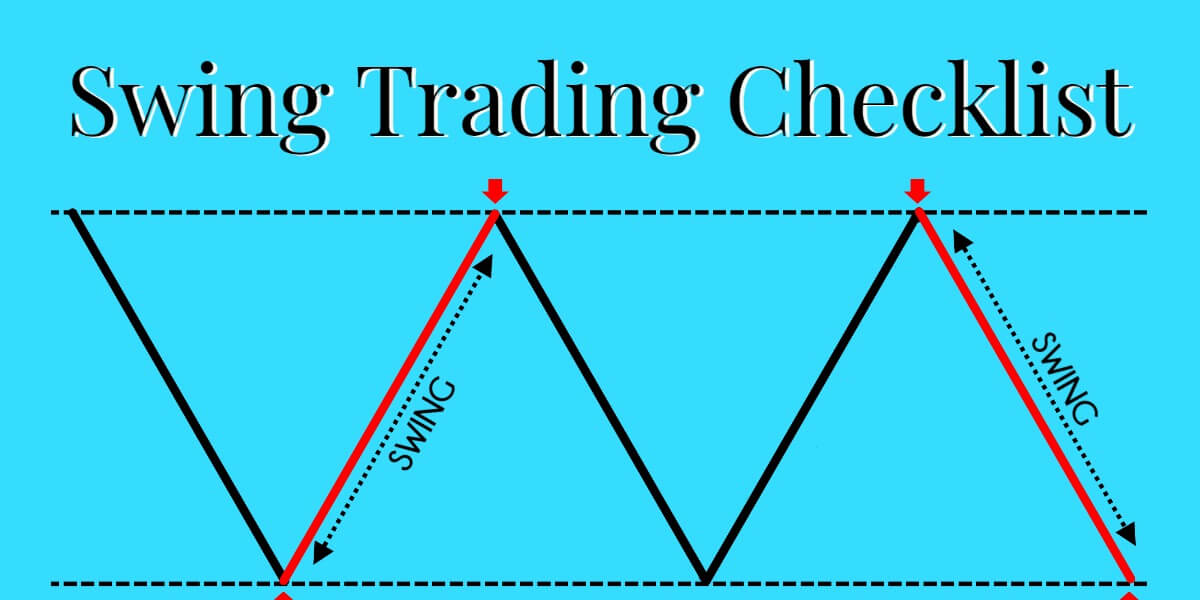

Swing trading leverages market trends to capture profits from price movements over days to weeks.

Unlike day trading, swing traders are not confined to closing out positions within a single session, allowing them to ride short-term trends and apply nuanced strategies.

This approach offers the flexibility to exploit bullish and bearish market environments. It is a popular choice for traders who cannot monitor their positions throughout the day but still seek to benefit from market fluctuations.

What Is Swing Trading?

