Trading Economics reports that concerns about a worldwide recession and the end of Chinese incentives for battery makers have dampened demand for electric cars. According to Bloomberg, weak demand led Tesla to reduce production at its Shanghai factory in February.

At the same time, China’s lithium production rose 89 percent year-on-year in December. Australia’s largest lithium producer forecasts global production to reach 915,000 tonnes in 2023, a 32 percent increase from last year’s estimate.

According to analysts, the market is waiting to see the impact of reducing subsidies for new energy vehicles in China. It is worried about low consumer confidence, which is related to the property crisis in the country. Lithium prices have skyrocketed since mid-2021, as a surge in electric car sales has made lithium in high demand.

In addition, lithium prices in China remain eight times higher than two years ago and are expected to fall further, reports the Financial Review. Such expectations are supported by the fact that the Chinese company CATL, the largest producer of batteries in the world, last week signed contracts with Chinese manufacturers of electric vehicles at reduced prices.

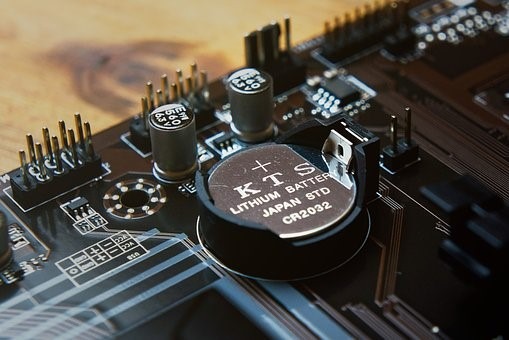

The value of lithium in the market dictates the prices of electric vehicles

Lithium has recently seen an astonishing price increase, considering that electric vehicles or the electric vehicle industry are preparing to reach bigger targets, with more environmentally and socially conscious consumers than ever before.

This is leading to a greater shift in demand for sustainable, environmentally friendly products, especially in transportation, which has been a boon for the electric vehicle industry lately. Tighter carbon regulations and governments pledging more towards carbon neutrality have also ensured electric vehicles gain much more prominence.