The most-active wheat contract on the Chicago Board of Trade (CBOT) (Wv1) fell 2.45% to $10.65-3/4 a bushel; corn (Cv1) was down 1.23% at $7.44-3/4 a bushel.

Soybeans (Sv1) dropped 0.7% to $16.98-1/4 a bushel.

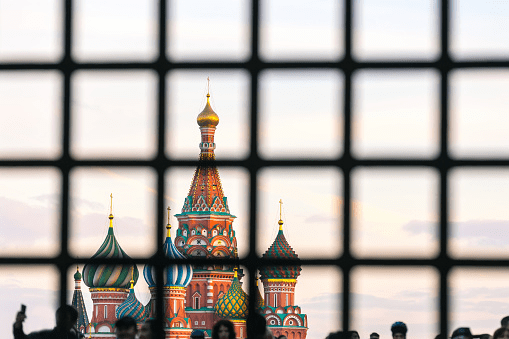

Wheat leaped to an all-time high earlier this month on worries over supplies from the Black Sea region behind Russia’s invaded Ukraine. But the market is eyeing other origins, such as European Union and India, to substitute some of the lost supplies from the Black Sea region.

Large speculators increased their net long position in CBOT corn futures on March 22, regulatory data released on Friday revealed.

Wheat prices should be up until the war ends, expressed an Asia-based trader.

There is no significant change on the fundamentals side. Just funds squared off their positions behind gaining profits, expressed the anonymous trader.

The Commodity Futures Trading Commission’s weekly commitments of traders report also revealed that noncommercial traders, a category containing hedge funds, raised their net short position in CBOT wheat and their net long position in soybeans.

Strong Demand for The U.S. Suppliers

Analysts anticipated the U.S. Department of Agriculture (USDA) report to demonstrate that farmers intend to decrease their corn seeding by 1.5% compared with 2021. Soybean plantings grew by 1.8%.

The report should come at 1600 GMT on Thursday.

Losses in soybeans were determined by signs of strong demand for U.S. supplies, even with newly harvested beans from South America open in the marketplace.

Asian shares delayed, and oil prices slid as the COVID-19 lockdown in Shanghai looked positioned to hit global activity while throwing another wrench into supply chains that could add to inflationary tensions.