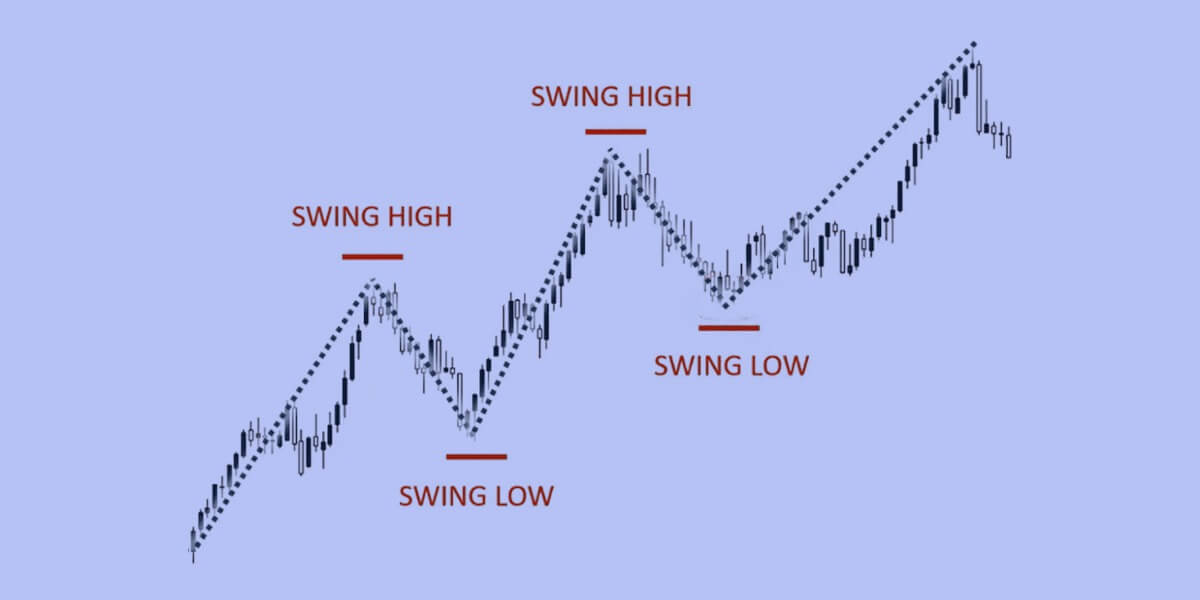

Swing trading engages with the market rhythm, utilising technical analysis to identify upswings or downturns in asset prices for entry and exit positions. This strategy capitalises on trends and market volatility, focusing on capturing gains from short- to medium-term price movements.

Traders often use charts, trend lines, and indicators to spot patterns and make informed decisions. Unlike day traders who aim to profit from minute-to-minute changes, swing traders typically hold positions for several days to weeks, allowing them to benefit from more significant price shifts.

The essence of swing trading lies in its ability to adapt to various market conditions. By identifying potential swing points where the price will likely reverse or accelerate, traders can position themselves to ride these waves for profit. This method requires a keen understanding of technical analysis tools such as moving averages, Relative Strength Index (RSI), and Fibonacci retracements, which help predict potential market moves.

The Risks Involved in Swing Trading

Swing trading, a popular strategy among traders seeking short to medium-term gains, offers opportunities for profit within volatile market conditions.

However, it also comes with inherent risks that traders must navigate to safeguard their investments:

1. Overnight and Weekend Market Risk

One of the primary risks associated with swing trading is the exposure to overnight and weekend market movements. Since positions are held beyond a single trading session, unexpected news or events occurring outside regular trading hours can significantly impact the market, potentially leading to gaps in price when the market reopens. These gaps can result in substantial gains or losses, making it essential for swing traders to stay informed about global events and market sentiment.

2. Position Risk

Another critical risk factor is position risk, which arises when trades move against expectations. Even with thorough analysis, market movements can be unpredictable, and positions can quickly turn unprofitable. This unpredictability necessitates stringent exit strategies and a robust understanding of market dynamics. Traders must be prepared to cut losses swiftly to prevent minor setbacks from escalating into significant financial blows.

3. The Necessity of Robust Market Understanding

Swing trading demands a solid grasp of market behaviour and the ability to interpret technical indicators accurately. Inexperienced traders might misread signals or fail to anticipate market reversals, leading to poor trading decisions. Therefore, continuous learning and adapting to new market information is crucial for minimising risks and enhancing trading performance.

Comparing Swing Trading and Day Trading

Active trading strategies, such as swing trading and day trading, offer traders various avenues for capitalising on short-term market movements.

However, each approach carries its own set of risks and requires distinct skill sets:

Time Horizon and Trade Frequency

While both active trading strategies, day trading and swing trading, differ significantly in their approach and execution, day trading involves rapid trades within a single market day, with traders executing multiple trades within hours or minutes. This requires constant monitoring of the market and quick decision-making to capitalise on short-term price movements.

In contrast, swing trading allows for trades around extended market shifts, enabling strategic patience. Swing traders typically hold positions for days to weeks, providing more flexibility to analyse trends and make calculated moves.

Strategic Patience and Decision-making

Swing trading offers the advantage of strategic patience, allowing traders to wait for optimal entry and exit points without the pressure of closing positions by the end of the trading day. This extended timeframe can lead to more informed decision-making, as traders can consider broader market trends and factors. However, both methods demand high discipline and a well-thought-out trading plan.

Similarities in Analytical Approaches

Despite these differences, swing and day trading rely heavily on technical analysis. Traders use charts, indicators, and patterns to predict market movements and identify profitable opportunities. Whether aiming for short-term gains within a day or riding longer-term trends over several days, accurately interpreting market data remains critical.

Effective Risk Management Strategies

Effective risk management is crucial for traders to navigate the unpredictable nature of financial markets and safeguard their investments.

By implementing sound risk management strategies, traders can mitigate potential losses and increase the likelihood of long-term profitability:

1. The 1% Rule

Adherence to the 1% rule is a cornerstone of effective risk management in swing trading. This rule limits the risk on any single trade to no more than 1% of the total account capital, mitigating the potential impact of any single loss.

