Hong Kong Leads Stock Market Rally; Japanese Economy Contracts, but Investors Remain Optimistic

Asian shares experienced a notable surge on Wednesday, propelled by a robust rally on Wall Street, marking one of the strongest days of the year. The surge was fueled by an unexpectedly positive inflation report, alleviating concerns and bolstering confidence in the market.

Japan’s Mark Stock Resilience and Economic Challenges

Despite the worse-than-expected contraction of Japan’s economy by 2.1% in the July-September period, Tokyo’s Nikkei 225 benchmark surged 1.8% to reach 33,293.67. Analysts attribute the economic challenges to weakening private demand, slack demand for exports, and sluggish wage growth, anticipating a slowdown in GDP growth from 1.7% in 2023 to 0.5% in 2024.

Optimism in Hong Kong and China

Hong Kong’s trending stock Hang Seng surged 2.8% to 17,885.19, and the Shanghai Composite gained 1.4% to 3,072.64. Economic data for October indicated a resilient Chinese economy despite indicators like property sales, lending, exports, and inflation showing lower-than-expected figures.

Global Impact of Wall Street Rally

Tuesday’s rally on Wall Street had a significant impact, with the S&P 500 experiencing its best day since April, closing at 4,495.70. The Nasdaq composite rose 2.4%, and the Dow Jones Industrial Average rallied 1.4%. The positive inflation report raised hopes that the Federal Reserve might reconsider further interest rate hikes.

Stock Management and Financial Trends

The prospect of no more rate hikes reverberated across financial markets, causing the US dollar to fall against many currencies while gold prices rose. Initially impacted by higher rates, real estate and high-dividend stocks saw substantial gains. Bank stocks, including Zions Bancorp and Comerica, surged on expectations of reduced pressure on the financial system.

Global Economic Outlook and Caution

The article also touches on the global economic outlook, emphasizing the role of economic factors, inflation rates, and central bank policies in influencing gold prices. Investors are advised to exercise caution and consider risk management strategies in the current volatile market conditions.

Asian Markets Respond to Upbeat China Data

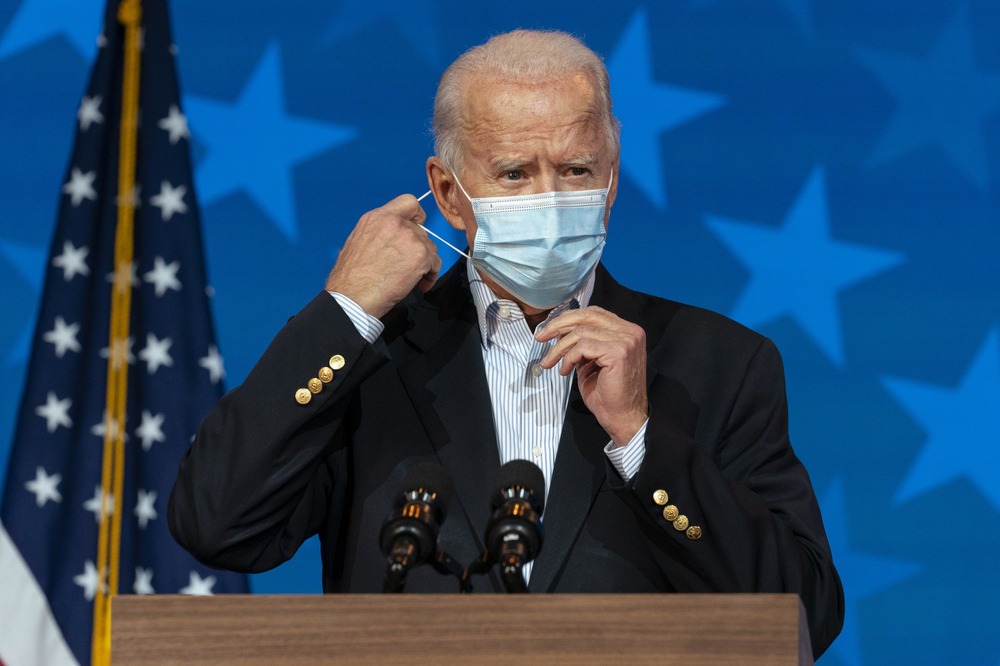

The article further discusses how Hong Kong stocks led gains in Asia-Pacific markets following upbeat economic data from China. Retail sales and industrial data for October exceeded expectations, contributing to a positive market sentiment. The report highlights key geopolitical events, including an anticipated meeting between US President Joe Biden and China’s President Xi Jinping.

In summary, the Asian stock market rally is navigating a complex economic landscape influenced by global trends, economic indicators, and central bank policies. The article provides a comprehensive overview of the factors shaping market dynamics and offers insights for investors navigating uncertainties.