Quick Look

- GBP/USD struggled to breach the 1.2650 – 1.2685 resistance, eyeing a potential decline.

- Technical analysis suggests a drop below the 50-day SMA could intensify selling pressure.

- EUR/GBP shows signs of a rebound, with resistance at 0.8575, pivotal for sustained recovery.

- GBP/JPY retreats from highs, with trendline support at 190.20 critical to halt further losses.

- Broader market dynamics influenced by U.S. Dollar Index gains and economic sentiment reports.

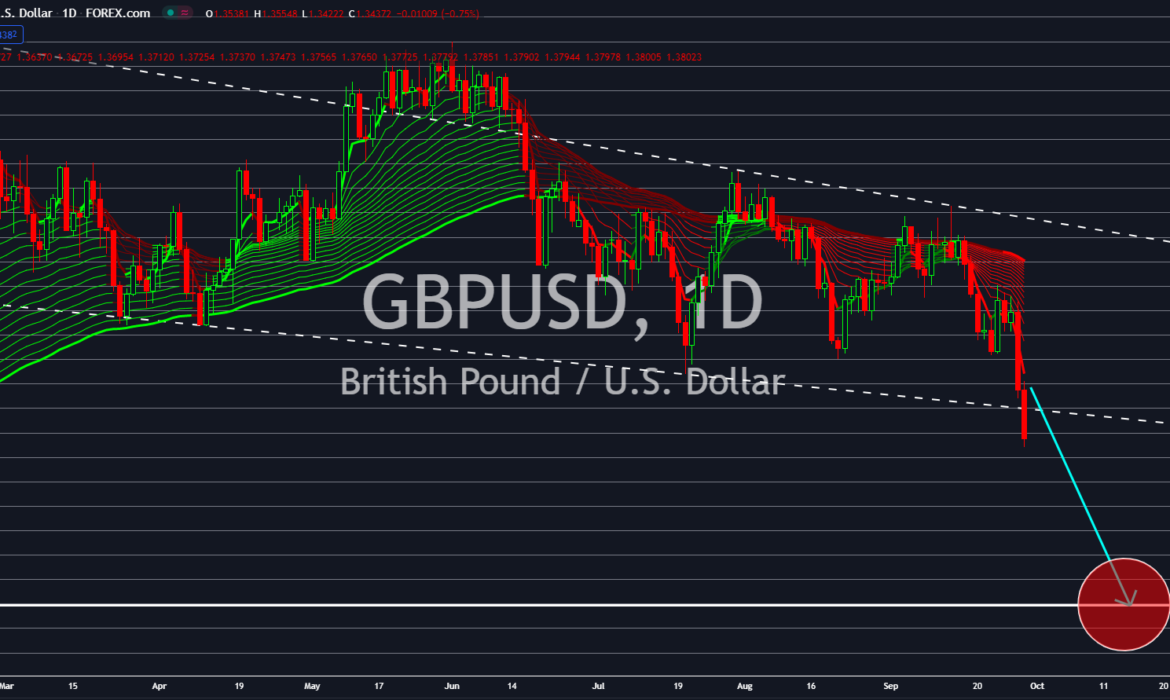

The British Pound is under the spotlight as it faced resistance to surpass the 1.2650 – 1.2685 range against the U.S. dollar. A further slip below the critical level of 1.2600 could lead GBP/USD towards the nearest support between 1.2500 – 1.2520. Adding to the pressure, GBP/USD’s recent fall below its 50-day simple moving average signals a potential escalation in selling momentum. A daily close beneath this indicator might accelerate declines, aiming for trendline support near 1.2600 and possibly the 200-day SMA around 1.2570. Conversely, a market rebound would see bulls challenging the 50-day SMA at 1.2675, with a break above possibly igniting a rally towards 1.2720 and, if sustained, to 1.2830.

EUR/GBP Eyes 0.8575 Resistance; GBP/JPY Tests Support

Since November, EUR/GBP’s downtrend hints at a gradual recovery, with the pair testing resistance at 0.8575. A clear move above this level is necessary for the euro to secure a stronger rebound, targeting the 200-day SMA at 0.8610. Should resistance hold, support is expected at 0.8530, followed by the critical 0.8500 threshold.

In contrast, GBP/JPY has retreated from its peak above 191.00, now testing trendline support at 190.20. Bulls must defend this level to prevent further slides towards 188.50. A successful counterattack by buyers could challenge resistance at 191.30, with a breakthrough potentially setting the stage for a push towards the 193.00 psychological barrier and beyond.

US GDP Growth Influences Currency Dynamics

The broader financial market also influences currency movements, highlighted by the U.S. Dollar Index’s advance following a GDP report indicating a 3.2% growth rate. Similarly, the EUR/USD pair faced downward pressure amidst a disappointing Euro Area Economic Sentiment report, affecting cross-currency dynamics and impacting GBP’s performance against fluctuating market sentiments and economic indicators.