By calculating the appropriate position size based on this rule, traders can ensure that no single trade significantly harms their portfolio, allowing them to survive losing streaks and maintain long-term profitability.

2. Strategic Stop-Loss Orders

Placing strategic stop-loss orders is another vital risk management tactic. These are predetermined exit points for trades designed to curb potential losses and safeguard capital from significant downturns.

By setting stop-loss orders, traders can limit their losses on any given trade and protect their investments from severe market reversals. This disciplined approach helps in maintaining a balanced and controlled trading strategy.

3. Ensuring Portfolio Diversification

Diversification is essential for diluting the adverse effect of any particular asset’s underperformance. By spreading investments across various assets and sectors, traders can reduce the overall risk of their portfolio. This strategy ensures that poor performance in one area is offset by gains in another, contributing to more stable and consistent returns over time. Diversification also allows traders to take advantage of different market conditions and opportunities, enhancing the profit potential.

Creating a Profitable Trading Environment

Creating a profitable trading environment requires strategic analysis, precise timing, and disciplined execution.

By leveraging technical analysis and market momentum, traders can identify lucrative opportunities and optimise their trading strategies for success:

Leveraging Technical Analysis

Utilising technical analysis is crucial for uncovering patterns that forecast market movements, enabling the identification of optimal entry and exit points. Indicators such as moving averages, Bollinger Bands, and MACD (Moving Average Convergence Divergence) provide valuable insights into market trends and momentum. By interpreting these signals accurately, traders can make well-informed decisions that increase their chances of success.

Timing with Market Momentum

Harnessing market momentum is essential for timing trades accurately. Momentum indicators help traders understand the strength and direction of market trends, distinguishing between potential profit and loss through precise entry and exit points. By aligning trades with the prevailing market momentum, traders can improve their chances of capturing significant price movements and achieving profitable outcomes.

Best Practices for Swing Trading

Success in swing trading requires more than identifying potential trades; it demands adherence to best practices that minimise risks and maximise returns.

1. Adherence to Predefined Risk Management Protocols

Successful swing trading requires strict adherence to predefined risk management protocols. This includes setting and respecting stop-loss orders, calibrating position sizes, and maintaining a favourable risk-reward ratio. Consistently applying these principles helps traders manage their risk effectively and enhances the likelihood of long-term profitability.

2. Constant Market Analysis and Adaptability

Market conditions are constantly evolving, requiring traders to stay vigilant and adaptable. Regularly analysing market data, news, and trends allows traders to adjust their strategies in response to changing conditions. This proactive approach identifies new opportunities and mitigates risks, keeping traders competitive and effective.

3. Disciplined Execution of Proven Strategies

Discipline is a critical factor in executing proven trading strategies. Emotions such as fear and greed can lead to impulsive decisions and deviations from the trading plan. By maintaining discipline and sticking to established strategies, traders can avoid common pitfalls and make more rational, data-driven decisions. This disciplined approach is fundamental to achieving consistent success in swing trading.

Achieving Long-Term Success in Swing Trading

Let’s delve into key strategies for achieving long-term success in swing trading:

Mastering Risk Management

Mastering risk management is vital for supporting portfolio growth and skillset cultivation. Effective risk management strategies protect traders from significant losses and provide a framework for sustainable growth. By balancing risk and reward, traders can pursue opportunities without compromising their financial stability.

Strategic Position Sizing

Calculating position sizes that align with risk tolerance is crucial for mitigating risks associated with market volatility. By ensuring that no single position exceeds a certain percentage of the account balance (typically no more than 1%), traders can manage their exposure and protect their portfolios from severe losses. This strategic approach helps in maintaining a balanced and controlled trading environment.

Optimising Reward-to-Risk Ratios

Balancing potential profits against the likelihood of loss is essential for achieving profitable trades. Traders aim for reward-to-risk ratios where the anticipated reward surpasses the possible risk, ensuring profitable trades counterbalance losses. By focusing on high-quality trade setups with favourable reward-to-risk ratios, traders can enhance their overall profitability and achieve long-term success.

Conclusion:

Swing trading presents a dynamic and flexible approach to capturing market profits by leveraging short- to medium-term price movements. Through the strategic application of technical analysis, disciplined risk management, and continuous market analysis, traders can navigate the complexities of the financial markets and achieve sustainable success.

By understanding risks and following best practices, swing traders can optimise strategies and build a resilient, profitable trading portfolio. Swing trading requires adapting to market rhythms, making informed decisions, and maintaining discipline for long-term growth and financial stability.