The Russian ruble has been on a downward trend since the start of the year, and there is no sign of it stopping anytime soon. The currency has lost over half of its value against the US dollar since the beginning of 2022, and it is now trading at its weakest level in over two decades.

There are a number of factors that have contributed to the ruble’s decline. The most significant factor is the ongoing Russian aggression in Ukraine. The war has led to a number of economic sanctions being imposed on Russia, which have had a negative impact on the country’s economy. The sanctions have made it difficult for Russia to import goods and services, which has led to a decline in demand for the ruble.

Another factor that has contributed to the ruble’s decline is the high level of inflation in Russia. Inflation is currently running at over 17%, and it is expected to continue to rise in the coming months. This is putting a strain on household budgets and businesses, and it is making it more difficult for people to afford to buy goods and services.

The negative outlook for the ruble is likely to continue in the near future. The war in Ukraine is showing no signs of ending, and the sanctions against Russia are unlikely to be lifted anytime soon. This means that the ruble will continue to be under pressure, and it is possible that it could even reach a new low in the coming months.

The negative outlook for the ruble has a number of implications for the Russian economy. The weak currency is making it more difficult for businesses to import goods and services, which is leading to higher prices for consumers. The weak currency is also making it more difficult for the Russian government to finance its budget deficit.

The negative outlook for the ruble is also having a negative impact on the Russian people. The high level of inflation is making it difficult for people to afford to buy goods and services, and the weak currency is making it more difficult for people to travel abroad.

The future of the Russian ruble is uncertain, but the current outlook is negative. The war in Ukraine and the sanctions against Russia are likely to continue to put pressure on the currency, and it is possible that the ruble could reach a new low in the coming months. This would have a significant negative impact on the Russian economy and the Russian people.

Central Bank of Russia and Interest Rate

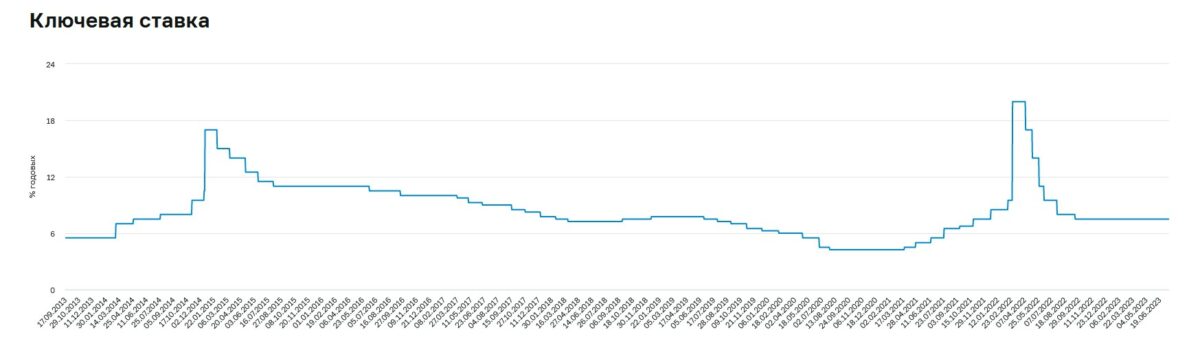

In the case of the Russian ruble, the interest rate has been a significant factor in the currency’s recent performance. In the aftermath of the invasion of Ukraine, the Russian central bank raised interest rates sharply in an attempt to stabilize the currency. This led to a temporary appreciation of the ruble, but the currency has since begun to depreciate again.

The Russian central bank’s decision to decrease interest rates from 20% in March 2022 to 7.5% in October 2022 has had a mixed impact on the ruble exchange rate.

On the one hand, lower interest rates make the ruble less attractive to investors, as they can earn a lower return on their investment by holding assets denominated in that currency. This can lead to a decrease in demand for the ruble, which can cause the exchange rate to depreciate.

On the other hand, lower interest rates can also lead to economic growth, as businesses are more likely to invest and hire workers when the cost of borrowing is lower. This can lead to an increase in demand for goods and services, which can in turn lead to an increase in demand for the ruble.

The net impact of the central bank’s interest rate cuts on the ruble exchange rate has been relatively muted. The ruble has appreciated somewhat against the US dollar since March 2022, but it is still trading well below its pre-war levels.

It is important to note that there are a number of other factors that have also affected the ruble exchange rate in recent months, including the ongoing war in Ukraine, the imposition of sanctions against Russia, and the uncertainty about the future of the Russian economy.

Overall, the central bank’s interest rate cuts have had a mixed impact on the ruble exchange rate. The net impact has been relatively muted, but it is possible that the ruble could appreciate further in the future if economic growth picks up.

Wagner Group – Friend or Foe for the Russian Economy?

The Wagner Group coup attempt in June 2023 had a significant impact on the Russian ruble rate. The coup attempt led to a sharp increase in uncertainty about the future of the Russian government and economy, which caused investors to sell rubles and buy other currencies. This led to a sharp depreciation of the ruble against the US dollar and other major currencies.

The coup attempt also led to a decline in demand for Russian exports, as businesses and consumers became more cautious about doing business with Russia. This decline in demand also put downward pressure on the ruble.

The full impact of the Wagner Group coup on the ruble rate is still being felt. However, it is clear that the coup attempt has had a significant negative impact on the Russian currency.

Here are some specific examples of how the Wagner Group coup affected the ruble rate:

- On June 25, 2023, the day after the coup attempt was announced, the ruble fell to its lowest level against the US dollar since the start of the war in Ukraine.

- The ruble lost over 10% of its value against the US dollar in the week following the coup attempt.

- The Russian central bank was forced to intervene in the foreign exchange market to prevent the ruble from falling even further.

The Wagner Group coup is just one of many factors that have affected the ruble rate in recent months. However, it is clear that the coup attempt has had a significant negative impact on the Russian currency. The full impact of the coup attempt is still being felt, but it is likely that the ruble will remain weak for some time to come.

Here are some additional negative scenarios that could play out for the Russian Ruble:

- The war in Ukraine could escalate, leading to further sanctions against Russia.

- The Russian economy could enter a recession, which would further weaken the ruble.

- The Russian government could default on its debt, which would have a significant negative impact on the currency.

- The Russian Federation will split into smaller states like the Soviet Union some over 30 years ago, leading to full collapse of the national currency.

The outlook for the ruble is bleak, and it is likely to remain weak for the foreseeable future.